Category: Forex News, News

Dollar Yen breaks higher as forecasted key levels to watch

- USD/JPY breaks past 146.80 as forecasted, validating the Fair Value Gap structure and liquidity sweep play.

- Tariff-driven yen weakness and fragile Japanese data fuel continued upside pressure into key resistance.

- The technical outlook favors bulls, with 147.00 and 148.00 in focus as long as price holds above 145.80 and FVG remains intact.

Yen weakens on renewed tariff pressure

USD/JPY traded sharply higher this week, fueled by renewed trade tensions and technical tailwinds. On July 7–8, the U.S. announced plans for 25% tariffs on Japanese and South Korean imports, set to take effect August 1. While not final, the announcement triggered an immediate market reaction. Check this out for reference: Forex, indices, Gold weekly gameplan: Technical analysis and price action outlook.

The result? The Japanese yen slid to multi-week lows as USD/JPY surged toward 146.90, fueled by:

- Tariff-induced yen weakness.

- Safe-haven support for the US Dollar.

- Technical reclaim of structure and bullish imbalance zones.

Meanwhile, Japan’s economic backdrop remains fragile. Q1 GDP showed contraction, real wages declined, and consumer sentiment weakened—all compounding yen softness and raising concerns ahead of Japan’s July 20 elections.

High-impact news driving USD/JPY

| Date | Event | Market reaction | USD/JPY impact |

| July 7–8 | Trump announces 25% tariffs on Japan/Korea | Risk-off spike | USD/JPY rallies past 147.50 |

| July 8 | PM Ishiba says Japan will continue trade talks | Eases panic slightly | Consolidation above 146.20 |

| July 9 | FOMC Minutes due | Market cautious | Could further fuel USD strength or cap gains |

These developments amplify the macroeconomic narrative driving USD/JPY:

- Weak yen fundamentals.

- Hawkish U.S. tone with risk-averse global positioning.

- Key resistance zones now under threat of breakout.

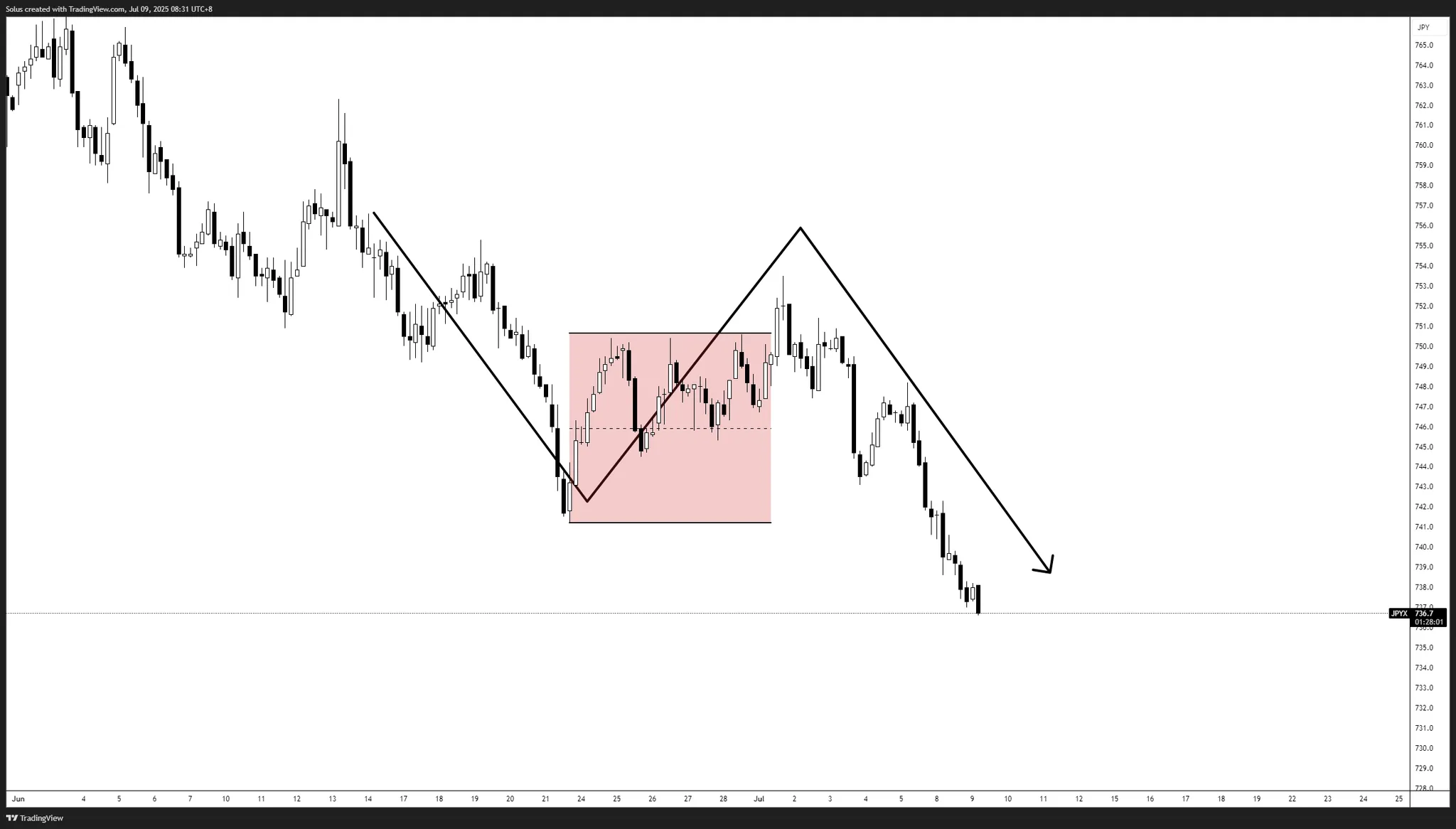

Forecast vs actual – Bullish scenario played out perfectly

In our prior analysis – EUR/USD, Gold, Nasdaq, Bitcoin forecast and more, breakout trading setups -, we outlined a bullish Smart Money structure built around a 4-Hour Fair Value Gap Level resting between 143.934-144.608, a sweep of previous highs at 145.00, and a continuation rally past it.

Actual market reaction

- Price swept highs at 145.00 after bouncing off from the 4-Hour Fair Value Gap Level resting between 143.934-144.608.

- USD/JPY then surged beyond 146.80 as projected.

This confirms the renewed strength of the U.S. dollar over the Yen’s dovish stance.

Technical outlook

USD/JPY has reclaimed its bullish trajectory, now sitting near its highest level since early June.

Bullish scenario – In progress

A break and hold above 147.00 could open the path toward multi-month highs. We could see further upside as long as:

- The 4-Hour Fair Value Gap between 146.280-146.631 remains intact.

- Price does not close below the immediate low at the 145.80 level.

- The Fed’s tone remains hawkish.

Targets:

- 147.00 – Next Psych Level.

- 148.00 – June High.

Bearish scenario

As the rally looks over-extended and over-stretched, this could pose a risk for downside as profit-taking takes place. We could see signs of weakness if:

- The 4-Hour Fair Value Gap between 146.280-146.631 gets closed down

- Failure to remain and break the 145.80 level

- A dovish Fed + July election sentiment

The USD/JPY rally played out almost identically to the forecasted Smart Money setup, reclaiming the Fair Value Gap, executing a sweep, and continuing higher.

With U.S. tariff risk pressuring Japan and institutional bullish structure now active, the path of least resistance leans toward a breakout. But traders should stay alert for event-driven volatility around FOMC and Japanese elections in the coming days.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: