Category: Crypto News, News

Shiba Inu Faces Bearish Pressure as Massive Transfers and Weak Technicals Drive Price Toward $0.00001050

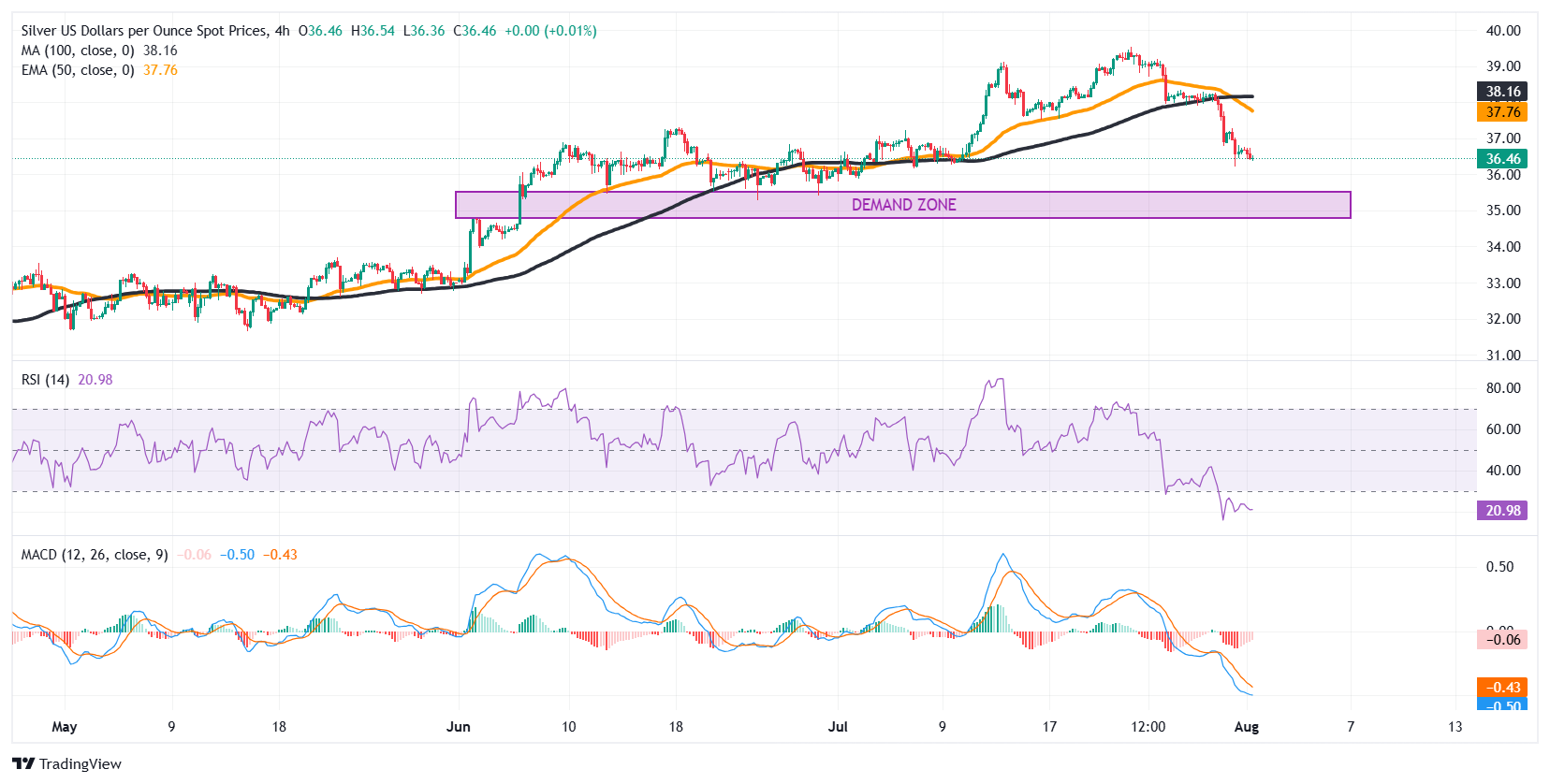

Shiba Inu (SHIB) is facing mounting bearish pressure amid record token transfers and deteriorating technical indicators. On July 31, over 4.87 trillion SHIB tokens were moved in a single day, a sign of aggressive selling activity by large holders. This volume far exceeded the seven-day average of 2.72 trillion tokens and aligns with a breakdown in key technical levels. The price has fallen below the 50 EMA and is nearing critical support at $0.00001200, raising concerns of further downward momentum [1].

The on-chain data paints a clear picture of market sentiment. Large token movements often correlate with distribution phases, in which whale activity intensifies during periods of increased volatility. A $4.2 million withdrawal from a Binance wallet was also noted on July 31, potentially signaling a shift in custody strategies among major SHIB holders [2]. This activity, combined with the price action, suggests a growing caution among long-term investors.

Technical indicators offer little optimism. While the price approaches oversold territory, the RSI shows no bullish divergence, a red flag for potential further declines. The absence of any recovery above key moving averages suggests that bearish momentum is structural rather than cyclical [3]. If the $0.00001200 level fails to hold, SHIB could drop toward $0.00001050, a level last seen in early 2025.

Burn activity has increased in recent days, offering a potential tailwind for the token. However, this has not been sufficient to offset the broader selling pressure. Analysts have not provided clear forecasts for a rebound, leaving the market in a state of uncertainty. The lack of bullish divergence in key metrics points to a continuation of the current downtrend in the near term [4].

The broader crypto market has mirrored SHIB’s bearish tone. Solana (SOL) fell to $166, Bitcoin and Ethereum both declined, and XRP saw a similar downward trend. The increased transaction volumes on Bitcoin and Ethereum, up 7.2% and 4.2% respectively, suggest a broad-based shift in trading behavior [5]. These trends reinforce the notion that the current selling pressure is not isolated to SHIB but reflects a wider market correction.

Market participants are now closely watching on-chain data and technical levels for signs of stabilization or reversal. For now, the bearish structure remains intact, with no immediate catalysts suggesting a reversal. Investors are advised to remain cautious and monitor both price action and whale activity for potential turning points.

Sources: [1] Mitrade. Shiba Inu Price Prediction: Why SHIB Might Have To Fight … https://www.mitrade.com/au/insights/news/live-news/article-3-996969-20250730

[2] Blockchain. SHIB Price Struggles Despite Massive Burn Rate Spike as … https://blockchain.news/news/20250731-shib-price-struggles-despite-massive-burn-rate-spike-as-bears [3] AInvest. Binance Wallet Withdraws $4.2M in Crypto Amid Self … https://www.ainvest.com/news/ethereum-news-today-binance-wallet-withdraws-4-2m-crypto-custody-shift-2507/ [4] Yahoo Finance. Most Active Crypto Currencies: Coins and Tokens With the … https://uk.finance.yahoo.com/markets/crypto/most-active/ [5] CoinJournal. Solana Price Forecast as SOL Bulls Look to Buy the Dip https://coinjournal.net/news/solana-price-forecast-as-sol-bulls-look-to-buy-the-dip/Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: