Category: Crypto News

Bearish Pattern Sets Dogecoin Price for 8% Fall Ahead, But There’s a Twist

Dogecoin’s Bullish Surge Fueled by Awakening Whale Wallets

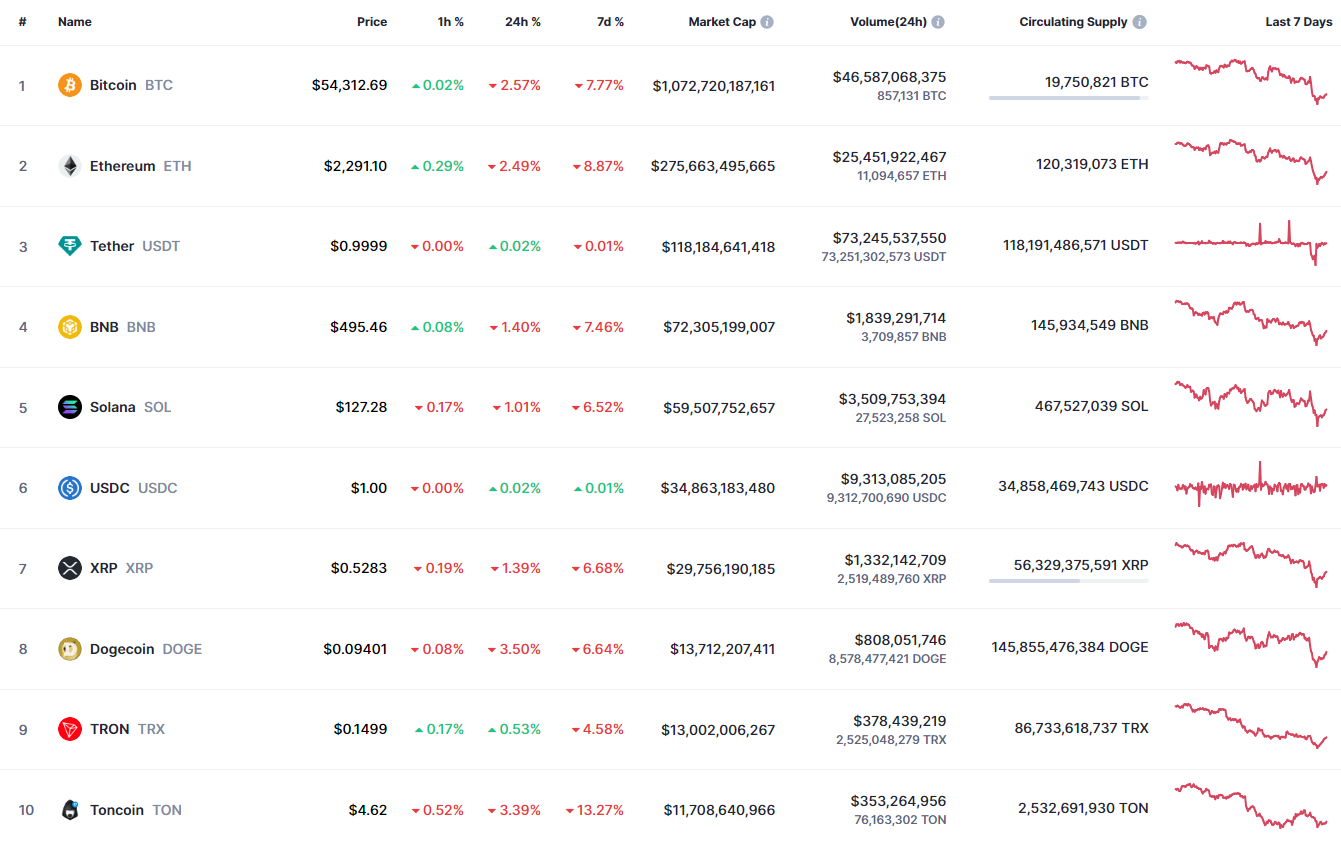

Unlike other leading cryptocurrencies, Dogecoin, the popular dog-themed meme coin, displayed an aggressive bullish trend in March. The asset witnessed a notable inflow in the month’s fourth week, which propelled its value from $0.122 to $0.228 high to register 86.8%.growth.

As per a recent highlight from crypto analytics platform Santiment, this growth is largely driven by the awakening of major dormant whale wallets, which has injected Dogecoin back into the market without causing the typical FOMO that characterizes market peaks.

Moreover, the data reveals a marginal 0.21% increase in the number of DOGE wallets with coins over the past two weeks. While, the average age of Dogecoin investments has decreased from 510 to 416 days within five weeks, indicating increased movement of long-held coins.

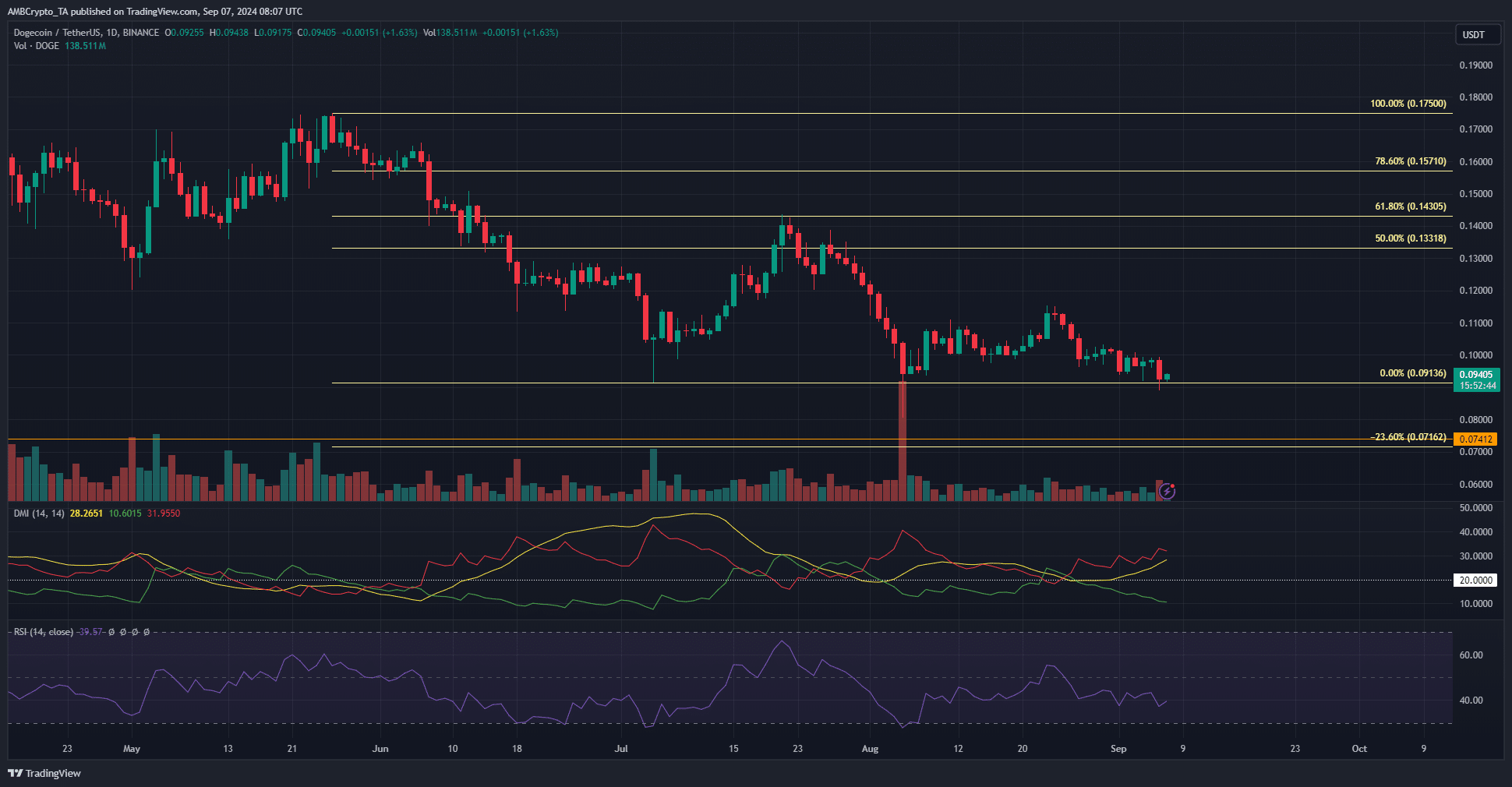

However, with the current market correction, the DOGE price reverted from the $0.22 barrier and developed a double-top bearish pattern. With a 9% intraday drop, the sellers gave a decisive breakdown from the neckline support at $0.195.

If the supply pressure persists, the Dogecoin price may plunge another 8% to hit combined support of the ascending trendline and 38.2% Fibonacci retracement level at $0.17. This confluence of technical levels should bolster buyers to counter and regain trend control.

Technical Indicator

- Exponential Moving Average: The 50-day EMA will be key support of memecoin holders amid the current correction.

- Relative Strength Index: A notable bearish divergence in the daily RSI slope reflects the weakening of buyers’ conviction and a higher potential for prolonged correction.

Related Articles

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: