Category: Crypto News, News

Here’s XRP Price If Nine Global Banks Buy XRP with Just 0.5% of Their Assets

XRP could witness a massive price spike due to supply shock if nine of the largest global banks invest only 0.5% of their total assets.

Notably, discussions around the potential adoption of XRP by the banking system has gained momentum amid positive regulatory changes. For one, the U.S. SEC’s recent change in leadership has triggered speculations of an imminent settlement in the Ripple vs. SEC case.

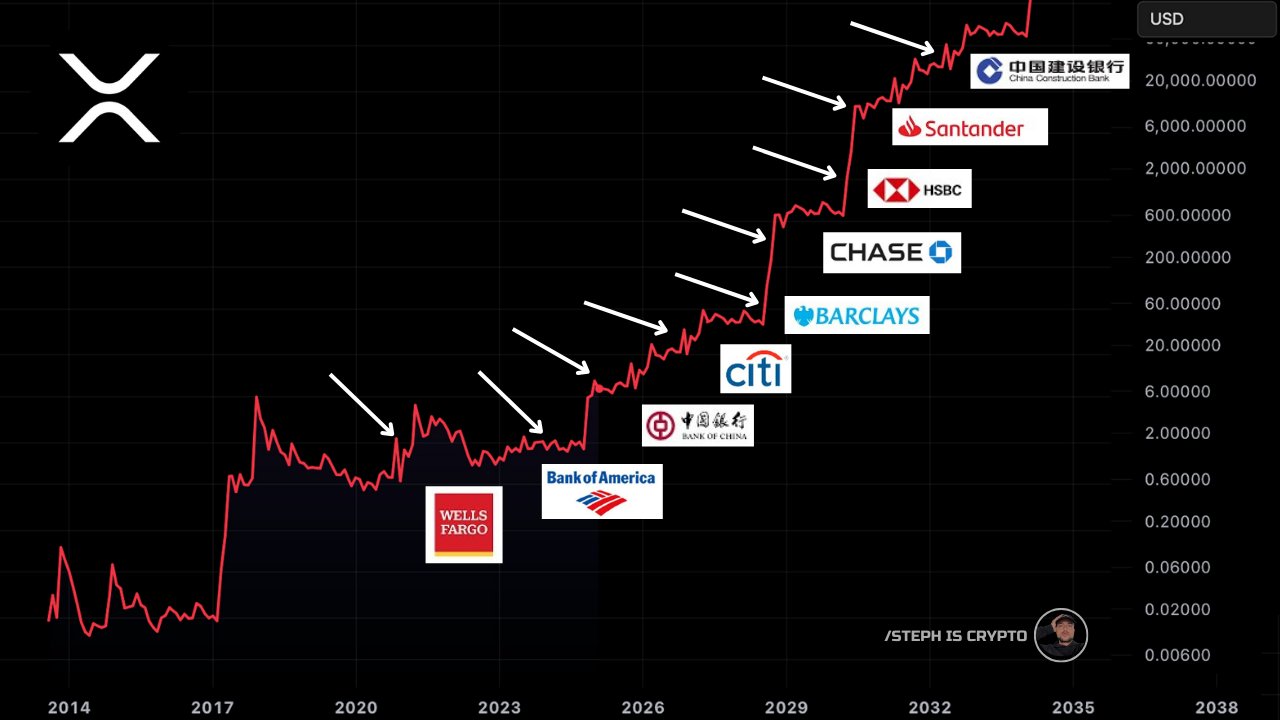

This could completely lift any regulatory cloud over XRP, leading to greater institutional adoption. Amid these discussions, market analyst Steph recently suggested that if some of the world’s largest banks adopted XRP, the impact on its price could be massive.

In an accompanying chart, he called attention to such possible adoption by nine of these banks. However, his disclosure lacked specific figures. Notably, a more streamlined analysis provides a clearer picture of how this could unfold.

Massive Institutional Capital Flowing Into XRP

Data from CompaniesMarketCap.com shows the sheer scale of assets held by these financial giants. Particularly, the China Construction Bank controls $5.837 trillion, while the Bank of China holds $4.859 trillion.

Meanwhile, JP Morgan follows with $4.210 trillion, and Bank of America has $3.324 trillion. HSBC’s total assets amount to $3.098 trillion, Wells Fargo’s to $1.922 trillion, Citigroup’s to $2.430 trillion, Banco Santander’s to $2.013 trillion, and Barclays’ to $2.049 trillion. Combined, these banks control a staggering $29.74 trillion in assets.

If each of them allocated just 0.5% of their total assets to purchasing XRP, the capital injection would surpass $148.7 billion. At XRP’s current price of $2.3, this would result in substantial acquisitions.

Specifically, China Construction Bank alone could purchase 12.69 billion XRP, while Bank of China would obtain 10.56 billion XRP. JP Morgan’s allocation would translate to 9.15 billion XRP, and Bank of America’s to 7.23 billion XRP.

Further, HSBC would secure 6.73 billion XRP, while Wells Fargo, Citigroup, Banco Santander, and Barclays would acquire 4.18 billion, 5.28 billion, 4.38 billion, and 4.45 billion XRP, respectively. In total, these banks would accumulate 64.66 billion XRP, representing nearly 65% of the liquid supply.

The Ripple Effect on XRP Price

With XRP’s total supply at 100 billion, removing 64.66 billion XRP from the market would create an extreme supply shock. Notably, a purchase of this scale would likely drive prices higher. However, the extent of this price surge remains uncertain, so we sought insights from ChatGPT.

The AI chatbot first used a market cap formula to estimate the impact of this potential capital influx. Given that the purchase would inject $148.7 billion into XRP, its market cap would more than double.

If the price followed this increase proportionally, ChatGPT estimates XRP could rise to at least $4.6. However, this estimate assumes the market reacts in a linear fashion.

In reality, several factors could drive the price even higher. The chatbot noted that a supply squeeze, combined with surging demand, could send XRP’s value soaring well beyond $10. It also projected that XRP could climb to $20 or even $50, depending on how aggressive the market response is.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: