Category: Forex News, News

XAU/USD now targets the $3,000 mark

- Gold prices rose to an all-time high past $2,980 on Thursday.

- The US Dollar added to Wednesday’s uptick and hit weekly tops.

- Rising uncertainty around US tariffs continue to support safe haven demand.

Gold prices (XAU/USD) advanced for a third consecutive day on Thursday, soaring to all-time highs past the $2,980 mark per troy ounce and setting the stage for a potential test of the psychological $3,000 threshold.

The precious metal’s steady climb has entered its second straight week, with gold posting gains in the first three months of the new year. Looking at the bigger picture, the yellow metal has only recorded monthly losses four times since 2024.

Tariff chaos and cooling inflation boost Gold

Since President Trump’s inauguration on January 20, US trade policy has taken center stage. However, the lack of a clear direction—highlighted by announcements of new tariffs followed by abrupt reversals—has heightened uncertainty among market participants, who see the administration’s trade stance as anything but firm.

This ongoing back-and-forth in the tariff narrative has driven investors toward safe-haven assets, giving gold an extra push and bringing the $3,000 milestone into sight.

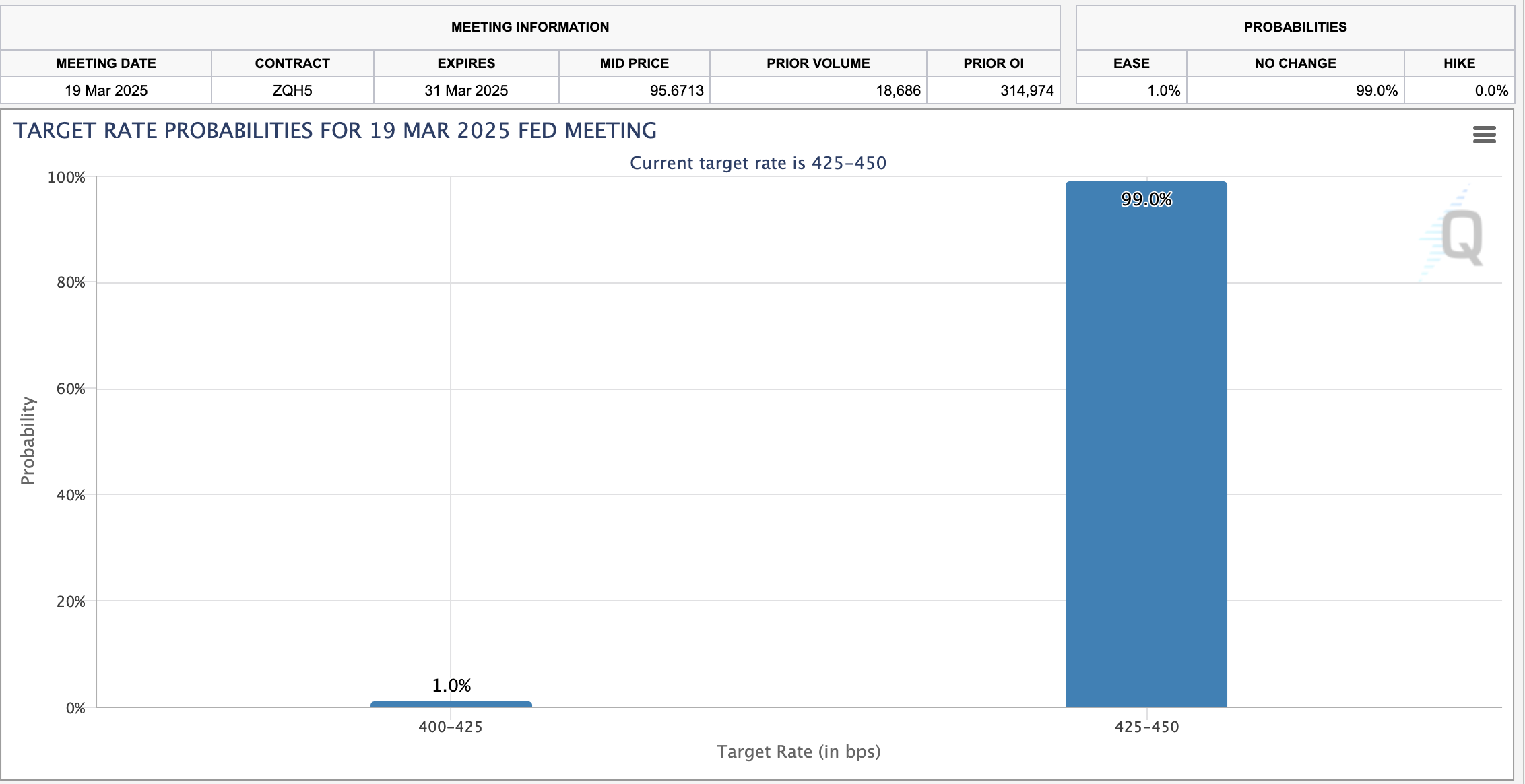

Meanwhile, US inflation gauges—both the Consumer Price Index (CPI) and Producer Price Index (PPI)—eased slightly in February, fueling speculation that the Federal Reserve (Fed) could resume its easing cycle in the near future. On the flip side, softening inflation also suggests a slowing economy, bolstering concerns about a possible recession in light of recent weakness in US fundamentals.

Peace talks: A potential headwind?

For now, negotiations aimed at ending the Russia-Ukraine conflict are ongoing, but no concrete outcome has emerged. Should a ceasefire scenario materialize, gold could face a setback as the removal of geopolitical risk might prompt a move back into riskier assets.

Gold’s short-term technical outlook

Gold’s next big target on the upside is its record high of $2,983 reached on March 13. Should these levels be breached, Fibonacci projections point to potential milestones at $3,254, $3,396, and $3,600.

On the downside, the first line of defense lies at the weekly low of $2,832 (February 28), followed by the interim 55-day and 100-day SMAs t $2,805 and $2,741, respectively. Down from here emerges the ky 200-day SMA at $2,610, which precedes the November’s low of $2,536 (November 14).

While the Relative Strength Index (RSI) remains on the rise beyond 67, the Average Directional Index (ADX) near 25 indicates a fairly decent strength of the trend.

Gold daily chart

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: