Category: Forex News, News

Pound Sterling sellers retain control ahead of key inflation test

- The Pound Sterling returns to the red against the US Dollar, hitting 14-month lows.

- GBP/USD licks wounds heading into the UK/US inflation showdown.

- Pound Sterling remains vulnerable below the key 21-day SMA at 1.2530.

The Pound Sterling (GBP) resumed its bearish momentum against the US Dollar (USD), pushing GBP/USD to the lowest level in 14 months below 1.2200.

Pound Sterling kept falling

Nothing could stop Pound Sterling sellers as the GBP/USD pair faced a double whammy in the first full week of 2025. The week began on an upbeat note as risk appetite returned on China’s stimulus optimism and strong Caixin Services PMI data. The People’s Bank of China (PBOC) pledged over the weekend that it will step up financial support for technology innovation and consumption stimulation as part of a continued effort to boost economic growth, per Bloomberg.

Positive risk sentiment weighed on the safe-haven USD, while helping the higher-yielding British Pound extend its previous week’s late rebound. However, the tide turned against the pair as inflation fears resurfaced on increased concerns over the potential impact of US President-elect Donald Trump’s immigration and trade policies, reviving the safe-haven demand for the US Dollar.

Expectations of fewer interest rate cuts by the US Federal Reserve (Fed) this year, fanned by encouraging US Job Openings and Labor Turnover Survey and ISM Manufacturing and Services PMI data, drove US Treasury bond yields higher across the curve, adding to the upside in the Greenback.

The decline in the GBP/USD pair gathered traction midweek after the Pound Sterling came under intense pressure due to a sharp sell-off in the British government bond market, fuelled by investors’ anxiety about UK assets and the economic outlook.

The bond market rout extended on Thursday, with the yield on benchmark 10-year UK Gilts rising by as much as 0.12 percentage points to 4.921%, the highest since 2008. This smashed the pair to its lowest level since November 2023 at 1.2239 before it recovered some ground to near 1.2300.

GBP/USD licked its wound near multi-month troughs heading into Friday’s US Nonfarm Payrolls (NFP) data release. Investors remained wary of the sell-off in the global bond market and growing Chinese economic worries.

In the American session on Friday, the USD gathered strength against its rivals after the December jobs report showed that NFP rose by 256,000, beating the market expectation of 160,000 by a wide margin. Additionally, the Unemployment Rate edged lower to 4.1%, while the Labor Force Participation Rate remained unchanged at 62.5%. Pressured by the USD rally, GBP/USD declined sharply with the immediate reaction and declined below 1.2200.

Inflation data remain the central focus

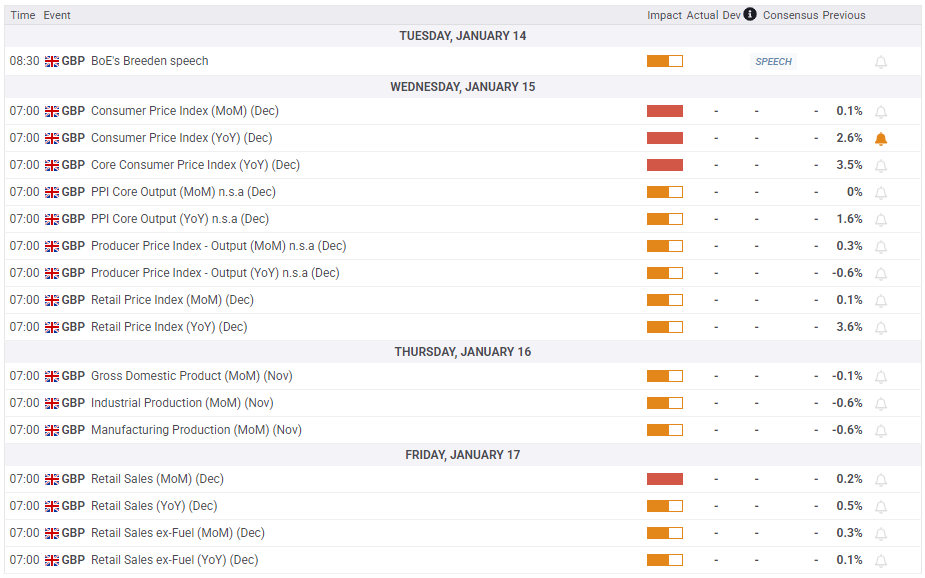

After a week dominated by US economic events, attention also turns to the UK macro data amid a quiet start to a busy week.

The early part of the week lacks any top-tier UK data releases but the Producer Price Index (PPI) data from the US will grab some eyeballs on Tuesday.

The high-impact Consumer Price Index (CPI) inflation data from both sides of the Atlantic will stand out on Wednesday.

The UK monthly Gross Domestic Product (GDP) report and Industrial Production will be published on Thursday ahead of the US Retail Sales and Jobless Claims data.

Friday will feature the Chinese fourth-quarter GDP and December activity data, which could significantly impact risk sentiment and higher-yielding assets such as the British Pound.

The UK Retail Sales and the mid-tier US housing data will be published on the same day.

Apart from the data publication and speeches from Fed policymakers, Trump’s policy speculations and geopolitical developments will also emerge as potential market drivers.

GBP/USD: Technical Outlook

GBP/USD confirmed a downside break from the six-week-long falling wedge formation after closing Thursday below the lower boundary of the wedge at 1.2330.

The 14-day Relative Strength Index (RSI) languishes in negative territory near 30, indicating more scope for the downside.

Further, the 50-day Simple Moving Average (SMA) and the 200-day SMA Death Cross, confirmed last month, remains in play and acts as a headwind to the pair.

If sellers flex their muscles and keep the pair below the previous 14-month low of 1.2239, the next downside target is November 10 2023 low of 1.2187.

Further south, the 1.2100 demand area could offer some respite to buyers. If that support caves in, the 1.2050 psychological level will be tested.

Conversely, any recovery will need acceptance above 1.2511 to sustain. That level is the confluence of the 21-day SMA and the upper boundary of the wedge.

The pair will then challenge the 50-day SMA at 1.2639 toward the 200-day SMA at 1.2803.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: