The main category of The Gold News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of The Gold News.

You can use the search box below to find what you need.

[wd_asp id=1]

In this article, we discuss 10 best gold ETFs to buy now. If you want to skip our discussion on the gold industry, check out 5 Best Gold ETFs To Buy Now.

In late 2023, gold prices experienced a significant surge due to increased central bank buying and growing investor concerns over geopolitical tensions including the Israel–Hamas and Russia–Ukraine conflicts. This rally was further fueled by a weakening US dollar and expectations of interest rate cuts by the Federal Reserve. Gold prices reached a record high of $2,135.39 per ounce in December. After continuous interest rate hikes that brought the Federal Reserve funds rate to its highest level in over 22 years, policymakers have signaled plans for at least three rate cuts in 2024. Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan, commented:

“Commodities are unlikely to benefit from core inflation in 2024. Inflation should fall to under 3%, so that, along with properly timing the business cycle, are the two conditions needed to initiate long positions, making the outlook for the sector very tactical in 2024. Across commodities, for the second consecutive year, the only structural bullish call we hold is for gold and silver.”

Reflecting similar market sentiment, Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan, stated:

“Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical. At the moment, gold still appears quite rich relative to underlying rates and foreign exchange (FX) fundamentals, and still looks vulnerable to another modest retreat in the near-term, as Fed rate cut expectations are now running earlier than our forecasts.”

In 2023, gold showcased strength despite expectations, outperforming multiple assets including commodities, bonds, and most stock markets. The World Gold Council highlighted that market consensus leans towards a ‘soft landing’ in the US, historically not favorable for gold returns, although geopolitical tensions and continued central bank buying may provide support. However, the possibility of the Fed achieving a soft landing with interest rates above 5% remains uncertain, with a global recession still possible, prompting investors to consider gold as an effective hedge. While the odds favor a soft landing, historical data shows it has been achieved only twice following nine tightening cycles, indicating potential challenges. The World Gold Council noted that the labor market’s status is crucial in determining economic conditions, with potential shifts from a soft to a hard landing. Other possible scenarios include a ‘no landing,’ characterized by reaccelerated inflation and growth, which could initially challenge gold. Expected policy rate easing may not translate as favorably for gold due to factors like real interest rates and consumer demand constraints. A recession, if it occurs, historically benefits high-quality government bonds and gold, though initially, it might pose challenges for gold. However, if inflation surges, it could lead to a stronger monetary response, reinforcing the case for strategic gold allocations.

Goldman Sachs Research expects gold prices to rise due to increased central bank purchases and robust retail demand in emerging markets. Analysts Nicholas Snowdon and Lavinia Forcellese predict a potential 6% climb in gold prices over the next year to reach $2,175 per troy ounce. While uncertainties surrounding Federal Reserve interest rate policy may lead to short-term fluctuations, the downside risks to gold prices are expected to be limited. Strong central bank purchases, particularly from China and India, have offset outflows from gold exchange-traded funds, driven partly by geopolitical tensions such as the Russia-Ukraine conflict and the COVID pandemic. The recent decrease in ETF purchases is attributed to already high holdings and the influence of real interest rates. Speculative positioning by hedge funds seems more responsive to shifts in long-term yields than ETF holdings. Historically, changes in gold ETF holdings have correlated with major risk-off events and cycles of monetary policy easing. Analysts anticipate a potential increase in ETF holdings once the Fed begins cutting rates, possibly starting in May. Additionally, rising incomes in emerging markets are boosting consumer demand for gold, particularly in jewelry. According to Goldman Sachs analysts:

“The rapidly growing cohort of ‘affluent’ consumers in India … will drive growth in jewelry consumption. Moreover, gold consumption has also been supported by a lack of alternative investments in some countries which saw big policy shifts (Turkey, China) in the past few years.”

Gold and silver are expected to see continued growth in 2024, as UBS forecasts, largely due to anticipated interest rate cuts by the US Federal Reserve. This expectation, coupled with a weaker dollar, is projected to push gold prices upwards, with forecasts suggesting a potential increase to $2,200 per ounce by year-end. Historically, gold tends to rise when interest rates decrease, as it becomes a more attractive investment compared to bonds in a low-rate environment. Additionally, lower interest rates typically lead to a depreciation of the dollar, making gold more affordable for international buyers, thereby boosting demand. Despite uncertainties surrounding the timing and extent of rate cuts, UBS maintains its forecast for Federal Reserve policy easing. The recent surge in gold’s appeal as a safe haven asset, particularly amidst geopolitical tensions like Israel’s conflict with Hamas, has also contributed to its record-breaking prices. Moreover, optimism extends to silver, often considered gold’s “poorer cousin,” which is expected to perform well, especially in the event of Federal Reserve easing. While silver has historically underperformed gold, analysts believe it has significant catching up to do, potentially resulting in a dramatic surge.

Some of the best gold stocks to buy include Newmont Corporation (NYSE:NEM), Barrick Gold Corporation (NYSE:GOLD), and Franco-Nevada Corporation (NYSE:FNV). However, we discuss the best gold ETFs in this article.

Our Methodology

We curated our list of the best gold ETFs by choosing consensus picks from multiple credible websites. We have mentioned the 5-year share price performance of each ETF as of March 18, 2024, ranking the list in ascending order of the share price.

A close-up of a hand placing a block of gold into a safe.

5-Year Share Price Performance as of March 18: 20.53%

iShares Gold Trust Micro (NYSE:IAUM) is an exchange traded fund designed to track the price of gold bullion, using the LBMA Gold Price as its benchmark. It was established on June 15, 2021, and as of March 15, 2024, it holds $1 billion in net assets. The fund incurs a sponsor fee of 0.09%. It is one of the best gold ETFs to buy.

In addition to gold ETFs, Newmont Corporation (NYSE:NEM), Barrick Gold Corporation (NYSE:GOLD), and Franco-Nevada Corporation (NYSE:FNV) are some of the best stocks to buy for exposure to the gold industry.

5-Year Share Price Performance as of March 18: 25.09%

U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE:GOAU) offers exposure to companies involved in producing precious metals, either through active mining or passive ownership of royalties or production streams. Its benchmark is the U.S. Global GO GOLD and Precious Metal Miners Index. Established on June 27, 2017, the ETF currently holds net assets worth $85.2 million, with an expense ratio of 0.60% as of March 15, 2024. U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE:GOAU) is one of the best gold ETFs to invest in.

5-Year Share Price Performance as of March 18: 30.55%

VanEck Gold Miners ETF (NYSE:GDX) ranks 8th on our list of the best gold ETFs. VanEck Gold Miners ETF (NYSE:GDX) aims to closely replicate the price and yield performance of the NYSE Arca Gold Miners Index, which tracks companies in the gold mining industry. VanEck Gold Miners ETF (NYSE:GDX) holds $12.77 billion in net assets as of March 15, 2024, with an expense ratio of 0.51%. The fund was established on May 16, 2006.

5-Year Share Price Performance as of March 18: 33.84%

iShares MSCI Global Gold Miners ETF (NASDAQ:RING) aims to mirror the performance of the MSCI ACWI Select Gold Miners Investable Market Index, comprising global equities of companies primarily involved in gold mining. The ETF holds net assets worth $420.3 million as of March 15, 2024, with an expense ratio of 0.39%. Its portfolio consists of 36 stocks. iShares MSCI Global Gold Miners ETF (NASDAQ:RING) was established on January 31, 2012 and it ranks 7th on our list of the best gold ETFs to buy.

Newmont Corporation (NYSE:NEM) is the largest holding of the iShares MSCI Global Gold Miners ETF (NASDAQ:RING). The company is involved in the production and exploration of gold, as well as other metals like copper, silver, zinc, and lead. On February 22, Newmont announced a Q4 non-GAAP EPS of $0.50 and a revenue of $4 billion, up 24% on a year-over-year basis.

According to Insider Monkey’s fourth quarter database, 53 hedge funds were long Newmont Corporation (NYSE:NEM), compared to 49 funds in the last quarter. Jean-Marie Eveillard’s First Eagle Investment Management is the leading stakeholder of the company, with 23.75 million shares worth $983.2 million.

Here is what First Eagle Investments Global Fund has to say about Newmont Corporation (NYSE:NEM) in its Q2 2022 investor letter:

“Shares of Colorado-based Newmont, the largest gold miner in the world, experienced weakness in the quarter as falling gold bullion prices and cost inflation hurt miners in general. More idiosyncratically, the company reported slightly disappointing earnings and production results for its most recent quarter due to pandemic-related disruptions, ongoing supply-chain constraints, and labor shortages.

It also warned that operating costs for 2022 were likely to come in at the upper end of previous guidance. We remain constructive on the stock, which offers steady production anchored in good jurisdictions, a good pipeline of organic projects, a strong balance sheet, and proven management.”

5-Year Share Price Performance as of March 18: 61.29%

SPDR Gold Shares (NYSE:GLD) provides a cost-efficient and secure way for investors to access the gold market without the need for physical delivery. The ETF represents fractional ownership interests in a Trust holding gold bullion and cash. SPDR Gold Shares (NYSE:GLD) aims to lower barriers to investing in gold, such as access, custody, and transaction costs. It currently holds 831.84 tonnes of gold. The fund was listed on NYSE in November 2004. It is one of the best gold ETFs to consider.

In addition to ETFs like SPDR Gold Shares (NYSE:GLD), investors can pick up shares of Newmont Corporation (NYSE:NEM), Barrick Gold Corporation (NYSE:GOLD), and Franco-Nevada Corporation (NYSE:FNV) for exposure to the gold industry.

Click to continue reading and see 5 Best Gold ETFs To Buy Now.

Suggested articles:

Disclosure: None. 10 Best Gold ETFs To Buy Now is originally published on Insider Monkey.

India’s gems and jewellery exports declined 12.66% year-on-year to $3.05 billion in February 2024. On the other hand, imports witnessed a marginal increase of 1.12% to $2.26 billion. However, there’s a bright spot—gold jewellery exports surged 16.43% to $821.55 million. The data highlights a widening trade gap in the gems and jewellery sector.

According to the Gem Jewellery Export Promotion Council (GJEPC) report, “The overall gross exports of Gems & Jewellery at US$ 3046.84 million (Rs 25274.640 crores) in the month of FEB 2024 is showing a decline of 12.66% (-12.34% in Rs. term) as compared to US$ 3488.51 million (Rs 28832.86 crores) for the same period the previous year.”

“On the other hand, the overall gross imports of Gems & Jewellery at $2.26 billion (Rs 18,765.3 crore) in February 2024 represent a growth of 1.12% (1.6% in Rs term) as compared to $2.23 billion (Rs 18,470.62 crore) for the same period the previous year.”

Besides, the total gross export of Gold Jewellery, at $821.55 million (Rs 6,815.65 crore) in February, showed a growth of 16.43% (16.91% in Rs terms) compared with $705.61 million (Rs 5,829.65 crore) the previous year.

Also read: Gold prices rise by 0.10%, silver prices dip 0.20%

Also read: FM’s caution on cryptocurrency: What do crypto players feel?

Also read: How can individuals and senior citizens claim tax benefits for a multi-year health insurance policy?

Colin Shah, MD, Kama Jewelry on ‘Jewellery Export & Import February 2024 Data’ said, “Indian gems and jewellery exports have been on a continuous downtrend for almost a year now. While the major influence of this remains global political unrest, the ripple effect can be seen through other triggers, including the rise in export duties, rising prices of precious metals, and, on the contrary, low-end demand in the overall international markets due to weak purchasing power.”

While the mainstream industry is experiencing a sluggish phase, it is notable that even lab-grown diamonds have not grown as expected and have shown a small rise of 2.90% in exports.

“It is interesting to see the rise in overall imports of gems and jewellery, showcasing a robust demand in the domestic market. This demand is here to stay and will also not be impacted in the long run. We owe it to the economic stability in the country, which leads to higher disposable incomes and purchasing power, along with the sentimental value of precious metals. Overall, with the plans of the US Fed for a potential rate cut, the exports are expected to witness a gradual but steady rise as we enter in the second of 2024,” said Shah.

Gold rate in Pakistan today on March 19, 2024 is Rs227,300 per tola for 24-carat of the precious metal, while the price for 10 gram gold is Rs194,873 in the local bullion market.

On Tuesday, the price of 1 tola gold increased by Rs400 and 10-gram gold saw an increase of Rs343.

| 19-March-24 | Gold | Silver |

|---|---|---|

| per Tola | Rs227,300 (↑ Rs400) | Rs2,580 |

| per 10 grams | Rs194,873 (↑ Rs343) | Rs2,212 |

These are live gold prices in Pakistan, including Karachi, Lahore, Islamabad, Rawalpindi, Quetta, Multan, and others. However, a change of a few hundred rupees may be observed.

Internationally, the rate of the yellow metal increased by $3 to settle at $2,173 per ounce (with a premium of $20 in Pakistani market).

Silver 24kt rate in Pakistan on Tuesday is Rs2,580 per tola. The price of 10 gram silver is Rs2,211.93.

Gold, silver rates per tola in last 10 sessions:

| Dates | 24K Gold | 24K Silver |

|---|---|---|

| 18-March-24 | Rs226,900 | Rs2,580 |

| 16-March-24 | Rs227,500 | Rs2,600 |

| 15-March-24 | Rs228,550 | Rs2,600 |

| 14-March-24 | Rs228,550 | Rs2,600 |

| 13-March-24 | Rs228,300 | Rs2,600 |

| 12-March-24 | Rs230,100 | Rs2,600 |

| 11-March-24 | Rs230,200 | Rs2,600 |

| 9-March-24 | Rs230,200 | Rs2,600 |

| 8-March-24 | Rs228,600 | Rs2,600 |

| 7-March-24 | Rs228,150 | Rs2,600 |

The rates of gold in Pakistan closely follow trajectory of the US dollar and international rates of the commodity as the country remains a net importer of the precious metal.

When the rupee is under pressure, investors take refuge in this safe-haven metal. Other than that, the precious metal is also widely used in making of jewellery.

Gold and silver prices are fixed by respective Sarafa associations in their city.

The precious yellow metal is a store of value across the world, and recognised by cultures as a symbol of wealth.

For thousands of years, gold and silver have been seen as valuable commodities, as the two metals have been widely used for coins for centuries.

What determines the rate of gold?

There happen to be a number of factors that affect the price of gold on daily basis.

Its rates are moved by a combination of various elements such as demand and supply, value of rupee against the US dollar, international prices, interest rates, investor behavior, etc.

Some also consider gold as an inflation hedge, and the precious metal also garners support in case of economic uncertainty in a country like Pakistan. It is a worldwide commodity just like oil.

In Pakistan, it’s not easy to forecast future gold rates as the bullion market remains volatile for multiple reasons.

Since last year, the prices of the yellow metal have seen fluctuation on rupee’s devaluation and economic and political uncertainty.

One tola gold rate in Pakistan hit all-time of Rs240,000 on May 10, 2023.

The domestic currency has devalued significantly in last many months, pushing investors to seek out safe-haven assets such as gold.

Demand for the precious metal increases when investors rush to buy it, which affects its price in the market.

Other than that, jewellery can also be considered one of the drivers of gold prices, but a weaker one, as most people buy jewellery to keep that for years.

Gold prices opened on the Multi Commodity Exchange (MCX) on Tuesday at Rs 65,609 per 10 grams and hit an intraday low of Rs 65,604. In the international market, prices hovered around $2159.15 per ounce.

Meanwhile, silver opened at Rs 75,575 per kg and hit an intraday low of Rs 75,520 on the MCX. In the international market, the price hovered around $25.11 per ounce.

“Yesterday gold prices increased by 0.10% and closed at 65,608 levels. Recently, gold hit a new high of 66,356. Silver prices closed on a negative note, down 0.20%, and closed at 75,496. The market is awaiting the Fed’s decision, and it is a statement on interest rates,” said Anuj Gupta, Chief of Commodity and Currency at HDFC Securities.

COMEX Gold prices pared early losses and closed marginally higher on Monday, ahead of a slew of central bank decisions this week. Gains in the dollar index and treasury yields limited the upside in the non-yielding yellow metal. The US benchmark 10-year yields have been rising for the past six days as hotter-than-expected US CPI in Jan, and Feb prompted traders to dial back bets on the pace and scope of monetary easing expected this year. Geopolitical tensions also remained high, boosting the allure of the safe-haven metal. A record win secured by Russian President Vladimir Putin in the Presidential elections raised the spectre of an increase in tensions between Russia and Ukraine. Meanwhile, Israeli Prime Minister Benjamin Netanyahu said he would proceed with plans to push into Gaza’s Rafah enclave, making chances for a peace agreement more difficult and adding to the geopolitical risk premium, per Kotak Securities Research report.

Now, the major focus is on the FOMC meeting due tomorrow, where the Federal Reserve is expected to hold the rates steady. However, attention will be paid to updated projections and Fed Chair Jerome Powell’s guidance on rate cut timing. Jateen Trivedi, VP Research Analyst, LKP Securities, said, “Market attention now turns to the Federal Reserve’s policy statement scheduled for Wednesday evening. While no interest rate cuts are anticipated, investors will closely scrutinise the statement for clues regarding potential rate cuts later in 2024.”

Also read: FM’s caution on cryptocurrency: What do crypto players feel?

Also read: Decoding no-cost EMIs: Debunking myths and unveiling facts

Deveya Gaglani, Research Analyst – Commodities, Axis Securities, said, “Gold prices posted a smart recovery in the last session. Prices rallied more than 500 points from the day’s low and settled around 65630 level. Now, traders will focus on the FOMC decision, which will be out on Wednesday. The FED Policy makers may signal a less dovish approach and can deal with the easing cycle Considering the recent CPI data, which came hotter than expected. This may push the US dollar higher, leading to profit booking in Gold prices this week. However, the short-term trend looks strong for Gold prices as long as the 64500 level is intact on the downside.”

COMEX Silver prices closed lower on Monday, tracking mixed sentiments in the industrial metals and marginal gains in gold prices. Chinese data released earlier today showed that Chinese Retail sales, Industrial output and fixed asset investment topped estimates. Supply-side stimulus and export demand are offering some relief even as domestic demand remains muted. At the same time, upbeat data also raised doubts over whether policymakers will step up support that is still needed to boost demand, per Kotak Securities Research report.

Former President Donald J. Trump, at an event on Saturday ostensibly meant to boost his preferred candidate in Ohio’s Republican Senate primary race, gave a freewheeling speech in which he used dehumanizing language to describe immigrants, maintained a steady stream of insults and vulgarities and predicted that the United States would never have another election if he did not win in November.

With his general-election matchup against President Biden in clear view, Mr. Trump once more doubled down on the doomsday vision of the country that has animated his third presidential campaign and energized his base during the Republican primary.

The dark view resurfaced throughout his speech. While discussing the U.S. economy and its auto industry, Mr. Trump promised to place tariffs on cars manufactured abroad if he won in November. He added: “Now, if I don’t get elected, it’s going to be a blood bath for the whole — that’s going to be the least of it. It’s going to be a blood bath for the country.”

For nearly 90 minutes outside the Dayton International Airport in Vandalia, Ohio, Mr. Trump delivered a discursive speech, replete with attacks and caustic rhetoric. He noted several times that he was having difficulty reading the teleprompter.

The former president opened his speech by praising the people serving sentences in connection with the Jan. 6, 2021, riot at the Capitol. Mr. Trump, who faces criminal charges tied to his efforts to overturn his election loss, called them “hostages” and “unbelievable patriots,” commended their spirit and vowed to help them if elected in November. He also repeated his false claims that the 2020 election was stolen, which have been discredited by a mountain of evidence.

If he did not win this year’s presidential election, Mr. Trump said, “I don’t think you’re going to have another election, or certainly not an election that’s meaningful.”

Mr. Trump also stoked fears about the influx of migrants coming into the United States at the southern border. As he did during his successful campaign in 2016, Mr. Trump used incendiary and dehumanizing language to cast many migrants as threats to American citizens.

He asserted, without evidence, that other countries were emptying their prisons of “young people” and sending them across the border. “I don’t know if you call them ‘people,’ in some cases,” he said. “They’re not people, in my opinion.” He later referred to them as “animals.”

Border officials, including some who worked in the Trump administration, have said that most migrants who cross the border are members of vulnerable families fleeing violence and poverty, and available data does not support the idea that migrants are spurring increases in crime.

Mr. Trump mentioned Bernie Moreno, his preferred Senate candidate in Ohio and a former car dealer from Cleveland, only sparingly. Though he has Mr. Trump’s endorsement, Mr. Moreno, whose super PAC hosted Saturday’s event, has struggled to separate himself in a heated Republican primary contest to face Senator Sherrod Brown, Democrat of Ohio, this fall. Mr. Trump was redirected from a planned trip to Arizona to appear with Mr. Moreno as a last-minute push.

Mr. Trump issued vulgar and derogatory remarks about a number of Democrats, including ones he often targets, like Mr. Biden and Fani Willis, the Atlanta prosecutor overseeing his criminal case in Georgia, as well as those widely viewed as prospective future presidential candidates, such as Gov. Gavin Newsom of California and Gov. J.B. Pritzker of Illinois.

Mr. Trump called Mr. Biden a “stupid president” several times and at one point referred to him as a “dumb son of a — ” before trailing off. He also compared Ms. Willis’s first name to a vulgarity, called Mr. Newsom “Gavin New-scum” and took jabs at Mr. Pritzker’s physical appearance.

The Biden campaign issued a statement after the event claiming that Mr. Trump’s comments doubled “down on threats of political violence.”

“He wants another January 6, but the American people are going to give him another electoral defeat this November because they continue to reject his extremism, his affection for violence, and his thirst for revenge,” said James Singer, a spokesman for the Biden campaign.

Steven Cheung, a spokesman for Mr. Trump, clarified that Mr. Trump was talking about the auto industry and the economy, not political violence, and wrote in a statement that “Crooked Joe Biden and his campaign are engaging in deceptively, out-of-context editing.”

Mr. Trump’s sharp words were not reserved for national politicians: He briefly took aim at one of Mr. Moreno’s primary opponents, Matt Dolan, a wealthy Ohio state senator who has been surging in recent polls. Returning to his prepared remarks, Mr. Trump said he did not know Mr. Dolan but depicted him as “trying to become the next Mitt Romney.”

“My attitude is anybody who changes the name from the Cleveland Indians to the Cleveland Guardians should not be a senator,” Mr. Trump said, referring to the professional baseball team that Mr. Dolan’s family holds a majority stake in.

When Mr. Moreno was briefly called back onstage toward the end of Mr. Trump’s remarks, he praised the former president as a “good man.” But Mr. Moreno did not explicitly remind the crowd to support him in his Senate bid on Tuesday. Mr. Trump, for his part, said Mr. Moreno was a “fantastic guy.”

Mr. Trump’s campaign speeches generally swing between scripted remarks and seemingly off-the-cuff digressions. On Saturday, he acknowledged struggling to read the teleprompter as he tried to quote statistics on inflation.

“Everything is up: Chicken’s up, bread is up and I can’t read this damn teleprompter,” Mr. Trump said. “This sucker is moving around. It’s like reading a moving flag in a 35-mile-an-hour wind.”

Then, Mr. Trump, who before his presidency was known in New York for refusing to pay his bills to a wide range of service providers, joked about not paying the teleprompter company.

“Then they say Trump’s a bad guy, because I’ll say this: Don’t pay the teleprompter company,” he said as the crowd laughed. “Don’t pay.”

Gold Rate in Qatar Today – 19 March 2024

Gold rate in Qatar recorded a QAR 2,78.14 24k per tola on 19 March 2024. These rates are given in 1 tola, 1 gram, and 10-gramme increments in Qatari Riyal. Every day, the local gold and bullion markets in the Qatar provide live rates.

Live international today gold rate in QAR and its converted price of gold Qatari Riyal facilitates to the Qatari gold souk, gold investors, and individuals for fresh updates.

| Gold 24K per Ounce | QAR 7,415.74 | $2,036.51 |

| Gold 24K per 10 Grams | QAR 2,384.18 | $654.74 |

| Gold 22K per 10 Grams | QAR 2,185.50 | $600.18 |

| Gold 24K per Tola | QAR 2,781.14 | $763.76 |

| Gold 22K per Tola | QAR 2,549.38 | $700.11 |

Austin Gold Corp (AUST) is around the top of the Gold industry according to InvestorsObserver. AUST received an overall rating of 61, which means that it scores higher than 61 percent of all stocks. Austin Gold Corp also achieved a score of 91 in the Gold industry, putting it above 91 percent of Gold stocks. Gold is ranked 126 out of the 148 industries.

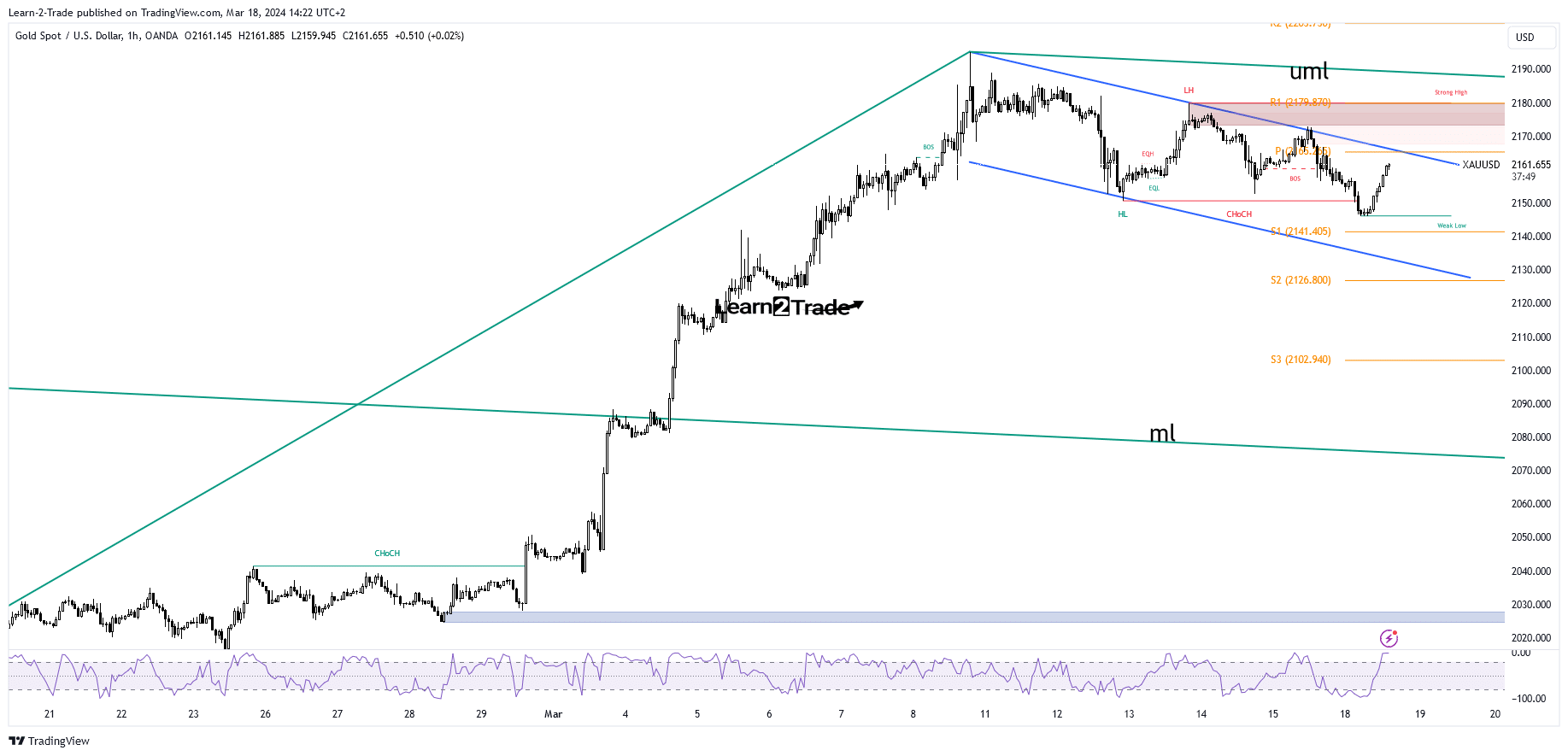

The gold price rallied in the last hours and now trades at $2,163. The precious metal has dropped slightly in the short term, but the bias remains bullish.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

Fundamentally, the XAU/USD turned to the upside as the US Prelim UoM Consumer Sentiment, Capacity Utilization Rate, and Empire State Manufacturing Index came in worse than expected.

Today, Chinese industrial production rose 7.0%, beating the expected 5.3% growth. Retail Sales registered only a 5.5% growth, less than the 5.6% growth forecasted. Unemployment Rate jumped unexpectedly from 5.1% to 5.3%, while Fixed Asset Investment came in better than expected. Furthermore, the Eurozone Final CPI and Final Core CPI matched expectations, while the Trade Balance was reported higher at 28.1B above the 14.2B estimated.

The BOJ and the RBA are expected to keep the monetary policy tomorrow, but the press conferences should move the markets.

In addition, the Canadian Consumer Price Index may announce a 0.6% growth after only a 0.0% growth in the previous reporting period. The FOMC and the UK CPI represent high-impact events on Wednesday that remain pivotal for the gold.

Technically, the XAU/USD dropped within a down-channel pattern. It could print a more extensive correction if it stays below the downtrend line.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The weekly pivot point of $2,165 stands as a static resistance. The price could try to test the resistance levels in the short term.

We have a vital confluence area at the intersection between the pivot point and the downtrend line. A valid breakout activates further growth, while false breakouts may announce a new sell-off.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Australia’s Gold Coast Airport has unveiled its 2024 Preliminary Draft Master Plan. It outlines the objectives for the airport and surrounding precinct over the next 20 years, with a more detailed focus on the initial eight years leading up to the 2032 Olympic and Paralympic Games.

It is the largest of four airports owned by Queensland Airports Limited and, as the country’s sixth busiest airport, Gold Coast Airport currently welcomes more than 6.2 million passengers a year. By 2044, that number is set to soar to around 13 million passengers annually.

Under the new plan, Gold Coast Airport will reinvent itself as a “destination within its own right – delivering a reimagined precinct that serves the communities of the Gold Coast and northern New South Wales”, the airport said.

Queensland Airports Limited CEO Amelia Evans said the Master Plan embraces innovation and new technologies. Smart aviation technologies being considered as part of the plan include biometric-enabled check-in and a fully digital passenger experience that could anticipate customer behavior and provide personalized travel suggestions based on travel history.

According to the Master Plan document, an expanded security screening footprint at the airport will accommodate evolving security requirements.

“Significant expansions to check-in, security and baggage make-up infrastructure will necessitate continued development of the passenger terminal to the south within the Terminal and Aviation Expansion Precinct,” the plan states. “Planning is in-place for check-in and security processes to ultimately be able to relocate to Level 2, where all domestic and international passengers would then flow and combine seamlessly into a Common Departure Lounge.”

One of the key concepts considered during the preparation of the Master Plan was the ongoing development of a Common Departure Lounge concept, where domestic and international passengers would be able to share the same departure facilities. This would require domestic and international passengers to be screened to the same standard, as well as the sharing of biometric information.

The Master Plan also reflects Gold Coast Airport’s commitment to sustainability including reaching Net Zero Scope 1 and Scope 2 emissions by 2030.

Gold Coast Airport’s 2024 Preliminary Draft Master Plan is open for public consultation and community feedback until 14 June 2024.

Gold is expected to trade at $2067.94 per ounce by the end of this quarter, according to global macroeconomic models and analysts’ forecasts.

Furthermore, inflation and PMI figures for major economies will be announced. Most central banks are expected to keep interest rates steady this week, as traders look for clues about the possible start of interest rate cuts this year. Meanwhile, the Bank of Japan is expected to exit its negative interest rate policy due to rising wages, high inflation, and a stable economy.

In a factor impacting the gold market, the US dollar index (DXY) steadied around 103.5 on Monday as investors looked ahead to the Federal Reserve’s policy decision this week, where it is expected to keep key US interest rates unchanged. Last week, the index rose 0.7% as hotter-than-expected US inflation data raised concerns that the Fed may keep interest rates at restrictive levels for longer.

Last Thursday data showed that US producer prices rose more than expected in February on both a monthly and annual basis. Moreover, this followed data earlier in the week showing that US consumer prices rose more than expected last month. Currently, the markets see about a 55% chance of a US rate cut in June, down significantly from around 80% seen earlier this month.

Despite the recent selling pressure, the overall trend for the price of gold remains bullish. According to the performance on the daily chart, a bearish trend reversal is unlikely to occur without gold prices moving towards the support levels of $2080 and $2020 per ounce. The current upward trajectory of gold prices is supported by the shift in global central bank policies towards easing, along with increased global demand for purchasing gold bullion led by global central banks. This is in addition to growing global geopolitical tensions, which support gold buying as a safe haven.

Based on the overall upward trend, the resistance levels of $2165 and $2180 per ounce are the next targets. From there, it would be prudent to consider selling gold, but without excessive risk.

The question now, will the price of gold decline in the coming days? Gold prices have risen by $89.55 per ounce, or 4.34%, since the beginning of 2024, according to trading on the Contract for Difference (CFD) tracking the standard market for this commodity. Finally, the gold is expected to trade at $2067.94 per ounce by the end of this quarter, according to global macroeconomic models and analysts’ forecasts. Looking ahead, we anticipate gold to trade at $2134.44 within 12 months.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.