Category: Crypto News, News

ADA (Cardano) Price Prediction & Analysis: Is $1 the Next Target?

TLDR:

- Cardano (ADA) has gained 13% last week and continues to rise, trading at $0.80

- Technical analysis shows strong support at $0.74, with potential for 22% rally to $0.98

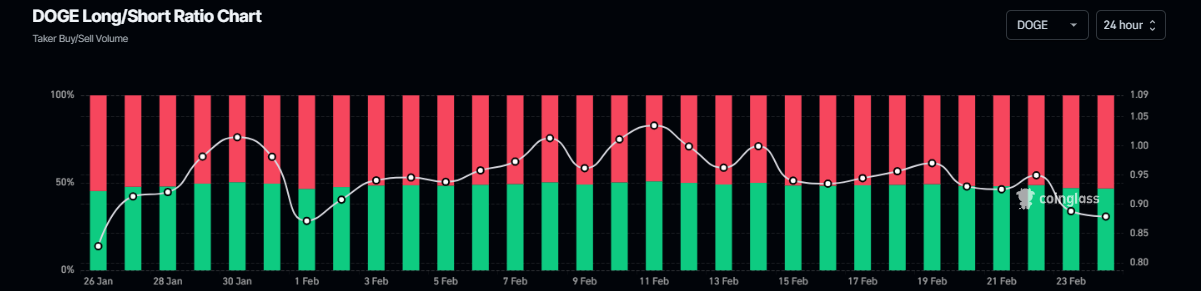

- Long-to-short ratio reaches monthly high of 1.09, indicating bullish market sentiment

- Funding rates have turned positive, showing traders are betting on price increases

- Grayscale’s potential spot ADA ETF approval could drive further growth, with 58% approval odds

Cardano’s ADA token has reached $0.80, marking a 13% increase over the past week. The cryptocurrency continues to show strength despite broader market weakness, as revealed by trading data from February 17, 2025.

The digital asset found strong support at $0.74 last week, using this level as a foundation for its current upward movement. This price level corresponds to a key technical zone that traders have been watching closely.

Market data indicates that ADA’s trading volume has increased substantially, supporting the price appreciation. This volume surge comes as more traders take bullish positions in the market.

The long-to-short ratio for ADA has reached 1.09, its highest level in over a month. This metric indicates that more traders are betting on price increases than decreases, suggesting growing market confidence.

ADA Price

Technical analysis reveals that ADA found support around its 61.8% Fibonacci retracement level, calculated from the August 5 low of $0.27 to the December 3 high of $1.32.

The Relative Strength Index (RSI) on the weekly chart reads 53, having bounced from its neutral level of 50. This technical indicator suggests maintenance of bullish momentum in the market.

Funding rates data shows a shift from negative to positive territory, moving from -0.0007% to 0.0016%. This change indicates that traders holding long positions are now paying those with short positions, typically a bullish signal.

The cryptocurrency has established clear support at the $0.74 level, which served as previous resistance. This price point now acts as a foundation for potential further upward movement.

Grayscale ETF Application

A major development that could impact ADA’s price is Grayscale’s application for a spot ADA exchange-traded fund (ETF) in the United States. Market odds currently show a 58% chance of approval before year-end.

The ETF approval could provide institutional investors with regulated exposure to ADA without directly holding the asset. This development might increase demand and accessibility for traditional investors.

Trading volume analysis shows consistent buying pressure, with increased activity during price rises. This pattern suggests strong market participation during upward moves.

Market structure analysis reveals potential targets at $0.98, representing a 22% increase from current levels. This target coincides with the January 30 high.

The weekly chart structure shows that ADA has maintained its position above key moving averages, suggesting sustained bullish momentum. This technical formation often precedes continued upward movement.

Current market data indicates ADA is one of the few cryptocurrencies showing positive performance while other major assets experience declines. This relative strength has attracted attention from traders and analysts.

The most recent market data shows ADA trading at $0.80, with immediate resistance at $0.98 and support established at $0.74.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: