WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027421', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027421', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027421', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027421', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027422', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_2'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027423', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_ad_43'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_stats`]

UPDATE wp_bsa_pro_stats

SET custom = 73, action_time = 1767916800

WHERE id = 52009 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_ads`]

UPDATE wp_bsa_pro_ads

SET ad_limit = `ad_limit` - 1

WHERE id = 43 LIMIT 1

Category: Gold News

Technical trading, short-covering and a weaker dollar, oh my

- Wheat futures launched a rebound Wednesday after sliding lower since the new week, month and quarter began. Lifting wheat was a round of short covering, technical trading, a weakening dollar and geopolitical news after Russia halted exports on some ships owned by one of the biggest local grain trading houses. Corn futures, too, firmed on short covering as the dollar weakened, though gains were limited by ample supplies and forecasts for good planting weather later this month on the heels of rainy, snowy conditions this week that improved soil moisture. Also, technical buying and short covering were behind soybean futures’ bounce from one-month lows induced by lackluster demand and increasing South American supplies. May corn added 5¼¢ to close at $4.31¾ per bu. Chicago May wheat jumped 10¾¢ to close at $5.56 per bu. Kansas City May wheat soared 17¼¢ higher and closed at $5.80½ per bu. Minneapolis May wheat added 12¢ and closed at $6.39½ per bu. May soybeans advanced 8¼¢ to close at $11.82¼ per bu. May soybean meal was up $1.70 to close at $330 per ton. May soybean oil added 0.25¢ to close at 48.85¢ a lb.

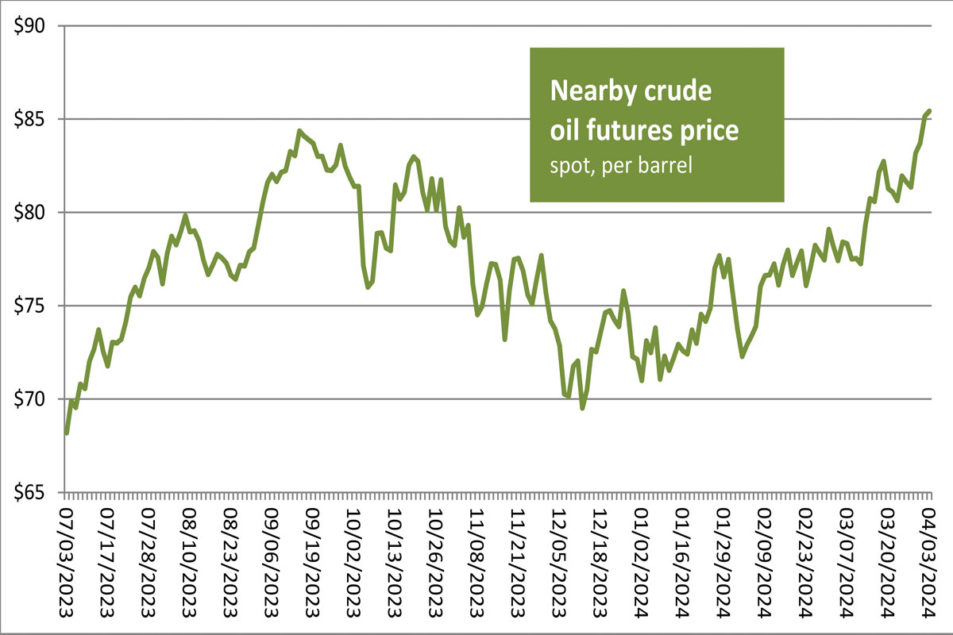

- US crude oil prices hit the highest levels since late October Wednesday on concerns about supply disruptions due to Ukraine’s attacks on Russian refineries and a vow of revenge against Israel by Hamas-backer Iran, the third-largest oil producer in the Organization of the Petroleum Exporting Countries cartel. The May West Texas Intermediate light, sweet crude future added 28¢ to close at $85.43 per barrel.

- US equity markets were mixed Wednesday, the Dow industrial index slipping while the Nasdaq and S&P 500 gained, the latter snapping a two-day losing streak after Fed chairman Jerome Powell said a strong economy hasn’t changed the expectation interest rate cuts will be warranted later this year. The Dow Jones Industrial Average eased 43.10 points, or 0.11%, to close at 39,127.14. The Standard & Poor’s 500 added 5.68 points, or 0.11%, to close at 5,211.49. The Nasdaq Composite added 37.01 points, or 0.23%, to close at 16,277.46.

- The US dollar index closed lower again Wednesday.

- US gold futures jumped higher again Wednesday. The April contract added $33.40 to close at $2,294.40 per oz.

Recap for April 2

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027424', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027425', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_1'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_ad_39'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = 'a:29:{s:2:\"id\";s:2:\"39\";s:8:\"space_id\";s:1:\"1\";s:9:\"space_ids\";N;s:8:\"priority\";N;s:13:\"withdrawal_id\";N;s:7:\"ad_name\";s:6:\"IronFX\";s:11:\"buyer_email\";s:19:\"m.karam@outlook.com\";s:5:\"title\";s:0:\"\";s:11:\"description\";s:0:\"\";s:6:\"button\";s:0:\"\";s:3:\"url\";s:0:\"\";s:3:\"img\";s:0:\"\";s:4:\"html\";s:235:\"<center><a href=\"https://go.ironfx.com/visit/?bta=35262&nci=7057&campaign=4039&utm_campaign=BipnsFxSidebarAds\" Target=\"_blank\"><img border=\"0\" src=\"https://ironfx.ck-cdn.com/tn/serve/?cid=470770\" width=\"300\" height=\"250\"></a></center>\";s:8:\"ad_model\";s:3:\"cpm\";s:8:\"ad_limit\";s:10:\"2146851577\";s:7:\"capping\";s:1:\"0\";s:14:\"optional_field\";s:0:\"\";s:10:\"additional\";N;s:4:\"cost\";s:4:\"0.00\";s:4:\"paid\";s:1:\"2\";s:6:\"starts\";N;s:4:\"ends\";N;s:15:\"show_in_country\";N;s:16:\"show_in_advanced\";N;s:6:\"p_time\";N;s:6:\"p_data\";N;s:7:\"p_error\";N;s:8:\"w_status\";N;s:6:\"status\";s:6:\"active\";}', `autoload` = 'off' WHERE `option_name` = '_site_transient_bsa_ad_39'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_stats`]

UPDATE wp_bsa_pro_stats

SET custom = 173, action_time = 1767916800

WHERE id = 52008 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_ads`]

UPDATE wp_bsa_pro_ads

SET ad_limit = `ad_limit` - 1

WHERE id = 39 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_6'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027426', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_6'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_6'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_6'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_6'

- US wheat futures continued lower Tuesday, a day after the USDA said winter wheat was in the best early spring shape since 2019. Beneficial rains in the forecast for the dry southern Plains added pressure as did cheap grain on the global market that limited US export demand. Corn futures also dipped as forecasts indicated good spring planting weather ahead that eased concerns about the USDA’s lower-than-expected acreage outlook issued late last week. Soybean futures trended higher before breaking through previous support levels, which initiated technical selling and lower closing prices. May corn fell 9¢ to close at $4.26½ per bu. Chicago May wheat declined 11¾¢ to close at $5.45¼ per bu. Kansas City May wheat fell 12¼¢ and closed at $5.63¼ per bu. Minneapolis May wheat dropped 7¼¢ and closed at $6.27½ per bu. May soybeans shed 11¾¢ to close at $11.74 per bu. May soybean meal was down $5.10 to close at $328.30 per ton. May soybean oil added 0.36¢ to close at 48.6¢ a lb.

- US crude oil prices were higher again Tuesday, pushing the Brent benchmark above $89 a bu for the first time since October. Support came from escalating Middle East conflict and a Ukrainian drone strike on one of Russia’s biggest refineries. The May West Texas Intermediate light, sweet crude future added $1.44 to close at $85.15 per barrel.

- The US dollar index closed lower Tuesday.

- US gold futures jumped higher Tuesday. The April contract added $24.50 to close at $2,261 per oz.

- US equity markets closed lower Tuesday, pressured by climbing bond yields, rising crude oil prices and widening doubts that the Federal Reserve fully contained inflation. The Dow Jones Industrial Average dropped 396.61 points, or 1%, to close at 39,170.24. The Standard & Poor’s 500 fell 37.96 points, or 0.72%, to close at 5,205.81. The Nasdaq Composite fell 156.38 points, or 0.95%, to close at 16,240.45.

Recap for April 1

- Ample supplies weighed on US grain and oilseed futures Monday. Traders took profits off last week’s steep gains in the corn market precipitated by the USDA pegging corn acreage below expectations. Some surmised seeded area would increase due to good planting weather in forecasts. Wheat futures were pressured by expectations for improved crop conditions that did not materialize. Soybeans followed wheat and corn lower while under pressure from seasonally slowing US export demand. May corn fell 6½¢ to close at $4.35½ per bu. Chicago May wheat shed 3¼¢ to close at $5.57 per bu; later months were mixed. Kansas City May wheat fell 9¾¢ and closed at $5.75½ per bu. Minneapolis May wheat dropped 10¼¢ and closed at $6.34¾ per bu. May soybeans lost 5¾¢ to close at $11.85¾ per bu. May soybean meal was down $4.30 to close at $333.40 per ton. May soybean oil added 0.29¢ to close at 48.24¢ a lb.

- The US dollar index closed higher Monday.

- US gold futures climbed Monday despite the strengthening dollar. The April contract added $19.10 to close at $2,236.50 per oz.

- US equity markets posted mixed closes to open the second quarter Monday. The Nasdaq advanced while the Dow industrials index and S&P 500 slipped after a closely watched report, the ISM manufacturing index for March, based on a survey of purchasing managers, came in at 50.3, up from 47.8 in February and above the 48.1 reading anticipated by economists in a Wall Street Journal survey. The Dow Jones Industrial Average dropped 240.52 points, or 0.6%, to close at 39,566.85. The Standard & Poor’s 500 fell 10.58 points, or 0.2%, to close at 5,243.77. The Nasdaq Composite added 17.37 points, or 0.11%, to close at 16,396.83.

- US crude oil prices were higher Monday. The May West Texas Intermediate light, sweet crude future added 54¢ to close at $83.71 per barrel.

Recap for March 28

- Corn futures Thursday posted their largest one-day rally since July after the USDA estimated March 1 corn stocks and projected 2024 corn plantings below trade estimates. Winter wheat futures followed corn higher even as all-wheat stocks and plantings slightly topped expectations. Meanwhile, spring wheat futures took a downturn after spring wheat and durum planting expectations topped projections. May corn jumped 15¼¢ to close at $4.42 per bu. Chicago May wheat added 12¾¢ to close at $5.60¼ per bu. Kansas City May wheat added 7¢ and closed at $5.85¼ per bu. Minneapolis May wheat dropped 6¢ and closed at $6.45 per bu. May soybeans lost 1¢ to close at $11.91½ per bu; the September future and beyond were higher. May soybean meal was down $1.30 to close at $337.70 per ton; later months were mixed. May soybean oil added 0.28¢ to close at 47.95¢ a lb.

- The US dollar index closed higher Thursday.

- US gold futures soared Thursday despite the strengthening dollar. The April contract added $26.80 to close at $2,217.40 per oz

- US equity markets were mixed Thursday. The S&P 500 notched a 22nd record-high close of 2024 and its best first quarter since 2019. Support was drawn from a report noting the US economy grew in the fourth quarter even more than previously thought, according to the government’s revised estimate for gross domestic product. A University of Michigan survey said consumer confidence rose to its highest level in almost three years. The DJIA also closed at a record high. The US stock and bond markets will be closed for Good Friday. The Dow Jones Industrial Average added 47.29 points, or 0.12%, to close at 39,807.37. The Standard & Poor’s 500 added 5.86 points, or 0.11%, to close at 5,254.35. The Nasdaq Composite fell 20.06 points, or 0.12%, to close at 16,379.46.

- US crude oil prices climbed Thursday. The May West Texas Intermediate light, sweet crude future added $1.82 to close at $83.17 per barrel.

Recap for March 27

- Corn, soybeans and KC wheat futures declined Wednesday in positioning ahead of Thursday’s USDA grain stocks and prospective plantings reports. Chicago and Minneapolis wheat posted gains in technical trading. May corn dropped 5¾¢ to close at $4.26¾ per bu. Chicago May wheat added 4¢ to close at $5.47½ per bu. Kansas City May wheat added 1¢ and closed at $5.78¼ per bu; September was steady and all later months declined. Minneapolis May wheat added 3¾¢ and closed at $6.51 per bu. May soybeans lost 6½¢ to close at $11.92½ per bu. May soybean meal was down 80¢ to close at $339 per ton. May soybean oil dropped 0.75¢ to close at 47.67¢ a lb.

- US gold futures advanced again Wednesday. The April contract added $13.40 to close at $2,190.60 per oz.

- The US dollar index closed higher Wednesday.

- US equity markets snapped their losing streaks Wednesday. The S&P 500 was up 10% for the year and set to post a spectacular first quarter. The Dow Jones Industrial Average soared 477.75 points, or 1.22%, to close at 39,760.08. The Standard & Poor’s 500 jumped 44.91 points, or 0.86%, to close at 5,248.49. The Nasdaq Composite added 83.82 points, or 0.51%, to close at 16,399.52.

- US crude oil prices were lower Wednesday. The May West Texas Intermediate light, sweet crude future fell 27¢ to close at $81.35 per barrel.

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |

Source link

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027427', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_3'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027428', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_4'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027429', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_ad_29'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = 'a:29:{s:2:\"id\";s:2:\"29\";s:8:\"space_id\";s:1:\"4\";s:9:\"space_ids\";N;s:8:\"priority\";N;s:13:\"withdrawal_id\";N;s:7:\"ad_name\";s:4:\"Hycm\";s:11:\"buyer_email\";s:19:\"m.karam@outlook.com\";s:5:\"title\";s:0:\"\";s:11:\"description\";s:0:\"\";s:6:\"button\";s:0:\"\";s:3:\"url\";s:0:\"\";s:3:\"img\";s:0:\"\";s:4:\"html\";s:257:\"<center><a href=\"https://clicks.hyaffiliates.com/afs/come.php?id=1679&cid=814255302&atype=1&ctgid=100\" target=\"_blank\">\r\n<img src=\"https://display.hyaffiliates.com/afs/show.php?id=1679&cid=814255302&ctgid=100\" width=\"300\" height=\"250\" border=0></a></center>\";s:8:\"ad_model\";s:3:\"cpm\";s:8:\"ad_limit\";s:10:\"2147107430\";s:7:\"capping\";s:1:\"0\";s:14:\"optional_field\";N;s:10:\"additional\";N;s:4:\"cost\";s:4:\"0.00\";s:4:\"paid\";s:1:\"2\";s:6:\"starts\";N;s:4:\"ends\";N;s:15:\"show_in_country\";N;s:16:\"show_in_advanced\";N;s:6:\"p_time\";N;s:6:\"p_data\";N;s:7:\"p_error\";N;s:8:\"w_status\";N;s:6:\"status\";s:6:\"active\";}', `autoload` = 'off' WHERE `option_name` = '_site_transient_bsa_ad_29'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_stats`]

UPDATE wp_bsa_pro_stats

SET custom = 107, action_time = 1767916800

WHERE id = 52002 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_ads`]

UPDATE wp_bsa_pro_ads

SET ad_limit = `ad_limit` - 1

WHERE id = 29 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027430', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_space_5'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = '1768027431', `autoload` = 'off' WHERE `option_name` = '_site_transient_timeout_bsa_ad_49'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_options`]UPDATE `wp_options` SET `option_value` = 'a:29:{s:2:\"id\";s:2:\"49\";s:8:\"space_id\";s:1:\"5\";s:9:\"space_ids\";N;s:8:\"priority\";N;s:13:\"withdrawal_id\";N;s:7:\"ad_name\";s:8:\"Iqbroker\";s:11:\"buyer_email\";s:19:\"m.karam@outlook.com\";s:5:\"title\";s:0:\"\";s:11:\"description\";s:0:\"\";s:6:\"button\";s:0:\"\";s:3:\"url\";s:0:\"\";s:3:\"img\";s:0:\"\";s:4:\"html\";s:283:\"<center><a target=\"_blank\" href=\"https://affiliate.iqbroker.com/redir/?aff=5373&aff_model=revenue&afftrack=BpnsFxadinnewsEndOfPostAdIQ\"><img alt=\"banner image\" src=\"https://static.cdnaffs.com/files/storage/public/5e/32/b746c0f280b0c5d2j7.jpg\" width=\"300\" height=\"250\" /></a></center>\";s:8:\"ad_model\";s:3:\"cpm\";s:8:\"ad_limit\";s:10:\"2147263124\";s:7:\"capping\";s:1:\"0\";s:14:\"optional_field\";N;s:10:\"additional\";N;s:4:\"cost\";s:4:\"0.00\";s:4:\"paid\";s:1:\"2\";s:6:\"starts\";N;s:4:\"ends\";N;s:15:\"show_in_country\";N;s:16:\"show_in_advanced\";N;s:6:\"p_time\";N;s:6:\"p_data\";N;s:7:\"p_error\";N;s:8:\"w_status\";N;s:6:\"status\";s:6:\"active\";}', `autoload` = 'off' WHERE `option_name` = '_site_transient_bsa_ad_49'

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_stats`]

UPDATE wp_bsa_pro_stats

SET custom = 74, action_time = 1767916800

WHERE id = 52020 LIMIT 1

WordPress database error: [UPDATE command denied to user 'u117406468_wyYa1'@'127.0.0.1' for table `u117406468_rofUe`.`wp_bsa_pro_ads`]

UPDATE wp_bsa_pro_ads

SET ad_limit = `ad_limit` - 1

WHERE id = 49 LIMIT 1

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: