Category: Forex News, News

EUR/USD Analysis 13/11: Trend Reversal (Chart)

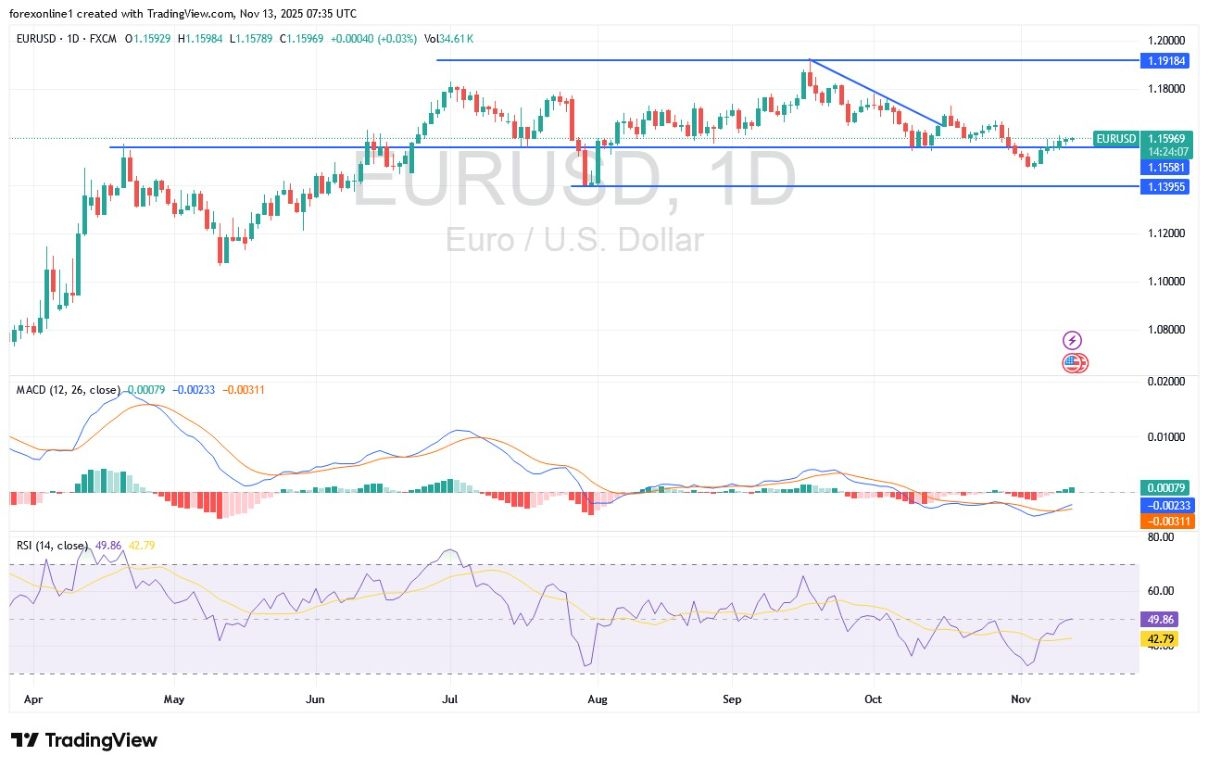

EUR/USD Analysis Summary Today

- Overall Trend: : Bearish

- Support Levels for EUR/USD Today: 1.1540 – 1.1490 – 1.1400

- Resistance Levels for EUR/USD Today: 1.1620 – 1.1700 – 1.1780

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1480 with a target of 1.1700 and a stop-loss at 1.1400.

- Sell EUR/USD from the resistance level of 1.1700 with a target of 1.1500 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

In the short and medium term, the EUR/USD pair is in a strong downtrend, and the move towards and below the psychological support level of 1.1500 confirms this trend. Recent attempts to rebound upwards have not been enough to stop the losses, and a cautious wait-and-see approach will remain the order of the day until the US government shutdown ends, which is increasing the uncertainty surrounding the future policies of the US Federal Reserve.

Technically, and according to reliable trading platforms, the EUR/USD pair is experiencing a slight downward trend that may continue until the end of the year, following the strong rally seen in the first half of 2025. A new analysis of the weekly chart shows that the exchange rate reached an overbought condition in the first half of the year, and the subsequent pullback has allowed this trend to reverse, in line with the forex market’s trend towards returning to the average.

The chart shows that the currency pair is now capped by its 9-week Exponential Moving Average (EMA), which is currently at 1.1615, signaling that this decline will persist longer. This indicator has limited the series of rallies the pair has seen in recent weeks, confirming the weak demand for the Euro. Overall, this reflects the stability of the European Central Bank’s (ECB) policy, as no further interest rate cuts or hikes are expected in the foreseeable future. According to Forex currency market trading, we observe that the EUR/USD pair tends to reliably move on both sides of the 9-day EMA, meaning the recent breach below this line may lead to further declines in the coming weeks.

The 9-day EMA guided the strong upward trend that began in March, pushing the pair from 1.04 to a peak of 1.1918 in mid-September.

This means a drop to the 1.14 support level is expected by the end of 2025.

Keep in mind that the weekly ranges since last September have been relatively limited: large moves are usually concentrated during specific weeks. Therefore, we are likely going through a consolidation phase similar to the January-August 2024 period when the Euro/Dollar moved sideways around 1.08. If we are in such a phase, periods of weakness should be relatively limited, as should periods of strength. Accordingly, our preferred tactical approach is to trade the EUR/USD pair between 1.14 and 1.17, expecting the price to return to its mean at extreme levels, which could bring the exchange rate back to around 1.16.

A strong upward trend for the EUR/USD will remain contingent on the resistance levels of 1.1800 and 1.2000, respectively.

Trading Advice:

The anticipated strong movement of the EUR/USD pair in either direction will be significant, so carefully monitor the factors influencing currency prices and do not take risks, regardless of the available trading opportunities.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: