Will Bitcoin (BTC USD) Price Slump To $75,000?

Key Insights

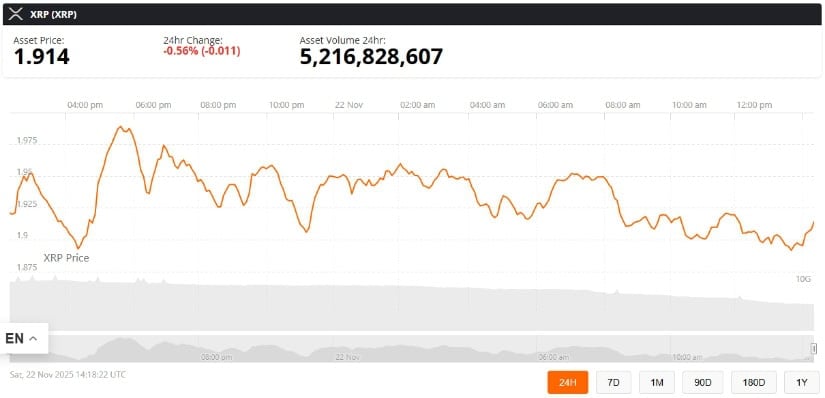

- Bitcoin USD traded at $83,967 on November 21, down 23.4% for the month and 3% in the past 24 hours after briefly dipping below $80,000 on derivatives exchanges.

- Analyst Stacy Muur compiled bottom predictions from five market observers ranging from $75,000 to $94,500, with reasoning spanning technical chart patterns to credit events and four-year cycle dynamics.

- The crypto market experienced $2.2 billion in liquidations over 24 hours as total market capitalization fell below $3 trillion for the first time since April 2025.

As Bitcoin (BTC USD) traded near $83,900, the market witnessed numerous price prediction observations from analysts and market watchers.

On November 21, the price briefly touched $80,000 on derivatives exchange Hyperliquid before stabilizing in the low-$80,000 range.

This triggering widespread liquidations across cryptocurrency markets. At the time of writing the leading crypto was trading at

Analyst Stacy Muur aggregated predictions from five market observers on November 21, presenting a range of potential local bottom targets.

The forecasts spanned from $75,000 to $94,500, with varying methodologies and timeframes for Bitcoin price support levels.

Analyst Bitcoin (BTC USD) Price Predictions Compiled

Chris Burniske of Placeholder VC identified $75,000 or lower as a re-entry level rather than a formal bottom call.

On October 17, Burniske stated he took profits after the sharp October crash, noting “cracks” in the monthly charts for Bitcoin and Ethereum.

He indicated he would watch Bitcoin’s reaction to $100,000 but would only consider buying again when Bitcoin reached $75,000 or lower, framing this as part of a gradual de-risking strategy.

Arthur Hayes of BitMEX projected a near-term target of $80,000 to $85,000, followed by $200,000 to $250,000 by year-end.

In his November 17 essay “Snow Forecast,” Hayes argued that Bitcoin’s drop from approximately $125,000 to the $90,000 area, while US equity indices remained near highs, signaled a looming credit event.

According to his Bitcoin price prediction, it could fall to roughly $80,000-$85,000 during a “soft period” before Federal Reserve or Treasury money-printing schemes could drive prices to $200,000-$250,000.

Chinese analyst Ban Mu Xia forecast a first stop at $94,500, with an ultimate bottom near $84,000.

His view is of a “complex sideways adjustment,” in which Bitcoin first dipped to around $94,500, then entered an oscillation that could rebound above $116,000 before forming an ultimate bottom near $84,000, potentially 6-8% lower at extremes.

JPMorgan analysts, led by Nikolaos Panigirtzoglou, discussed the forced selling risk related to a potential removal of MicroStrategy from the index, rather than publishing a specific Bitcoin price target.

The bank estimated that roughly $2.8 billion in passive flows could be forced to sell MicroStrategy stock if MSCI removed the company from major equity benchmarks, with as much as $8.8 billion at risk if other index providers followed suit.

The $75,000-$80,000 range corresponded to common technical support zones identified in this analysis.

CoinShares’ James Butterfill focused on flow data and cycle behavior rather than numeric bottom predictions.

In Bloomberg coverage, Butterfill stated crypto suffered “heavy selling by whales who follow the four-year cycle narrative.”

He noted CoinShares data showed large holders sold more than $20 billion in crypto since September, calling the pattern “somewhat self-fulfilling” even though CoinShares did not fundamentally endorse the four-year-cycle thesis.

Market Liquidations and Capitalization Loss

Coinglass data showed $2.2 billion in positions liquidated in the crypto market over the past 24 hours, as of press time.

Bitcoin USD accounted for approximately $1 billion of total liquidations, with long positions representing $887 million. Roughly 391,000 traders faced liquidations across exchanges.

The cascade of forced selling created a feedback loop that accelerated downward price pressure as leveraged traders were forced to close positions.

The total cryptocurrency market capitalization dipped below $3 trillion for the first time since April 2025, currently at $2.96 trillion, down 7.5% over the past 24 hours.

US-listed spot Bitcoin ETFs recorded approximately $3.79 billion in net outflows during November, the largest monthly outflow since the products launched in January 2024.

Open interest in Bitcoin perpetual futures fell 35% from October’s peak near $94 billion, reducing liquidity across derivatives markets.

The combination of reduced open interest, extreme fear sentiment, and massive liquidations created conditions where relatively small sell orders moved the Bitcoin price significantly.

It remains to be seen whether the current range will provide support for a bounce or if Bitcoin is preparing for a move into a bearish period.

The post Will Bitcoin (BTC USD) Price Slump To $75,000? appeared first on The Coin Republic.