Category: Crypto News, News

Can Algorithms Predict the Future of Ripple?

The crypto market’s reliance on AI-driven price predictions has grown exponentially, but how trustworthy are these forecasts when pitted against real-world fundamentals? For XRP (Ripple), a token embroiled in regulatory battles and banking partnerships, this question is more pressing than ever. Let’s dissect the AI-generated price projections for 2025, weigh them against XRP’s evolving fundamentals, and determine whether algorithms or human insight holds the edge.

AI-Driven Price Projections: A Mixed Bag for 2025

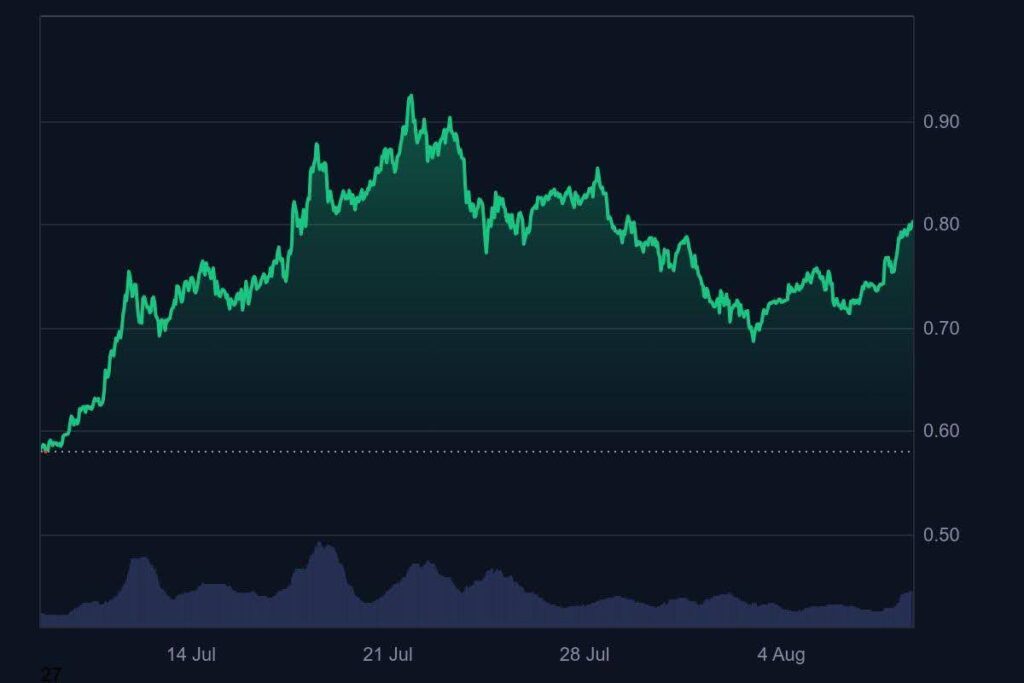

The AI models predict a turbulent 2025 for XRP, with short-term fluctuations masking a broader trend. For July alone, prices are expected to dip to $2.21 before rebounding to $2.51 by late month—a swing of nearly 13% in just weeks. By year-end, the average price is forecasted to drop to $2.07, resulting in a -4.8% annual ROI.

However, these predictions hinge on historical data and technical indicators like moving averages. The 50-day moving average on the daily chart has turned bearish, while the weekly chart remains bullish—a contradiction suggesting no clear consensus. Meanwhile, the Fear & Greed Index for crypto markets sits at 65 (Greed), implying overconfidence that could fuel volatility.

Fundamental Developments: The Elephant in the Room

AI models may excel at crunching numbers, but they struggle to account for unpredictable real-world events. For XRP, the SEC’s ongoing legal battle looms large. The $125 million penalty imposed in 2024 was a win for Ripple, but the SEC’s appeal could reignite uncertainty. A loss here might deter institutional adoption, undermining XRP’s core value proposition as a banking settlement tool.

Technically, XRP’s utility remains unmatched in cross-border payments. Partnerships with banks like Axis and Santander validate its real-world use case, but decentralization remains a hurdle. With only 55 validator nodes, critics argue XRP’s network is too centralized to thrive long-term. Yet, Ripple’s push to expand validator networks hints at progress.

Why AI Predictions Fall Short

AI’s strength lies in pattern recognition, not crystal-ball gazing. For instance:

– Regulatory Risks: The SEC appeal’s outcome isn’t quantifiable in historical data, yet it could tank prices overnight.

– Adoption Velocity: AI can’t measure the time it’ll take for banks to fully integrate XRP into their systems.

– Market Sentiment: While 62% of traders are bullish, human emotions often defy algorithmic logic—panic or euphoria can override trends.

The disconnect between AI’s short-term optimism (e.g., $2.51 peaks) and its gloomy annual forecast (-4.8% ROI) highlights this tension. Algorithms see the “what,” but not the “why.”

Investment Considerations: Short vs. Long

For traders chasing quick gains, the July–August volatility offers opportunities—but only for those with nerves of steel. The 30-day volatility of 3.06% and a 50% win rate suggest a fair gamble.

Long-term investors, however, should focus on fundamentals. If Ripple’s legal issues resolve favorably and partnerships scale, XRP’s $16.91 average price by 2030 (per long-term projections) isn’t far-fetched. But this requires patience: the path to $1,894 by 2050 is littered with regulatory and technical pitfalls.

Recommendation:

– Hold for the long term if you believe in XRP’s banking utility and legal resilience.

– Avoid short-term trading unless you can stomach 10%+ swings.

– Diversify: Even if bullish on XRP, allocate no more than 5% of your crypto portfolio to it.

Conclusion: Algorithms Are Tools, Not Oracles

AI predictions offer a snapshot of XRP’s potential trajectory, but they’re no substitute for understanding its fundamentals. While the $2.51 July peak might materialize, the bigger picture hinges on Ripple’s ability to navigate regulation, expand its validator network, and prove its decentralization claims.

Investors must ask themselves: Is the algorithm’s “crystal ball” worth following, or is XRP’s future better judged by its real-world progress? The answer, as always, lies in balancing data with discernment.

Final Note: Always consult a financial advisor before making investment decisions.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: