The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The most notable Dogecoin rally happened during the 2021 bull market. Dogecoin delivered over 1000x gains to early investors, who rode the price surge to all-time highs.

Despite the price dip, analysts continued to place their Dogecoin price prediction at $1. However, their patience has waned, and Dogecoin price has not even come near $0.50, talkless of $1.

While investors still expect the $1 Dogecoin price prediction, the savvy investors are investing in Remittix (RTX), a PayFi project set for the moon.

Despite the broader decline in the meme coin sector and interest, DOGE continues to benefit from brand recognition, widespread exchange availability, and active community support.

Dogecoin is currently at $0.26, gearing to move towards resistance at $0.27. If the $0.27 resistance is broken, the next resistance level is $0.286, followed by $0.3151.

In his Dogecoin price prediction, Ali Martinez reported that Dogecoin is breaking out of a triangle, targeting $0.31, holding the $0.25 support.

For Dogecoin to hit $1, it would need a significant influx of retail buying power and broader adoption and utility. Also, remember that Dogecoin has a large market cap of over $37 billion. A 3x to reach $1 will require billion-dollar inflows, which is impossible in the short term.

While Dogecoin loyalists blindly cling to Dogecoin price predictions, the savvy investors are diversifying into Remittix (RTX).

Remittix is designed to make cross-border payments faster, cheaper, and more efficient. It’s bridging a $19 trillion payment gap between traditional payment systems and cryptocurrency.

The is built to enable instant crypto-to-bank transfers in 30+ countries, and supports over 40 cryptocurrencies.

Remittix recently launched a referral program that allows users to earn thousands daily. Users will earn a 15% reward on the buyer’s presale purchase in USDT. The rewards are paid in USDT and instantly claimable every 24 hours on the Remittix dashboard, either to be withdrawn or reinvested.

Remittix highlights:

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Cardano is back in the headlines, pushing past $0.90 and turning heads. After months in the $0.70-$0.80 range, ADA has gained enough strength to test resistance zones that once seemed out of reach. Right now, analysts are predicting lofty gains, and for many investors, the real question remains: Can Cardano price attain double figures by 2028? Can the technical breakouts, strong accumulation and ecosystem developments translate to something big for Cardano? Let’s find out.

Cardano price analysis. Source: X/Ali Martinez

ADA is trading near $0.90, having climbed steadily from mid-summer lows. Analysts are watching resistance at $1.15-$1.25 closely. These levels acted as barriers during previous rallies and have returned as key decision points. A clean weekly close above that zone could create a foundation for higher targets. The current pattern points first to $2.47, which aligns with the 0.786 Fibonacci retracement of past cycles.

If buyer demand holds and volume backs it, the next absolute ceiling becomes $5.00. From today’s price, that implies more than 5x upside just to reach $5. Whales are engaging. On-chain data shows large addresses increasing holdings. Exchange outflows suggest ADA tokens are staying with holders rather than circulating. That kind of accumulation reduces liquid supply, making upward breaks more likely when they happen.

Still, the $1.15 zone must flip convincingly. Failure to sustain gains above $0.94-$0.96 support could bring back pressure, pulling ADA back toward $0.60-$0.80 territory. That’s the risk path. But if $1.15 breaks and ADA holds above it, doors open toward $1.50-$1.80 short term, then $2.47, then $5.00 in a favorable market environment.

While ADA lays strong groundwork, Layer Brett (LBRETT) offers something different: massive upside potential in exchange for higher risk. Its presale is live. Token price sits at $0.0058. Early staking yields are pushing over 712% APY, depending on timing. Its total supply is capped at 10 billion, with a large portion allocated to presale and staking rewards. Low entry cost plus high rewards grab attention.

Transactions are processed off-chain but settle against Ethereum, cutting gas fees down and boosting throughput. Layer Brett is designed for speed and efficiency, not just meme culture. It pairs community energy with technical infrastructure. That means staking, NFT plans, gamified rewards, and future bridging between chains. For early entrants, the value proposition isn’t just meme hype—it’s being part of something built for scale.

Investor appetite already shows up. Over $3.7 million raised, and the holder number is closing in on 10,000. Buzz in social circles. If the next meme supercycle plays out perfectly, Layer Brett could multiply far beyond what many expect from ADA under current conditions. It’s a low-risk, high-reward investment that could mirror the early days of Shiba Inu, PEPE or Dogecoin.

ADA shows signs of waking up. If ADA overtakes resistance at $1.15-$1.25 and secures that breakout above $1.39, it could cruise toward $2.47, even $5, within its trajectory before 2028. But $10 would require a near-perfect run.

Layer Brett, by contrast, offers far more leverage now. At $0.0058, with staking rewards north of 712%, capped supply, and real Layer 2 engineering that aims to reshape meme culture. A stitch in time save nine—join Ethereum’s biggest L2 meme revolution now.

Layer Brett is still in presale, but it won’t be forever. Get in now before prices rise and rewards drop.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The crypto market is preparing for what’s expected to be the first US interest rate cut in nine months at this week’s FOMC meeting – but it’s far from smooth sailing. There’s a lot of confusion, conflicting sentiment, and an overall sense of uncertainty about the Fed’s current stance, so prices have generally trended lower today.

President Donald Trump has urged the Fed to implement more aggressive monetary easing, stating in a social media post on Monday that Fed Chair Jerome Powell “MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND.” But not everyone agrees with Trump.

Of the twelve policymakers on the FOMC, two are still undecided – and uncertain if they’ll even vote at all at the September FOMC meeting, which began today and concludes tomorrow. Meanwhile, the appeals court has blocked Trump’s attempt to oust Fed board member Lisa Cook, in an apparent effort to orchestrate larger rate cuts directly from the Oval Office.

So, investors are asking – what does all of this mean for the altcoin market? Let’s run through some XRP, BNB, and SOL price predictions, and also explore some potentially lucrative alternative investments preferred by top analysts during this high-stakes period.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Several anomalies are emerging around this FOMC meeting, creating uncertainty and making it a particularly interesting period for the crypto market. Notably, Trump’s effort to fire Lisa Cook is the first presidential attempt at such a removal in the 112-year history of the Federal Reserve.

Additionally, The Kobeissi Letter noted that it’s also rare for the Fed to cut interest rates while the stock market is nearing all-time highs (ATHs).

However, it notes that previous instances have resulted in strong gains, with a later post highlighting that JP Morgan researchers found “when the Fed cuts rates with the S&P 500 within 1% of an all-time high, it results in an average return of +15% over the next 12 months.”

The time has come:

On Wednesday, the Fed will cut rates for the first time in 2025 and “blame” a weak labor market.

This will be just the 3rd year since 1996 with Fed rate cuts while the S&P 500 is at record highs.

What happens next? Let us explain.

(a thread) pic.twitter.com/N7Nmfr7aqD

— The Kobeissi Letter (@KobeissiLetter) September 13, 2025

The market is pricing in a 25-basis-point cut at this meeting, but the main uncertainty revolves around the language Fed Chair Jerome Powell will use in his speech. According to Cas Abbe, dovish language and warmth toward future rate cuts could spark bullish momentum, while hawkish language might cause a short-term pullback.

Bitcoin is walking into one of the most important weeks of this quarter.

The FOMC is set to cut rates by 25bps that’s already priced in.

What isn’t priced in is Powell’s tone.

If he hints at more cuts or a softer stance, liquidity expectations could flip instantly.

The… pic.twitter.com/YDiEGSHSjO

— Cas Abbé (@cas_abbe) September 16, 2025

This signals that volatility awaits throughout the remainder of this week. However, both Abbe and The Kobeissi Letter agree that the mid-term outlook remains positive, with interest rate cuts making borrowing cheaper and thereby increasing liquidity flows to risk assets. As such, let’s look at some price predictions for top altcoins.

According to the analyst Muro, XRP is forming a “classic cup and handle pattern,” which could lead to a move toward $4 by October. However, it’s worth noting that there’s a possibility for much higher returns if the Fed hints at another rate cut in December.

BNB hit a new ATH of $944 two days ago, and the bullish mid-term outlook suggests it won’t slow down anytime soon. Regarding potential gains, analyst Leshka.eth expects the uptrend to continue toward $1,200.

$BNB broke perfect bullish channel pattern and no one’s talking about it

Textbook continuation setup – every support touch led to new highs

Channel target: $1,200+ pic.twitter.com/M8g8K1zVul

— Leshka.eth ⛩ (@leshka_eth) September 12, 2025

Solana recently reached $249.60, its highest price since January. It’s demonstrating clear strength, and analysts believe more gains are ahead. Popular trader Don predicts it’s poised to reach the top of a wedge pattern at $300, and a clean break above could push it to $600.

While the above top altcoins are expected to rise over time, many traders are pouring funds into trending crypto presales – recognizing that their pre-scheduled price increases shield against near-term volatility. These presale tokens are expected to list on the open market in Q4 – when analysts believe the effect of rate cuts will take hold, and prices will rise. With that in mind, let’s take a look at some of the most popular presales taking place right now.

Alongside rate cuts, one of the major events this week is the launch of the Dogecoin spot ETF, which is set to be approved under the so-called “40 Act” on Thursday. This opens the door for regulated exposure to the meme coin market for institutional and traditional investors, potentially creating a new narrative and speculative demand flows.

While buying DOGE directly could generate gains, many investors are purchasing Maxi Doge (MAXI), Dogecoin’s younger, riskier cousin, who’s more focused on raising his bench press and 1000x leverage than on risk management.

MAXI also offers real utilities, such as staking, community giveaways, and plans to integrate with futures trading platforms. This sets it apart from other meme coins and indicates it could hold real staying power in the entertainment token space.

The project is currently in a presale, offers staking APYs of 145%, and has raised over $2.2 million so far, reflecting strong early investor interest and potential for big gains ahead.

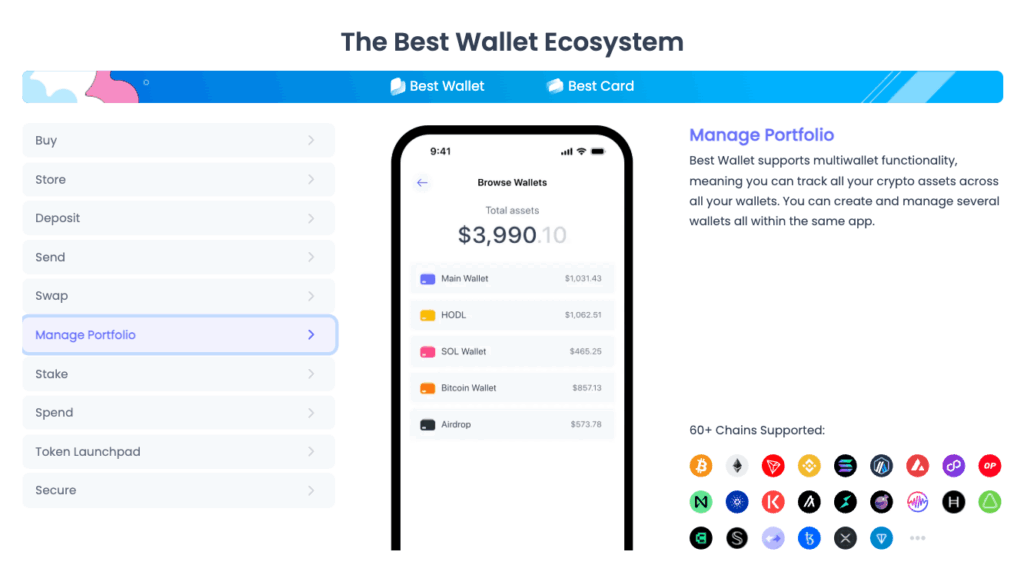

Another promising presale is Best Wallet Token (BEST), which powers the multi-chain crypto wallet Best Wallet. The wallet supports over 60 networks, including Bitcoin, Ethereum, and Solana, helping to address the issue of blockchain fragmentation.

The wallet also features built-in tools like a crypto debit card, a presale aggregator, a staking aggregator, and an upcoming futures trading platform. Holding the Best Wallet Token provides trading fee discounts, higher staking yields (including BEST staking APYs of 83%), governance rights, and access to promotions on partner projects.

The BEST presale has already raised over $15.5 million, making it one of the biggest fundraisers on the market and signaling huge potential once listed on exchanges.

The last presale showing significant potential is SUBBD Token (SUBBD). It’s the native utility token for the SUBBD content subscription app, which leverages AI tools to empower creators by automating account management, helping them foster deeper connections with fans and even improving content creation workflows.

SUBBD ensures fast, private, and secure payments, and also unlocks benefits like 20% APY staking rewards, access to exclusive features, and loyalty bonuses. The SUBBD presale has raised $1.1 million so far, demonstrating strong investor interest but also leaving room for growth.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Nothing says a token is trending in the crypto market than when it gains a massive influx of price predictions in the crypto news. This appears to be the fate of Solana, following another price surge in the crypto market at the start of the new week.

Following its latest rally, analysts have offered fresh insights into what they believe is a feasible Solana price prediction heading into the tail end of the ongoing bull market. The magic number appears to be $1000, a significant increase from the token’s current value.

Following yet another rally in the SOL price, analysts have offered a fresh batch of Solana price predictions as the ongoing bull market ramps up. The general verdict is that Solana could end up around $1000 over the next five years, indicating a significant increase from its current value.

Meanwhile, the upcoming PayFi project, Remittix, has received a huge boost ahead of its token generation event as the project has now become fully verified by Certik, the leading blockchain security firm in the industry.

Barely days after crossing the all-so-important $25 million mark in its ongoing presale, Remittix has surpassed yet another milestone as the wins continue to stack up for the highly anticipated PayFi project. It is now fully verified by Certik, the leading blockchain security firm in the industry, as preparations ramp up for its upcoming token generation event.

With its presale drawing closer to the $30 million mark, Remittix has launched a mega referral rewards program to incentivize token purchases. The way it works is simple. For every token purchase made by a referred user, the referrer stands to gain 15% of the token purchase in USDT rewards. These rewards can be paid out instantly and there is no limit on how much a user can earn with the program.

Remittix has risen to become a crypto native favorite over the past few weeks, thanks to its perceived potential to transform the global payments experience when it eventually launches. It is expected to achieve this with innovative features, such as:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

The latest rally has put Dogecoin back in the spotlight, with its price climbing over 30% this week to trade around $0.26. Optimists are pointing to ETF updates and bullish chart patterns as proof that DOGE could finally reclaim the hype it enjoyed back in 2021. But beneath the surface, it’s becoming clear that while Dogecoin might grind toward $1 in the long run, its upside is capped compared to the explosive potential of new meme-powered tokens like Layer Brett (LBRETT). With its presale on the verge of breaking past $3.7 million and fast racing toward $4 million at just $0.0058 per token, Layer Brett is showing why it’s the project with real 100x potential.

At $0.27, Dogecoin has rallied hard, but its next big hurdle sits between $0.35 and $0.40—a resistance level that has capped growth since 2021. Analysts argue that a breakout above $0.40 could confirm a longer-term bullish cycle, with a possible move toward $1 if momentum holds. For the average retail investor, though, that means at best a 3–4x gain from current levels, and only if everything breaks in DOGE’s favor.

That’s the problem with Dogecoin today. Despite ETF buzz and institutional chatter, it’s an old meme coin with little real innovation. Most of its short-term movements are still tied to speculation, hype, or mentions from influencers. It has a large market cap already, and every step higher takes billions of dollars in new money—something harder to achieve in a crowded market.

While Dogecoin battles to reclaim old highs, Layer Brett is redefining what a meme coin can be. Built as an Ethereum Layer 2 memecoin, it combines the viral energy of meme culture with actual blockchain utility. By processing transactions off-chain while anchoring to Ethereum, LBRETT delivers lightning-fast speeds and ultra-low gas fees—fixing problems that plague other meme tokens.

On top of that, LBRETT holders can instantly stake through MetaMask or Trust Wallet and earn some of the highest staking rewards in the market today, with APYs soaring above 700%. Add in transparent tokenomics, a fixed supply of 10 billion tokens, and ecosystem plans for gamified staking and NFTs, and it’s clear why investors see Layer Brett as meme-born but utility-built.

At just $0.0058, the upside potential is staggering. A run to $1 in the next bull cycle would represent nearly 200x returns—exactly the kind of asymmetric upside that Dogecoin can no longer deliver. That’s why more investors are rotating away from old names like Dogecoin and into presales like Layer Brett that still offer room for life-changing gains.

Yes, Dogecoin may have some fuel left in the tank, but its growth story is slowing, and its ceiling is lower than ever. Layer Brett, on the other hand, is early, cheap, and already backed by millions in presale inflows. With the presale closing in on $3.7 million and on pace to smash through $4 million, this Ethereum Layer 2 memecoin is proving to be the breakout star of 2025.

LBRETT is available now at $0.0058. Don’t miss out on the next 100x—join the Layer Brett presale today.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: Layer Brett (@LayerBrett) / X

This article is not intended as financial advice. Educational purposes only.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

The crypto market is hyped up with Cardano news today, as the ADA price eyes the $1.40 target analysts are watching. Alongside ADA’s push toward the key $0.90–$1 range, Chainlink (LINK) and NEAR Protocol (NEAR) are being spotlighted as top altcoins to watch now, with many calling them hidden gems for long-term growth.

Adding to the excitement, MAGACOIN FINANCE has started making waves as a new community-driven project with real-world impact.

The latest Cardano news today centers on ADA testing the crucial $0.90–$1.00 level, a zone that traders have been monitoring closely. Over the past week, ADA recorded an estimated 9% gain, which has renewed confidence that a breakout may be on the horizon.

Technical analysts suggest that if ADA secures a daily close above the $1 line, it could fuel a rally toward previous highs in the $1.30–$1.40 range.

This sets up the much-discussed ADA price prediction of $1.40, which has become a talking point among traders speculating on where the token might head next.

In the Cardano market outlook, the $1 level remains more than just a price target — it’s also a psychological barrier. A decisive break could pull in sidelined buyers, while rejection might lead to another phase of sideways consolidation.

While ADA’s rally grabs attention, Chainlink (LINK) has quietly maintained its ground around the $23–$24 region. Analysts are eyeing a breakout above the $24.5 resistance, which could clear the path for a short-term surge toward $25–$28.

This momentum is being supported by large investors. Data from recent coverage shows whales have accumulated around 2.08 million LINK (about $49.5 million) over the past 180 days.

This kind of activity adds weight to the growing LINK price prediction 2025 discussions, with some forecasts pointing to potential moves toward $30 or even $40 in the coming year.

Strategic partnerships, including work with SBI Japan and collaborations on U.S. government data initiatives, continue to strengthen the perception of Chainlink (LINK) as a hidden gem in the top altcoins to watch now category.

Another strong performer has been NEAR Protocol (NEAR). In recent trading sessions, NEAR has outpaced other major assets, pushing the CoinDesk 20 index higher by 1.1%.

This performance has turned heads, with many starting to discuss a NEAR price prediction for 2025 that points toward growing demand in the ecosystem.

NEAR’s fundamentals are also gaining attention. Its “Intents” product recently surpassed $1 billion in lifetime transaction volume, highlighting growing real-world usage.

At the same time, protocol upgrades have brought down inflation to around 2.5%, a move that could support long-term token stability. Strategic collaborations with projects like Everclear, Aptos, and Shelby are fueling speculation that NEAR could be a hidden gem with more upside than expected.

Beyond the Cardano price forecast for 2025 and the hype around LINK and NEAR, a new name is quietly entering the conversation: MAGACOIN FINANCE. The project positions itself as a secure, community-driven altcoin with audited protocols — an important reassurance in a market where investors often worry about safety.

What sets it apart is its focus on real adoption and sustainable growth. The project’s security and transparency offer participants the chance at a safe ROI.

As many are scanning for the best hidden gem cryptos of 2025, MAGACOIN FINANCE is beginning to stand out, aiming to combine security with real utility. Its model appeals to those seeking both potential growth and community-focused initiatives.

The latest Cardano news today points toward a possible breakout near $1.40, while LINK and NEAR are being framed as hidden gems in the market.

Long-term watchers are also paying attention to the Cardano price forecast 2025, along with the LINK price prediction 2025 and NEAR price prediction 2025, as adoption stories build momentum.

Alongside these established names, MAGACOIN FINANCE is stepping into the spotlight with its focus on community and real-world impact, giving investors another potential contender among the best hidden gem cryptos of 2025.

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Traders are weighing Cardano updates and the latest XRP price prediction while hunting the top crypto to buy now. Remittix keeps showing up for users who want crypto with real utility and rewards. This mix fits low-cap crypto gems and new altcoins to watch lists. As Cardano builds and XRP price prediction chatter grows, many ask which pick can really multiply.

Source: AlexBucher

Cardano sits near $0.90 inside an upward wedge that can break either way. Resistance stands at $1.00 to $1.05 and $1.33, with support at $0.77 and $0.45 to $0.50. RSI is around 56, MACD hints at a turn, and volume is light, so any breakout needs confirmation.

With consensus upgrades, ZK proof work, Hydra scaling, and the Chang fork for on-chain governance, Cardano stays on top of crypto to buy now radars. Smart traders repeat it often: watch the wedge line on Cardano for the next move, even while scanning the latest XRP price prediction trends.

Source: Anasta

The XRP price prediction today points higher after a clean bounce from $2.8 support. Reclaiming $3.2 opens the path to the $3.6 zone if momentum holds. Ledger upgrades like XLS 86 firewall, a native AMM, and growing legal clarity add fuel to any XRP price prediction.

With a U.S. spot ETF slated for September 18, 2025, institutions get a clearer lane, which many fold into their XRP price prediction playbook. As flows shift, an XRP price prediction that targets $3.6 looks reasonable, though risk control still matters.

Remittix has raised over $25.6 million through over 662 million tokens sold at $0.1080 each. CEX access is confirmed at BitMart and LBank, and the Beta Wallet launches on 15 September 2025. The referral program pays 15% in USDT per new buyer you refer, claimable every 24 hours in the dashboard, paid in USDT to withdraw or reinvest.

While Cardano advances and every XRP price prediction gets louder, this DeFi project aims to deliver low gas fees, centralized exchange reach, and decentralized exchange access in one stack.

Remittix pairs access and incentives with product delivery, which is what many want when seeking top crypto under $1 and high-growth crypto. Compared with waiting on a wedge break for Cardano or timing an XRP price prediction, RTX offers a straightforward plan and a live way to earn.

If you want more than headlines, Remittix gives you CEX access, a dated wallet launch, and a daily 15% USDT referral that is easy to use. It is a practical top crypto to buy now when you want utility plus rewards in one place. Head to remittix.io, grab your referral link, and claim 15% USDT daily.

Disclaimer: The content above is presented for informational purposes as a paid advertisement. The Tribune does not take responsibility for the accuracy, validity, or reliability of the claims, offers, or information provided by the advertiser. Readers are advised to conduct their own independent research and exercise due diligence before making any decisions based on its contents and not go by mode and source of publication.

Solana has reasserted its strength in the crypto markets, climbing back above $200 as institutional demand surges. With public companies now holding millions of SOL and new investment vehicles like Nasdaq-listed SOL Strategies opening the door for wider access, Solana is proving it can capture both retail and institutional attention. This resurgence underscores its role as one of the most dynamic blockchains in the industry. Yet while Solana cements its position as an institutional-grade asset, retail traders are also eyeing opportunities elsewhere, with MAGACOIN FINANCE emerging as a high-upside candidate attracting growing attention.

Solana has recaptured momentum, rallying to $202.40 amid growing strategic demand. Public companies alone hold over 3.5 million SOL, valued at more than $591 million, reflecting a substantial institutional commitment to the network’s long-term prospects.

Among them, SOL Strategies stands out. The Solana-focused treasury firm secured approval to list on Nasdaq under ticker STKE, effective September 9, offering a regulated and liquid path for institutional investors to gain exposure to Solana. This approval brings credibility and a new layer of market access to SOL’s ecosystem.

Additionally, traditional corporations are taking notice. BIT Mining Ltd., a listed entity, announced plans to raise $200–$300 million in phases to build a substantial Solana treasury, swapping crypto holdings for SOL as part of its long-term growth strategy.

These trends are being amplified by upcoming financing instruments. Analysts estimate Solana ETF approval odds at around 95%, with several major firms like Fidelity, Grayscale, and VanEck already filing proposals to launch their own Solana-based funds. This confluence of demand, infrastructure, and regulatory clarity is positioning Solana as a premier institutional-grade blockchain.

When large-scale investors allocate capital, they bring more than just buying power—they bring confidence. SOL’s recent staging above $200 is no coincidence, it reflects faith in the network’s ability to deliver infrastructure value and enduring performance. Institutions are treating SOL not only as a digital asset to hold, but also as a productive asset to stake and integrate into portfolios via regulated channels like STKE.

This momentum gives retail investors a backdrop of stability to pair with speculative moves. And as market cycles continue to reward platforms with both utility and institutional adoption, Solana’s dual appeal makes it one of the most compelling large-cap stories today.

While Solana reclaims its strength, MAGACOIN FINANCE is emerging as the high-upside opportunity investors are watching most closely. Priced at just fractions of a cent, analysts project the token could deliver up to 50x returns as demand accelerates.

What sets MAGACOIN FINANCE apart from other early-stage projects is its combination of cultural momentum and structural credibility. The project has successfully completed audits with HashEx and CertiK, providing a level of transparency and trust uncommon in small-cap tokens. This has allowed it to attract not only speculative retail buyers but also more serious investors looking for vetted opportunities.

At the same time, MAGACOIN FINANCE thrives on community growth. Telegram groups and X threads are expanding daily, turning the token into a cultural talking point. Traders describe it not just as a presale play, but as a movement building at the perfect time. Analysts suggest this convergence of trust and momentum creates the kind of setup where explosive multiples become possible.

For investors comparing ADA, TRON, or even Solana, the upside ceiling is clear: these are already multi-billion-dollar projects. While they offer stability and adoption, their growth trajectories are more measured. MAGACOIN FINANCE, however, is starting from a point where exponential returns are possible.

At just a fraction of a cent, MAGACOIN FINANCE offers retail investors the ability to accumulate large positions without overcommitting capital. This accessibility, combined with growing recognition, makes it one of the most talked-about breakout candidates of the current cycle.

Smart portfolios don’t bet everything on one type of asset. Ethereum provides credibility, Solana offers scalability and cultural adoption, and MAGACOIN FINANCE delivers speculative asymmetry. By holding a mix of these categories, investors can capture both resilience and explosive upside.

Solana’s rally above $200 proves it remains a leading force in crypto’s infrastructure race. But for those searching for life-changing multiples, analysts increasingly point toward tokens like MAGACOIN FINANCE. Its unique positioning as both audited and culturally resonant makes it a rare high-risk, high-reward candidate.

Solana’s rebound above $200 is more than market noise, it’s confirmation of a building institutional thesis. With $591M+ in corporate accumulation, staking strategies, and ETF pathways opening, SOL is becoming mission-critical for institutional portfolios.

At the same time, MAGACOIN FINANCE offers the kind of exponential upside that institutions don’t chase,but narratives fly. With 50x potential, confirmed audits, and retail energy converging, it could be the breakout play of the 2025 cycle.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

Ethereum is trading at $4,494, slipping 2.39% in the last 24 hours, yet still higher by 3.6% over the week. The move comes after ETH printed an all-time high at $4,957 in August, a 240% surge from April’s $1,400 low. Despite this rally, revenue from Ethereum’s network dropped sharply to $14.1 million in August, a 44% fall from July’s $25.6 million. Transaction fees also declined by 20% to $39.7 million, largely due to the Dencun upgrade, which lowered gas costs for layer-2 rollups. While users welcome cheaper fees, it reduces Ethereum’s direct revenue stream, raising concerns for long-term token value capture.

The most aggressive accumulation wave came from BitMine Immersion Technologies, which absorbed 319,000 ETH in a single week, worth over $1 billion, bringing its total holdings to more than 2.12 million ETH valued at $9.3 billion. The company aims to own 5% of ETH’s circulating supply, fueling fears of a potential supply shock. Analyst Paul Barron calculated that at this pace—319,000 ETH weekly—demand could reach 4.1 million ETH by year-end against a liquid exchange supply of just 11 million ETH. Inflows into ETH ETFs confirm the institutional bid: last week alone, more than $637 million poured in, lifting total AUM to $13.38 billion. Treasury holdings now represent nearly 3% of supply, reinforcing Ethereum’s role as institutional infrastructure.

Ethereum has oscillated between $4,100 support and $4,761 resistance, repeatedly failing to close above $4,800. The price is now consolidating near the $4,500 pivot, with hidden bearish divergences forming on the RSI. A rising wedge pattern on daily charts warns of potential pullbacks. Immediate support rests at $4,485 and $4,382, while deeper downside targets emerge at $4,276 and $4,060. Bulls need to reclaim $4,634 for confirmation of strength and to push toward the $5,000–$5,500 zone. If broken, analysts point to possible runs toward $7,500 in 2025, a level Standard Chartered has projected. Meanwhile, speculative calls like Paul Barron’s suggest $15,000 ETH by December is mathematically possible if institutional demand persists.

Large Ethereum whales have begun reallocating profits into emerging plays such as Rollblock (RBLK) and Remittix (RTX). Rollblock’s presale has attracted more than 50,000 investors, with token prices rising 580% to $0.068, on track for a $1 target. Similarly, Remittix has raised $25.4 million, selling over 660 million tokens at $0.108, with BitMart and LBANK listings confirmed. These projects are not direct competitors to ETH but highlight a shift where whales look for 100x returns while Ethereum consolidates as a “blue-chip” crypto. Still, ETH remains the backbone of DeFi and tokenization, hosting more than $145 billion in stablecoin supply and processing trillions in settlements, cementing its systemic role.

On-chain metrics reveal Ethereum supply in profit peaked at 99.68% on September 12 before easing to 98.14%, historically a trigger for corrections. For example, when ETH hit $4,829 on August 22, it quickly fell to $4,380, a 9% drop. Futures market data adds caution, with the taker buy-sell ratio sliding to 0.91 on September 13, its second-lowest of the month, signaling growing bearish pressure. September has historically been Ethereum’s weakest month, with a median return of –12.7%. Combined with a rising wedge structure, the setup suggests risk of short-term pullback before any renewed push toward $5,000. Still, derivatives positioning shows bullish skew, with options traders pricing 40% probability of ETH above $5,000 by year-end and 20% odds of $6,000.

Macro conditions remain favorable as markets anticipate up to three Fed rate cuts in 2025, cutting the opportunity cost of holding non-yielding assets like ETH. At the same time, tokenization of real-world assets—estimated by U.S. lawmakers to reach $100 trillion on Ethereum rails—adds a structural growth layer. Ethereum co-founder Joseph Lubin echoed this, forecasting ETH could rally 100x long term as it becomes Wall Street’s financial backbone. Tom Lee has backed $12,000 ETH by year-end, while near-term ranges remain locked between $4,100 and $4,800. The dual narrative is clear: ETH has transitioned from a speculative rocket into a foundational layer of global finance, but its price action is still prone to heavy volatility driven by whale accumulation, ETF flows, and macro shifts.

The price of Bitcoin (BTC-USD) is locked in a crucial battle around $115,000, a level that traders call pivotal heading into the Federal Reserve’s rate decision. At the time of writing, BTC trades at $114,770, down nearly 1% on the day, after peaking at $116,800 late last week. The market is digesting institutional inflows, ETF activity, and mounting macroeconomic signals that are shaping both short-term volatility and long-term direction.

Technical signals show that Bitcoin faces stiff resistance between $116,000 and $117,200. Analysts argue that reclaiming $114,000 as firm support is essential for sustaining bullish sentiment. Trader Titan of Crypto highlighted that a weekly close above $115,000 would confirm momentum, aligning with Ichimoku Cloud metrics that flagged upside breakouts earlier this year. Failure to hold $115K risks a correction toward $112,500–$113,500, while a breakout above $117K opens the path to $120,000 and potentially $122,000, the target from a bull flag structure visible on the 4-hour chart.

The RSI at 54 remains supportive of an uptrend but shows fading strength, while a recent MACD bullish crossover from September 6 remains intact. Importantly, a golden cross between the 50- and 200-period moving averages supports the bullish camp, suggesting the broader trend still favors upside.

U.S.-listed spot Bitcoin ETFs have recorded their strongest week since mid-July, with $2.34 billion in inflows last week. Data from Glassnode showed that on September 10 alone, inflows reached 5,900 BTC, the largest single-day tally in two months. These flows are nearly nine times the weekly supply of newly mined Bitcoin, effectively tightening liquidity and underpinning price stability.

Major corporates have also been adding to reserves: Capital B boosted its holdings to 2,249 BTC after adding 48 coins, while healthcare firm Prenetics raised its total to 228 BTC and announced a daily accumulation strategy. Governments are expanding reserves as well—collectively holding 526,394 BTC worth over $61 billion, with the U.S. and China accounting for more than 190,000 BTC each.

On-chain data adds another layer of bullish evidence. CryptoQuant’s Binance Scarcity Index spiked over the weekend, signaling strong buying activity outweighing available supply. The index reached 2.94, the highest since June, when Bitcoin rallied toward $124,000. If sustained, this imbalance between demand and supply could propel BTC higher in the coming weeks.

Markets are fully pricing a 25-basis-point Fed cut this week, with a 94–96% probability according to CME FedWatch. A smaller chance—around 3–5%—remains for a 50-point cut. Rate easing is arriving in unusual conditions: equities are at record highs, with the S&P 500 (^GSPC) at 6,611 and the Dow (^DJI) above 45,850, while labor data is softening. Historically, Bitcoin rallies when credit becomes cheaper, and current conditions echo previous cycles where Fed stimulus fueled speculative appetite.

Analysts at Mosaic Asset Company noted that the Fed’s pivot, coupled with strong market breadth and easing financial conditions, “favors an ongoing expansion,” supporting both equities and Bitcoin. At the same time, commentary from The Kobeissi Letter stressed that the “AI revolution and rate cuts” are creating a unique environment where long-term asset owners will “party,” with Bitcoin and gold leading the move.

While BTC peaked at $124,500 earlier this year, analysts remain divided on whether that was the cycle high. Joao Wedson, founder of Alphractal, argues that the Max Intersect SMA model, historically accurate in calling cycle tops, has not yet flashed a signal. His projections suggest a top closer to $140,000 by October, with some chart-based models even pointing toward $160,000 in the months ahead. Traders like Jelle see potential for a 35% rally toward $155,000, citing bullish stochastic RSI signals on the weekly chart.

Outside crypto-specific flows, credit markets provide another bullish indicator. The ICE BofA High Yield Index shows yields declining, a trend that historically correlates with Bitcoin rallies. Lower junk bond yields imply easing credit risk and stronger appetite for speculative assets. Analysts highlight this as an underappreciated tailwind that aligns with ETF inflows and on-chain scarcity.

Despite bullish macro trends, distribution patterns remain visible. Glassnode’s Trend Accumulation Score shows investor cohorts holding below the 0.5 threshold, meaning many are prioritizing profit-taking rather than building positions. RSI weakness and failure to defend $115K as firm support could trigger a retest of $112,500, undermining near-term optimism.

Balancing all data—ETF inflows of $2.34 billion, government reserves surpassing 526,000 BTC, technical resistance at $117K, and Fed-driven macro tailwinds—the medium-term setup remains bullish. However, near-term risks tied to distribution and fading RSI momentum suggest volatility before a decisive breakout.

At current levels of $114,770–$115,000, Bitcoin (BTC-USD) is a Buy for investors targeting a breakout toward $120,000–$122,000, with the possibility of extending toward $140,000 if cycle patterns hold. Traders must remain alert to support zones at $114K and $112.5K, as losing those levels would temporarily weaken the bullish structure.