Category: Forex News, News

EUR/JPY Forecast Today 18/04: Momentum Wanes (Chart)

- The euro initially rallied against the Japanese yen during the trading session on Thursday but gave back gains to show signs of hesitation.

- This does make a certain amount of sense, considering that the euro itself is overbought against quite a few currencies, and we have to worry about Good Friday slowing things down during the next session.

- Beyond that, there are a lot of concerns out there when it comes to the global economy, and of course the idea of whether or not the tariff war is going to continue to be a major problem.

Technical Analysis

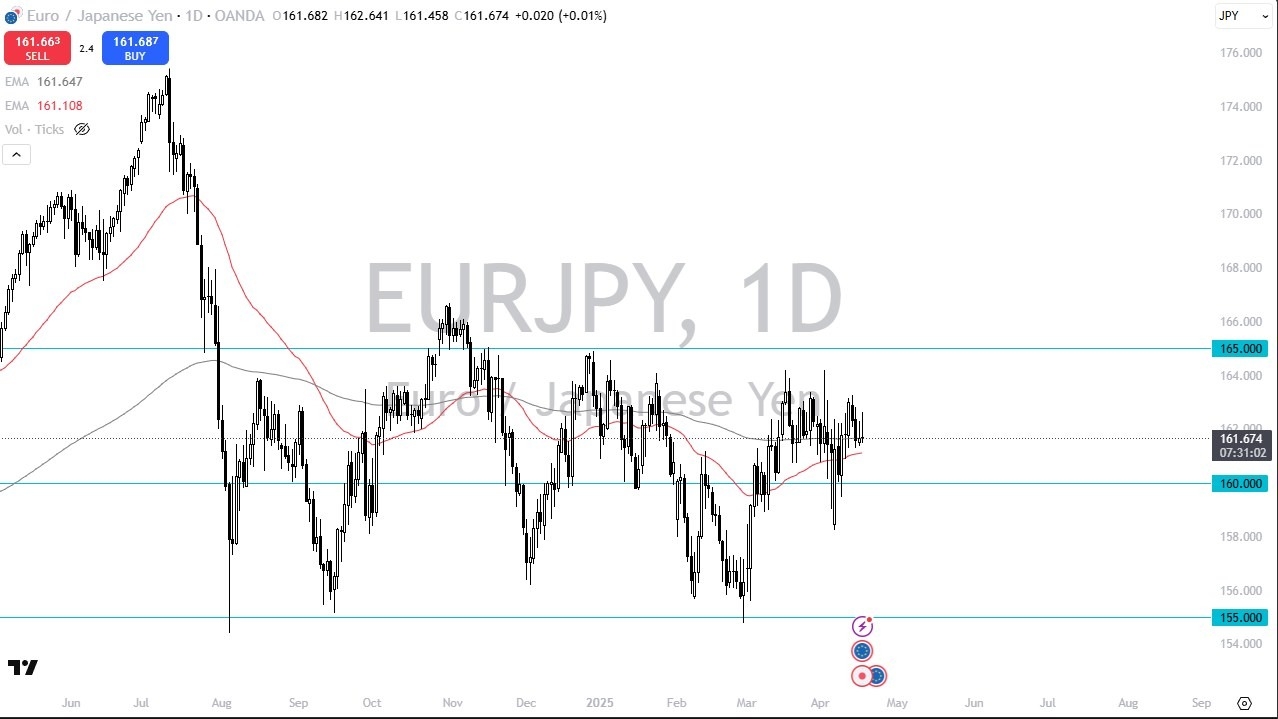

The technical analysis for this market is somewhat stagnant at the moment, as the 50 Day EMA sits just below the current trading range, and this does suggest that perhaps we are sitting on potential technical support. Beyond that, the ¥160 level of course, is an area that a lot of people will be watching, as it is a large, round, psychologically significant figure, and of course an area that has been important more than once.

On the upside, if we were to break above the ¥164 level, then it opens up the possibility of a move to the ¥165 level. In general, I think you’ve got a situation where traders will continue to perhaps kick the EUR/JPY pair between the ¥160 level on the bottom, and the ¥165 level on the top, essentially making this a flat and sideways market. However, if you are a short-term range bound trader, this could be a currency pair that you excel in as it looks like it has nowhere to be.

Expect volatile and choppy trading, but I think you can say that about pretty much any market at this point. I don’t like the idea of taking on a position right now, so position sizing will be crucial going forward. I am looking at this pair through the prism of small position, and short-term trade ideas.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: