The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The crypto market is still full of names that are already known, but investors are asking which projects still have the potential to explode. Cardano (ADA) and Chainlink (LINK) are two well-known crypto coins with strong communities and real-life usage cases. But their very high market capitalization makes it difficult for them to achieve a 20× return in the near term.

At the same time, Digitap ($TAP) is a new project that has started to gain attention with the presale that is picking up momentum. Now analysts are putting these three side by side to see in which one the next 20× gains are more achievable.

Cardano is currently trading for about $0.83 and is down about 73% from its all-time high of $3.01. It is also down a few percent during the past week. In the historical data, Cardano has had its prices recently between $0.80 and $0.90, and there has also been resistance near $1.00. The resistance level indicates some potential for growth, but the increase needed to reach 20× would still require a drastic change in market interest or some kind of breakthrough in the product.

Chainlink is currently trading at around $21.40 and has dropped in the last month. Despite that, the volume of its trading remains large, and its position in DeFi and the oracle market gives it strong fundamental support. LINK is far from its all-time high, and therefore it can still increase; however, once again, 20× from the current $20-$23 range would put LINK at $400-$500 levels. This seems improbable unless there is a significant shift in demand or the range of the token’s application grows.

In contrast to ADA or LINK, which are already well-known in the market, Digitap is just coming out of the gate. The $TAP token includes:

If everything goes right, the token value may increase 20x because $TAP is starting earlier in the roadmap. Therefore, more potential gains will come with new users, faster adoption, higher usage, and strong tokenomics.

USE THE CODE “Digitap15” FOR 15% OFF FIRST-TIME PURCHASES

Cardano (ADA): Going 20× from the present ~$0.83 so that the price of ADA will be $16-$20. It is not supported by its market size (large cap), the pace of the adoption of its ecosystem (smart contracts, DeFi), and the competition from other smart contract platforms. That is why it is a very difficult goal.

Chainlink (LINK): On the basis of the price being around $21-$23, 20× demand would lead to a price close to $400-$500. In addition to having great usefulness in oracle services, Link has also had continuous partnerships which have verified its reputation in the market. However, its expansion is more slow-paced incremental. The 20× is achievable but less probable in the short/medium term unless something significant and unforeseen occurs. In fact, current analysis shows that $19.8 looks like the macro support for Chainlink in the near term.

Digitap ($TAP): Just based on the fact that $TAP is a newer project, its starting price (or presale price) might be much lower than that of both ADA and LINK. What this means is that for Digitap, 20× is not that far off percentage-wise. Demand for the Visa-card and payment features, privacy & no-KYC features that are attractive to the user base make the supply continuously tight. If Digitap manages to achieve what it promises, then it can potentially grant more of an uptrend than ADA or LINK but in a much shorter stage.

Most of the time, analysts feel a 20x increase in the value of an asset is achievable when its price is still low and the related product has room for rapid growth. In that regard, Digitap is considered by many to be the best crypto investment that can go much higher.

In their view, without seeing new developments (significant protocol upgrades, new markets, large partnerships), ADA and LINK could bring good but smaller returns. Those investors who only take a low-risk approach and consider projects like Cardano or Chainlink to be the most reliable might still see them as main players. However, their road to such a high return is more challenging.

So, for investors who decide to back the success of the product, Digitap would be the crypto that could give them 20× wins.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto investors love milestones, and two tokens now sit at the center of a key debate: will XRP finally break through $5, or will presale newcomer BlockchainFX (BFX) reach $1 first? Both targets carry weight, but the path to each looks very different — one driven by a decade-old network fighting regulatory battles, the other by a live super app gaining traction at presale stage prices.

With $8 million already raised and more than 10,000 investors involved, BlockchainFX is emerging as the project analysts believe could get there faster.

BlockchainFX isn’t a whitepaper promise — it’s already live. The super app at the core of BFX supports trading across crypto, forex, stocks, and commodities, with millions in daily volume and thousands of active users. Because it allows both long and short positions, the platform continues generating activity in any market condition, which whales and analysts see as a major advantage.

From today’s presale price of $0.025, BlockchainFX has a confirmed listing at $0.05 and long-term forecasts stretching toward $5. That creates potential for a 500x return, but even a move to $1 represents a 40x gain from current levels. Compared to XRP’s climb to $5, that milestone looks far more achievable in the near term.

Holders aren’t just betting on price. BlockchainFX is designed to reward participation. Staking yields up to 90% APY, while daily USDT payouts can reach $25,000 for top stakers. The referral program pays 10% of every buy made through a user’s link, with leaderboard bonuses adding extra incentives. And with the upcoming BFX Visa Card, holders can spend globally with zero restrictions.

The urgency is clear. Each presale stage increases the token price, and buyers can still use the BLOCK30 code for 30% extra tokens. That bonus won’t last, and whales are already positioning themselves before retail demand floods in.

XRP has one of the most dedicated communities in crypto. Its role in cross-border payments and Ripple’s ongoing partnerships with banks and payment providers give it real-world use cases few tokens can match. After years of regulatory battles, partial legal clarity has also given the market renewed confidence.

Still, the math is daunting. At today’s market cap, XRP needs enormous liquidity to climb from current levels to $5. It’s possible in a full bull cycle, especially if institutional adoption accelerates, but gains will be measured in percentages, not multiples. For those seeking stability and long-term presence, XRP makes sense. For investors chasing rapid ROI, however, the opportunity looks more constrained compared to BlockchainFX.

The question isn’t whether XRP can reach $5 — it’s when, and how much upside is left once it gets there. BlockchainFX, on the other hand, only needs to reach $1 to deliver life-changing multiples, and its ecosystem is already live and expanding.

That’s why analysts — and whales — are backing BFX. With $8M raised, a token price of $0.025, and forecasts stretching to $5, BlockchainFX offers the asymmetric upside that XRP no longer can. Every stage makes the entry point more expensive, and the BLOCK30 code granting 30% more tokens is closing soon.

👉 If waiting years for XRP to reach $5 doesn’t appeal, secure your BFX allocation now at BlockchainFX.com before the presale window narrows.

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

The FTSE 100 Index is currently at 9,223.32 GBP, down slightly by 0.04% today. After modest declines in recent sessions, investors are watching how market forces unfold. Meanwhile, crypto markets are showing more activity.

Solana price prediction suggests SOL could test key support zones near $200. At the same time, a rising altcoin, Remittix (RTX), is capturing investor attention as one of the best cryptos to buy now.

The FTSE 100 Index is at 9,223.32 GBP, down by 0.04% today. It has fallen on two of the previous three trading days and is 1.05% below the 52-week high of 9,321.40. The index is 12.85% up year-to-date, gaining 1,050 points to date.

Despite recent declines in the crypto world, the FTSE 100 remains 20.10% above its 52-week low of 7,679.48. This is a major sign of strength. The financials and technology are being watched by traders for signs of further momentum or weakness.

Investors are also comparing traditional markets to crypto potential, with digital assets like Solana and Remittix posting stronger short-term returns. The disparity is driving demand for portfolio diversification between traditional equities and high-upside altcoins.

The Solana price is currently around $218. The market started the week on a bearish note, dragging Bitcoin below $112,000. SOL, previously showing strong momentum, is now consolidating. Buyers are defending support levels while sellers put pressure.

Solana has displayed reduced volatility, hinting at a decisive move soon. With 24-hour volumes above $12 billion, liquidity tests could lead to rapid swings. Institutional confidence remains strong, with roughly 590,000 SOL added to holdings in the past month. Corporate staking commitments exceed 8.27 million SOL, signaling long-term interest.

The daily chart shows SOL trading within an ascending channel. Price recently pulled back from $260 near the upper boundary. Support lies around $210–$215, near the 50-day EMA. RSI sits at 47, suggesting cooling from overbought levels. Holding above the channel midline could allow a retest of $250+, while a breakdown may push the price toward $190–$200.

Remittix (RTX) is standing out in September’s crypto market. The token is currently priced at $0.1130. Over 669 million tokens have been sold, raising over $26.4 million. The project is verified by CertiK and ranked #1 among pre-launch tokens.

Its wallet beta is live, letting early users test features and earn rewards. Remittix is designed for real-world PayFi use cases, enabling cross-border crypto-to-fiat payments. Unlike speculative altcoins, it delivers practical utility and institutional-grade security.

Remittix Key Highlights:

Solana price prediction shows potential support near $200, but volatility remains high. The FTSE 100 and broader crypto markets continue to fluctuate.

Other altcoins may offer short-term moves, but Remittix provides a safer, utility-focused investment. Verified by CertiK, with a live wallet beta and strong token sales, RTX combines growth and trust for investors seeking the best crypto to buy now.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Dogecoin is riding a wave of institutional interest thanks to the launch of DOJE, the first ETF built to track DOGE. With that kind of endorsement, analysts are calling it a “memecoin legitimacy moment.” Early buyers are already sitting up and paying attention.

Meanwhile, there are rising talks about a new project that is said to be poised to outpace Dogecoin soon. This project focuses on real-world utility rather than hype.

Dogecoin (DOGE) is currently trading in the $0.22-$0.30 range depending on the source, with resistance looming near $0.30. Short-term Dogecoin price predictions suggest it might test $0.40 if it can break out cleanly above current resistance.

For DOGE to hit $1, analysts say three big catalysts are needed: broader real-world payment adoption beyond meme circles, more institutional flows (especially regulatory clarity or more ETFs), and tighter control or perception of its inflation (since DOGE is inflationary).

If those line up, some are projecting DOGE could reach $0.40-$0.50 in the next cycle, then push toward or test $1 in 2026. But caution: large market caps make huge jumps harder. Missed breakout windows now might be regrets later.

Remittix (RTX) is showing up, not just as another upcoming crypto project, but as a DeFi-inspired real utility platform that aims to make cross-border, cross-currency moves smooth, with real-world pay-fi applications. RTX is designed to let users send crypto directly to bank accounts, handle real-time FX conversions, and support many fiat & crypto types.

Compared to DOGE and many large meme or utility coins, Remittix offers tighter tech, more immediate use-cases, and community growth that might outpace older coins in this next 100x crypto race. Early holders are already seeing buzz and credibility from audits and exchange listing confirmations.

Remittix doesn’t just ask you to believe. It lets you benefit. There’s a $250,000 giveaway active right now with thousands of people entered. Over 25,000 holders are already onboard. Dozens of entries on the giveaway page (300,000+ entries across the community). All this while listings on major exchanges like BitMart and LBank have been confirmed. It’s rare to see that level of traction in early stage crypto investment.

Dogecoin has entered a new phase: with its own ETF, institutional interest, and potential for real price discovery. The $1 target feels possible but still needs clean breakouts, fresh utility, and regulatory clarity. If those come, DOGE could ride institutional waves and cross major psychological thresholds. But waiting might raise the entry cost.

At the same time, Remittix appears positioned to bring more upside if you believe in undervalued crypto project utility. It’s aiming at being among the top DeFi altcoin picks, especially for those who want exposure to a cross-chain DeFi project with solid fundamentals now, not later. Early holders could see big gains if Remittix hits full utility, wallet launch, and CEX listings.

If you want to pick one bet, Remittix seems to have more leverage potential; if you want safe, DOGE might offer a steadier upside. But in both cases, the fear of missing out is real. Just don’t miss it.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Recent Solana price prediction models now indicate uncertainty, with some suggesting the price could drop below $150 by 2025. Despite SOL retaining its position as an essential aspect of blockchain development, investors are also considering future alternatives that are growing through clear real-world utility.

Remittix (RTX), having already amassed over $26.4 million and launched its Beta Wallet this month, is gaining interest and has become one of the front-runners for the best crypto presale of 2025. But can it deliver the next 100x crypto?

Solana price prediction doesn’t reflect that of a network known for its high performance and low gas prices. The long-term stability of the project remains in doubt. The level of doubt is prompting some investors to consider future crypto projects and early-stage crypto investment alternatives that promise real-world usage rather than hype.

Source: TradingView

Remittix has already recorded token sales of over $26.4 million, having sold more than 669 million RTX tokens. Unlike other low-cap crypto gems, RTX is a cross-chain DeFi project to enable direct crypto-to-bank remittances in over 30 countries.

Its recently-launched Beta Wallet is now accessible to the community and supports 40+ cryptocurrencies and 30+ fiat currencies with real-time FX conversion.

With the level of development, RTX ranks high as the top DeFi project of 2025 with actual utility for freelancers, businesses and ordinary remitters. Additionally, Remittix is fully audited by CertiK and is positioned #1 as a pre-launch asset. Security here is sound, and it enjoys industry trust, which makes RTX a cryptocurrency with real-world utility and could deliver the next 100x crypto.

Additionally, Remittix is currently running a $250,000 giveaway and a 15% USDT referral program. These programs reward early adopters and increase adoption through incentivization.

Remittix Developments That Could Deliver the Next 100x Crypto:

Savvy investors seeking the best crypto presale 2025 and the next 100x crypto prospect agree that the live wallet engagement, near-future listings and security credentials validated make Remittix one to consider. While Solana price prediction is under scrutiny, RTX offers the most promising alternative.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway:https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

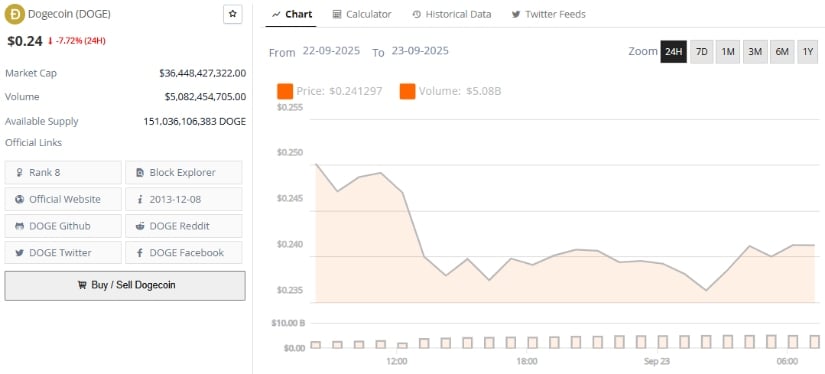

Dogecoin (DOGE) is trading at 0.23875263 today, September 23, 2025, up around 1.15% in the last 24 hours. For the Dogecoin price prediction today, it looks like the price action is largely subdued, with Dogecoin bouncing slightly off recent support after earlier dips. As usual, traders are watching whether this stability holds or if renewed selling pressure drags the price lower.

DOGE sold off hard until around 03:00, then made a sharp V-reversal recovery. Afterward, the intraday range has been relatively tight, and as seen on the chart, DOGE has found some buying interest after trading lows near $0.2350.

(Dogecoin price prediction September 23, 2025)

Regarding Dogecoin price prediction today, the trend leans neutral to mildly bullish if the latest support zones keep holding and volatility remains limited for now.

An overhead supply zone where selling pressure has emerged looks to be between $0.255 and $0.260. A decisive break above this range could indicate the start of a more substantial recovery.

The $0.280 level is a more distant resistance level that would become a target should bullish momentum reestablish itself.

For the support level, there’s the $0.235 – $0.240 price range, which is the area of recent intraday lows. Holding here is key to stopping more selling and further decline.

The lower safety net would be the $0.025 zone. If the price falls below the first support, this is the next level to watch.

For September 23, 2025, and Dogecoin price prediction today, if the memecoin stays above $0.235 – $0.240 and manages to climb past $0.255, there’s a possibility it could then aim for $0.260 – $0.280.

On the other hand, a decisive break below the $0.235 support level would increase the likelihood of a decline toward $0.225. In case the overall market mood turns negative, then the selling could intensify, testing even lower price levels.

For those of you not too familiar with meme coins or DOGE, check out our evaluation of Dogecoin’s investment capabilities.

Dogecoin is slightly higher today, trading around $0.2410 with support holding near $0.235 and resistance beginning around $0.255 – $0.260. Whether the bulls manage to push upward past resistance or sellers drag the price below current support will likely determine short-term direction. For Dogecoin price prediction today, expect choppy moves and pay close attention to those key levels for now.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like

eToro, Coinbase, or Uphold. These platforms allow users to purchase and trade XRP instantly from any device, including smartphones, tablets, and computers.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

The crypto market is optimistic as Ripple (XRP) shows signs of recovery and momentum. Traders are watching closely as XRP consolidates above key support levels. Meanwhile, a new PayFi altcoin, Remittix (RTX), is gaining attention due to its strong adoption and innovative features.

Investors seeking growth are comparing Ripple’s stability with Remittix’s potential for high returns. With market dynamics shifting, now may be an ideal time to monitor both coins.

Ripple (XRP) is currently trading around $2.86. Recent dips saw XRP fall from $3 to $2.70, resulting in $1.6 billion in liquidations within 24 hours. However, the weekly Bollinger Bands show XRP is holding above $2.70. Sellers repeatedly tested the lower band but failed to break it. XRP has traded sideways between $2.77 and $2.96 for the entire month.

A move above $3.16 could trigger further upward momentum. Analysts note that the sell-off under $2.90 is likely a market positioning move. Traders selling into dips may miss the next potential rally. XRP’s market cap stands at nearly $180 billion, reflecting both its liquidity and institutional interest.

Technical charts suggest a steady upward trend forming. Daily structures indicate that the midline at $2.70 is acting as strong support. Ripple’s resistance levels remain at $2.96 and $3.16. Historical Bollinger compression indicates the market is preparing for expansion. Trading volume has increased recently, adding to potential bullish momentum. While XRP exhibits consolidation, analysts remain optimistic about a potential breakout.

Remittix is currently priced at $0.1130, with over 669 million tokens sold and more than $26.4 million raised. The wallet beta is now live, allowing users to test cross-border payments ahead of its full launch. Remittix is ranked #1 on CertiK for pre-launch security. Its design focuses on real-world adoption and practical crypto-to-bank utility. Analysts highlight its potential as a high-growth PayFi altcoin, complementing Ripple.

Why Remittix stands out:

XRP price shows consolidation above key support, signaling potential growth. Ripple remains a major player in crypto with strong liquidity flows. Remittix delivers real-world utility, institutional-level security, and expanding adoption.

With #1 CertiK ranking, Remittix is poised for significant momentum. Both tokens present opportunities for traders looking to combine high liquidity with innovative PayFi solutions. Investors should closely monitor XRP breakout points and Remittix adoption milestones.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Solana (SOL) seems stuck in a holding pattern lately. While it’s not crashing, experts note that SOL is also not breaking out with the energy many had hoped for.

Meanwhile, a newcomer, Rollblock (RBLK), is taking center stage. With substantial presale numbers, appealing tokenomics, and a real-utility promise, Rollblock is being tipped as a possible breakout winner for those looking beyond the usual suspects.

Rollblock (RBLK) is rapidly establishing itself as one of the best crypto projects of the year with its combination of practical use, transparent mechanisms, and healthy tokenomics. The project has already raised more than $11.8 million in presales, showing improved adoption with over 55k signups.

As a Web3 iGaming platform, Rollblock offers over 12,000 licensed casino titles, a live sportsbook, and simple onboarding with just an email signup. Additionally, new users can claim a welcome bonus of up to $1,100.

The tokenomics stand out with a deflationary, revenue-sharing model: 30% of weekly platform revenue is used for buybacks, with 60% of those tokens burned and the remaining 40% distributed to stakers. This setup generates consistent rewards and potentially up to 30% APY. It also creates constant demand for RBLK in a way that speculative meme coins cannot match.

Here are some of Rollblock’s major highlights:

Currently selling at $0.068 per token, Rollblock is poised to record gains north of 25x by the end of 2025.

Solana is currently trading at $221, holding steady between $220 and $235 without any significant breakdown or persuasive rally.

Solana’s price continues to attract developers and institutional interest to its ecosystem. It remains a go-to blockchain for DeFi, NFTs, and gaming, thanks to its low-cost, high-speed transactions. The network’s institutional adoption is increasing. Likewise, recent treasury allocations and joint ventures are also supportive even when price momentum halts.

Going forward, TradingView analysts note that SOL may remain stuck in its current range as long as profit-taking and competition from newer projects continue.

Nevertheless, as the wider crypto market gains strength and the Solana ecosystem keeps growing, others predict that SOL will likely revisit previous highs, and even reach the goal of nearing the $300 price level by the end of the year.

Solana has established itself among the quickest and smoothest blockchains, yet its price development implies that it could be suspended at a higher level of consolidation at present. On the other hand, Rollblock is becoming a new prospect in the Web3 gaming industry, with jaw-dropping rewards for users.

Here’s how both coins compare:

| Category | Solana (SOL) | Rollblock (RBLK) |

| Core Purpose | High-speed blockchain for DeFi, NFTs, and dApps | Licensed Web3 iGaming platform with casino, sportsbook, and staking |

| Current Price | $220–$235 (sideways trend) | $0.068 (presale stage) |

| Tokenomics | Inflationary model with staking rewards to validators | Deflationary: 30% of revenue for buybacks, 60% burns, 40% staker rewards |

| Growth Projections | Short-term sideways action, long-term utility | Analysts project 20x upside post-listing |

| Investor Appeal | Large ecosystem, strong developer base, institutional interest | Revenue-sharing model, strong presale momentum, and lucrative staking |

| Adoption Driver | NFT projects, DeFi platforms, and high throughput for developers | 12,000+ games, $1,100 welcome bonus, and a rapidly growing user community |

Rollblock provides a high-growth opportunity with deflationary tokenomics, strong presale momentum, and a clear revenue model. With analysts projecting up to 25x–50x gains by the end of 2025, RBLK is emerging as one of the most exciting breakout plays in the market.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Bitcoin, Ethereum Price Prediction: Bitcoin (BTC) and Ethereum (ETH) have long dominated the cryptocurrency market, serving as benchmarks for both retail and institutional investors.

Bitcoin price (BTC/USD) Prediction: As we look ahead, many are pondering whether BTC/USD and ETH/USD will continue to rise. This article delves into the factors influencing the price movements of these leading cryptocurrencies, explores potential scenarios, and offers insights into the future.

Overview of Bitcoin and Ethereum

What is Bitcoin?

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, is the first decentralized cryptocurrency. It operates on a peer-to-peer network and utilizes blockchain technology to enable secure and transparent transactions. Bitcoin is often referred to as digital gold due to its limited supply of 21 million coins, which contributes to its value proposition as a store of wealth.

What is Ethereum?

Ethereum, launched in 2015 by Vitalik Buterin and a team of developers, is more than just a cryptocurrency. It is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). The native currency, Ether (ETH), fuels these operations and has gained a reputation for being the backbone of the decentralized finance (DeFi) ecosystem.

Factors Influencing BTC and ETH Prices

1. Market Demand and Adoption

The demand for Bitcoin and Ethereum plays a crucial role in their price movements. Increased adoption by retail investors, institutions, and corporations enhances the legitimacy and acceptance of these cryptocurrencies. As more businesses accept BTC and ETH as payment, the demand is likely to rise, driving prices upward.

2. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has a significant impact on market sentiment. Positive regulatory developments can bolster confidence among investors, while strict regulations may lead to market hesitation. Investors should closely monitor regulatory announcements from key jurisdictions, as these can influence price trends.

3. Technological Developments

Both Bitcoin and Ethereum are constantly evolving. Bitcoin is exploring enhancements such as the Lightning Network to improve transaction speed and scalability. Ethereum is transitioning from a proof-of-work to a proof-of-stake consensus mechanism with Ethereum 2.0, aiming to increase scalability and reduce energy consumption. Successful implementation of these upgrades can attract more users and positively influence prices.

4. Economic Conditions

Global economic conditions can significantly affect cryptocurrency prices. Factors such as inflation, interest rates, and monetary policy can influence investor behavior. In times of economic uncertainty, cryptocurrencies are often viewed as alternative assets, which can lead to increased demand and price appreciation.

Price Predictions for Bitcoin

1. Optimistic Scenario

In an optimistic scenario, Bitcoin continues to gain traction as a digital gold alternative. Increased institutional adoption, driven by major corporations adding BTC to their balance sheets, can lead to higher demand. If Bitcoin maintains its bull market momentum, prices could reach new all-time highs, potentially exceeding $100,000 by 2030.

2. Moderate Scenario

In a moderate scenario, Bitcoin experiences steady growth, but faces challenges such as regulatory scrutiny and market volatility. While it may not reach astronomical heights, BTC could stabilize in the range of $50,000 to $75,000. Continued adoption and the successful implementation of technological improvements could support this growth trajectory.

3. Pessimistic Scenario

In a pessimistic scenario, Bitcoin could struggle with regulatory hurdles and increased competition from other cryptocurrencies. If market sentiment turns negative, BTC could see significant price corrections, potentially falling below $30,000. This would require a reevaluation of investor confidence and market dynamics.

Price Predictions for Ethereum

1. Optimistic Scenario

In an optimistic outlook, Ethereum’s shift to a proof-of-stake model significantly enhances its scalability and energy efficiency. As the DeFi and NFT markets continue to expand, demand for ETH could surge. In this case, ETH might reach prices of $10,000 or more by 2030, solidifying its position as the leading smart contract platform.

2. Moderate Scenario

In a moderate scenario, Ethereum experiences steady growth but faces competition from emerging blockchain platforms. While ETH may not reach its highest potential, it could maintain a price range between $3,000 and $5,000, driven by ongoing development and community support.

3. Pessimistic Scenario

In a pessimistic scenario, Ethereum could be hindered by scalability issues or regulatory challenges. If the market turns against it, ETH might experience significant declines, potentially falling to the $1,500 range or lower. This would necessitate a reassessment of its market strategy and technological advances.

As we look to the future, both Bitcoin and Ethereum hold substantial potential, but their paths will be shaped by various factors. Market demand, regulatory developments, technological advancements, and economic conditions will all play crucial roles in determining their price trajectories.

A Balanced Perspective

Investors should approach both BTC and ETH with a balanced perspective, considering both the opportunities and risks. While the potential for significant price increases exists, extreme volatility and market uncertainties are inherent in the cryptocurrency landscape.

Staying informed about market trends, technological developments, and regulatory changes will be critical for making informed investment decisions. As the cryptocurrency market evolves, both Bitcoin and Ethereum will continue to be pivotal players, shaping the future of finance and investment.

Dogecoin (DOGE) is holding firm at critical support levels as traders eye a breakout above $0.31, a move that could unlock fresh momentum toward $0.38.

Despite recent volatility, market data shows higher lows since April 2025 and surging trading volume, fueling speculation that Dogecoin may be entering a new phase of accumulation and recovery.

While short-term volatility has shaken retail confidence, long-term Dogecoin predictions remain bullish. Analysts argue that if accumulation continues, DOGE could revisit major highs not seen since 2021.

Dogecoin (DOGE) is consolidating above the $0.23 support level, with $0.31 as key resistance, signaling steady accumulation and growing investor confidence since April. Source: Joe Swanson via X

Crypto expert Crypto Rover has highlighted repeating historical cycles in Dogecoin price. According to his research, each phase of growth has been followed by sharp corrections, yet every cycle has ultimately expanded in scale. This recurring market rhythm suggests a strong foundation for the next rally.

Ether Nasyonal highlighted Dogecoin’s market dominance chart, noting that after years of trading below a descending trendline, DOGE recently broke above it and completed a successful retest. This technical shift is often seen as a bullish indicator, suggesting renewed buyer strength and the potential for further upside momentum.

Institutional interest continues to add fuel to bullish Dogecoin price forecasts. Grayscale recently amended its S-1 filing with the U.S. Securities and Exchange Commission in a bid to convert its Dogecoin Trust into a spot ETF. If approved, the product would be listed on NYSE Arca under the ticker symbol GDOG, with Coinbase serving as the custodian.

Grayscale filed to convert its Dogecoin Trust into a GDOG ETF. Source: Crypto Tony via X

This move mirrors developments in Ethereum and Bitcoin ETFs, potentially opening the door for Dogecoin to attract institutional capital. Analysts suggest such milestones could boost liquidity and stability, two factors often cited as crucial for the future of Dogecoin.

Despite optimism, Dogecoin price prediction today remains divided. A sharp dip to $0.238 earlier this week underscored how fragile sentiment can be. CoinMarketCap data showed a nearly 10% drop in a single day, with market cap falling to $35.9 billion. Analysts warn that failure to hold above $0.22 could lead to retesting the $0.20–$0.21 accumulation zone.

This zone offers an attractive entry for DOGE ahead of a potential breakout toward $0.50. Source: Ali Martinez via X

Still, many traders remain upbeat. Ali Martinez, another crypto analyst, argued, “If DOGE can reclaim the $0.27–$0.28 range, it could rally toward $0.45, a level not seen since late 2021.”

Some long-term Dogecoin predictions go further, with projections for 2025 placing the coin above $0.50 in bullish scenarios. A few forecasts even point to the possibility of DOGE crossing $2 if momentum builds and meme coin ETFs gain traction.

The question of “Will Dogecoin reach $1?” continues to dominate investor discussions. Despite ongoing short-term resistance at $0.31 remaining the largest hurdle, experts agree that DOGE is showing stronger structural support than seen in earlier cycles. Instead of crazy spikes, Dogecoin now appears to be based within more stable zones, suggesting institutional forces might be reshaping its view.

Dogecoin was trading at around $0.24, down 7.72% in the last 24 hours at press time. Source: Brave New Coin

With whale accumulation, rising trading volumes, and ETF speculation in play, the Dogecoin price forecast for the coming months points toward sustained volatility—but also the potential for another rally. Whether DOGE can break resistance and sustain momentum will determine if the 2025 narrative shifts from cautious optimism to full-scale bullish momentum.