Category: Forex News, News

XAU/USD loses ground to near $3,350, weaker US jobs data might cap downside

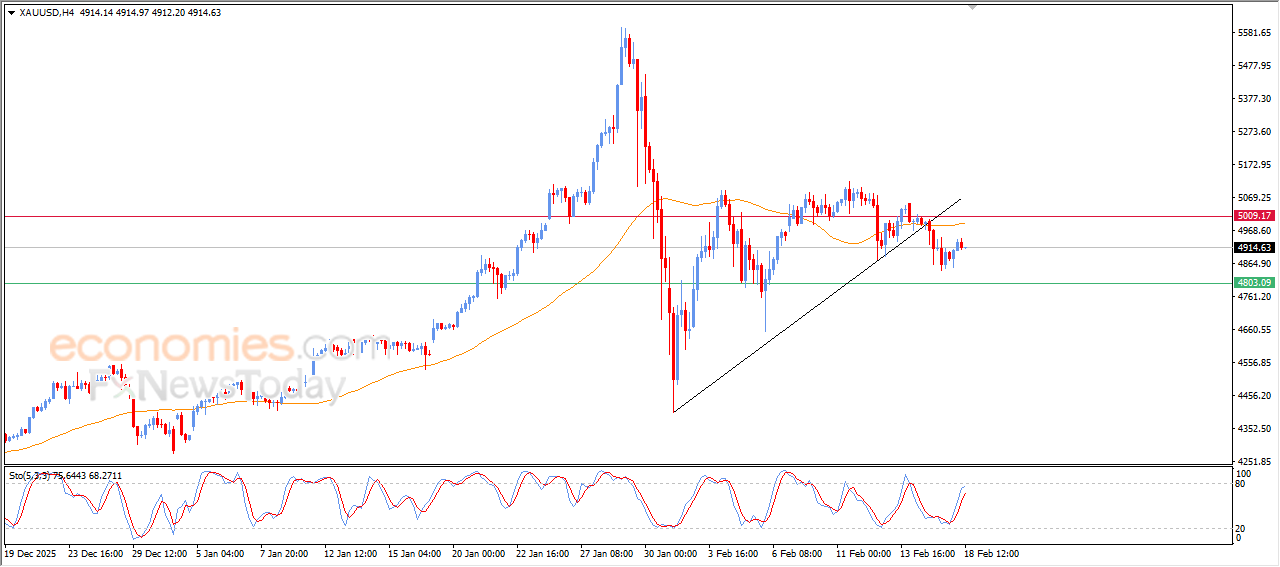

- Gold price drifts lower to near $3,360 in Monday’s early Asian session.

- The recovery in the USD weighs on the precious metal.

- Weaker US NFP and tariff fears could boost safe-haven assets like the Gold price.

The Gold price (XAU/USD) edges lower to around $3,360, snapping the two-day winning streak during the early Asian session on Monday. Nonetheless, weak US job data and tariff fears might weigh on the US Dollar (USD) and help limit the USD-denominated commodity’s losses.

The yellow metal loses traction due to the rebound in the Greenback. The potential upside for Gold might be limited as an underwhelming US Nonfarm Payrolls (NFP) data boosted expectations of a Federal Reserve (Fed) rate cut.

The US NFP rose by 73,000 in July, versus a 14,000 increase (revised from 147,000) prior, the US Bureau of Labor Statistics (BLS) revealed on Friday. This figure came in below the market consensus of 110,000. Meanwhile, the US Unemployment Rate ticked higher to 4.2% in July from 4.1% in June, as expected.

“Payrolls numbers came in below expectations, but a little higher than the market was printing. So, this gives a better probability that the Federal Reserve will cut (rates) later in the year,” said Bart Melek, head of commodity strategies at TD Securities.

Furthermore, fresh tariff announcements and uncertainty over US trade policies spur safe-haven demand. On Friday, US President Donald Trump hit many countries with new levies, causing shock and confusion. Investors will closely monitor the developments surrounding US tariffs announcement.

Trump and Canadian Prime Minister Mark Carney will likely talk “over the next number of days” after the U.S. imposed a 35% tariff on goods not covered by the US-Mexico-Canada trade agreement. Tariff pause extension between the US and China, the world’s two largest economies, will also be closely watched. Any signs of renewed trade tensions could boost the precious metal.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: