Category: Forex News, News

Crude Oil Price Forecast: Failed Breakout Signals Weakness

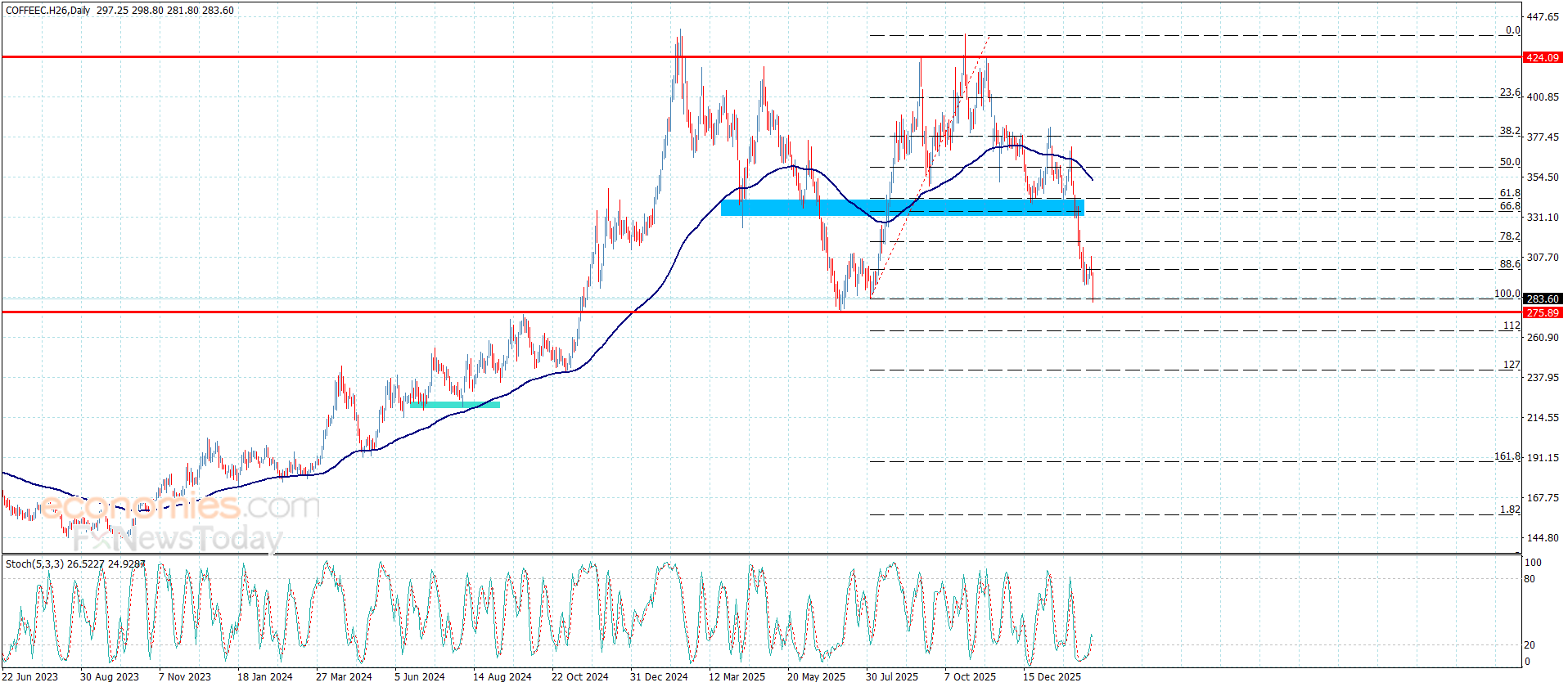

Bull Breakout Fails

A rally earlier in Tuesday’s trading session saw crude oil trigger a potential breakout of a double bottom bullish reversal pattern. However, the subsequent bearish reaction negates that breakout and adds to the risk of a failed bull breakout. Therefore, the chance that crude oil may challenge recent lows before attempting to go higher again increases. Although a drop below today’s low would provide the next sign of weakening demand, crude oil would be falling into a support zone that has been retained for approximately 10 days, including today.

Another Upside Attempt Possible

Certainly, it is possible that an upside breakout of the double bottom pattern will be attempted again, and it may have greater success next time. Given that the 20-Day MA continues to fall, the price that it represents will also decline. This makes it the next key potential resistance level to be challenged and possibly exceeded, if the bulls are to have a chance at a counter-trend rally. A daily close above the 20-Day MA would be needed for bullish signs that may continue to strengthen. Furthermore, a daily close above approximately $68.98 would then be needed to further confirm strength.

Weekly Chart is More Bullish Than Not

Note that the weekly chart (not shown) shows a potential bullish doji hammer candlestick pattern that formed last week. A bullish breakout signal triggered today and of course it has failed so far. But it is possible that following a deeper pullback into last week’s price range, a bullish reversal might follow that could lead to another breakout above last week’s high at $68.03 and the neckline of the double bottom pattern at $68.37.

For a look at all of today’s economic events, check out our economic calendar.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: