Category: Forex News, News

EUR/USD Analysis Today 02/12: Euro Trading Higher (Chart)

EUR/USD Analysis Summary Today

- Overall Trend: : Neutral.

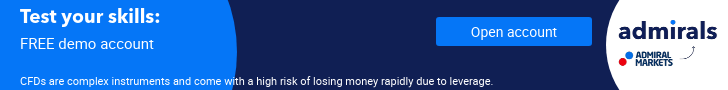

- Support Levels for EUR/USD Today: 1.1565 – 1.1480 – 1.1400

- Resistance Levels for EUR/USD Today: : 1.1670 – 1.1740 – 1.1830

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1700 and a stop-loss at 1.1460.

- Sell EUR/USD from the resistance level of 1.1720 with a target of 1.1500 and a stop-loss at 1.1800.

Technical Analysis of EUR/USD Today:

Based on recent trades, the EUR/USD price has seen stability within a symmetrical triangle pattern over the past few weeks, with trend lines converging by connecting higher lows and lower highs. The currency pair is currently trading around the key psychological level of 1.1600 and appears ready to test the upper boundary of the triangle, which may determine its next direction.

Technically, a break above the resistance trend line at 1.1650 would confirm an upward breakout and could trigger a rally as high as the widest part of the triangle pattern. Concequently, this would put the EUR/USD on track to test higher levels near or beyond 1.1700. However, if the resistance holds, the EUR/USD pair could retrace towards the triangle’s support at the psychological level of 1.1500, where the ascending trend line has provided support since late November. This area also coincides with the 100-period simple moving average, which has acted as dynamic support throughout the period of neutrality.

The 100-period simple moving average (SMA) is currently above the 200-period SMA, suggesting that the stronger trend has shifted to bullish or that an upward breakout is likely to gain momentum. The narrowing gap between the moving averages reflects continued neutrality, although the overall technical structure still favors buyers. Meanwhile, the Stochastic oscillator is hovering near its midpoint after pulling back from overbought territory, indicating that momentum is relatively neutral at present. The oscillator has room to move in either direction, so a break above resistance could push it back to overbought levels, while a rejection could lead to a decline.

At the same time, the Relative Strength Index (RSI) is hovering near the 50 level, indicating a balance between bulls and bears. The oscillator’s neutral stance suggests that the direction of the breakout could be decisive once the price breaks out of the triangle’s boundaries.

Trading Tips:

Please be aware that the EUR/USD exchange rate may be affected by upcoming economic data and central bank comments, particularly any shifts in expectations regarding the European Central Bank’s (ECB) policy or the US Federal Reserve’s (Fed) actions, which could impact the dollar.

Factors Affecting EUR/USD Trading Today

Amid attempts to bounce higher, and according to forex currency market trades, the EUR/USD path today, Tuesday, December 2, 2025, will be affected by anticipated remarks from US Federal Reserve Chair Jerome Powell. Economically, it will be influenced by the announcement of the Eurozone Consumer Price Index (CPI) reading, along with the announcement of the bloc’s unemployment rate, which will be released at 12:00 PM Egypt time.

On the front of global central bank policies, expectations suggest that the US Federal Reserve will cut interest rates again on December 17, and several times next year. In contrast, the European Central Bank (ECB) will keep interest rates unchanged for the foreseeable future due to increasing economic recovery and improving inflation dynamics.

Recently, the Harmonized Consumer Price Index (HICP) in Germany saw a notable acceleration in November, rising from 2.3% in October to 2.6% in November (consensus was 2.4%). Meanwhile, the ECB’s October survey showed a slight increase in one-year inflation expectations from 2.7% to 2.8%, reinforcing the view that the ECB is unlikely to cut rates in December. With the ECB having no justification to move, and the US Federal Reserve likely cutting rates in December, the divergence in interest rate policy between the EU and the US is expected to provide a continuous fundamental source for the EUR/USD price to rise.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: