Category: Forex News, News

EUR/USD Analysis Today 22/10: Downward Trajectory (Chart)

EUR/USD Analysis Summary Today

- Overall Trend: Bearish

- Support Levels for EUR/USD Today: 1.1570 – 1.1500 – 1.1430.

- Resistance Levels for EUR/USD Today: 1.1670 – 1.1750 – 1.1810.

EUR/USD Trading Signals:

- Buy the EURUSD from the support level of 1.1520, target 1.1800, and stop 1.1460.

- Sell the EURUSD from the resistance level of 1.1730, target 1.1600, and stop 1.1800.

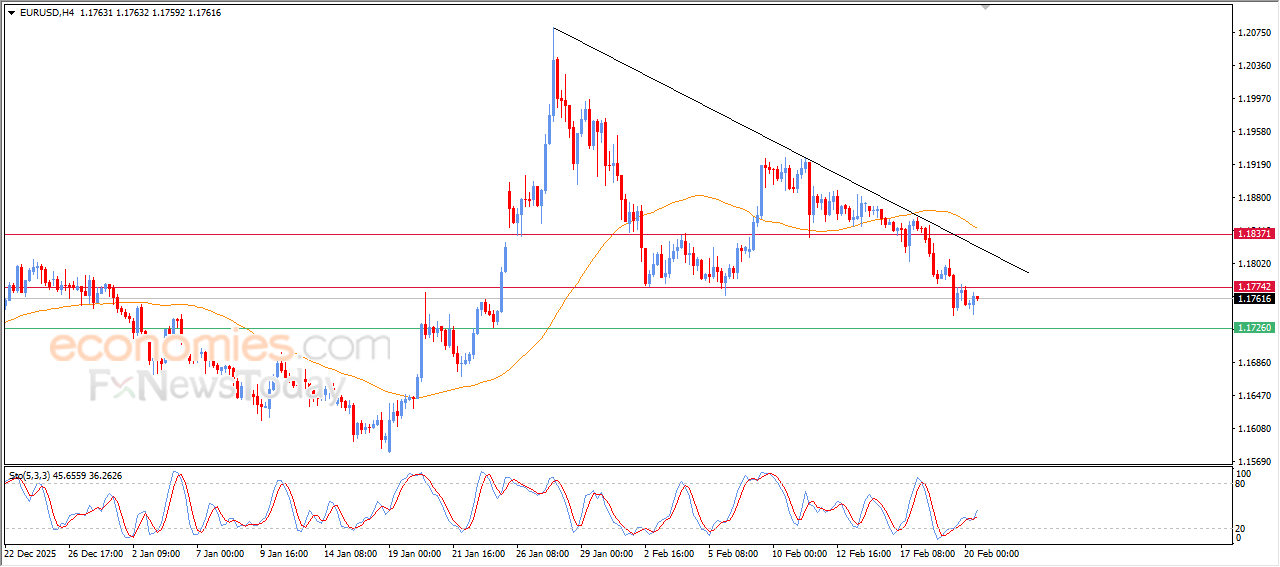

Technical Analysis of EUR/USD Today:

Investor appetite for the US Dollar as a safe haven has recently increased amid rising US-China tensions. This has led to selling pressure on the EUR/USD pair, extending losses to the 1.1600 support level today, Wednesday, October 22, 2025. With a complete absence of important US economic releases today, investors will continue to monitor for signals regarding the future policies of central banks. Today, ECB Governor Lagarde will deliver new statements at 15:30 Cairo time.

Movement of Technical Indicators Confirms EUR/USD Bias

Based on the daily chart performance and through reliable brokerage platforms, the EUR/USD price bias is currently steadily bearish. Breaking the 1.1600 support level will increase the technical losses for the currency pair. The 14-day Relative Strength Index (RSI) is currently around a reading of 43, which confirms the bearish shift, and it still has room for further decline before reaching the oversold zone. Similarly, the MACD indicator is firmly in the downward-sloping area. A break below the 1.1600 support will increase the likelihood of targeting the next, more significant support levels at 1.1550 and 1.1470, respectively.

EUR/USD Bullish Scenario

Conversely, over the same timeframe, there is no strong chance of a corrective rebound for the EUR/USD price without a renewed push towards the psychological resistance of 1.1800. Otherwise, the bears will continue to control prices.

Trading Tips:

Keep in mind that the EUR/USD pair will continue to be heavily influenced by investor risk appetite and the future easing of central bank policies.

Factors Influencing EUR/USD Trading in the Coming Days

Forex trading experts pointed to French concerns, as S&P Global Ratings recently downgraded France’s credit rating from AA- to A+ after the market close on Friday, due to persistent worries about its fiscal trajectory. On another note, important economic data will be released later in the week, with the release of the PMI Business Confidence Index and the US Consumer Price Report. At the same time, the US banking sector, the government shutdown, and political rhetoric are all expected to be influential market events.

Recently, a sense of relief has prevailed in the US banking sector, with equity markets making gains. Danske Bank noted that the earnings results of major UK banks were strong. It added: “These earnings have helped stabilize investor confidence and provided some support for the sector overall, even as concerns about smaller regional banks persist.” However, ING Bank maintained a cautious outlook, stating, “Indicators suggesting that lending issues do not extend beyond Zions Bancorp and Western Alliance may help ease pressure on the Dollar, but that may not be enough to fully calm concerns about the health of the credit market and reverse all of the Dollar’s losses.”

On the monetary policy front, financial markets are pricing in a nearly 100% probability of a rate cut next week, with more than a 95% chance that the US Federal Reserve will cut rates again at the December meeting. The Federal Reserve is currently in a media blackout period ahead of the meeting, with no official comments expected. Consequently, any unofficial media briefings will be closely monitored in case of sharp movements in equity markets.

On another front, trade tensions between the United States and China will remain a key factor. President Trump’s rhetoric was conciliatory over the weekend, raising hopes for a successful push on China.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: