Category: Forex News, News

May Trade in a Limited Range (Chart)

EUR/USD Analysis Summary Today

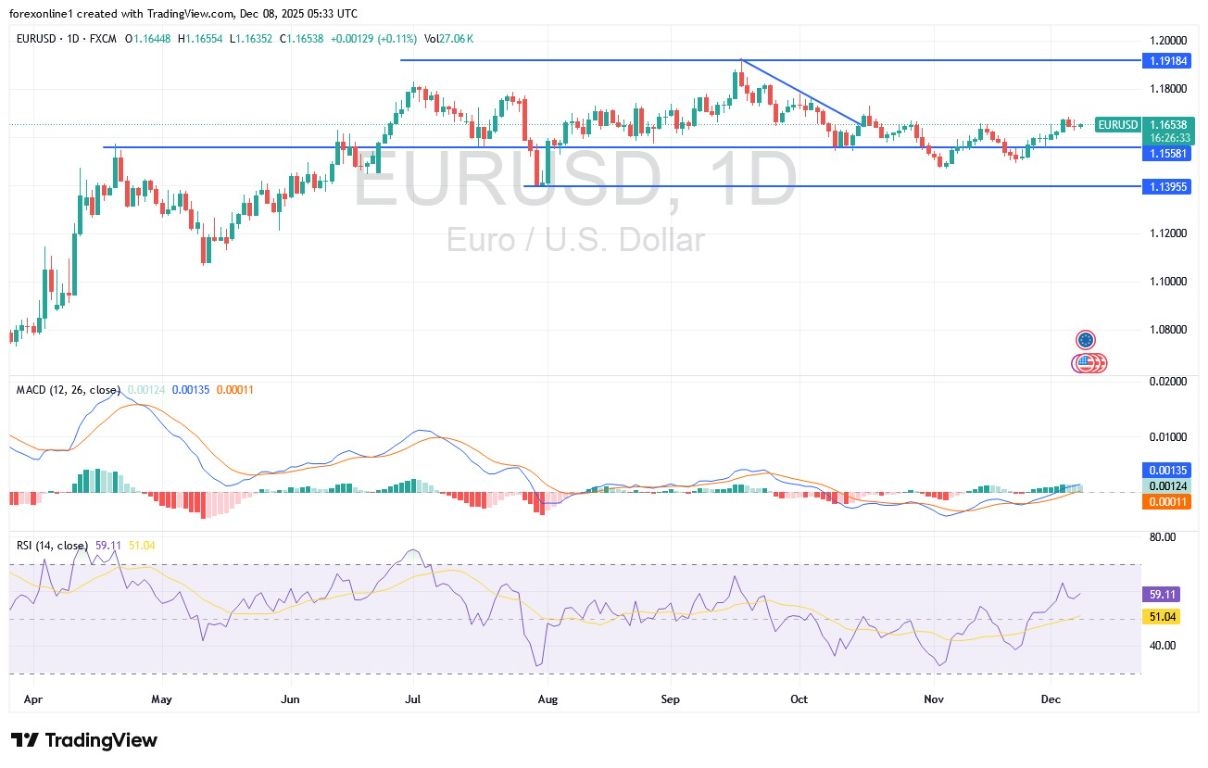

- Overall Trend: : Bullish.

- Support Levels for EUR/USD Today: 1.1610 – 1.1560 – 1.1480

- Resistance Levels for EUR/USD Today: : 1.1680 – 1.1760 – 1.1820

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1570 with a target of 1.1800 and a stop-loss at 1.1500.

- Sell EUR/USD from the resistance level of 1.1730 with a target of 1.1500 and a stop-loss at 1.1800.

Technical Analysis of EUR/USD Today:

We expect the EUR/USD pair to move within a narrow range at the start of this important trading week, within its recent price range. According to reputable trading platforms, the EUR/USD closed around 1.1640 last week after gains that extended to the 1.1681 resistance level, the pair’s highest point since mid-October.

Last week, the EUR/USD’s gains were fueled by investor optimism following positive European economic data. Germany saw improvements, with factory orders rising 1.5% in October, according to the German Federal Statistical Office (Destatis), five times the market forecast of 0.3%. The September reading was also revised upwards from 1.1% to 2.0%. French industrial production also contributed to this improvement, exceeding expectations with a 0.2% increase compared to the anticipated 0.1% decline. Spanish production rose by 0.7%, exceeding expectations of 0.5%.

Further Confirming the strength of the underlying economic conditions, the Eurozone also released its GDP data, which showed the economy grew by 0.3% quarter-on-quarter in the third quarter, surpassing expectations of 0.2%.

Employment also grew at a comfortable rate of 0.2%, exceeding expectations of 0.1%. Overall, all of this points to a strong economic pulse that will encourage the European Central Bank to hold interest rates steady for an extended period. In a world where interest rates are so crucial, this presents the euro with a good opportunity to make further gains against the dollar, which is expected to be subject to a series of US interest rate cuts by the Federal Reserve this week.

Daily Chart Technical Indicators Support the Bulls

According to the daily Forex chart, technical indicators continue to support the upward trend of the EUR/USD pair. The 14-day Relative Strength Index (RSI) is around 61 and has more time to achieve stronger gains before reaching overbought territory. This could happen if the bulls manage to push back towards the psychological resistance level of 1.1800. Meanwhile, the MACD indicator continues its steady upward trend.

The scenario for a bearish in the EUR/USD on the daily chart depends on the bears pushing prices back toward the psychological support of 1.1500 once again. The Euro/Dollar is not anticipating major data releases today apart from the announcement of the German Industrial Production reading at 09:00 AM Egypt time, followed by the Sentix Consumer Confidence reading for the Eurozone at 11:30 AM Egypt time.

Accordingly, limited trading for the Euro/Dollar can be expected today, pending the market’s reaction to the most important event: the US Federal Reserve’s policy announcement next Wednesday.

Trading Tips:

Please note that trading currencies within narrow ranges is not a sound investment decision. It is best to wait for the currencies’ reaction to this week’s key releases to determine the most suitable trading opportunities, avoiding unnecessary risk regardless of how strong the trading opportunities may seem.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: