Category: Crypto News, News

Ripple Acquires Rail for $200M to Expand Stablecoin Payments Infrastructure

Ripple has announced a significant strategic move in the digital payments sector, acquiring Rail, a stablecoin payments platform, for $200 million. The acquisition, set to close in the fourth quarter of 2025 following regulatory approvals, underscores Ripple’s commitment to expanding its cross-border payment infrastructure [1]. The deal comes in the wake of U.S. President Donald Trump signing the GENIUS Act, a new stablecoin law intended to clarify the regulatory landscape for stablecoin operations [2].

Rail, based in Toronto, provides real-time payment solutions and stablecoin services, which Ripple plans to integrate into its broader ecosystem to enhance efficiency and scalability [4]. Ripple President Monica Long highlighted that the acquisition will support the growth of RLUSD, Ripple’s stablecoin, by leveraging Rail’s regulated infrastructure in the U.S., Canada, and key emerging markets [3]. This move positions Ripple to capitalize on the maturing stablecoin regulatory environment both in the U.S. and globally.

This is not Ripple’s first major investment in the digital asset space. Earlier this year, CEO Brad Garlinghouse sold over $200 million in XRP tokens, a decision analysts have linked to market volatility [5]. Despite these sales, XRP remains a key asset for many investors, with some analysts forecasting a potential price surge to $5–$10 by 2028 if Ripple secures its position in the payments industry and resolves ongoing legal challenges [6].

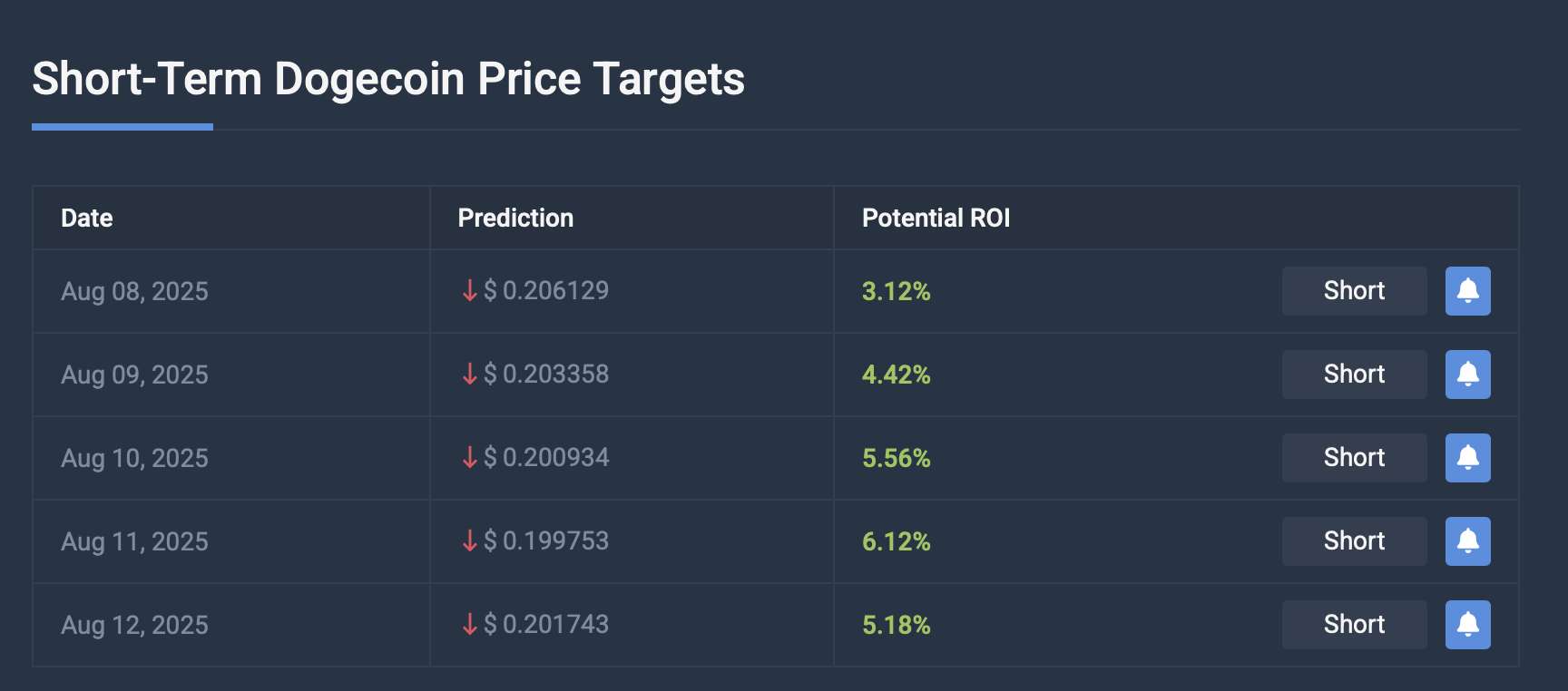

Market speculation also suggests that XRP could reach $4.71 by 2026, assuming a 5% annual growth rate [7]. However, these projections remain speculative and should be viewed as forecasts, not certainties. The broader crypto industry faces ongoing regulatory scrutiny, as evidenced by recent actions against platforms such as Paxos, which was fined $26.5 million for compliance issues [8]. In this environment, Ripple’s move to secure a regulated payments platform through the Rail acquisition appears strategically advantageous.

By acquiring Rail, Ripple is positioning itself to navigate regulatory changes while expanding its footprint in the global payments ecosystem. As the digital asset industry continues to evolve, strategic acquisitions like this may prove essential for firms seeking to maintain a competitive edge in the market.

Source: [1] https://en.bitcoinsistemi.com/attention-xrp-investors-ripple-announces-new-200-million-investment/ [2] https://www.aol.com/news/exclusive-ripple-buy-stablecoin-platform-122413419.html [3] https://m.economictimes.com/crypto-news-today-live-07-aug-2025/liveblog/123149180.cms

[4] https://coinpedia.org/crypto-live-news/ [5] https://www.msn.com/en-us/money/markets/xrp-price-update-ceo-brad-garlinhouse-sold-over-200m-this-year-what-does-he-know/ar-AA1K0M0y?ocid=finance-verthp-feeds [6] https://www.interactivecrypto.com/xrp-price-prediction-could-ripple-surge-past-350-in-2025 [7] https://www.bitget.com/price/ripple/price-prediction [8] https://www.economictimes.com/crypto-news-today-live-07-aug-2025/liveblog/123149180.cmsWritten by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: