Category: Crypto News, News

Solana Price Prediction: Golden Cross and Liquidation Squeeze Set Stage for Next Rally

Solana is gaining momentum after a key breakout, with technical signals and real-world adoption hinting at a potential major rally ahead.

After days of corrective price action, Solana is starting to flip the script. The token has bounced off key support near $155 and is now showing signs of renewed strength, both on the charts and in real-world adoption.

Solana’s Adoption Goes Corporate

In a surprising move, Artelo Biosciences has adopted Solana as a reserve asset, marking a major step in real-world crypto adoption. The pharma firm raised $9.475M through a private placement to back this treasury strategy, making it the first publicly traded biotech company to integrate SOL into its financial reserves. This marks a corporate headline, and it shows the growing confidence in Solana’s longer-term perspective.

While short-term price movement may not instantly reflect this news, structurally, this kind of adoption can build long-term investor trust and open the door for a broader bullish trend.

Solana Price Signals the Bottom May Be In!

Solana’s price is starting to show strong signs of reversal, with NoirBit’s latest chart pointing to a confirmed bottom formation. The price has broken out of a multi-month downtrend and is now riding a clean ascending support line. Two smaller consolidation phases are marked clearly within this climb, suggesting healthy continuation as buyers gradually regain control.

Solana breaks out of a multi-month downtrend, forming a clean ascending structure with potential targets up to $250. Source: NoirBit via X

The key zone to hold now is around $160 to $155, just above the recent breakout level. If SOL maintains this structure, the path towards $195, followed by $230 and $250, appears open. It’s a technically clean chart and strong structure. When paired with Solana’s growing real-world adoption, this lends extra weight to the long-term upside case.

Solana Faces Major Liquidation Wall Near $166.8

As Solana builds strength through both corporate adoption and technical structure, fresh data from CoinAlytix adds another layer: the futures market is heating up. According to CW8900, Solana’s futures volume is now the third largest among all crypto assets, highlighting growing speculative interest. The heatmap shows a thick concentration of open short positions around the $166.8 mark, setting up a potential liquidation cluster if the price pushes through.

Solana’s futures heatmap reveals a heavy short buildup near $166.8, hinting at a potential liquidation squeeze. Source: CW8900 via X

This aligns neatly with the earlier view of a bottom forming and the steady accumulation trend. If Solana reclaims $166.8, the unwinding of these shorts could act as a fuel injection, propelling the price towards higher resistance zones.

Solana Price Prediction: Long-Term Structure Points to $300–$400

As Solana continues building strength across spot, futures, and adoption fronts, Jesse Peralta’s latest long-term chart presents a compelling macro case. The trendline stretching from Solana’s earliest accumulation phases remains intact, and price has consistently respected this diagonal base throughout bull and bear cycles. This kind of structure often leads to one of the strongest directional rallies.

Solana maintains a macro uptrend dating back to 2020, with its structural base pointing to a potential move towards $300–$400. Source: Jesse Peralta via X

What’s particularly notable is that this ascending trendline has been in play since 2020, surviving multiple market cycles without a significant break. Each touchpoint reinforces its reliability as a structural base and opens the idea of a major bullish breakout ahead. If Solana continues to respect this long-standing diagonal support, the next leg up could realistically stretch towards the $300 to $400 zone, especially as fundamentals and sentiment align.

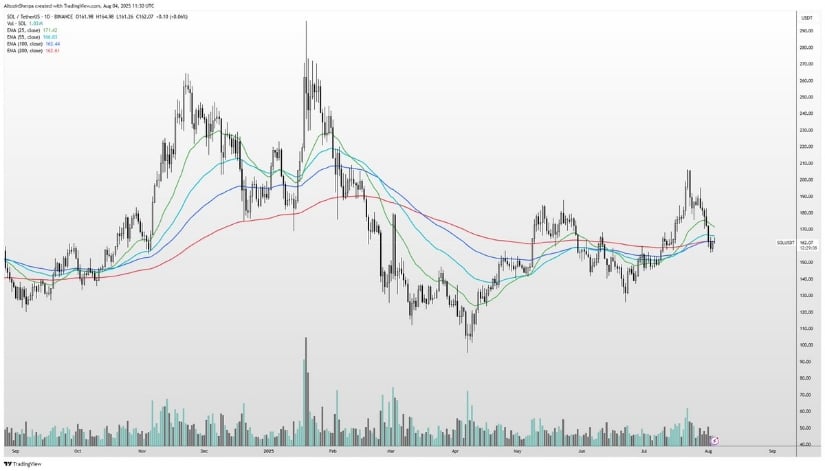

Solana Prepares for Imminent Golden Cross

Solana’s daily chart is starting to show early signs of a potential golden cross, with the shorter-term EMAs curling upward toward the longer-term ones. The convergence of the 50-day and 200-day exponential moving averages hints at an impending bullish crossover, typically seen as a trend-confirming signal in technical analysis. As SOL continues to trade above key support zones, this golden cross setup could reinforce the broader momentum already highlighted in previous sections.

Solana’s EMAs are converging toward a golden cross, signaling growing bullish momentum if key supports hold. Source: Altcoin Sherpa via X

Final Thoughts: Can Solana Flip Momentum Into a Full-Blown Rally?

Solana is shaping up to be one of the most well-rounded narratives in crypto right now, supported by corporate adoption, clean technical breakouts, and even a potential golden cross brewing on the charts. With futures volume rising and key levels like $166.8 acting as pivot zones, the stage is set for a possible wave of liquidations that could drive the price higher.

Still, for Solana to truly break into the $300 to $400 range, it must hold that critical $155 to $160 zone and maintain its structural integrity. The long-term trendline dating back to 2020 remains a powerful base, and if respected, it could serve as the launchpad for Solana’s next major leg up.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: