The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The market is heating up again, and Solana is firmly in the spotlight. With momentum returning to major Layer 1s and meme coin buzz spilling over into Ethereum Layer 2, investors are watching closely for breakout opportunities. According to the latest Solana price prediction, analysts say SOL could retest the $250 level if current demand holds. Meanwhile, early-stage buyers are turning their attention to Layer Brett (LBRETT), a meme coin that’s gaining serious traction during its presale.

Let’s break down where SOL stands today and why Layer Brett is being tipped as the next big mover.

Solana (SOL) is currently trading around $243, marking an impressive climb from earlier lows this year. The network continues to lead in terms of NFT volume, transaction throughput, and active development, making it a top choice among high-performance Layer 1s.

Analysts tracking Solana’s price action note that if bullish momentum persists, the $250 mark is a realistic target in the coming weeks. With interest in on-chain gaming, DeFi, and tokenized assets growing, Solana is well-positioned to ride the next wave of inflows, especially as talk of a potential SOL ETF gains steam.

However, while Solana’s core fundamentals are strong, meme coins in its ecosystem have seen reduced hype. That’s left room for newer projects like Layer Brett to capture retail attention with more aggressive upside potential.

While SOL eyes a move back to $250, Layer Brett (LBRETT) is making waves in the early-stage market. Built on Ethereum’s Layer 2, this robot-themed meme coin is blending virality with real tech. Priced at $0.0058 in its ongoing presale, the token has already raised over $3.78 million, signaling strong community backing.

What’s setting Layer Brett apart is utility, something most meme coins lack. Transactions are lightning-fast and cheap thanks to Layer 2 scaling. But perhaps most notably, it offers a staking system with around 689% APY, giving holders real incentives to participate early. Staking is simple and requires no KYC, with full support for MetaMask and Trust Wallet users.

The project also comes with a fixed supply of 10 billion tokens, and its roadmap includes NFT integration, gamified staking, multichain expansion, and a $1 million community giveaway to reward early adopters. The tone on X (formerly Twitter) is turning increasingly bullish, with some influencers calling it the next Shiba Inu or PEPE, but with real functionality under the hood.

Solana continues to show strength across the board, and the $250 target appears within reach if broader market sentiment remains positive. However, Layer Brett offers the kind of asymmetrical upside that early investors often seek. Its low presale price, high staking rewards, and growing social momentum are giving it a unique edge.

If current momentum holds, LBRETT could easily outperform Solana meme coins and potentially hit $1 before the next cycle peak. For investors hunting for short-term upside and long-term growth, Layer Brett is quickly becoming a top pick this month.

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: Telegram: View @layerbrett

X: (1) Layer Brett (@LayerBrett) / X

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

Dogecoin is back in the spotlight, rallying nearly 40% in a single week and sparking fresh optimism that the popular memecoin could soon retest its former highs.

The sharp rise has drawn attention across both retail and institutional circles, with traders pointing to bullish technical patterns and the launch of the first U.S. Dogecoin ETF as key drivers behind the surge.

On the weekly chart, Dogecoin is trading above its 50-week exponential moving average (EMA) at $0.227, a key support zone that helps sustain the rally. Analysts caution that if this level fails, DOGE could retest the 200-week EMA around $0.215.

Dogecoin (DOGE) shows a strong bullish setup with a 70% probability of breaking above $0.31 in the next 10 days, though short-term signals suggest caution. Source: Dr Anton Micheal via X

Momentum readings are also favorable. The Relative Strength Index (RSI) remains below the overbought threshold, suggesting there is still room for further upside. Meanwhile, Dogecoin’s MVRV Z-Score, which measures whether the asset is overvalued or undervalued relative to holder cost basis, currently sits near 1.35. Historically, similar levels have preceded major rallies, including the 230% surge in November last year.

These metrics strengthen the argument for a positive Dogecoin outlook, though traders remain cautious about near-term volatility.

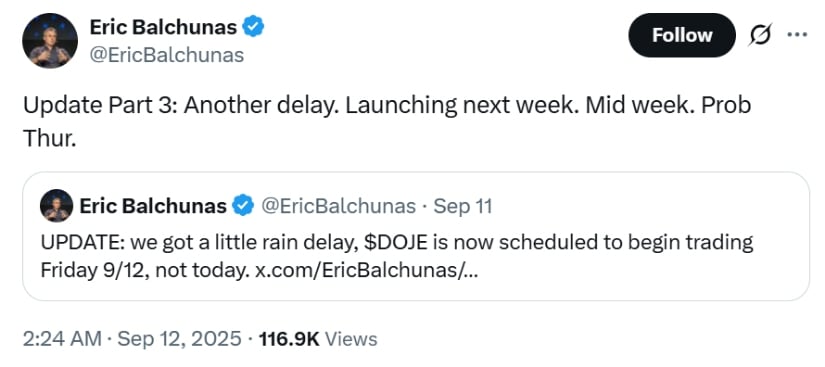

Beyond technicals, Dogecoin has gained fresh momentum from a landmark development in U.S. financial markets. The first-ever Dogecoin ETF, known as DOJE, launched on the Cboe BZX exchange this week. The fund, issued by REX Shares and Osprey Funds, shattered expectations by recording nearly $6 million in trading volume within its first hour—more than double analyst forecasts.

$DOJE launches Thursday under the ’40 Act, likely the first U.S. ETF holding an asset with no utility, while several ’33 Act ETFs await SEC approval. Source: Eric Balchunas via X

Bloomberg Senior ETF Analyst Eric Balchunas remarked that his “over/under got destroyed in the first hour,” calling DOJE’s debut “shockingly solid.” For comparison, most new ETFs attract less than $1 million on their first day.

The ETF gives both retail and institutional investors regulated exposure to Dogecoin (DOGE), a token once dismissed as purely speculative. Its rapid uptake underscores rising mainstream demand and positions Dogecoin alongside more established assets like Bitcoin and Ethereum in U.S. markets.

The mix of technical strength and ETF-driven enthusiasm has led many to revisit the perennial question: Will Dogecoin reach $1?

While some chartists, such as CryptoKing and CryptoGoos, point to nearer-term resistance around $0.45, others believe a breakout toward $0.60 could pave the way for a longer-term run. If the momentum mirrors last year’s 230% surge, Dogecoin bulls argue that the path toward the $1 threshold is not far-fetched.

Still, risks remain. A downturn in broader crypto markets or a failure to hold key support levels could limit gains. Regulatory developments around ETFs and shifting investor sentiment will also play critical roles in shaping the future of Dogecoin.

For now, the Dogecoin price prediction today is tilted firmly bullish. Traders are eyeing $0.45 as the first major resistance, followed by $0.60 if upside momentum continues.

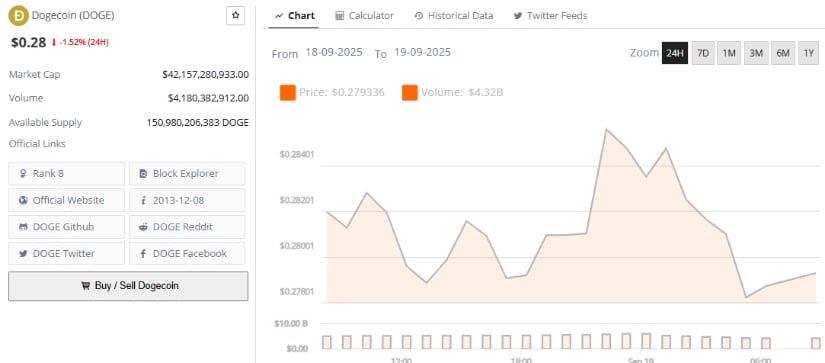

Dogecoin was trading at around $0.28, down 1.52% in the last 24 hours at press time. Source: Brave New Coin

Longer-term Dogecoin predictions are more varied. Some analysts see the recent rally as a step towards a large Dogecoin bull trend, particularly with institutional products like ETFs making the asset more mainstream. Others are not sure that the memecoin can sustain such prices without constant hype and use.

With Dogecoin now breaking out technically, enjoying strong on-chain fundamentals, and supported by a groundbreaking ETF launch, the market’s attention is firmly fixed on whether DOGE can maintain its climb—and ultimately answer the question investors keep asking: Can Dogecoin hit $1?

Cardano Price Prediction remains a focal point of cryptocurrency discussion as ADA investors weigh the possibility of new highs in the next market cycle. The network has built a reputation for reliability, scalability, and a vibrant developer ecosystem.

While most investors continue to view ADA as a long-term bet, there is growing interest in newer tokens that carry greater near-term real-world impact. One such is Remittix, a DeFi project aimed at transforming global payments, now considered by analysts as a serious challenger to established Layer-1 blockchains.

Cardano is currently trading at $0.9157, up 5.04% over the past 24 hours. It has a market cap of $32.77 billion, supported by a trading volume of $2.33 billion, up 96.61% over the day.

The figures indicate resumed interest from retail and institutional investors. For readers following Cardano Price Prediction closely, the question is if ADA can sustain momentum as newer and more targeted real-world projects enter the scene.

Cardano continues to hold its emphasis on low gas fees, smart contract functionality, and enterprise-grade blockchain solutions. This positions it as one of the strongest Layer-1 competitors for decentralized finance and general blockchain adoption.

That said, with innovation now more than ever leading investment decisions, traders are moving into crypto with real utility and looking at early stage crypto investment.

Remittix (RTX) is gaining traction by addressing inefficiencies in the $19 trillion global remittance market. Priced at $0.1080 per token, RTX has already raised $26 million+ with more than 665.7 million tokens sold in its current presale. The platform facilitates the transfer of crypto directly to bank accounts in over 30 countries with real-time FX conversion and support for 40+ cryptocurrencies.

This focus on solving daily problems with crypto sets Remittix apart from speculation tokens. With its combination of cross-chain DeFi project innovation and usability in mainstream finance, it’s positioning itself as one of the best crypto presale 2025 options. Future listings on BitMart and LBank have also been confirmed, reflecting a strategic vision for liquidity and accessibility.

Trust is another driver of Remittix‘s ascent. The project is now completely verified by CertiK, sitting at number #1 among pre-launch tokens on the platform’s security leaderboard (source). This accolade enhances investor trust and highlights RTX as one of the best crypto under $1 with institutional-grade transparency.

Alongside its security milestones, Remittix has initiated community-building measures to fuel adoption. A live $250,000 giveaway incentivizes early users who engage, and a 15% referral program rewards users in USDT for inviting new buyers. Beta testing of the Remittix wallet has also commenced, allowing early adopters to experience its low gas fee transactions and seamless user interface.

Key Highlights of Remittix:

For investors searching for the next big altcoin 2025, RTX offers access to a rapidly expanding presale with sound fundamentals. The balance between the established longevity of Cardano and the revolutionary innovation of Remittix indicates a maturing market where both established stability and fresh breakthroughs have their place.

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article is not intended as financial advice. Educational purposes only.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto markets are entering a decisive stretch: XRP traders are counting on ETF-driven momentum for a 15% rally, while analysts tracking presale projects say Rollblock could deliver a move many times larger.

The difference lies in where adoption is already visible – on live charts or inside a functioning iGaming ecosystem. Can Rollblock outshine blue-chip giants like XRP?

When Rollblock launched its presale in 2024, only a few investors outside early-stage forums paid attention. A year later, that quiet entry has snowballed into one of the most anticipated launches of 2025.

The reason is simple: Rollblock didn’t just raise funds – it built a working iGaming ecosystem while still in presale.

More than 50,000 players have already placed over $15 million in wagers across blackjack tables, AI-driven crash games and sportsbook markets spanning the NBA to La Liga. That level of usage before listing sets Rollblock apart from the countless tokens still promising future adoption.

The upcoming launch is expected to act as a catalyst because the native RBLK token is tied directly to platform mechanics:

Rollblock’s ecosystem also offers benefits beyond tokenomics. Users who joined early are still loyal to the platform because of VIP tiers, rakebacks and massive prize pools.

Since Rollblock already has an Anjouan iGaming license and uses SolidProof-audited smart contracts to provide institutional-grade safeguards, deposits and payouts are both 100% secure.

At its current presale price of just $0.068, investors are buying into a live iGaming economy that’s primed for massive upside. With iOS and Android apps on the way and exchange listings around the corner, analysts argue the stage is set for a launch rally that could outpace many of today’s blue-chip tokens.

XRP is regaining bullish momentum above $3.12 after the US Federal Reserve announced a 25-basis-point interest rate cut on September 17. Bulls are eying a breakout toward XRP’s all-time high of $3.66, but other analysts are already pointing toward a bull flag pattern.

From a technical perspective, there are two bull flags on the XRP weekly chart.

The first is a smaller one that formed in mid-June and was resolved earlier this week when the XRP price broke above the flag’s upper boundary at $3.

The second is a bigger bull flag pattern that has been forming since November 2024, leading to XRP price predictions as high as $15.80.

However, these predictions are hinging on the REX-Osprey XRP ETF that begins trading on US exchanges on September 18. If XRP attracts enough institutional liquidity to sustain the uptrend, it could record a 15% rally.

But if selling pressure intensifies, the XRP price could face another pullback below $3 soon.

The launch of XRP’s spot ETF may be its most important catalyst in years – but ETF rollouts have not always lived up to their hype. Dogecoin’s ETF frenzy earlier this month fizzled out almost immediately, and a similar underwhelming debut could weigh heavily on XRP’s momentum.

That leaves traders balancing two very different scenarios: XRP pushing toward $3.50 on strong inflows or sliding back under $3 if institutional demand underperforms.

In contrast, Rollblock is not waiting for outside catalysts. Its adoption is already making headlines during the presale with $15M in wagers processed, 50,000+ active users and a presale price still at just $0.068. For investors, that sets up a sharper and more predictable growth curve heading into launch.

The takeaway? XRP’s ETF will decide its near-term fate. But Rollblock’s rally potential stems from a working economy that has already proven its traction.

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Solana (SOL) continues to demonstrate resilience in the current market environment, with SOL trading at $226.78 and showing a solid +1.21% gain. The cryptocurrency has maintained its position above critical support levels while bulls prepare for a potential push toward the next resistance zone at $240.

Following a solid recovery from recent lows, Solana has successfully maintained its bullish trajectory. The price action shows SOL consolidating comfortably above the $226 level, with consistent buying interest emerging around the $200 psychological support zone. Market analyst Bit_Rise notes that as long as SOL maintains its position above this crucial level, the overall market structure continues to favor bullish momentum.

The sustained buying pressure at key support levels suggests that institutional and retail investors alike view any dips as attractive entry opportunities.

Current price action reveals several critical technical elements worth monitoring. SOL is currently supported by a well-established ascending trendline that has provided reliable bounce points during recent pullbacks. The immediate resistance target sits at $240, representing the next significant hurdle for bulls to overcome. Below current levels, major support remains intact at the $199-200 zone, which has consistently acted as a demand area. Additional downside protection exists at $185 and $156, though these levels appear less likely to be tested given current momentum. The rising trendline structure indicates that buyers continue to step in aggressively on any weakness, maintaining the positive price trajectory.

Solana’s fundamental appeal continues to drive investor interest, particularly its robust DeFi ecosystem that offers high transaction throughput combined with significantly lower fees compared to competing networks. The respect shown for established demand zones indicates that market participants view temporary price weakness as accumulation opportunities rather than reasons for concern. This behavior pattern typically emerges during healthy uptrends where investors maintain confidence in the underlying asset’s prospects.

A successful break above $240 could open the door for further upside extension toward $250 and potentially higher levels. However, traders should remain aware that a decisive move below the $200 support zone would compromise the current bullish structure and potentially trigger deeper corrective action. For the immediate term, the bias remains constructive as dip-buying activity continues to provide upward momentum and market stability.

Cryptocurrencies are considered a high-risk asset class. Investing in them may result in the loss of part or all of your capital. The content on this website is intended solely for informational and educational use and should not be interpreted as financial or investment advice.

Dogecoin price prediction is back in focus as the world’s top meme coin holds around $0.2709, down nearly 3% in the past day but still commanding a massive $40.9 billion market cap.

Trading volume has cooled to $3.98 billion, a sharp 28% drop, showing retail momentum is stalling after a volatile summer.

Analysts are split: some see the recent ETF approval and institutional demand pushing DOGE toward new highs, while others point to technical resistance and whale sell-offs as reasons for caution.

Yet with Wall Street stepping in and meme culture expanding, traders are asking a familiar question – can Dogecoin repeat history, or will new challengers like Maxi Doge capture the spotlight?

Momentum indicators are flashing mixed signals. The RSI recently cooled to 60 after touching overbought territory at 70, which often signals short-term exhaustion.

At the same time, the MACD has yet to confirm a bullish crossover, leaving room for more downside pressure if bears stay in control.

Still, chart analysts point to a bullish pennant pattern, with $0.26 acting as a strong support base. A breakout from this zone could set DOGE up for a 40% move toward $0.38, aligning with its previous August high.

If momentum holds, the path opens toward $0.46, its strongest level in the past 12 months.

A more aggressive outlook comes from bullish traders who see ETF-driven demand lifting DOGE as high as $1 – a 270% rally from today’s levels. For that scenario, whales and institutions would need to step in heavily.

Data shows large holders already moving coins: over 81 million DOGE ($23.4M) was transferred to exchanges recently, suggesting some are preparing to take profit.

One of the most important drivers behind today’s Dogecoin price prediction is the arrival of the REX-Osprey DOGE ETF, the first U.S. regulated fund to give direct exposure to DOGE.

Unlike typical crypto ETFs under the Securities Act of 1933, this one operates under the Investment Company Act of 1940, offering a unique pooled structure and attracting institutions that prefer managed products.

Early demand has been strong. DOGE ETFs recorded multi-million dollar volumes in their debut, far outpacing most new crypto funds.

Analysts argue this legitimizes Dogecoin in the eyes of traditional finance, transforming it from a meme to a serious asset in managed portfolios.

Corporate adoption is also creeping in. CleanCore Solutions, a publicly traded cleaning and disinfecting company, announced it added 100 million DOGE to its balance sheet, worth nearly $170 million.

Its partnership with the Dogecoin Foundation could see long-term accumulation of up to 5% of circulating supply, underscoring growing mainstream interest.

While Dogecoin’s path now leans on ETFs and institutional credibility, Maxi Doge is storming in from the opposite direction – pure chaos and meme culture.

The token is priced at $0.000258 and has already raised over $2.32 million in its presale, with a price hike looming in less than two days.

Maxi Doge isn’t selling utility – its branding is loud, unapologetic, and perfectly tuned to Gen Z humor.

A buff Doge mascot, gym lingo, and crypto Twitter memes are driving virality. The project embraces the leverage narrative, promising up to 1000x leveraged trades with no stop loss, a setup aimed squarely at degen traders.

The presale’s appeal is clear: while DOGE is chasing Wall Street legitimacy, Maxi Doge is leaning into volatility. Presale funds are earmarked to fuel aggressive margin trading strategies, with 25% of proceeds directed into high-risk plays.

For those who see Dogecoin’s ETF path as too slow, Maxi Doge offers the thrill of riding wild swings where fortunes can be made – or lost – in hours.

Dogecoin’s next move will depend on whether ETFs and institutions can sustain momentum above $0.26 and push toward $0.38 and beyond.

But as mainstream adoption grows, the meme coin culture that made DOGE famous is already migrating into high-octane plays like Maxi Doge, where degen traders are chasing the kind of returns that legacy markets could never match.

While Cardano price prediction models point toward a major rally, new developments in the Pi Network news cycle have reignited excitement among holders. Meanwhile, Remittix (RTX) continues to capture investor attention as the hottest pre-launch token.

ADA is currently trading around $0.915. The Cardano price prediction trend suggests that ADA will pass the $1 mark soon if it stays above $0.80. Market analyst Ali Martinez believes the current bull run for Cardano is just getting started. According to his model, ADA could pass $5 and eventually reach $6.25.

source: KnownasEliot on TradingView

Another analyst predicts ADA could first target $1.19 and eventually $2.16. However, $1.20 is a price investors should watch. On the other hand, if investors start selling, ADA risks dropping to $0.80, which would affect the price increase.

Pi is currently trading around $0.358. A mysterious whale has been aggressively accumulating Pi tokens since August, buying and moving over 376.9 million Pi tokens worth over $134 million. This massive buying spree has sparked speculation of a potential bullish reversal.

Technically, Pi Network is showing promising signs. The Relative Strength Index (RSI) has moved back to the neutral 50 level, and the MACD indicates a hidden bullish divergence. Analysts believe Pi could be gearing up for a 242% rally, with a price target of $1.23 if momentum continues.

However, resistance remains strong, with the Ichimoku Cloud hovering above current price levels. If Pi fails to pass $0.4650, the token could drop to $0.32. Still, the growing whale activity and steady platform upgrades are fueling hopes that 2026 could bring significant rewards for long-term Pi holders.

source: TradingView

Remittix is quietly positioning itself as the most promising altcoin of 2025. The project has raised over $26 million, selling over 666 million tokens at $0.1080 each. Even more exciting, the team has officially announced its first exchange listings on BitMart and LBank.

Unlike many pre-launch projects that make promises but deliver nothing, Remittix has already launched its beta wallet. Adding to its credibility, Remittix successfully passed a rigorous smart contract audit by CertiK, one of the most respected blockchain security firms.

Also, when you refer a new buyer to the project, you get 15% of their purchase back in USDT, instantly claimable every 24 hours. With strong fundamentals, real-world use cases, and a fast-growing community, Remittix is perfectly positioned to become the next 100x altcoin.

Here’s why investors are banking on Remittix:

The crypto market is in an exciting place. However, the biggest opportunity may lie with Remittix, a project combining innovation, real-world use cases, and massive investor demand. For investors seeking explosive growth, Remittix is the project that defines the next crypto bull run.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway:https://gleam.io/competitions/nz84L-250000-remittix-giveaway

XRP price reached $3.10 today, posting 3.2% gains in the past 24 hours. Trading volume surged 62.12% to $7.36 billion, reflecting increased investor interest in the third-largest cryptocurrency.

The price rally coincided with the successful launch of the REX-Osprey XRP ETF. The new fund attracted $37.7 million in trading volume on its debut day, far exceeding typical ETF launch expectations.

Bloomberg ETF analyst Eric Balchunas noted that most new ETFs generate around $1 million in initial volume. The XRP ETF’s performance marked the largest day-one volume for any 2025 ETF launch.

Weekly data shows XRP gained 3.01% over seven days. This steady growth pattern demonstrates resilience against broader cryptocurrency market fluctuations.

Current technical analysis reveals strong momentum indicators for XRP price. The Relative Strength Index stands at 58.26, well below overbought levels and suggesting room for additional gains.

The RSI signal line reads 53.31, confirming the upward trend without immediate reversal signals. These readings indicate healthy buying pressure without excessive speculation.

MACD indicators also support the bullish thesis. The MACD line shows 0.02226 against a signal line of 0.01144, with a histogram of 0.03370 demonstrating positive momentum divergence.

Crypto analyst Egrag Crypto identified critical price levels for XRP’s next moves. Downside support sits at $3.03, which could serve as a retest point before further advances.

A break below $3.03 would target $2.85 as the next support level. However, a close above $3.20 would signal continued bullish momentum and potentially trigger the next rally phase.

CoinGlass data shows growing derivative market interest. Trading volume jumped 79.70% to $9.04 billion across all platforms, indicating broader market participation.

Open interest increased 6.96% to $9.11 billion. The OI-weighted funding rate remains at 0.0105%, suggesting balanced market sentiment without extreme positioning.

The ETF launch created additional institutional access to XRP exposure. Within 90 minutes of trading, the fund had already captured $24 million in volume, demonstrating strong institutional demand.

Combined with Dogecoin ETFs, the new crypto funds generated $54.7 million in total trading volume. This performance exceeded analyst expectations and signals growing institutional acceptance of alternative cryptocurrencies.

XRP price faces immediate resistance at $3.20, which represents a key technical level. A successful break above this threshold could trigger momentum toward the $3.30 target identified by analysts.

The $3.30 level serves as a critical breakout point that could confirm the current uptrend. Reaching this price would validate the bullish thesis and potentially extend the rally further.

Current technical indicators support continued upward movement. The combination of healthy RSI readings, positive MACD signals, and strong volume suggests XRP has room to advance toward these targets.

Derivative market data reinforces the bullish outlook, with increasing open interest and balanced funding rates supporting the current price structure.

Solana is pressing against the key $250 resistance, with tightening supply and strong momentum signaling a potential breakout into fresh highs.

Solana price has once again found itself at a key crossroads, with price pressing hard against the $250 barrier that has acted as a ceiling multiple times before. Participants are watching closely as momentum builds beneath this level, supported by higher lows and steady volume.

Solana is currently pressing against the $250 resistance, a level that has repeatedly acted as a ceiling in past attempts. The chart highlights how price has been consolidating just under this zone, with shorter-term moving averages curling upward to support momentum. Trading volume has shown steady participation, and as long as SOL maintains its structure above the $230 to $235 area, the overall bias leans constructive.

Solana is testing the $250 resistance, a level that has capped rallies multiple times, with participants eyeing a potential breakout. Source: Altcoin Sherpa via X

Analyst Altcoin Sherpa notes that holding long positions remains valid until the market shows a clear reversal. For now, the key lies in whether Solana can secure a breakout through $250, which would flip the level into new support. If successful, this opens the path towards higher extensions, while failure at this point could lead to another retest of the lower moving averages for confirmation.

Solana against Bitcoin (SOLBTC) is forming a new upward channel after bouncing strongly from its recent base. The chart highlights how price has reclaimed structure with a series of higher highs and higher lows, supported by rising volume at the breakout points. The channel boundaries are clean, with SOL holding momentum inside the range and showing early signs of continuation if it maintains this trajectory.

SolanaBTC is carving out a clear uptrend channel, with higher highs and lows signaling a potential sustained recovery. Source: Jess B via X

Analyst Jess B points out that this setup aligns with a textbook bottoming pattern, signaling that the pair could be positioning for its next sustained leg higher. As long as SOLBTC respects the lower boundary of the channel, upside targets remain intact, with the mid-channel zone acting as the first checkpoint before any attempt at fresh highs. This makes the structure one to watch closely for confirmation of trend strength.

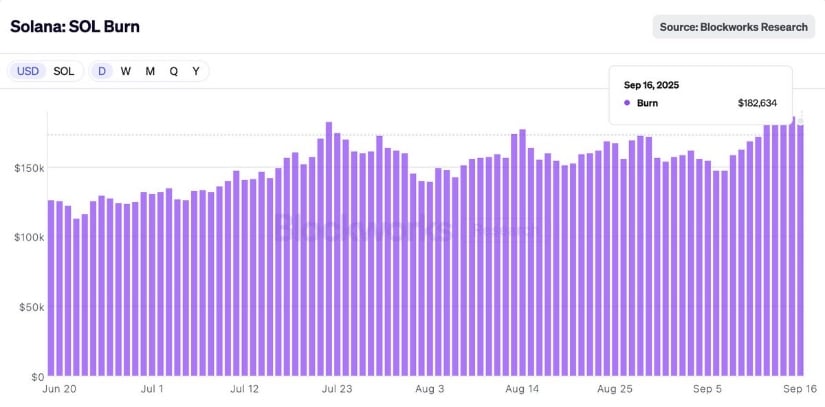

Solana’s token dynamics are showing a steady contraction in supply as more than $180K worth of SOL was burned in just a few days. The mechanism permanently removes half of every base and priority fee from circulation, meaning fewer new tokens are entering the market each year. The chart shows a steady rise in burn activity, proving that network usage is directly lowering supply. With fewer tokens entering the market and steady demand still present, Solana is strengthening its position. This supply reduction also supports the bigger bullish narrative around $250 resistance level.

Solana’s supply continues to shrink as rising burn activity removes tokens from circulation, reinforcing bullish momentum. Source: Solana Sensei via X

Solana price is showing signs of pressing further into price discovery, with the chart indicating room for expansion above its current levels. The structure highlights how SOL has been building higher lows after recovering from earlier pullbacks, supported by a steady rise in momentum indicators. Volume also remains consistent, pointing to healthy market participation. This suggests that while price is already near its highs, there is still technical space for continuation as long as current support levels hold.

Solana is edging towards price discovery, with strong support and rising momentum indicators. Source: Cold Blooded Shiller via X

Analyst Cold Blooded Shiller points out that the indicators still have “plenty of room to go,” reinforcing the idea that Solana is not yet overstretched. In terms of technical zones, holding above $230 to $235 keeps the structure strong, while a confirmed breakout past $250 would open the door to fresh levels. For now, the Solana price prediction remains constructive, with the setup favoring bulls.

Solana price continues to show strong positioning with momentum building across both USD and BTC pairs. The $250 resistance remains the biggest test ahead, but the underlying factors, tighter token supply, consistent burn activity, and healthy trading volume, all support the bullish case. With higher lows holding and moving averages curling up, the technical picture leans constructive, keeping bulls in control as long as price respects the $230 to $235 support area.

Whether Solana can truly break into price discovery depends on its ability to flip $250 into support. A confirmed breakout would not only open fresh upside targets but also reinforce the long-term bullish structure.

As Dogecoin price momentum fades off, with experts issuing warnings of a potential retrace below the $0.20 threshold, investor interest has turned to Mutuum Finance (MUTM). The platform is a new DeFi protocol that’s reshaping crypto lending and borrowing. Mutuum Finance has had 5 presales to date with the sixth live now at a price of $0.035.

The presale of MUTM currently has 16370 investors and has raised more than $15.9 million. Whereas DOGE surfs on memecoin popularity and hype community-based, Mutuum Finance is different as it provides actual utility and long-term growth opportunities from its unique on-chain financial system. This volatility dichotomy of hype and utility-led innovation is driving speculation that capital may flow from Dogecoin into Mutuum Finance as the market looks for sustainable alternatives.

Dogecoin (DOGE) is trading at $0.2678 currently, showing minor decline over the last day as recent gains are observed slowing.

The intense surge over the last week has pushed price towards resistance levels, and on-chain metrics signal that profit-taking is gaining speed. Support levels of $0.22-$0.25 will be one to watch; breaking below would offer room for further retracements. Compared to meme-driven volatility within DOGE, Mutuum Finance is being considered by more investors as having more solid structural potential for returns.

Mutuum Finance has registered gargantuan presale momentum with more than 16,370 investors buying coins and a total of more than $15.9 million raised to date. Tokens can be bought in Phase 6 at the rate of $0.035 per token. Its multi-phase pricing mechanism is an incentives program and people who enter early get maximum ROI.

Mutuum Finance (MUTM) has introduced a $50,000 Bug Bounty Program, inviting developers, security researchers and ethical hackers to come and test its security. They get rewarded for discovering and reporting bugs that have the potential to jeopardize the security of the protocol.

The reward and incentive will be proportionate to the severity of the problem, from small bugs to severe vulnerabilities. This will benefit not just the protocol but also users and create trust from investors.

Mutuum Finance has adopted a new paradigm in an attempt to reduce market risk, volatility, and stability of their systems even under conditions of liquidity stress. Liquidity depth and Loan to Value (LTV) will be varied based on the condition of the market. Policies are firm under conditions of high volatility in an attempt to reduce exposure to risks and elastic in stability. The use of reserve funds also covers, and it increases with the proportion of risks so that it can protect the stakeholders.

Besides system security, Mutuum Finance will also be a community-focused DeFi platform. Presale buy, reward plans and system security audit are all targeted towards the duality of the venture, ensuring long-term stability and collaborative community efforts. Mutuum Finance is a secure and scalable DeFi platform.

Mutuum Finance (MUTM) is dominating investor interest as Dogecoin (DOGE) is showing weakness. DOGE risks a potential pullback below $0.20, but MUTM continues to gain momentum with 16,370+ buyers and over $15.9M raised in its presale. Stage 6 tokens are now at $0.035, to increase in the next stage, giving early investors the perfect entry point. With a backing of a $50K CertiK bug bounty, good liquidity control, and community-driven DeFi ecosystem, MUTM offers long-term utility over hype. Lock in your tokens now in Stage 6 before prices increase.

For more information regarding Mutuum Finance (MUTM) please use the following links:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance