Category: Crypto News, News

Why is XRP price going up ?

- XRP price rebounded above $2.42 on Friday, posting a 28% recovery from the weekly timeframe low of $1.90.

- Analysts predict an XRP ETF could attract $5 billion in inflows, mirroring Bitcoin’s ETF impact and fueling a rally.

- XRP must break $2.99 resistance to reach $3.40, pushing its market cap toward the $200 billion milestone.

XRP price rebounded above $2.42 on Friday, marking a 28% recovery from the weekly timeframe low of $1.90. The rally was fueled by the U.S. Securities and Exchange Commission’s (SEC) kicking off settlement talks with Ripple, and speculations the Blackrock could launch altcoin derivatives products.

How high can XRP price reach if altcoin exchange-traded fund (ETF) are approved this year?

XRP crosses $2.4 on reports of SEC commodity classification

XRP rebounded 5% to reclaim the $2.30 support level amid reports that the SEC may classify it as a commodity in ongoing settlement discussions with Ripple Labs. This potential regulatory milestone could eliminate legal uncertainties and encourage broader institutional participation.

Receent market reports show that SEC officials are evaluating whether XRP should be treated similarly to Bitcoin and Ethereum, both of which fall under commodity regulations. If XRP secures this classification, it could significantly enhance the chances of an XRP ETF approval.

Ripple (XRP) Price Action, March 14

Market analysts suggest that an official SEC statement confirming XRP’s commodity status could serve as a catalyst for a price rally. In the past, similar speculation drove XRP from $0.90 to $3.10 in under two months. This suggests XRP could potentially attempt another retest of the $3 level if the altcoin ETFs are approved.

Will Blackrock launch XRP ETFs?

Beyond the ongoing speculations surrounding ETF approvals, fresh discussions have emerged suggesting that BlackRock may launch ETFs for XRP and Solana. Nate Geraci, Co-Founder of The ETF Institute, has fueled this speculation with his bold prediction:

“I’m ready to log formal prediction… BlackRock will file for both Solana & XRP ETFs. Solana could be any day.

Think XRP once SEC lawsuit. BlackRock is currently the leader by assets in both Bitcoin & Ether ETFs… I simply don’t see them allowing competitors to come in & launch ETFs on 2 of the top 5 non-stablecoin crypto assets without any sort of fight. I also believe BlackRock will file for crypto index ETFs btw.”

– Nate Geraci, March 15, 2025

At press time, BlackRock currently holds over 567,000 Bitcoin valued at over $47.8 billion—outpacing MicroStrategy’s 499,096 BTC holdings, within 15 months of inception.

This speculation that BlackRock could launch altcoin ETFs further enhances XRP’s appeal to strategic investors looking to buy in early, ahead of potential institutional inflows.

When could the US SEC approve an XRP ETF?

The timeline for an XRP ETF approval depends on ongoing regulatory developments. The SEC is currently reviewing multiple crypto ETF applications, including those for Ethereum and XRP, as institutional demand for diversified digital asset exposure grows.

Industry experts anticipate that an XRP ETF could gain approval in late Q3 or early Q4 of 2025, contingent on the resolution of Ripple’s legal battle.

If Ripple successfully negotiates a settlement and XRP attains commodity status, the path to ETF approval would become significantly clearer.

The approval of spot Bitcoin ETFs in January 2024 triggered significant institutional inflows, driving BTC to new all-time highs.

A similar scenario could play out for XRP, with analysts forecasting that an XRP ETF could attract over $5 billion in inflows within its initial months.

As institutional interest and regulatory momentum build, XRP remains a leading contender for ETF approval. Key upcoming catalysts include further court rulings in the Ripple vs. SEC case and statements from SEC officials as well as references to Ethereum and Bitcoin’s regulatory status.

More so, the Gary Gensler’s recent depature, and other key crypto-friendly cabinet appointments have resulted in the rollback of several several sanctions in recent weeks.

Notably the likes of Coinbase, Robinhood, Ripple (XRP), and Uniswap have all had notable charges filed by the previous SEC administration.

All of these factors, combined with reports that SEC is leaning towards decaling XRP a commodity, have triggered a increase in the probability of multiple altcoin ETF approvals this year.

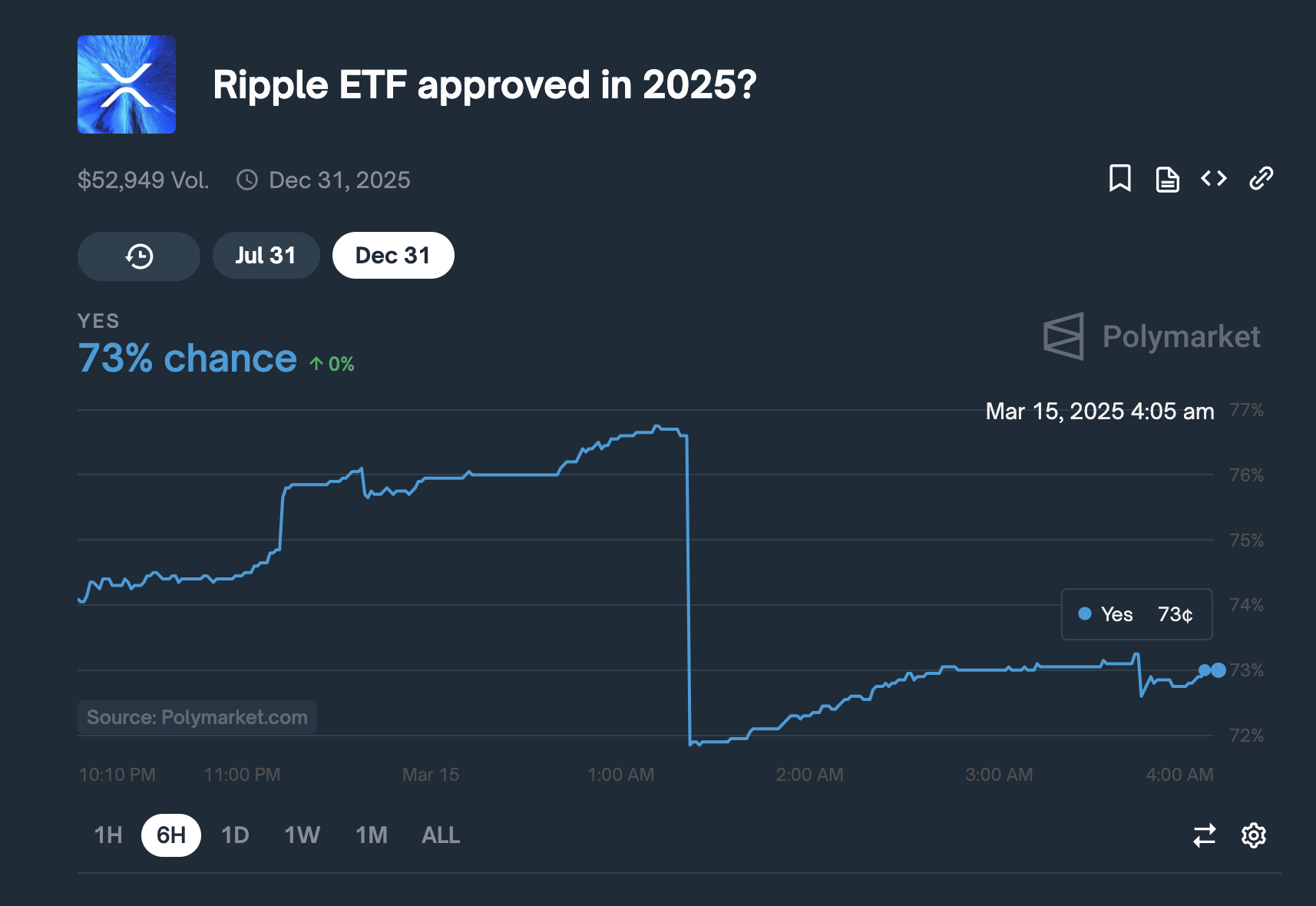

According to Polymarket data, traders currently assign a 73% probability to XRP ETF approval before December 31, 2025. Similar probabilities apply to other altcoins with pending ETF applications.

XRP Price Forecast: $200 billion market cap breakout ahead?

At press time, XRP is consolidating above $2.40 with a market capitalization of $140 billion, down from its recent high of $3.10.

For Ripple to reach a $200 billion valuation, XRP would need to surpass $3.40—a level that may be attainable if ETF approvals materialize and institutional demand matches up to levels seen when Bitcoin derivatives were approved in early 2024.

XRP price is rebounding from recent lows, currently trading around $2.42, as bullish momentum gains traction.

After booking nearly 28% gains over the past four days, insights from technical indicators suggest more upside ahead.

The Donchian Channel (DC) upper band at $2.99 remains the primary resistance level, while the mid-band at $2.44 is acting as a short-term pivot point.

A decisive break above this level could trigger further upside toward the $2.60-$2.80 range.

XRP Price Forecast | XRPUSD

The Relative Strength Index (RSI) has climbed to 50.89, crossing above the signal line at 47.64, suggesting strengthening bullish momentum.

This shift in RSI structure aligns with the increase in trading volume, which has exceeded 1.13 billion, reflecting growing investor interest.

If RSI continues to rise toward the 55-60 zone, it could confirm sustained buying pressure, pushing XRP towards the $2.99 resistance.

On the bearish side, failure to hold the $2.30 support could invalidate the current recovery, exposing XRP to a potential pullback toward $1.90.

However, with volume increasing and RSI reclaiming neutral territory, the bias leans bullish.

If price action sustains above $2.44, XRP could extend its rally toward $2.80, with a breakout above $2.99 opening the door for a retest of $3.40, which could effectively catapult Ripple’s valuation above the $200 billion milestone

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: