Category: Forex News, News

Gold (XAUUSD) Price Forecast: Gold Breakout Stalls as Traders Lock Gains Near Resistance

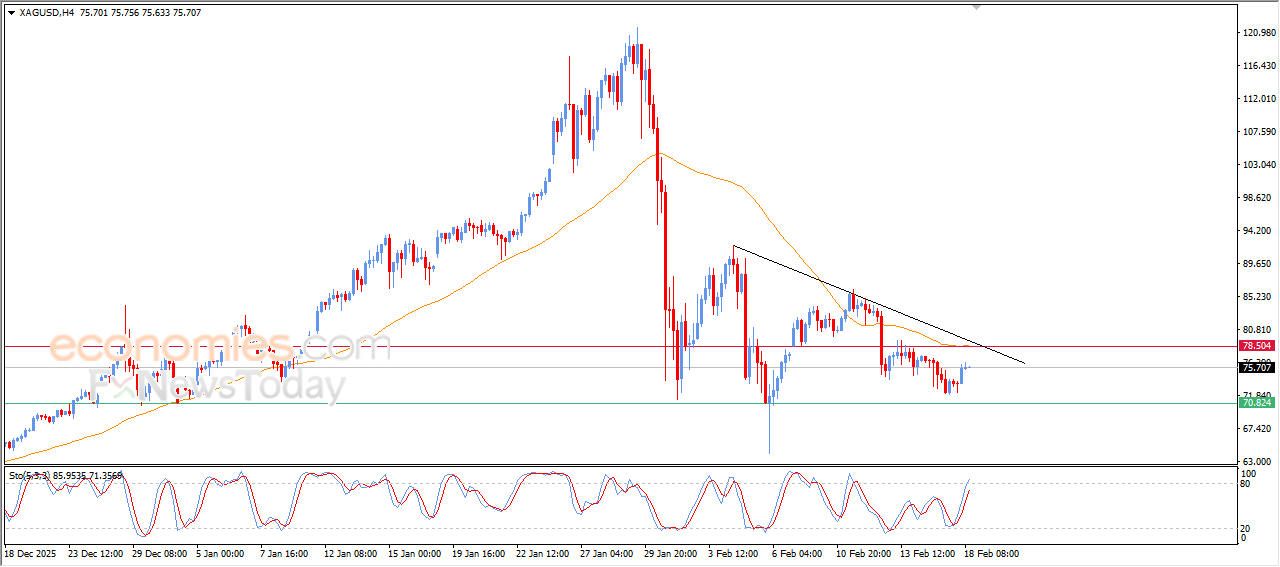

From a price perspective, early next week’s upside focus remains unchanged. Initial resistance sits at Friday’s peak of $4353.56, followed by the record high at $4381.44. A clean push through that zone would keep the breakout structure intact.

On the downside, the nearest support remains the Fibonacci level at $4192.36. The market spent nearly two weeks straddling this price before bullish Federal Reserve news triggered the latest upside extension. Below that, additional support comes in at the 50% level at $4133.95, with the major 50-day moving average at $4114.24 acting as deeper support if selling accelerates.

Federal Reserve Rate Cut Supports Gold but Tone Turns Cautious

Gold’s broader bid this week followed the Federal Reserve’s third quarter-point rate cut of the year. While the move was widely expected, policymakers signaled caution on delivering additional cuts until more data confirms easing inflation and labor market weakness.

Chicago Fed President Austan Goolsbee reinforced that message on Friday, saying he was uncomfortable front-loading rate cuts and suggesting officials may have acted too quickly. Even so, investors are still pricing in two rate cuts next year, with next week’s U.S. non-farm payrolls report shaping near-term expectations.

Treasury Yields Rebound as Dollar Finds a Floor

Pressure on gold late Friday also came from a rebound in Treasury yields. The 10-year yield jumped back to 4.188% after sliding for two sessions, while the 30-year climbed to 4.852%. Rising yields reduced demand for non-yielding assets into the close.

The U.S. dollar also firmed modestly, with the dollar index ticking up to 98.44 after hitting a two-month low earlier in the week. Despite Friday’s bounce, the index remains on track for a third straight weekly decline and is down more than 9% for the year, keeping longer-term support under gold prices.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: