Category: Forex News, News

Breaks Out Ahead of FOMC (Video)

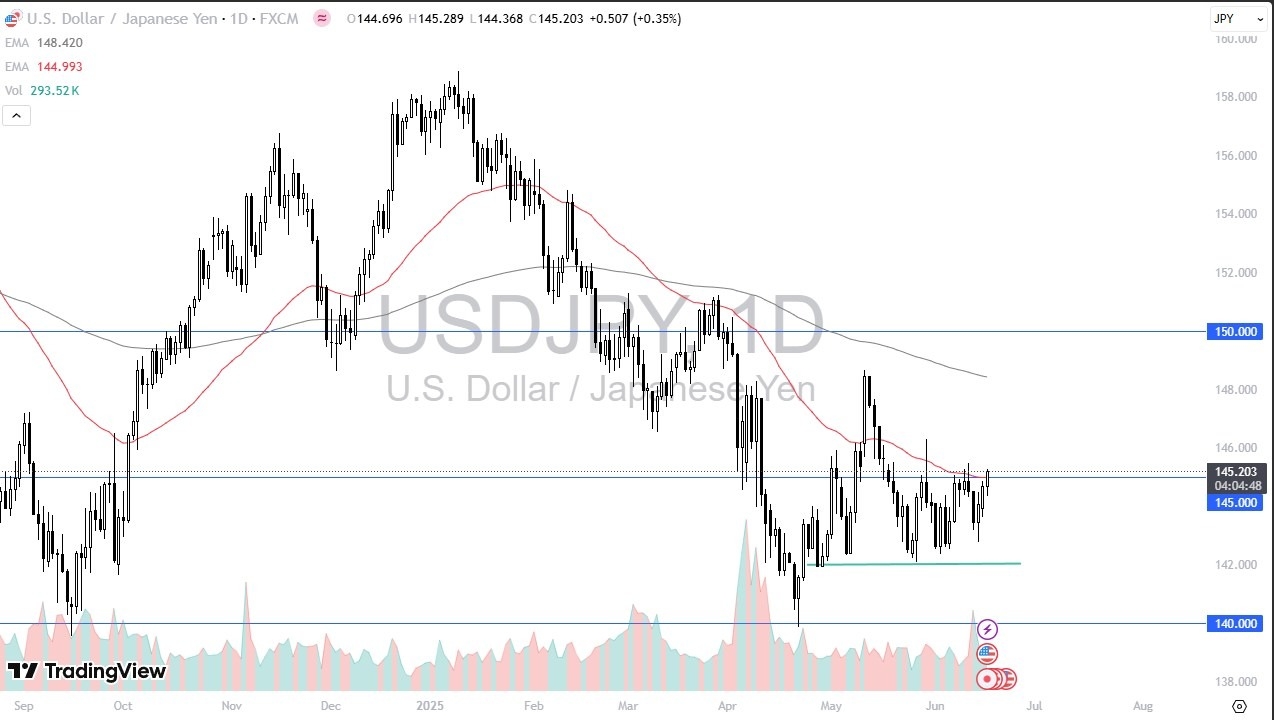

- The US dollar has initially pulled back just a bit during the early hours on Tuesday only to turn around and show signs of life.

- As we have seen the US dollar show signs of recovery against multiple currencies.

- This is a pair that I’ve been talking about and watching quite a bit over the last couple of weeks as the 145 yen level is an area that I think a lot of people will be paying close attention to.

It’s a large round psychologically significant figure, but it’s also where we have the 50 day EMA currently hanging around. Because of this, I think you must look at this as a dangerous area, but if we get follow through here, that could open up the U.S. dollar going much higher. However, it is worth noting that this is a pair that has been very rangebound for a while, and we are getting a lot of things to think about in the next few sessions.

Timing Could Be Better

It’s unfortunate that this is happening the day before the FOMC announcement because the interest rate difference, the interest rate statement and press conference of course is something that will move the market.

Now there are hints that the United States may be looking at getting involved in the war against the Iranians. So, everything is a fluid situation at the moment. This is a market that if it does break down from here, and it wouldn’t really surprise me that much, it should at least in theory, open up a buying opportunity, but we’ll just have to see there’s so many variables at the moment.

It is going to be very difficult to do anything in size, I more than anything else will be keeping my position size small in this environment because quite frankly, it would be very easy to lose money.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: