Category: Crypto News, News

Dogecoin Falls 2% Today (Aug 19) — Is a Qubic ‘Attack’ on the Horizon?

Jakarta, Pintu News – After successfully taking over more than half of Monero’s hashrate, the Qubic community is now targeting Dogecoin , voting to “attack” the popular memecoin. This news shook the market, sending the price of DOGE down after briefly targeting the $0.30 level.

For now, the price correction doesn’t seem to be over. In this analysis, CCN’s report reveals how the AI-focused blockchain is targeting DOGE, as well as its potential impact on the coin’s price movement.

Dogecoin Price Drops 2.98% in 24 Hours

On August 19, 2025, Dogecoin saw its price drop by 2.98% over 24 hours, trading at $0.2158, or approximately IDR 3,514. During the same period, DOGE fluctuated between IDR 3,513 and IDR 3,677.

At the time of writing, Dogecoin’s market capitalization stands at roughly IDR 534.7 trillion, while its 24-hour trading volume rose 11% to IDR 47.31 trillion.

Read also: Ethereum Plunges to $4,200 Today: Is the $5,000 Milestone Slipping Away?

Dogecoin Selected as Qubic Target

Late last week, a report suggested that Qubic founder Sergey Ivancheglo chose Zcash as his next target after a successful attack on Monero. However, Ivancheglo soon denied the rumors via X.

He explained that there was a community vote, with Dogecoin, Zcash, and Kaspa as options. In the end, the Qubic community chose Dogecoin as the target.

Ivancheglo added that this move should not be taken as a literal “attack”, but rather as Qubic’s plan to mine Dogecoin.

According to the founder, the goal is to divert some of the mining power from Proof-of-Work (PoW) projects to demonstrate their proof-of-concept – not to damage the targeted network.

“To avoid misunderstandings: Dogecoin mining preparation requires several months of development. During this period, the Qubic pool continues to mine #Monero,” he explained.

Networks struggle to keep up with price movements

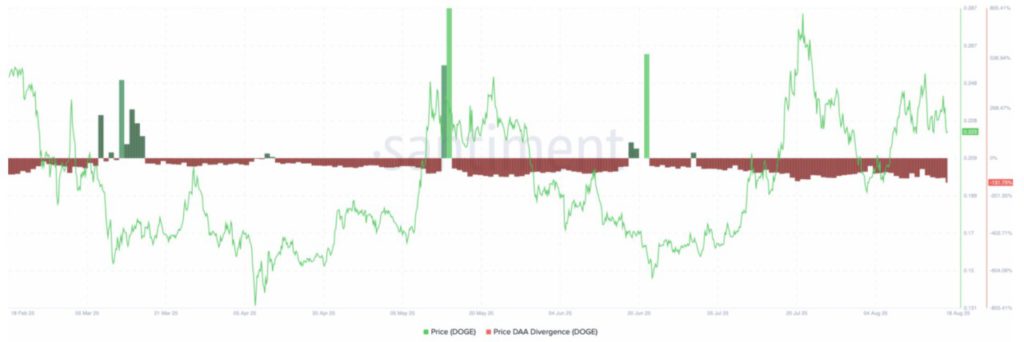

Amid the controversy, DOGE’s price dropped from $0.24 to $0.22 (18/8) – but the impact wasn’t just on its market value. On-chain data from Santiment shows that Dogecoin’s Price-Daily Active Addresses divergence fell to -131.75%.

Read also: Bitcoin Holds Around $115K on August 19: Is Further Decline on the Horizon?

This drop indicates that network activity is not in line with price movements. In other words, fewer unique addresses are interacting with DOGE relative to its valuation.

This could suppress DOGE’s price recovery if network activity does not increase to affirm demand.

DOGE Price in a Tight Triangle Pattern

Technically, the Dogecoin price consolidated within a symmetrical triangle pattern, signaling a possible next big move. However, indicators are bearish.

The Money Flow Index (MFI) fell to 34.21, indicating selling pressure was greater than inflows, and DOGE prices were approaching oversold conditions.

Adding to the downside risk, the red Supertrend line is now above the price, reinforcing the sell signal and showing that bearish pressure is still dominant.

If the downtrend persists, the price of DOGE risks breaking the lower trend line of the triangle. In the event of a breakdown, the price could fall to $0.20. Further selling pressure could lower the next target to $0.17 – equivalent to a 25% correction from current levels.

On the other hand, if the buyers (bulls) take over and push the DOGE through the upper limit of the triangle, this bearish projection could be invalidated.

In that scenario, the price of DOGE could rise to $0.26, and in the event of a strong bullish breakout, it could even jump to $0.30.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: