Category: Forex News, News

Copper price forecast: third-party price target

What drives the copper price rate?

Copper prices are influenced by a variety of factors, but they can be broadly categorised into the following five key drivers:

1. Global economic activity

Copper is closely tied to economic growth, making it a reliable barometer for global health. Indicators such as GDP growth, industrial production, and manufacturing activity directly influence demand. Infrastructure projects, urbanisation, and the transition to renewable energy – like EVs and wind turbines – further fuel demand during periods of economic expansion.

2. Supply dynamics

Supply disruptions, such as labour strikes, declining ore grades, or natural disasters, can tighten the market and drive up prices. Major producers like Chile and Peru dominate global supply, meaning any instability in these regions significantly impacts copper availability and pricing.

3. Market sentiment and speculation

Investor behaviour plays a major role in copper price fluctuations. Optimism about future demand, driven by trends like the energy transition, can create bullish momentum, while negative sentiment tied to economic slowdowns can cause prices to drop. Speculative activity in futures markets often amplifies these trends.

4. Geopolitical and trade factors

Geopolitical events, trade policies, and currency fluctuations significantly influence copper prices. Tensions between major economies, tariffs, and export restrictions can disrupt global trade flows, while a stronger US dollar often makes copper more expensive for non-dollar economies.

5. Interest rates and inflation

Monetary policies, particularly interest rate decisions, indirectly impact copper demand. Low interest rates encourage borrowing and investment in infrastructure, boosting demand. Conversely, rising interest rates or inflation can curb economic activity and reduce the need for industrial metals.

Historical copper performance

When it comes to copper’s historical performance, the brown metal has been a valuable resource for millennia, with its use dating back to ancient civilisations for tools, weapons, and currency. While no formal markets existed in early history, copper’s utility ensured its consistent demand.

In modern history, copper prices began to fluctuate with industrialisation. By the 1930s, copper traded at around $0.10 per pound during the Great Depression, following a steep decline from earlier highs. The post-World War II era saw steady growth in demand due to electrification and industrial expansion, with prices averaging between $0.30 and $0.60 per pound through the mid-20th century.

This century

The 2000s marked a significant turning point. Copper prices surged from under $0.80 per pound in 2003 to nearly $4.00 by 2008, driven by China’s rapid industrialisation. However, the 2008 global financial crisis caused prices to plummet to around $1.40 per pound before rebounding quickly as infrastructure investment picked up. By 2011, copper reached over $4.50 per pound.

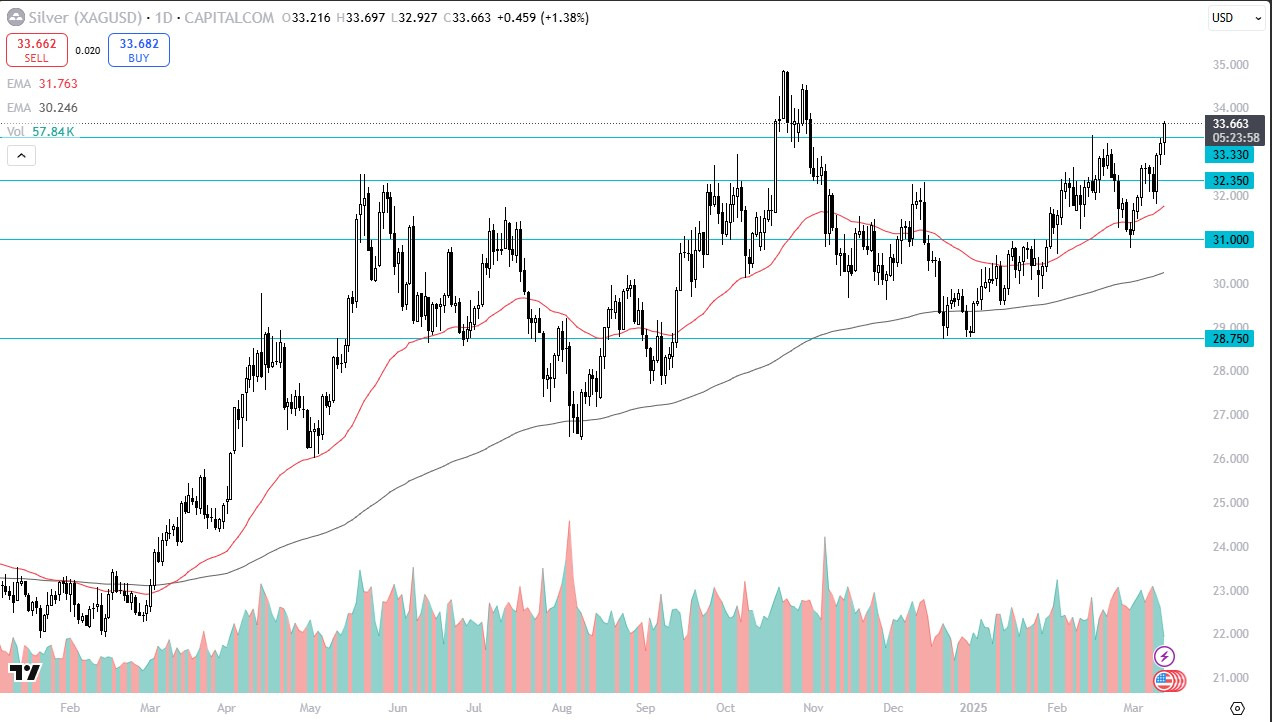

More recently, the energy transition and growing demand for electric vehicles (EVs) have sustained elevated copper prices. In May 2021, copper peaked at $4.80 per pound, fuelled by supply constraints and optimism around renewable energy projects. However, economic slowdowns in China, rising inflation, and monetary tightening have created price volatility. Over the past few years, copper prices have fluctuated between $3.50 and $4.50 per pound.

Today, copper remains a vital industrial asset, with its performance influenced by global economic activity, sustainability trends, and technological advancements. Its role in the green energy transition ensures its long-term significance, offering opportunities for traders to capitalise on price movements.

Copper trading strategies to consider

When approaching your copper trading strategy, it’s essential to recognise the opportunities and risks associated with this vital industrial metal. Copper’s role as an economic indicator and its importance in industries like construction, electronics, and renewable energy make it a dynamic asset to trade. Developing a robust trading strategy aligned with your goals, experience, and risk tolerance is critical for navigating its price volatility.

A well-planned trading strategy can help you open, manage, and close positions more effectively while minimising potential losses. Copper traders often combine technical analysis and fundamental insights to determine optimal entry and exit points.

1. Technical strategy

Technical strategies for copper rely on chart indicators to track price movements, identify patterns, and generate buy or sell signals. For instance:

These tools allow traders to interpret historical price data. Remember that past performance is not a reliable indicator of future results

2. Price action trading

Price action trading focuses on analysing copper’s historical price movements to anticipate future trends. For example:

Copper’s liquidity and volatility make this strategy a potential choice for short-term traders.

3. Trend trading

Trend trading involves taking long-term positions based on the direction of copper’s price trend. Traders may choose to:

-

Go long during periods of rising prices, driven by factors such as increased demand for electric vehicles or renewable energy infrastructure.

-

Short copper during economic slowdowns or increased supply from major producers like Chile and Peru.

Fundamental factors, such as China’s economic performance or changes in mining output, play a critical role in this strategy.

4. News trading

News trading capitalises on market-moving events that influence copper prices. Examples include:

-

Geopolitical events: labour strikes in major copper-producing nations can tighten supply and push prices higher.

-

Economic data: strong manufacturing data from China often signals rising copper demand, leading to price increases.

-

Weather disruptions: natural disasters affecting mines can lead to supply constraints.

Staying updated on news and analysis is crucial for implementing this strategy effectively.

5. Range trading

Range trading identifies support and resistance levels within which copper prices fluctuate. For instance, if copper is trading in a range of $3.50-$4.50:

-

Support level: prices near $3.50 per pound (an undervalued zone).

-

Resistance level: prices nearing $4.50 per pound (an overbought zone).

-

Using tools like Bollinger Bands, traders buy at support and sell at resistance, leveraging copper’s historical price behaviour.

6. Breakout trading

Breakout trading targets opportunities when copper prices move outside of established ranges, signaling potential volatility. For example:

Breakouts often occur due to significant market catalysts, such as policy changes in China or major supply disruptions.

7. Fundamental trading

Fundamental trading in copper focuses on analysing supply-demand dynamics rather than relying solely on technical indicators. You can consider:

-

Going long on copper during periods of strong economic growth or increased infrastructure investment.

-

Shorting copper when global demand slows or mining output increases significantly.

This strategy requires a deep understanding of macroeconomic trends, particularly those tied to industrial production and the energy transition.

Additional trading insights

-

Diversify your strategies: instead of relying on a single approach, consider a mix of strategies based on market conditions. For instance, position trading might work well in a bullish market, while trend trading can be effective in volatile conditions.

- Risk management is key: set clear stop-loss levels and position sizing rules to protect your capital. Even the most effective strategies can lead to losses without proper risk controls.

-

Stay educated: regularly update your knowledge of market trends, economic indicators, and sector performance. Enrolling in commodity trading courses or following expert analysts can deepen your expertise.

Disclaimer: All figures included in the above examples are for illustrative purposes only and do not reflect actual market data or real account conditions.

FAQ

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: