Category: Crypto News, News

XRP Price Prediction: XRP Momentum Builds Toward $13–$27 Target Zone Amid Ripple’s $1B Liquidity Injection and Shrinking Reserves

After weeks of uncertainty, XRP is once again catching investor attention as new on-chain signals and Ripple’s $1 billion liquidity expansion hint at a major turning point.

Analysts suggest that a tightening supply and growing institutional participation could set the stage for XRP’s next explosive rally.

XRP Price Shows Steady Momentum Despite Market Caution

The XRP price today is holding steady near key support levels even as short-term volatility continues to shape market sentiment. After testing the $2.40 zone earlier this week, XRP price trades around $2.43, reflecting a slight 0.6% daily dip. Despite an 18% monthly decline, the token’s technical setup and on-chain indicators suggest that XRP momentum could be building toward a significant breakout.

XRP was trading at around $2.437 at press time. Source: XRP price via Brave New Coin

Trading data from CoinGlass shows derivatives activity is increasing again, with open interest up 2.8% and futures volume climbing 14.5% to nearly $6 billion. This renewed participation hints that traders are re-establishing positions rather than exiting the market, signaling anticipation of an upcoming move in XRP price.

Ripple Liquidity Push and Supply Shock Narrative

Much of the current optimism stems from Ripple’s $1 billion GTreasury acquisition, which aims to expand on-chain liquidity and strengthen Ripple’s DeFi ecosystem. According to on-chain data, exchange reserves have been declining steadily, with outflows surpassing inflows by 20–30% each month. This trend has fueled a “supply shock” narrative — the idea that diminishing exchange balances could tighten supply and potentially drive up the price of XRP in the coming months.

ChartNerdTA’s analysis projects XRP’s next bullish cycle to reach between $13 and $27 based on Fibonacci extensions from the 2017 rally. Source: @ChartNerdTA via X

A chart shared by analyst ChartNerdTA projects a long-term XRP price prediction between $13 and $27 based on Fibonacci extensions drawn from the 2017 bull run. The analysis notes that the current Relative Strength Index (RSI) of around 68 indicates growing bullish momentum without entering overbought territory, supporting the potential for a sustained rally.

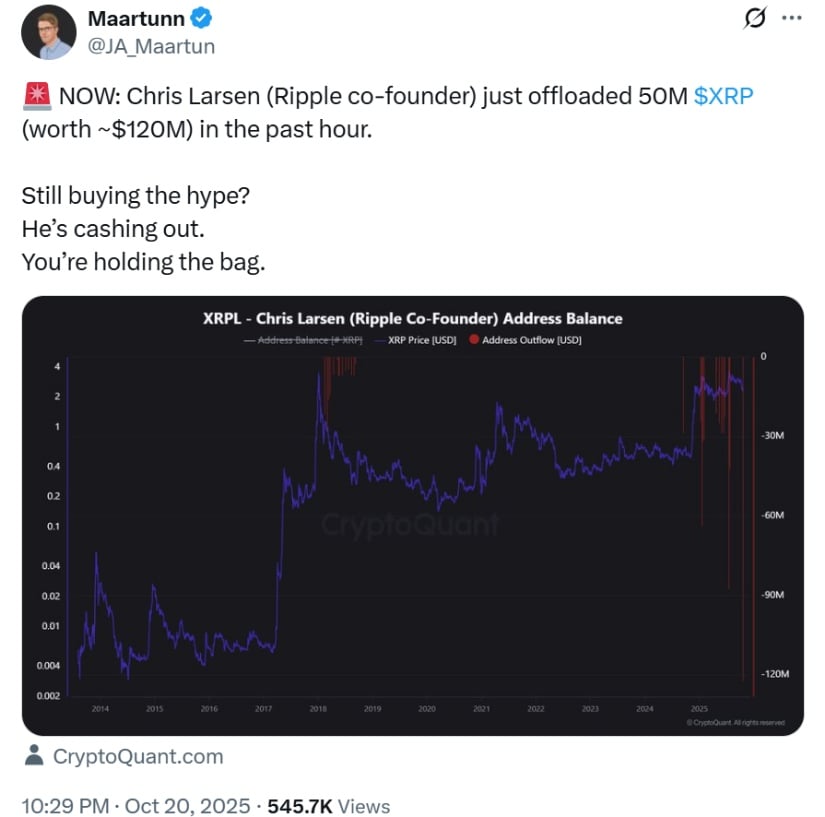

Chris Larsen’s $120M Transfer Sparks Discussion

Investor attention also turned to Ripple co-founder Chris Larsen, who recently transferred 50 million XRP (approximately $120 million at current market rates). The move initially sparked speculation of insider selling, but Larsen later clarified that the funds were directed toward Evernorth, a Ripple-backed venture.

A 50 million XRP transfer from Chris Larsen’s wallet, initially seen as a $120 million sell-off, was later clarified as an investment rather than a cash-out. Source: @JA_Maartun via X

Evernorth is poised to become the largest public XRP treasury following its planned $1 billion Nasdaq SPAC merger, which is designed to boost institutional adoption of Ripple XRP and decentralized finance solutions. The clarification helped calm market fears, transforming what some viewed as a sell-off into a sign of expanding corporate investment within the XRP ecosystem.

On-Chain and ETF Developments Support Long-Term Outlook

Beyond internal developments, optimism continues to grow around a potential Grayscale XRP ETF, alongside similar filings from CoinShares and Bitwise. Analysts estimate up to a 95% chance of approval, which could unleash $5–8 billion in institutional inflows. The effect would mirror the capital surge seen after Ethereum’s ETF approvals earlier this year, which fueled a sharp recovery in ETH prices.

Meanwhile, Ripple’s ecosystem expansion continues. The RLUSD stablecoin, now nearing $1 billion in circulation, strengthens Ripple’s foothold in cross-border payments and on-chain liquidity management. Combined with Evernorth’s growing institutional role, these factors suggest a broader foundation for the next XRP bull cycle.

Technical Outlook: XRP Price Eyes Breakout Targets

On the technical front, XRP today trades near the lower Bollinger Band, showing signs of compression before a potential move higher. The RSI around 39.9 signals mild bearish momentum but remains far from oversold conditions, leaving room for recovery.

The analysis envisions a potential surge in XRP price from around $2.48 to over $100, supported by Ripple-backed Evernorth’s $1B treasury raise signaling strong institutional demand. Source: Amonyx via X

If bulls can maintain the XRP current price above the $2.40 level, short-term targets lie around $2.60–$2.70—a region aligning with the mid-Bollinger Band. A successful break above $2.70 could pave the way for testing resistance levels near $3.00–$3.15. Conversely, a drop below $2.10 might expose the next critical support near $1.80.

Despite short-term fluctuations, the long-term XRP price forecast 2025 remains bullish, supported by Ripple’s liquidity initiatives, institutional expansion, and reduced exchange reserves. With a favorable regulatory environment on the horizon and growing speculation around XRP ETF approval, the stage appears set for a potential multi-cycle breakout.

Outlook: XRP Poised for a Major Reaccumulation Phase

While the current XRP price consolidates, multiple macro indicators hint at a possible reaccumulation phase. Historical data shows that similar setups in past cycles have preceded exponential rallies—most notably the 2017 surge when XRP soared over 64,000%.

If the projected Fibonacci levels hold, XRP price predictions between $13 and $27 could become realistic over the next major market cycle. Ripple’s liquidity expansion, institutional partnerships, and on-chain fundamentals all contribute to an increasingly robust outlook for Ripple XRP heading into 2026.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: