Category: Crypto News, News

XRP Pulls Back to $2.89 as Sell Signal and Key Support Levels Draw Focus

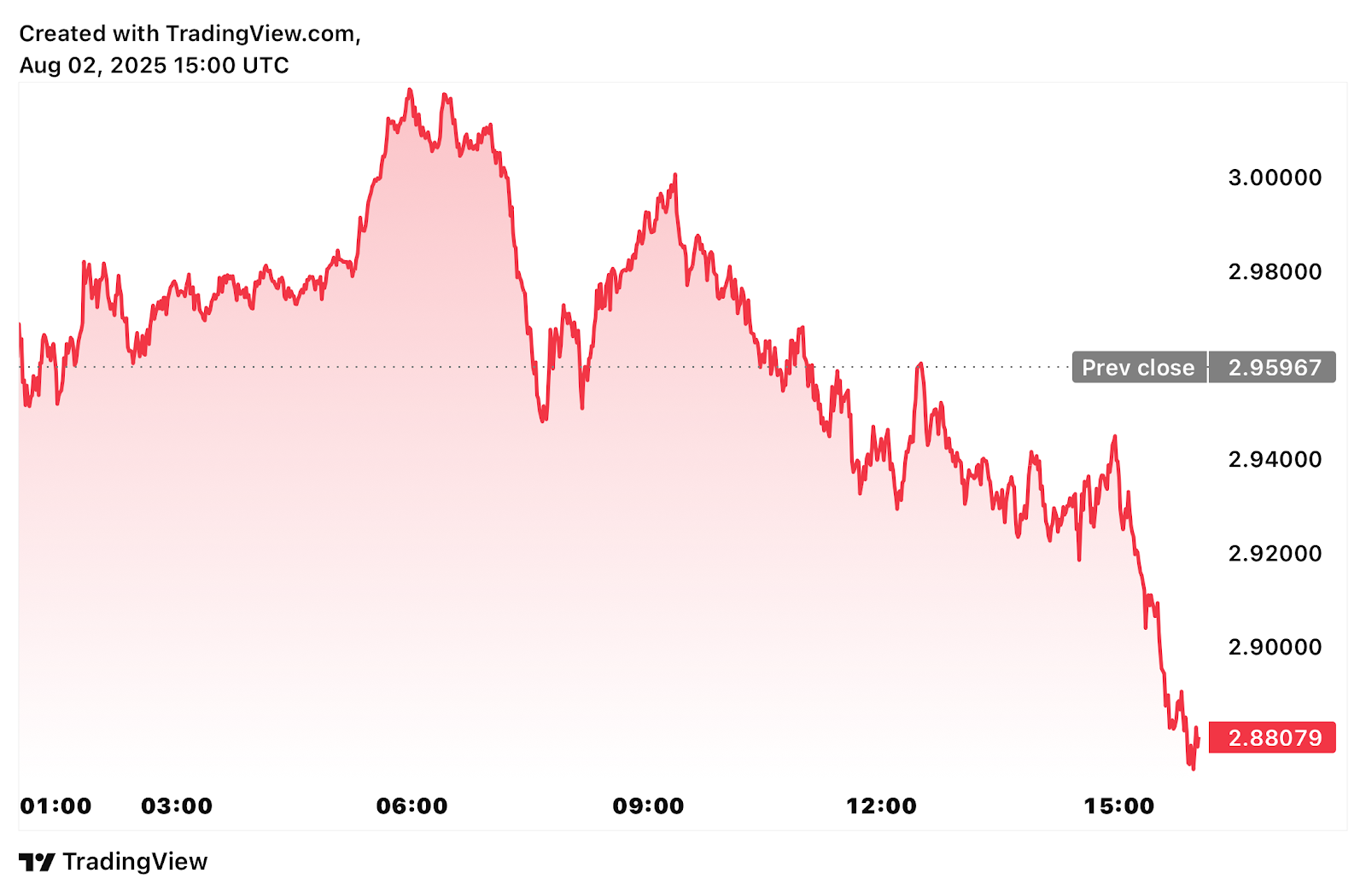

XRP has continued its downward movement in the wake of a strong July rally, drawing attention from traders and technical analysts. After reaching a local high of $3.55 mid-month, the token has since pulled back to around $2.89, with key support levels becoming focal points for market participants. According to Ali, a respected crypto analyst, the TD Sequential indicator has flashed a sell signal on the 3-day chart, indicating further downside risk. He has identified $2.40 as the next critical support level, a former resistance zone that now aligns with key horizontal structure from late June and early July [1].

The sell signal is a common indicator of trend exhaustion, typically emerging after a sustained upward move. In this case, the signal appeared shortly after XRP’s sharp climb from below $2.00 to nearly $4.00. The price action since has validated the warning, with a gradual decline reinforcing the likelihood of a deeper correction before a potential resumption of the upward trend [1].

Currently, XRP is trading at $2.89, having tested a recent low of $2.80. The bounce following that test has been weak, and without a clear push above $3.00, the short-term outlook remains bearish. The volume during the pullback has decreased, suggesting cooling momentum rather than panic selling. However, the lack of strong buyer interest raises concerns about the sustainability of XRP’s previous rally without a clear consolidation phase [1].

Technical indicators such as the RSI have also moved from overbought levels into neutral territory, further reinforcing the potential for further correction. While the RSI remains above 40, the MACD values are still negative, and volume has steadily declined since the July rally [1].

Looking ahead, the coming days will be crucial for XRP. A successful defense of the $2.40 level could spark renewed bullish momentum and set the stage for a rebound toward $3.10 and beyond. Conversely, a clean break below this level could expose the token to a deeper pullback, with the next logical area of interest near $2.20. The broader trend for XRP remains constructive, as the asset continues to hold above key long-term moving averages. Institutional interest in Ripple’s technology and products also remains strong [1].

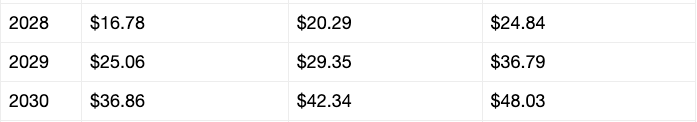

Despite the short-term bearish pressure, some analysts have maintained a cautiously optimistic outlook. For instance, Unilabs raised its price target for XRP in August to $5, citing increased trading volume and whale activity as potential catalysts for upward movement [6]. Meanwhile, Bitget has projected a more conservative trajectory, forecasting a price of $3.28 for August 2025 and $3.35 by January 2026 [7]. These forecasts, however, remain speculative and depend on broader macroeconomic conditions and market sentiment.

The recent correction has also coincided with significant whale activity. Over 710 million XRP were sold in the past 24 hours by large holders, reducing their total balance from over 10 billion to 8.02 billion since mid-July. This distribution began shortly after XRP reached a local peak near $3.50 and has coincided with a price decline, signaling potential profit-taking [1].

Fundamentally, Ripple has seen new investment opportunities emerge, including the “Free Start” cloud mining program offered by Ripplecoin Mining. The program allows users to lock in XRP and earn passive income, emphasizing accessibility and diversification across multiple currencies [3]. However, market conditions remain volatile, and XRP has mirrored the broader crypto downturn on August 2, 2025, falling 10.2% before stabilizing around $2.98 [5].

Overall, XRP appears to be consolidating, with a potential breakout contingent on overcoming key resistance levels. Investors are advised to closely monitor technical indicators and major market movements as the token approaches these critical price points [1].

Sources: [1] Same Pattern, Same Setup—Could XRP Really Be Heading Toward $12

(https://coinmarketcap.com/community/articles/688ec749d638b90b44164dbc/) [2] XRP News Today: XRP Eyes Major Breakout as Analysts Flag Bullish Technical Signals

(https://www.ainvest.com/news/xrp-news-today-xrp-eyes-major-breakout-analysts-flag-bullish-technical-signals-2508/) [3] XRP May Be Poised For A Historic Breakthrough, And Ripplecoin Mining Is Creating A New Passive Income Model

(https://www.barchart.com/story/news/33815647/xrp-may-be-poised-for-a-historic-breakthrough-and-ripplecoin-mining-is-creating-a-new-passive-income-model) [5] Bitcoin, Ethereum and XRP Sink as Crypto Liquidations Top $900 Million

(https://decrypt.co/333226/bitcoin-ethereum-xrp-sink-crypto-liquidations-top-900-million) [6] Expert Raises XRP Price Prediction for August to $5, But Says Unilabs Will Jump Even Higher

(https://coincentral.com/expert-raises-xrp-price-prediction-for-august-to-5-but-says-unilabs-will-jump-even-higher/) [7] XRP Price Prediction & Forecast 2025-2050

(https://www.bitget.com/price/ripple/price-prediction)

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: