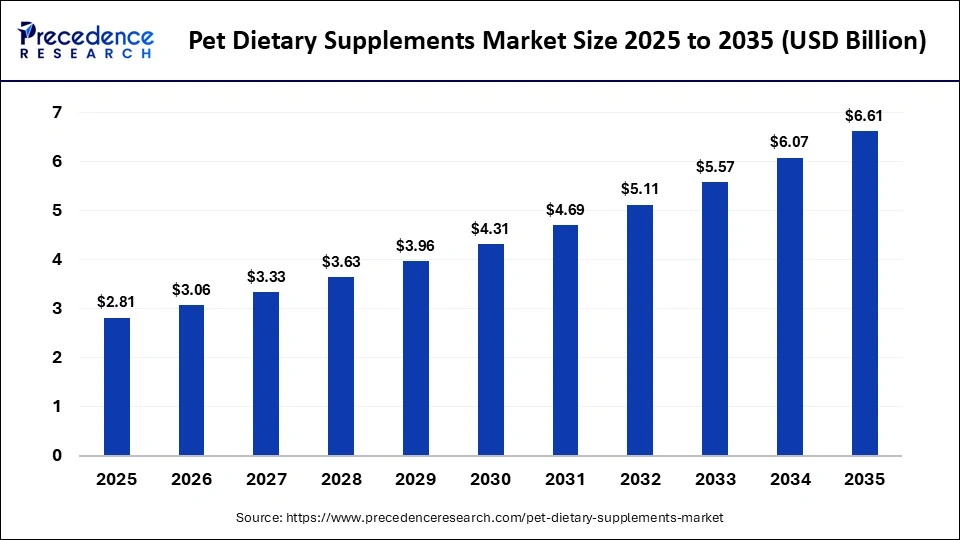

Revenue,

2025

USD 2.81 Bn

Forecast Year,

2035

USD 6.61 Bn

What is the Pet Dietary Supplements Market Size?

The global pet dietary supplements market size accounted for USD 2.81 billion in 2025 and is predicted to increase from USD 3.06 billion in 2026 to approximately USD 6.61 billion by 2035, expanding at a CAGR of 8.93% from 2026 to 2035. The pet dietary supplements market is driven by increasing pet humanization and rising focus on preventive animal healthcare.

Market Highlights

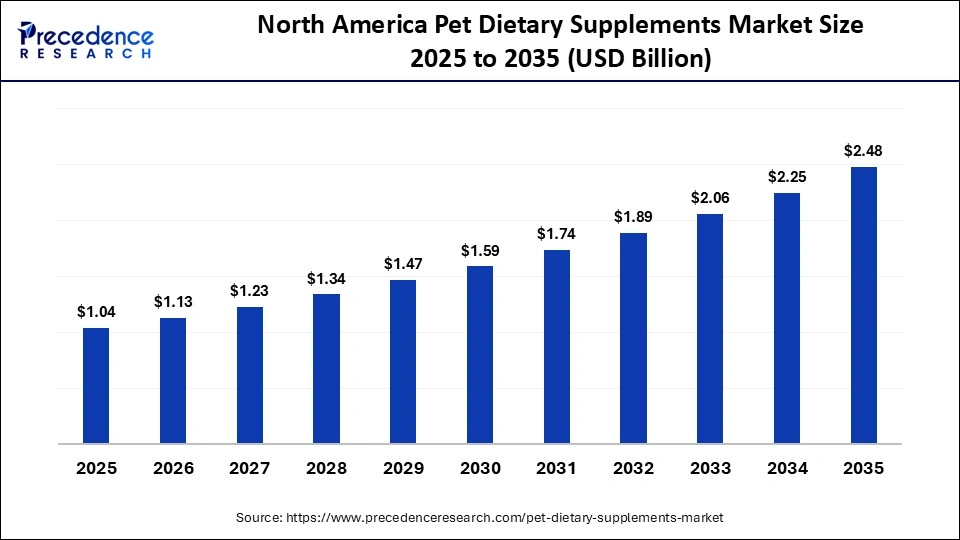

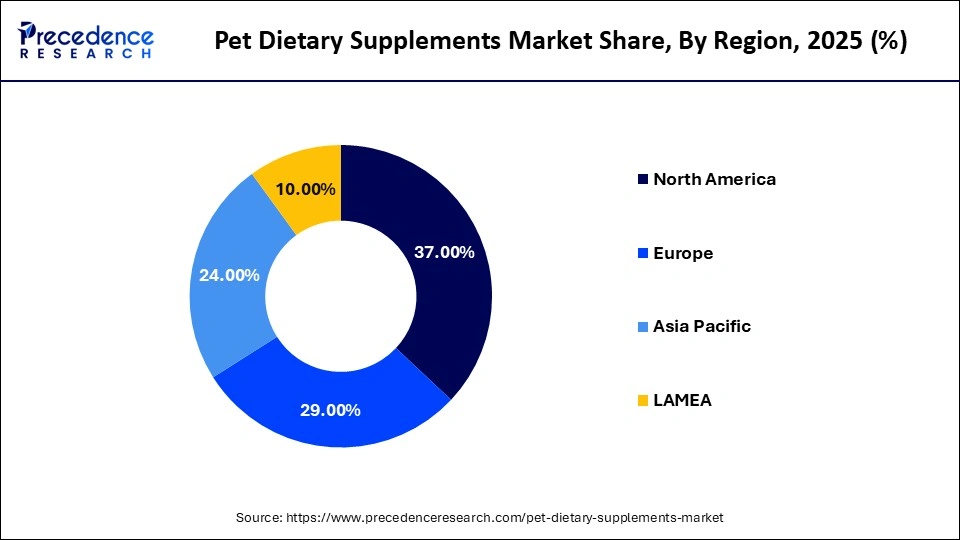

- North America accounted for the largest share in 37% 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By product form, the chewable and soft chews segment held a significant share in 2025.

- By product form, the liquids and gels segment is growing at a strong CAGR between 2026 and 2035.

- By supplement type, the multivitamins segment contributed the significant share in 2025.

- By supplement type, the CBD and hemp derivatives segment is poised to grow at considerable growth between 2026 and 2035.

- By function, the hip and joint health segment held a significant share in 2025.

- By function, the calming and anxiety relief segment is anticipated to show considerable growth in the between 2026 and 2035.

- By pet type, the dogs segment captured the biggest market share in 2025.

- By pet type, the cats segment is growing at a fastest CAGR between 2026 and 2035.

- By distribution channel, the specialty stores segment generated the biggest market share in 2025.

- By distribution channel, the online channel segment is growing at a string CAGR between 2026 and 2035.

Nourishing Wellness Beyond Nutrition: How Preventive Care Is Shaping the Pet Dietary Supplements Market

The pet dietary supplements market represents a broad area of nutraceutical products developed to improve the health of pets in general and to fill certain nutritional deficiencies in a standard diet. These are vitamins, minerals, amino acids, omega fatty acids, probiotics, and botanical extracts, which are aimed at promoting joint mobility, digestive, immune, skin and coat, and cognitive functions. The increase in pets and the tendency to ascribe human traits to them have made their owners act on long-term wellness in opposition to reactive treatment. As the attractiveness of companion animals as pets surges, there is an increasing need across the industry for premium, functional, and condition-specific supplements, such as those for dogs, cats, and other pets that belong to the family.

The market forces are the increasing knowledge on proactive pet care and the increasing cases of age- and lifestyle-related diseases that involve arthritis, obesity, allergies, and digestive disorders. The rising number of geriatric pets has raised the demand for joint, heart, and immunity-support supplements. Moreover, the improvement of animal nutrition science and clean-label, natural ingredient formulations is improving consumer trust and acceptance. Growth of veterinary services, online health services for pets, and subscriptions is expected to enhance the growth of the market around the world.

Key AI Integration in the Pet Dietary Supplements Market

Artificial intelligence is becoming a trend in the pet dietary supplements sector, as it allows for the creation of products and customization to create more intelligent interaction between consumers. In order to identify the most common nutritional deficiencies and new trends in the well-being of pets, AI-based analytics is applied to analyze the big data of veterinary data, pet health applications, and clinical research.

Artificial Intelligence is supportive of personalized nutrition websites because pet owners could specify their breed, age, weight, activity, and health conditions to be offered specific recommendations concerning supplements. As the digital pet healthcare ecosystems increase, AI integration will probably be the subject of the development of precision nutrition and preventive care of companion animals.

Pet Dietary Supplements Market Outlook

- Industry Growth Overview: The pet dietary supplements market has been showing stable growth due to increasing pet humanization and the adoption of preventative healthcare. There is a rising demand for functional supplements aimed at improving joint, digestive, and immune health, which is promoting the growth of the market in the long run.

- Global Expansion: The market is expanding globally with a healthy demand in North America and Europe, and the Asia-Pacific region is expanding at a high rate. Rising pet ownership, e-commerce penetration, and the developing pet infrastructure in developing economies help in the growth.

- Major Investors: The major competitors in the market of pet nutrition and supplements are Nestle Purina (Nestle S.A.), Mars Incorporated, and Hills Pet Nutrition (Colgate-Palmolive). Such brands as L Catterton and General Atlantic are also private investment firms that have invested in the premium and wellness-based pet nutrition brands.

- Startup Ecosystem: Startup firms such as Zesty Paws, Native Pet, and PetHonesty have been making inroads in the startup ecosystem. These emerging ventures focus on clean-label products, subscriptions, and condition-selective products to attract modern pet owners.

Market Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.81 Billion |

| Market Size in 2026 |

USD 3.06 Billion |

| Market Size by 2035 |

USD 6.61 Billion |

| Market Growth Rate from 2026 to 2035 |

CAGR of 8.93% |

| Dominating Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product Form, Supplement Type, Function, Pet Type, Distribution Channel, and Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Pet Type Insights

Why Did Chewable and Soft Chews Contribute the Most Revenue in 2025?

Chewable and soft chews contributed the most revenue in 2025 and are expected to dominate throughout the projected period, as these chews are highly palatable and easy to administer. The soft chews are commonly viewed as either a treat or medicine, which keeps up with the current trend of humanizing pets and supplementing their wellness regularly. Their flexibility in formulation enables the manufacturers to incorporate several functional benefits, joint support, immunity, skin and coat, calming effects, etc., into one chew. In addition, the distribution of chewables through electronic commerce, pet specialty retail outlets, and veterinary hospitals is also high and contributes to the high volumes of sales. More innovation in both natural flavors and clean-label ingredients, together with breed- or life-stage-specific formulations, is also a factor in the long-term dominance of chewable and soft chew supplements.

The liquid and gel segment is expected to grow substantially in the pet dietary supplements market. The rising demand among elderly pets, small breeds, and those with dental problems or those that cannot swallow solid supplements is leading to growth. The liquid and gel formulations are easily administered and offer the right dosage, potentially allowing the pet owners and the veterinarians to modify the dosage based on the weight, age, and health condition. Emerging technologies for better flavor and natural preservatives have also served to improve palatability and shelf stability, which has overcome the challenge of adoption. Due to the current increase in awareness of geriatric pet care and proactive health, liquid and gel supplements will become more accepted both in the veterinary prescription market and in the direct-to-consumer market.

Supplement Type Insights

Why Did the Multivitamins Segment Lead the Pet Dietary Supplements Market in 2025?

The multivitamins segment led the pet dietary supplements market and accounted for the largest revenue share in 2025. Multivitamin supplements are a diverse source of the necessary nutrients, such as vitamins, minerals, and trace elements, and help to maintain health, immunity, metabolism, and vitality in all life stages. Their preventative placement is highly endorsed by the vet and readily accepted by those who are new to the use of supplements. Increased knowledge on balanced dieting and increased concerns about nutrient imbalances in commercialized pet food have further contributed to demand. The multivitamins also come in various forms, including chewable, powder, and liquid, and this increases access and convenience.

The CBD and hemp segment is expected to grow at a significant CAGR over the forecast period. These supplements are gaining popularity owing to the potential advantages they could have in the management of anxiety, reduction of pain, and improvement of mobility, specifically in older pets. Increase in regulatory clarity of the key markets, particularly North America, and in some sections of Europe, has facilitated product novelties and product commercialization. Owners of pets that are seeking another solution to pharmaceutical therapy are increasingly choosing to use CBD-based supplements to treat chronic diseases such as arthritis and behavioral disorders. This has been further improved by the formulation of standardized dosing, quality formulations, and third-party testing, which has boosted consumer confidence. Also, there is a slowing but growing interest of the veterinary community in cannabinoid-based therapies, which positively contributes to market growth.

Function Insights

Why Did Hip and Joint Health Supplements Contribute the Most Revenue in 2025?

The hip and joint health supplements contributed the most revenue in 2025 and are expected to dominate throughout the projected period. The increasing population of companion animals and the increasing rate of mobility-related illnesses such as arthritis, hip dysplasia, and joint stiffness are the primary sources of this leadership. Owners of pets are also spending more on preventive and long-term mobility products to enhance the quality of life and postpone surgical procedures. There is a rapid substitution of the traditional glucosamine only products with advanced formulations with UC-II collagen, green-lipped mussel, turmeric, and boswellia serrata. These are next-generation ingredients that have been supported by clinical research that has shown better pain reduction, inflammation, and cartilage protection. The demand is further enhanced by the availability in chewables, liquids, and powders, and hip and joint health supplements are the largest and oldest functional segments.

The calming and anxiety relief segment is expected to grow substantially in the pet dietary supplements market. Changes in lifestyle in the post-pandemic period, such as more owners being away and no longer having routines, have also added to stress, separation anxiety, and noise sensitivity in pets. The L-theanine, chamomile, valerian root, tryptophan, and CBD product line are becoming widely accepted to use every day with stress, with anxiety before traveling, and before any situation to calm down. These are supplements that are increasingly being included in evening routines, grooming routines, and travel preparations. A new market growth segment is likely to take shape as emotional wellness comes to be a central component of the holistic care of pets, and calming and anxiety relief supplements become a central part of pet care.

Pet Type Insights

Why Did the Dogs Segment Lead the Pet Dietary Supplements Market in 2025?

The dogs segment led the pet dietary supplements market and accounted for the largest revenue share in 2025, because of the rate of adoption of the supplements and the wider availability of the supplements compared to other pets. The preventive care practices in dogs are firmly established, and the owners of this species understand the payback on the investment in early supplementation more and more. The most important demand drivers in the canine segment are joint health and digestive support and dental care supplements, as mobility problems, gastrointestinal sensitivity, and oral health-related issues are prevalent. Also, the high prevalence rates of obesity in dogs have driven the demand for weight management and metabolic health supplements. Manufacturers are still increasing the number of breed-specific, size-specific, and life-stage-based formulations and making their products more relevant and purchaseable again.

The cat segment is expected to grow at a significant CAGR over the forecast period due to the growing awareness of feline-specific health needs and the growing contribution to research and development. Historically underpenetrated because of poor appreciation of the supplements, the segment is resounding because of the manufacturers focusing on the special dietary needs and the health conditions of cats, especially chronic kidney disease, health of the urinary tract, and digestive sensitivity. Increased palatability by use of sophisticated flavor systems and texture has highly contributed to compliance effects in cats. Liquid, gel, and powder preparations are gaining more popularity because they dissolve readily in wet food. There are increases in demand for preventive and condition-specific supplements as the population of indoor cats increases, and the lifespan of cats also increases.

Distribution Channel Insights

Why Did Specialty Stores Contribute the Most Revenue in 2025?

The specialty stores contributed the most revenue in 2025 and are expected to dominate throughout the projected period. These outlets have an exclusive stock of quality and condition-specific supplements so that pet owners can make informed purchases. Proficient personnel and in-store advisors give advice on the benefits of supplements. their dosage and intake, which creates confidence and increases the rates of conversion. The location of the supplements should be at the point of contact with high-end pet food, grooming, and products recommended by the veterinarian, as this raises the value of the basket and the buying value. Specialty stores remain one of the main points of sale of dietary supplements, as consumers are more interested in pet wellness products of high quality and customization.

The online channel segment is expected to grow substantially in the pet dietary supplements market. The factors that promote growth include convenience, fair prices, and the rise in the number of people who buy the supplements on a subscription basis so that they can guarantee constant delivery. Mechanized delivery discounts and wellness packages make customers stay with them longer. Authenticated customer reviews and ratings are essential in the decision to purchase products, especially in the case of a first-time buyer. Online channels can also provide a wider variety of products, including niche and premium formulations that might not be found in physical stores. As the digital pet care ecosystems evolve and the consumers become more comfortable with the online healthcare purchase, the online channel will likely be a major growth driver in conjunction with the traditional specialty retail.

Region Insights

How Big is the North America Pet Dietary Supplements Market Size?

The North America pet dietary supplements market size is estimated at USD 1.04 billion in 2025 and is projected to reach approximately USD 2.48 billion by 2035, with a 9.15% CAGR from 2026 to 2035.

Why Did North America Lead the Global Pet Dietary Supplements Market in 2025?

North America held the dominating share of the pet dietary supplements market in 2025, with its growth based on a high level of consumer awareness, the presence of a well-developed veterinary healthcare infrastructure, and the high level of expenditure on pet wellness. The pet care ecosystem of the U.S. and Canada is well established, comprising veterinary clinics, specialty pet stores, and online platforms enabling people to get easy access to a wide variety of dietary supplements. Preventive care, joint health, digestive support, and immune functionality, and the adoption of premium formulations are increasing among consumers in the region. The frequent and repeated purchases of the products are supported by the availability of breed- and age-specific supplements, and they can be made by household and double incomes. Also, palatability, mode of delivery, and bioactive ingredients have enhanced the dominance of the market in North America.

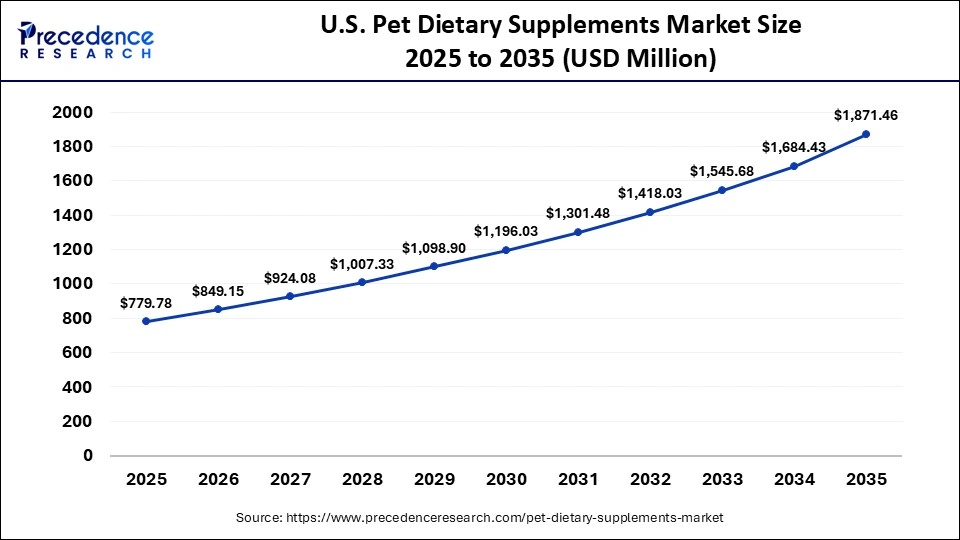

What is the Size of the U.S. Pet Dietary Supplements Market?

The U.S. pet dietary supplements market size is calculated at USD 779.78 million in 2025 and is expected to reach nearly USD 1,871.46 million in 2035, accelerating at a strong CAGR of 9.15% between 2026 and 2035.

U.S Pet Dietary Supplements Market Analysis

The U.S. is the biggest and most developed market of the North American pet dietary supplements market because of the advanced veterinary care, strong consumer awareness, and effective distribution channels. The high rate of adoption is due to the rising demand among pet owners for supplements that address the health of the joints, the digestive system, the skin and coat, and the immune system. The growing interest in prevention and wellness and the growing expenditure on high-quality pet products contribute to the growth of the market. The innovativeness of the form of delivery that ensures high compliance and efficacy includes soft chews, liquids, powder, and functional treats.

Why is Asia Pacific undergoing the Fastest Growth in the Pet Dietary Supplements Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. The adoption of pets is increasing rapidly in countries like China, India, Japan, and South Korea, which is increasing the demand for preventive and specialty supplements. Increasing the veterinary base, such as clinics, diagnostic facilities, and specialty hospitals, enhances the availability of nutritional products. Awareness about the wellness of pets, the development of e-commerce, and online subscriptions also contribute to the penetration of the market. Also, the increased impact of social media, educational campaigns, and veterinary prescriptions is encouraging uptake of quality formulations. Asia Pacific is the most rapidly developing market in the pet dietary supplement sector, with goods being launched, flavor innovation, and customized feline and canine products that are driving the growth of the region.

China Pet Dietary Supplements Market Trends

China has led the growth of the Asia Pacific pet dietary supplements market, which portrays significant growth in pet ownership and increasing awareness of preventive health. Urban families are now willing to accept pets as a part of the family, which increases the demand for joint, digestive, immune, and skin-care supplements. The introduction of e-commerce intake and internet veterinary consultation has led to increased access to the vast array of quality and functional formulations. The market enjoys the perks of regulatory reformation, quality certification rules, and expanded faith of consumers in branded goods. With the increasing awareness and disposable incomes, China should continue to play a key role in the fast growth of the pet dietary supplements market in the Asia Pacific.

Why Is the European Pet Dietary Supplements Market Experiencing Notable Growth?

The European pet dietary supplements market is recording significant growth owing to the high consumer awareness, well-established pet care industry, and good veterinary infrastructure. Germany, France, Italy, and the UK are examples of countries that show strong usage of joint health, digestive, skin and coat, and immune support supplements. Multi-functional formulation, breed-specific, age-specific, and premiumization are very popular. The presence of high regulatory standards provides safety and efficacy of products and will increase consumer confidence. The adoption is also increased by veterinary recommendations and professional advice in specialty stores and clinics. Constant innovation in products and promotion by the leading manufacturers makes them grow steadily.

UK Pet Dietary Supplements Market Trends

The UK pet dietary supplements market is on a continuous rise, and this is backed by the increasing number of pets, knowledge of preventive health, and the well-established networks of veterinarians. Supplements that are aimed at promoting joint health, digestive support, skin and coat care, and immune functionality are on the demand list by pet owners. Dedicated shops, animal clinics, and websites help to make it easy to access and get professional assistance and choose the products. Also, awareness and adoption are further enhanced by the educational campaigns and digital marketing initiatives.

Why Is the MEA Pet Dietary Supplements Market Gaining Momentum?

The Middle East and Africa pet dietary supplements market is expanding due to improvements in veterinary healthcare infrastructure, rising pet ownership, and growing acceptance of preventive nutrition for companion animals. Dietary supplements are becoming more accessible in countries such as the United Arab Emirates, Saudi Arabia, and South Africa, where the number of veterinary clinics, specialty pet retailers, and regulated online platforms is increasing. Stronger veterinary engagement is also improving awareness of condition-specific supplementation for pets across different life stages.

Premium and functional supplements targeting joint health, digestive function, immune support, and skin and coat condition are gaining traction, particularly among urban and higher-income households. Rising disposable incomes, urbanization, and the humanization of pets are encouraging pet owners to spend more on preventive and wellness-oriented nutrition rather than reactive care. Growth in e-commerce, including subscription-based purchasing models, home delivery, and diversified formats such as chews, powders, and flavored liquids, is improving adherence and repeat purchases while supporting broader market penetration.

UAE Pet Dietary Supplements Market

The UAE pet dietary supplements market is gaining steady traction, driven by rising pet ownership, increasing humanization of pets, and growing awareness of preventive animal healthcare. Urban households in the United Arab Emirates are increasingly treating pets as family members, which is translating into higher spending on nutritional supplements that support long-term health, immunity, and quality of life. This trend is particularly visible among dog and cat owners in major cities, where demand is rising for supplements targeting joint health, skin and coat condition, digestion, and overall vitality.

Market growth is further supported by expanding access to veterinary care and pet specialty retail channels. Veterinary clinics, pet hospitals, and premium pet stores are playing an important role in educating pet owners about the benefits of dietary supplementation, especially for aging pets and breed-specific health concerns. Supplements formulated with omega fatty acids, probiotics, vitamins, minerals, and glucosamine are seeing higher uptake as part of preventive care routines rather than reactive treatment.

Why Is the Latin American Pet Dietary Supplements Market Emerging Rapidly?

The Latin American pet dietary supplements market is developing at an extremely high pace because of the growing number of pets, the rise of preventive care, and the growth of the healthcare network. Brazil, Mexico, and Argentina are among other nations working towards the investment in veterinary clinics, specialty stores, and online platforms that enhance premium and useful supplements. The increase in disposable incomes, urbanization, and humanization of pets is stimulating the expenditure on quality formulations. Soft chews, flavored powders, and liquid supplements increase compliance and uptake. More education and trust are achieved through education campaigns, recommendations by the veterinarians, and digital marketing.

Brazil Pet Dietary Supplements Market

The Brazil pet dietary supplements market is experiencing steady growth, supported by rising pet ownership, increasing awareness of animal health, and the growing humanization of pets across urban households. Brazil has one of the largest companion animal populations globally, and pet owners are increasingly viewing dietary supplements as an essential part of preventive healthcare rather than optional add-ons. This shift is driving demand for supplements that support overall wellness, longevity, and quality of life for dogs and cats.

Veterinary influence plays a central role in market development. Expanding veterinary clinic networks and pet hospitals across Brazil are actively recommending supplements for joint mobility, digestive health, immunity, and skin and coat maintenance, particularly for aging pets and large dog breeds. Products containing glucosamine, chondroitin, probiotics, omega fatty acids, vitamins, and minerals are seeing higher adoption as part of routine care plans prescribed by veterinarians.

Who are the Major Players in the Global pet Dietary Supplements Market?

The major players in the pet dietary supplements market include Ark Naturals, Bayer, Blue Buffalo Pet Products, Food Science Corporation, Four Paws, Mars PetCare, Nestle Purina PetCare, Nutramax Laboratories, PetHonesty, Virbac, Zesty Paws, and Zoetis.

- In March 2025, Zesty Paws introduced New Vet Strength, which is a canine obesity supplement that promotes fat metabolism, digestion, and satiety in dogs. The product has scientifically developed components that help in good weight management.(Source: https://www.prnewswire.com)

- In February 2025, Fera Pets launched a pet dental support powder that is made of botanical ingredients and postbiotics. Formulating it with the inclusion of Oravestin, Bactase Pet, and a clinically tested postbiotic, it deals with oral health issues by using internal supplementation.(Source: https://www.prnewswire.com)

- In December 2025, General Mills purchased the North American business of Whitebridge Pet Brands (premium cat feeding and pet treating) from NXMH, which sold the business to General Mills for USD 1.45 billion. The acquisition empowers General Mills in the rapidly growing high-end pet food and treat markets.(Source: https://www.reuters.com)

Segments Covered in the Report

By Product Form

- Tablets and Capsules

- Chewable and Soft Chews

- Powders

- Liquids and Gels

- Capsules

- Other Forms

By Supplement Type

- Multivitamins

- Probiotics and Prebiotics

- Omega-3 and Essential Fatty Acids

- Glucosamine and Chondroitin

- CBD and Hemp Derivatives

- Antioxidants

- Herbal and Botanical Extracts

- Other Supplement Type

By Function

- Urinary Tract Health

- Hip and Joint Health

- Diabetes Management

- Heart and Renal Health

- Skin and Coat Health

- Immune System Support

- Digestive Health

- Calming and Anxiety Relief

- Dental and Oral Care

- Metabolic/Weight Management

- Senior/Cognitive Support

- Other Specialty Needs

By Pet Type

- Dogs

- Cats

- Birds

- Small Mammals

- Equine

- Aquatic

- Reptiles

- Other Pets

By Distribution Channel

- Convenience Stores

- Online Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Other Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa