Category: Forex News, News

USD/JPY Weekly Forecast: BOJ Pressured for Rate Hike

- The USD/JPY weekly forecast suggests growing pressure for rate hikes in the BOJ.

- The dollar and Treasury yields recovered during the week after the Fed cut rates by 25-bps.

- The Bank of Japan held interest rates as expected.

The USD/JPY weekly forecast tilts to the downside as the internal pressure grows in the Bank of Japan to hike interest rates.

Ups and downs of USD/JPY

The USD/JPY pair had a bullish week as the dollar recovered after an expected Fed rate cut. However, the Bank of Japan policy meeting also briefly boosted the yen on Friday.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The dollar and Treasury yields recovered during the week after the Fed cut rates by 25-bps. After months of anticipation, traders had mostly priced in the move. Therefore, when it happened exactly as expected, the dollar pulled back. At the same time, Powell said the central bank would continue assessing the risks of inflation.

Meanwhile, the Bank of Japan held interest rates as expected. However, traders were surprised when two policymakers voted for a rate hike. As a result, the yen rallied.

Next week’s key events for USD/JPY

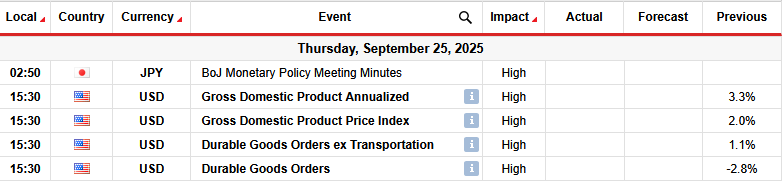

Next week, traders will pay attention to the Bank of Japan policy meeting minutes to see what went into Friday’s decision. Already, it was clear that two policymakers were ready to hike interest rates. Therefore, there is more pressure from inside the central bank to resume its monetary tightening. The minutes will give better details on the dissenting voices.

Meanwhile, the US will release its GDP report and core durable goods orders. These reports will show the state of the economy, shaping the outlook for future Fed rate cuts.

USD/JPY weekly technical forecast: Bulls to bounce off the channel support

On the technical side, the USD/JPY price trades in a shallow bullish channel and recently retested the channel support. Bulls emerged at the channel support and pushed the price above the 22-SMA. Meanwhile, the RSI moved above 50, indicating stronger bullish momentum.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

If bulls maintain their momentum, the price will climb to retest the channel resistance. Such a move would allow bulls to test the 152.06 resistance level. A break above would strengthen the bullish bias. On the other hand, there is a chance bears will retest the channel support.

Before it started trading in the channel, USD/JPY was in a solid downtrend. However, it paused when it got to the 140.00 key support level. Here, the price started a corrective move in a bullish channel. Therefore, another impulsive move could be to the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: