The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

Cardano news today suggests ADA is on the edge of breaking out, with resistance near $1 under the microscope and renewed strength in its fundamentals. At the same time, Dogecoin price prediction is gaining traction as analysts model its path toward $0.50 or more over the next few years.

Remittix (RTX) enters this picture with features that may outshine both ADA and DOGE for investors seeking higher upside. For many, Remittix’s security, product roadmap, and current metrics paint it as a token with potential to capture outsized growth in the PayFi wave that ADA and DOGE are only now brushing against.

ADA is trading around $0.86, holding a key zone that many believe must give way for a move toward $1 to become sustainable.

Recent Cardano news includes bullish patterns forming on the charts, increasing interest in Cardano upgrades, and analysts pointing to ADA’s potential target near $1.40 if it clears resistance and holds support. If ADA breaks above $1 cleanly, sentiment may shift strongly positive, pushing price toward $1.30 to $1.50.

Dogecoin price prediction models diverge. Many forecasts see DOGE reaching around $0.30 in the near term of 2025 if current momentum holds, especially as it flips resistance at $0.28 into support. Longer-term projections for DOGE toward 2030 range between $0.40-$0.75 in many bullish scenarios.

However, catalysts like ETF approvals, better utility integration through bridges and Layer 2s, or partnerships may help lift its price further.

When comparing Remittix to Cardano and Dogecoin, RTX seems to have traits combining high potential with early-stage flexibility that ADA lacks at its more mature market cap, and DOGE lacks in utility depth. ADA offers a strong community and blockchain pedigree, DOGE offers meme appeal and social traction.

Remittix seeks to bridge utility, security, incentive, and real-world payment rails. Its CertiK verification ranked #1 among pre-launch tokens, providing trust that many early tokens do not command. The wallet beta is active with community testers, giving early feedback, and listing on BitMart and LBank has been secured, with a third centralized exchange in view.

Remittix has sold over 663 million tokens, is priced at $0.108, and has raised over $25.8 million. It has a 15% USDT referral program claimable every 24 hours, and is running a $250,000 giveaway to drive adoption.

These features suggest that RTX could outperform DOGE if meme sentiment wanes and utility and execution matter more. Compared to ADA, Remittix’s lower price point means more room to grow, and its roadmap is tightly aligned with PayFi use cases, something ADA is still building toward.

Highlighted here are RTX features giving it a possible edge:

Cardano news today confirms that ADA is battling resistance but still has strong level targets toward $1.40 if momentum returns. Dogecoin price prediction points to DOGE hitting $0.30 to $0.50 over the coming years, depending heavily on sentiment, utility additions, and market cycles.

Remittix is positioned with several concrete advantages. For those evaluating tokens across ADA and DOGE, RTX might offer more asymmetric growth potential in the 2025 to 2030 window.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

XRP has been battling uneven demand despite upgrades in utility, and XRP price sentiment shows traders are split on whether momentum can really stick. Sui is also stuck in a similar loop, where each SUI price prediction points to upside but often clashes with fears of supply pressure. Both coins have strong communities, but they also carry doubts about stability.

So, what if there’s a project that flips the order and proves itself before the main event? That’s exactly what BlockDAG is doing. Instead of waiting for its mainnet, the Awakening Testnet is rolling out real infrastructure, ledger upgrades, explorer tools, miner integration, and account abstraction, all live.

This isn’t just testing; it’s early access to a crypto to explode. The prequel is already attracting the kind of attention most launches dream of, and it’s giving participants first-mover visibility.

Most projects keep their best features hidden until mainnet, but BlockDAG is already putting its architecture to work in the Awakening Testnet. This prequel isn’t a simple trial run; it is live infrastructure with core protocols, explorer tools, and miner integration all operating under real conditions.

By removing the old UTXO model and streamlining how transactions are stored and managed, BlockDAG has built a cleaner, faster ledger that proves scalability before launch. That is why early participants are treating this stage like a front-row ticket to a crypto to explode.

The big draw is visibility. Every transaction, miner connection, and vesting contract can be tracked in real time. That level of transparency is rare before a project launches, and it builds confidence that the systems can handle serious adoption. For early backers, this means more than testing—it is shaping how the network is built, with influence and rewards tied directly to involvement.

Then there is the presale. BlockDAG has already raised over $407 million, selling coins through structured batches that started at just $0.001 and now sit at $0.03 in batch 30. With a listing price set at $0.05, early buyers are already looking at a potential 2,900% return from the first batch, and more upside remains before the sale closes. But the current limited-time entry price is $0.0013. Add to that $40 million raised in the last month, and momentum is undeniable.

The Awakening Testnet proves BlockDAG isn’t asking investors to wait for validation; it is delivering it now. With the presale live and infrastructure already performing, this looks like the crypto to explode while others are still promising what they might one day deliver.

The discussion around XRP continues to focus on confidence, and at the moment, XRP price sentiment remains caught in a tug-of-war. Supporters point to utility upgrades and ongoing adoption news as reasons to hold for the long term.

At the same time, demand has not been steady, and each rally quickly runs into resistance levels that trigger doubt among traders. This inconsistency has left many questioning whether XRP can generate enough momentum to push into a strong new trend or if it will keep slipping back into the same trading ranges.

The bigger challenge is the lack of clarity on where momentum comes from next. XRP price sentiment shows a market split between those expecting upside and those wary of sudden drops if volume dries up.

Without steady catalysts to drive interest, XRP risks staying stuck in range-bound trading even as the broader market strengthens. That uncertainty has investors scanning for other opportunities that can deliver clearer growth signals and stronger returns. With competing projects showing transparent adoption metrics and defined roadmaps, XRP must overcome this hesitation or risk being overshadowed by assets that look more decisive.

Sui is currently trading around $3.65–$3.70, and analysts remain split on where it goes next. Technical charts show resistance near $3.85, with a possible rally toward $4.30 if demand increases.

On the downside, some warn of a drop back to the $3.10–$3.20 range if support fails. This is why every SUI price prediction right now feels like a balance between potential and risk. Traders acknowledge the upside but point to short-term token unlocks and uneven trading volume as factors keeping the coin from building a sustained uptrend.

Looking into Q4 2025, forecasts place Sui in the $5–$6 range if adoption and ecosystem growth continue at the current pace. Longer-term outlooks stretch even higher, with some predicting double-digit prices by 2027–2030.

Still, those projections depend heavily on consistent catalysts that have yet to materialise. Each SUI price prediction today is less about excitement and more about whether on-chain growth and broader market confidence will align. Until that happens, Sui remains a promising project under pressure to deliver proof that it can sustain its momentum.

XRP continues to struggle with uneven demand, and XRP price sentiment reflects that uncertainty as rallies face resistance and traders remain cautious. Sui sits in a similar spot, where every SUI price prediction highlights both potential gains and the risk of short-term pullbacks. Both coins are talked about, but neither has shown the kind of consistent momentum that convinces new buyers to pile in.

That is where BlockDAG separates itself. By turning its Awakening Testnet into a live proving ground, it is already doing what others only plan for after launch. With UTXO removal, explorer tools, and miner integration all active, it is showing real scalability before mainnet. Add in a presale that has raised $407 million and is still open, and it is easy to see why many believe this is the crypto to explode, while others remain stuck in hesitation.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

Wondering what the latest Solana price predictions are? The technical and fundamental indicators are screaming $300 is imminent. A good jump, no doubt, but what about the extreme bullish Solana price predictions that put it at a $1000 mark in 2026?

And what is going on in the meme sector, with a new coin called Layer Brett making rounds with experts saying it can do 100x easily in the same timeframe?

Layer Brett: The Meme Layer 2 You Can’t Ignore

Every cycle delivers a token that flips the script. This round, all eyes are on Layer Brett. With presale tokens sitting at just $0.0058, the project is already stirring serious FOMO, with chatter of 100x gains turning heads across the market.

Layer Brett is more than just another launch — it’s a collision of speed and culture. The backbone is Layer 2 tech, giving users transactions that clear almost instantly, gas fees that barely register, and scalability that puts sluggish Layer 1s to shame. With experts projecting that Layer 2 networks will process over $10 trillion a year by 2027, the timing could not be sharper.

But tech alone doesn’t drive hype. Layer Brett injects meme energy into its DNA, making the project as loud and fun as it is functional. This mix of utility and culture has been the secret sauce behind some of crypto’s biggest movers.

Then comes the staking rush: early buyers can lock in up to 700% APY, though rewards shrink as the crowd rushes in. Add to that a $1M giveaway, and the presale is engineered to send FOMO through the roof.

Fast. Meme-fueled. Built for this moment. Layer Brett is ready.

SOL is one of the most bullish crypto in the market right now, fueled by a perfect storm of institutional capital and on-chain growth. A new Solana price prediction from analysts is now targeting the $300 range, and this isn’t just speculation. It’s a direct result of massive institutional inflows, with major firms acquiring over $1.5 billion in SOL for corporate treasuries in a single week.

This demand, combined with an Open Interest (OI) that has reached a staggering $16.58 billion, is a powerful signal. With the network becoming the de facto home for DePIN, the current Solana price prediction is conservative, with some putting it at a cool $1,000 next year. SOL’s ascent is just getting started.

Solana price predictions, if achieved, will be some of the biggest moves for SOL this year. $300 presents a roughly 78% jump, while the 2026 estimates of $1,000 give it a little over 4.2x.

Compared to that, the Layer Brett estimates put it around 100x next year. Savvy traders are not seeing the price tag of future SOL, or $LBRETT, but the potential returns on their investment.

It is clear that Layer Brett has the upper hand.

Presales are the time when a coin is at its lowest point, and this is no different for $LBRETT. At a tiny $0.0058, the discounted price, when coupled with the utility and meme power, L2 tech, and the insane rewards, means Layer Brett may just do the expected 100x, outpacing SOL at every step.

Interested in making 100x gains? Join the Layer Brett presale with USDT and ETH, stake immediately, and enjoy!

Discover More About Layer Brett ($LBRETT):

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: View @layerbrett

X: Layer Brett (@LayerBrett) / X

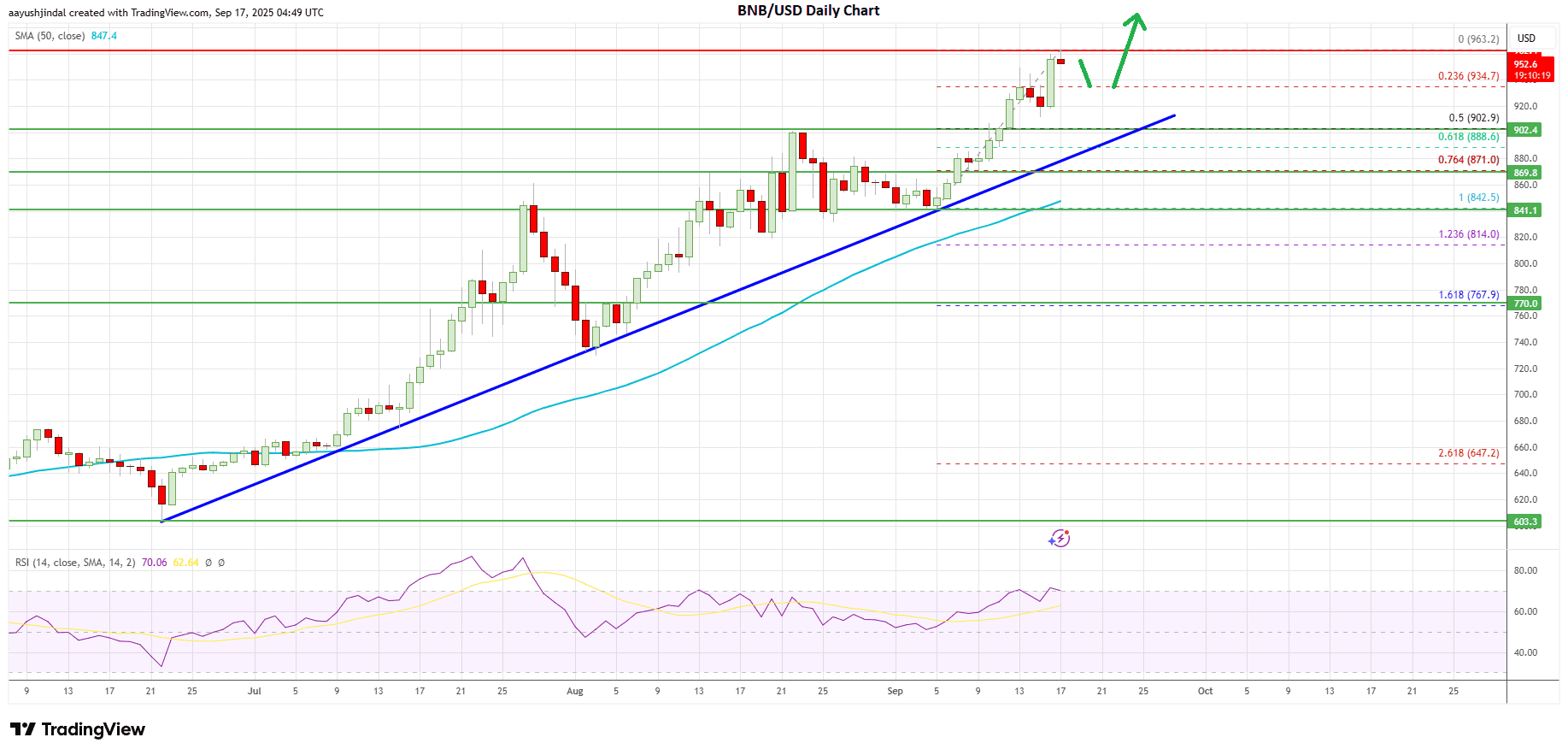

BNB extended gains and traded to a new all-time high above $950. The price is moving higher, and the bulls could soon aim for a move toward $1,000.

In the past few days, BNB price saw a steady increase above the $880 resistance. The bulls pushed the price above $900 and the 50-day simple moving average (blue) to set the pace for more gains, beating Bitcoin. Finally, the price spiked above $950 to hit a new all-time high at $963.

The last daily candle suggests an increase in bullish momentum above $930, and the price could continue to rise. It is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $842 swing low to the $963 high.

BNB is now trading well above the $920 pivot level and the 50-day simple moving average (blue). There is also a key bullish trend line in place with support at $902 on the daily chart.

The current price action is positive, and the bulls could soon aim for more gains above $960. Immediate hurdle for them could be near the $962 level. A clear move and close above the $962 resistance could open the doors for a move toward $980.

The next major resistance could be near the $1,000 handle. If there is a close above the $1,000 resistance, the price might gain bullish momentum. In the stated case, the price might be $1,120.

If BNB price fails to clear the $962 resistance, it might start a downside correction. Immediate support is near the $932 level. The first major support is now forming near the $900 level and the trend line.

The 50% Fib retracement level of the upward move from the $842 swing low to the $963 high is also near the $902 level. If there is a downside break below the trend line and $900, the bears might gain some strength. The next area of interest for the bulls could be $872.

The main support is $840 and the 50-day simple moving average (blue). A daily close below $840 could increase selling pressure. In the stated scenario, BNB price might dive and revisit the $760 support region since it coincides with the 1.618 Fib extension level of the upward move from the $842 swing low to the $963 high.

Overall, BNB price is showing positive signs above the $900 and $930 levels. A close above the $962 resistance could send the price toward $980 or even $1,000.

Press release

Dogecoin (DOGE) has just flashed its most bullish technical signal in years, with analysts predicting a massive 300% rally that could take the meme coin back to the psychological $1 mark.

According to crypto analyst XForce, Dogecoin recently broke above a key regional high after reclaiming the $0.30 level, a move he believes sets the stage for a parabolic rally.

$DOGE#DOGE just broke the previous regional high. It’s still programmed for $1+.

Will there be pullbacks along the way? Yes.

Remember, the alternative idea is still at large that could lead us to double digits if it continues as a strong impulse (make adjustments later). pic.twitter.com/fdQxruNmwj

— XForceGlobal (@XForceGlobal) September 13, 2025

XForce stated in an X post that $1 “is still programmed” for DOGE, marking a potential 300% surge from current levels.

The analyst acknowledged that pullbacks are likely along the way, but his chart suggested a strong upward impulse could even carry Dogecoin toward double-digit prices in the long term.

At the time of writing, DOGE trades at $0.2643, up more than 9% in the past week. The meme coin recently broke out of an ascending wedge pattern, suggesting renewed upside momentum.

If bulls can reclaim and hold above $0.30, Dogecoin could confirm its breakout and accelerate toward the next resistance near $0.45, followed by the long-term target at $1, representing a 300% rally from current levels.

Not all analysts are convinced. CrediBULL Crypto warned that DOGE is currently testing a major monthly supply zone. If the breakout fails, the price could retrace sharply, with downside targets near $0.15 support, as marked on the chart.

Source: TradingView

On the other hand, the Relative Strength Index (RSI) sits at 60, in bullish territory but not yet overbought, leaving room for further upside.

Similarly, the MACD line has crossed above the signal line, suggesting that bullish momentum is strengthening.

Dogecoin has not seen this much enthusiasm since the 2021 meme coin mania, and with the REX-Osprey DOGE ETF debut on the horizon, a Fed pivot favoring risk assets, and strong technical signals, the $1 target is back in play.

Still, caution is warranted. A clean breakout above $0.30 could be the trigger for the next explosive rally, while a rejection could see the meme coin retrace toward $0.15 before attempting another breakout.

With Dogecoin eyeing the much-anticipated $1 target, Maxi Doge ($MAXI) has entered the crypto market as a high-energy meme coin with a unique identity that fuses the worlds of trading and fitness culture.

Drawing inspiration from a gym-focused version of Doge, the project embodies values such as persistence, discipline, and ambition.

In its ongoing presale, Maxi Doge has already raised a massive $2.26 million with each $MAXI priced at $0.0002575. However, in 1 day, 10 hours, the prices will increase.

Maxi Doge aims to empower retail traders who often find themselves at a disadvantage against larger players, giving them a bold and relatable symbol to rally behind.

$MAXI is an ERC-20 token with fixed supply to maintain scarcity and long-term value, while the team is considering cross-chain bridges to broaden accessibility and reach.

To buy $MAXI, simply visit the official Maxi Doge website and connect a supported wallet like Best Wallet.

You can swap your existing crypto or use a debit/credit card to complete the transaction.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.

Related Releases

Maxi Doge Hits $2.2M in ICO – Is 12.8x Growth Possible by 2025?

September 16th, 2025

No Hardware Needed: PepeNode’s Meme Coin ICO Surges to $1.18M with Just 2 Days Left

September 16th, 2025

September 15th, 2025

The crypto market is buzzing with activity as traders focus on Pi coin news and the latest Cardano price prediction updates.

Meanwhile, Remittix (RTX) has been making headlines as the best crypto to buy now, attracting attention from both retail investors and Wall Street traders.

Pi is currently trading around $0.355, still down a massive 90% from its all-time high. However, Pi coin news today reveals that not everyone is bearish. Whales have been aggressively buying, with one whale spending thousands of dollars daily to build a portfolio of 373.78 million tokens, now worth over $132 million.

From a technical perspective, Pi’s chart has formed a double bottom at $0.3321, a bullish pattern that often signals a turnaround. The next major resistance sits at $0.4652. If the token breaks this level, Pi could see a 32% surge from current prices. Some analysts are even more bullish, calling for the token to reach $1.

source: TradingView

ADA is trading around $0.883. The Cardano price prediction remains bullish, with analysts watching a critical resistance zone between $0.90 and $0.92. This level forms the “neckline” of a cup and handle pattern, a formation that often precedes a strong price increase.

If ADA successfully passes this, it could reach $1.05, $1.15, and even $1.25. However, failure to pass $0.85 might lead to a price drop to $0.76 or $0.68 before another rally attempt.

source: @ali_charts on X

On-chain data also supports this bullish outlook, with a steady decline in short-term supply and accumulation by long-term holders. Analysts believe that a confirmed breakout above $0.9421 could set ADA up for a strong rally heading into Q4 2025.

While Pi and Cardano dominate headlines, Remittix is quietly becoming the best new altcoin. The project has raised over $25,6 million with more than 662 million tokens sold at $0.1080 each. This explosive growth has caught the attention of crypto whales and Wall Street traders alike.

Remittix has announced two CEX listings, with the first on BitMart and the second on LBANK. Adding to the excitement, the Remittix Beta Wallet will officially launch on September 15th 2025, allowing users to send and receive funds seamlessly. Remittix also offers a 15% referral rewards program, giving investors extra earnings for bringing friends and family into the community.

Why Remittix Is the Best Crypto to Buy Now:

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The idea of XRP reaching $100 is currently one of the most debatable of our cryptocurrency times. XRP was one of the longest runners in cross-border payments, but there is competition, regulatory challenges, and market volatility to consider whether it is in its own good.

This XRP Price Prediction explores whether or not such a milestone is possible and what it means for investors based on new developments such as Remittix (RTX) that are transforming digital finance.

XRP has been an established remittance player globally for several years now and is among the most sought-after cryptocurrencies besides Bitcoin and Ethereum. At a sale price of $3.05, market capitalization of $181.09 billion, and 24-hour trading volume of $5.02 billion (down 15.34%), XRP remains among the most traded cryptocurrency.

For XRP to be a real possibility at $100, though, it would need enormous market growth and adoption both in the institutional and retail spaces.

Although its role in cross-border payments is monopolistic, the crypto universe is today full of upcoming crypto initiatives offering faster settlement, lower fees, and higher integration flexibility. XRP’s trajectory is also highly dependent upon regulation clarity.

In the United States, judicial proceedings have decelerated momentum, whereas other regions keep testing out regulations that would benefit or injure its progress.

The crypto space is moving towards real-world utility. Low gas fee crypto projects, decentralized exchanges, and new altcoins with payment use cases are making large headlines. Investors are more concerned with hype coins now and are instead focusing on crypto with real utility, long-term sustainability, and practical adoption.

This shift creates space for platforms that do not only guarantee innovation but have even working solutions. While XRP is fighting to push banking adoption, rivalry from the next big altcoin 2025 players is tough. Among such projects creating buzz is Remittix (RTX), a cross-chain DeFi platform bridging crypto and fiat payments.

Remittix ($0.1080 per token) has already secured more than $25.9 million, selling 664Million+ tokens in presale. It solves a $19Trillion payments problem by allowing users to pay crypto straight to bank accounts in 30+ nations. Unlike most early-stage crypto investments, Remittix already possesses a real-world use case which is already being trialed through its wallet beta.

Important project highlights are:

With CertiK auditing, Remittix is a secure, open DeFi project and is increasingly viewed as the next altcoin 2025.

Whereas XRP is one of the top cryptos to invest in today for others, reaching $100 would require historic adoption and growth in the market. The cryptocurrency market is evolving at a fast pace, and investors are diversifying into low cap crypto gems and future cryptos that have real-world effects.

Remittix provides a fresh perspective by integrating cross-border payments with blockchain effectiveness, and therefore it is among the most realistic crypto presales that are currently running. Be it XRP hitting $100 or not, the advent of projects like Remittix is an indication that the future of crypto lies in offering practical solutions and not speculation.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The previous time Solana showed this particular bullish signal, its price continued to achieve more than 1,000% returns. With the current pullback in full swing, investors are once again on their toes to see if history would repeat itself.

While Solana Price Prediction headlines fill the airwaves, there is a new wave of interest also flowing towards early-stage ventures with strong fundamentals as well. Of them, Remittix (RTX) is quietly making a name for itself as a major contender in 2025.

At the moment, Solana is trading at around $230.80, having a 5.45% decline within the last 24 hours. Its market capitalization stands at $125.82 billion, and the trading volume has surged to $10.75 billion, up by 29.66%. This type of activity shows that interest in Solana continues to be active despite the recent decline, engaging traders in Solana Price Forecast talks.

This context highlights the broader investor interest in resilience-laden projects with innovation. Old players like Solana are still in the limelight with continued speculation, but many are exploring early-stage crypto investment projects with real-world adoption potential, lower entry and explosive utility increase.

One such project is Remittix (RTX), which is trading at $0.1080 per token at the moment. Unlike most new altcoins, Remittix is not for speculation purposes but for solving an actual $19 trillion payments issue crypto-to-bank transfers.

Its beta wallet, which has recently gone live as of writing, allows people to send over 40 cryptocurrencies to 30+ fiat currencies, straight into bank accounts in a number of countries.

This cross-chain DeFi project has already recorded a presale of more than $25,8 million selling more than 664 million tokens.

Remittix’s credibility made a giant leap when the project was deeply audited by CertiK, the top blockchain security label in the industry. And even more impressively, Remittix is currently #1 on CertiK Skynet among pre-launch tokens, which is proof of trust in its code, transparency and roadmap.

CEX listings add more fuel to the momentum. The first exchange partnership was revealed with BitMart after the $20 million presale milestone, then LBank after $22 million was hit.

To further promote community growth, Remittix has launched a referral program where users are given 15% in USDT each time they refer a new buyer to the presale. Rewards are cashable immediately every 24 hours, offering participants their rewards on a daily basis to grow the network.

Remittix is standing out because:

As Solana Price Prediction continues to capture traders’ attention after setting a record 1,000% gain, the attention is also being given to projects like Remittix that bring real-world solutions. Its live beta wallet, verified exchange listings, CertiK verification and low presale entry point make it one of the best DeFi projects 2025.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Ethereum (ETH-USD) is consolidating near $4,450–$4,500, absorbing a 5.7% pullback from weekend highs around $4,766 while traders brace for the Federal Reserve’s decision. Futures markets price in a 96% probability of a 25-basis-point cut, a sharp increase from 85% one month earlier, with expectations of at least two further cuts by year-end. This macro backdrop is crucial for Ethereum’s trajectory, as easing conditions have historically fueled risk asset rallies. Despite short-term caution, Ether’s structural foundation has strengthened, with ETF inflows, whale accumulation, and expanding DeFi use cases acting as firm supports beneath the surface.

Ethereum-linked exchange-traded funds have become the headline driver of demand. Over the last week, ETH ETFs attracted $1.1 billion in inflows, with $360 million arriving in a single day on September 15. BlackRock’s ETHA vehicle absorbed $363 million, while Grayscale’s ETHE added $10 million, partly offset by outflows from Fidelity’s product. Since their 2024 launch, ETH ETFs have amassed more than $13 billion, showing sustained appetite from institutions. While Bitcoin ETFs remain larger, with $2.6 billion in inflows in the same period, Ethereum’s resilience has stood out after sharp August drawdowns. This institutional rotation, paired with whales returning to accumulation, underscores why ETH has managed to hold above $4,400 despite volatility.

Ethereum’s chart setup remains constructive. On the daily, ETH is defending the 20-day EMA at $4,450, while the 50-day EMA around $4,200 provides deeper support. Price action has carved out a bull pennant, a continuation pattern that suggests further upside. If ETH closes above the pennant’s upper boundary, projections point to a breakout toward $6,750, implying gains of more than 45% from current levels. Analysts also highlight the Fibonacci retracement “golden pocket” zone between 0.5 and 0.618, which ETH has reclaimed, confirming bullish bias. Immediate resistance is seen at $4,800, with a decisive break likely opening the door toward $5,000 in the coming weeks. The RSI sits near 54, indicating momentum is neither overbought nor oversold, leaving room for expansion.

Beyond technicals, macro conditions are providing the largest tailwind. Fed rate cuts lower the opportunity cost of holding non-yielding assets like ETH, while easing global financial conditions typically drive capital into higher-risk plays. Options data from Derive shows a 40% probability of ETH closing above $5,000 by year-end, and a 20% probability of hitting $6,000. At the same time, Ethereum’s total value locked (TVL) has surpassed $208 billion, while the stablecoin market on its network has grown to $157 billion, cementing Ethereum as the dominant DeFi infrastructure. These fundamentals differentiate ETH from smaller altcoins whose valuations are more narrative-driven.

The upcoming Fusaka upgrade in November is expected to boost scalability and network security, a key factor as Ethereum processes growing institutional activity. On-chain metrics show that staking deposits remain steady following the Shapella upgrade, with more ETH locked in validators, reducing circulating supply. Whale wallets have resumed accumulation, indicating that long-term holders are confident in Ethereum’s next leg higher. This behavior is consistent with earlier market cycles where whales accumulated aggressively before large breakouts.

While Ethereum consolidates, attention among retail traders has briefly shifted to speculative presales such as Maxi Doge and Mutuum Finance. These high-risk tokens are drawing flows, but institutions remain anchored to ETH, treating it as the foundational asset for DeFi and staking yield. This divergence underscores the difference between speculative altcoin hype and Ethereum’s entrenched role in the market. Even as side narratives play out, Ethereum’s liquidity and adoption levels remain unmatched.

With Ethereum trading at $4,458, the key pivot remains whether it can hold the $4,440–$4,450 support zone ahead of the Fed’s decision. A confirmed break above $4,800 targets $5,000, while technical projections extend as high as $6,750 if the bull pennant plays out. On the downside, a failure to defend the 20-day EMA risks a slide toward $4,200, though dip-buying behavior has consistently emerged at those levels. Institutional flows, whale accumulation, network upgrades, and macro conditions all reinforce the long-term bull case. Based on these dynamics, Ethereum (ETH-USD) holds a Buy rating, with a short-term target of $5,000, medium-term upside toward $6,750, and long-term structural potential reaching $8,000 as ETF adoption and Fed easing converge.

A fringe thesis circulating projects 100,000% gains for XRP, implying a price near $2,990 per token. While historical runs (like the 60,000% surge in 2017) fuel such optimism, the market cap implications would exceed global equity benchmarks. For now, realistic targets are more restrained: analysts outline a bearish case at $2.40–$2.65, a neutral case at $3.30–$5.00, and a bullish case at $6–$9+ into 2026, assuming adoption, regulation, and ETF flows materialize.

Ripple’s XRP-USD sits at a crossroads. The bullish structure relies on reclaiming $3.07–$3.13, which would unlock upside to $3.40 and $3.66. Failure to defend $2.95–$2.85 invites a slide to $2.65–$2.40, with worst-case triangle targets near $2.06. Whale distribution, declining ledger activity, and neutral oscillators all lean bearish short term, but oversold signals near $2.65 could attract accumulation. Based on current data, XRP is best viewed as a Hold with tactical Buy zones below $2.80 for those anticipating regulatory and institutional catalysts. Bulls retain medium-term potential, but near-term risks remain skewed to the downside.