Category: Forex News

AUD to USD Forecast: RBA Outlook and US CPI Report to Steer Near-Term Trends

A larger-than-expected rise in US nonfarm payrolls in February suggests a robust demand environment. Softer US wage growth and a higher unemployment rate created market uncertainty before the report.

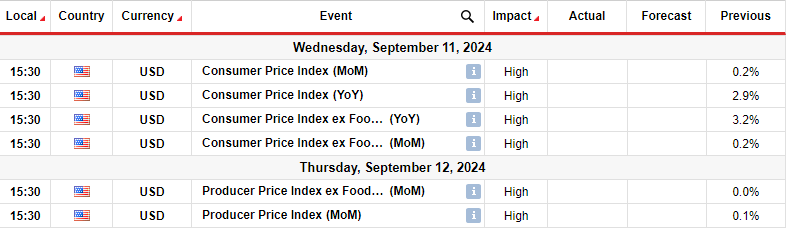

A hotter-than-expected CPI Report may force the Fed to delay an interest rate cut. A higher-for-longer rate path may impact disposable income. Downward trends in disposable income could curb consumer spending and dampen demand-driven inflation.

Short-Term Forecast

Near-term AUD/USD trends will hinge on the US CPI Report. Hotter-than-expected US inflation numbers could impact buyer demand for the AUD/USD. Delays to Fed rate cuts could tilt monetary policy divergence toward the US dollar.

AUD/USD Price Action

Daily Chart

The AUD/USD remained above the 50-day and 200-day EMAs, sending bullish price signals.

An Aussie dollar break above the $0.66162 resistance level would support a move toward the $0.67286 resistance level.

Australian economic data and the US CPI Report need consideration.

However, a drop below the 200-day and 50-day EMAs would give the bears a run at the $0.64900 support level.

A 14-period Daily RSI reading of 61.85 suggests an AUD/USD return to the $0.67 handle before entering overbought territory.

4-Hourly Chart

The AUD/USD sat above the 50-day and 200-day EMAs, affirming the bullish price signals.

A breakout from the $0.66162 resistance level would give the bull a run at the $0.67286 resistance level.

However, a break below the $0.66 handle would bring the 50-day and 200-day EMAs into play.

The 14-period 4-Hourly RSI at 67.93 indicates an AUD/USD move to the $0.67 handle before entering overbought territory.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: