The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

Many investors are focused on the XRP price prediction for the coming bull run, tracking every development from Ripple’s camp. While the established altcoin has a dedicated following, its growth potential is a constant debate, especially with an existing market cap in the hundreds of billions. It begs the question: What will 1000 XRP be worth in 2025, or can the explosive growth be found elsewhere?

Meanwhile, a new Ethereum Layer 2 project, Layer Brett (LBRETT), is gaining serious traction in its crypto presale, combining meme energy with powerful tech. It offers a ground-floor opportunity that legacy coins like XRP simply cannot match.

Analysts believe XRP could reach $5 before 2025 ends, making 1,000 XRP worth at least $5,000. Notably, 1,000 XRP is currently worth $2,980, and eight months ago, it was worth just $500. These analysts based their XRP price prediction on the assumption that XRP will continue its uptrend, especially with favourable developments for XRP.

For one, Ripple’s stablecoin, RLUSD, which was launched just eight months ago, has surpassed $500 million in market capitalization. It’s currently the second-fastest-growing stablecoin in 2025, trailing only BlackRock’s institutional USDTB.

Also, XRP’s ETF interest is rising. The newly launched XRP spot ETF has now exceeded analyst expectations with strong investor demand. Just on the first day, it recorded $37.7 million in trading volume. This made XRPR the largest debut by volume of any ETF launched in 2025.

With such massive inflows, analysts believe XRP can easily surge to $5. But while such a run is exciting, doubling in value is hardly the kind of life-changing return that made crypto millionaires. To find those opportunities today, many are turning their eyes to presales that combine real utility with early-stage explosive potential

Layer Brett is the new meme coin pioneering the future of scalability and user rewards. It operates on an Ethereum Layer 2, a technology projected to process trillions of dollars annually. This architecture gives Layer Brett a massive advantage. It unlocks near-instant transactions and shrinks gas fees to mere pennies, a stark contrast to the congestion that plague older networks.

Furthermore, Layer Brett at $0.0058 offers immediate utility through high-yield staking. Users can stake and immediately earn up to 664% APY, a figure that reduces as more investors join. This dwarfs many of the yield opportunities available for XRP holders.

With this edge, Layer Brett is offering exponential growth rather than incremental gains and for investors who act now, the numbers are staggering. A $10,000 purchase at today’s presale price buys roughly 1.7 million tokens. If LBRETT reaches just $0.5 by 2026, that investment becomes $850 thousand. At the higher end of a $1 projection, it transforms into $1.7 million.

And this doesn’t even factor in the daily staking rewards that would add a steady income long before those targets are hit.

XRP’s momentum could push it towards $5, but its era of explosive growth may be in the past. For those seeking the next wave of innovation and returns, Layer Brett is the go-to choice. This Ethereum L2 meme token combines real utility, blistering speed, and huge staking rewards into one community-driven package.

The presale won’t last forever. With a $1 million giveaway also active, this is an opportunity to get in early on a project built for the future.

Discover More About Layer Brett (LBRETT):

Website: LayerBrett | Fasts & Rewarding Layer 2 Blockchain

Telegram: View @layerbrett

X: (1) Layer Brett (@LayerBrett) / X

The cryptocurrency market continues to be in the headlines with fluctuating valuations and fresh projects. Solana Price prediction has been raking up investors’ discussion, especially as Solana’s price today is $238.97, 2.04% down in the past 24 hours. Its market capitalization is $128.98 billion with a daily turnover of $5.27 billion, down 37.86%.

Since this brings volatility across blockchain networks to the fore, it also brings new attention to up-and-coming crypto presales such as Remittix (RTX), which currently sells for $0.1080 per token. As a cross-chain DeFi project that is solving real payment problems, RTX quietly constructs the future while tried and true favorites such as Solana gyrate.

Solana Price prediction themes usually incorporate scalability and where it comes into play with decentralized exchange platforms, NFT marketplaces, and gaming on blockchain.

The term used by analysts to describe Solana’s high throughput with low gas fees is one of the largest positives despite volatile weeks of trading. Long-term sentiment is still hinged on higher adoption of blockchain infrastructure despite the 2.04% decline in a day.

With a market cap of nearly $129 billion, Solana remains among the top crypto to invest in today for investors seeking high growth crypto exposure. Its ongoing use in DeFi platforms and handling of tokenized assets has cemented its position as greater than just another low gas fee crypto.

However, most market analysts are seeking beyond ETH and SOL, searching for the next 100x crypto that possesses utility and solid early-stage investment value.

While Solana is hitting the headlines, Remittix (RTX) has set $26.2 million raised during presale, selling over 667 million tokens. RTX is a cryptocurrency with real-world utility, allowing direct crypto-to-fiat deposits into standard bank accounts in more than 30 countries. This capability solves the $19 trillion global payment market — something most blockchains are unable to do yet.

All these developments make Remittix one of the top DeFi projects of 2025, with a clear focus on adoption versus speculation. Its $250,000 Giveaway and 15% referral rewards program further increase community engagement, making RTX one of the top crypto presales of 2025.

As Solana is trailed by Ethereum, XRP, and Cardano, Remittix’s growth shows how crypto investment is becoming diversified. RTX’s CertiK audit and verified centralised exchange listings provide the trust markers that many presales lack. With low gas fees, cross-chain functionality, and worldwide payout rails, Remittix is already compared to early-stage Ripple (XRP) but with greater real-world traction.

For those searching for the next big altcoin, Remittix stands tall. It places DeFi innovation over real-world payment demands, meshing speculative demand with enterprise-grade use cases.

As presale momentum remains strong, RTX is becoming one of the quickest-growing crypto of 2025, proving that utility-based projects can make a lot of noise even as top-shelf tokens like Solana hog all the headlines.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

Dogecoin is again making headlines as investors debate whether or not DOGE can surge to $0.50. This discussion has been escalated by the fact that whales have accumulated over 280 million tokens before the first Dogecoin exchange-traded fund (ETF) approval in the United States. The ETF has recorded a volume of $17 million on the first day of launch, an outstanding start and an indication that the institutional money might have finally reached the memecoin space.

However, Dogecoin is not the only name that is evoking excitement. Analysts are also shifting their focus to MAGACOIN FINANCE, an emerging memecoin expected to become a high-ROI provider of up to 1600% before DOGE even hits $0.50. Its explosive surge is already being compared to the DOGE early rally, giving the possibility that, in the near future, MAGACOIN FINANCE might gain more momentum than DOGE.

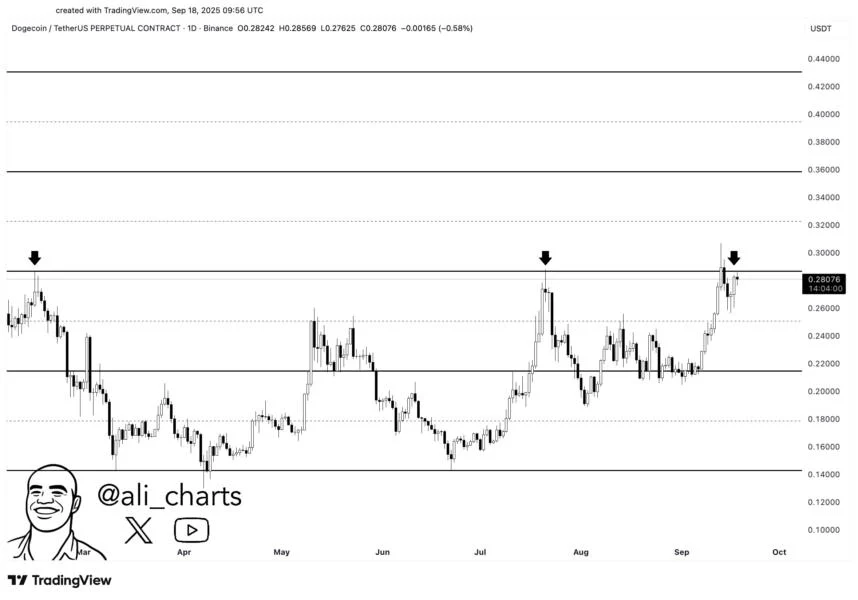

The Dogecoin technical structure provides traders with reasons to remain optimistic. Analyst Ali Martinez found a parallel channel pattern that has held DOGE price for several months. The trend develops when prices move sideways between two parallel trendlines that create distinct resistance and well-defined areas of support.

The resistance on the channel is at approximately $0.29, which DOGE was recently trying to reach this month, but was rejected. The bottom has served as a support level, preventing further breakdown. DOGE is currently after another retest on the upper line, and breaking out of it would be a bullish indication.

If DOGE breaks this resistance, Martinez projected an upside of $0.36 and $0.45, based on the height of the channel. The initial level is a half movement, whereas the second is a full extension. A decisive breakout would then clear the way to reach the most critical psychological target at $0.50.

According to blockchain data, in the days before the approval of the ETF, whales accumulated over 280 million DOGE. This aggressive purchase indicated a sense of confidence that institutional buying will drive prices up. Daily trading volumes also increased beyond 1.1 billion DOGE, highlighting the intensity of activity.

During its launch, the Dogecoin ETF was able to secure a total of $17 million in trading volume, which is one of the top launches of 2025. According to Bloomberg analyst Eric Balchunas, an initial inflow can seem small, but recurring listings have the potential to solidify DOGE as a semi-institutional asset. For a coin born from memes, the shift toward regulated investment products marks a significant evolution.

The Dogecoin ETF is structured and registered under the Investment Company Act of 1940 and employs derivatives and diversification strategies to comply with the rules of the United States. Such a design can cushion the short-run effect, but the expectations are high. DOGE even rose by 4% on speculative flows as the ETF began trading.

As DOGE rides institutional momentum, MAGACOIN FINANCE is being hailed as the next explosive memecoin. Analysts suggest MAGACOIN FINANCE could deliver up to 1600% ROI before Dogecoin even reaches $0.50, making it one of the hottest-selling coins in 2025.

Dogecoin paved the way, proving memecoins could capture global attention. MAGACOIN FINANCE is now being compared to those early days, with a meteoric rise that some believe could eventually surpass DOGE’s trajectory.

Community buzz is fueling MAGACOIN FINANCE’s climb across trading forums and social platforms. Traders argue that while Dogecoin is gaining institutional credibility, MAGACOIN FINANCE provides the percentage returns that made DOGE famous in the first place. This combination of fresh hype and massive ROI potential positions MAGA as a serious contender to lead the memecoin market in the months ahead.

Dogecoin’s path to $0.50 is being shaped by two powerful forces: whale accumulation and its historic ETF debut. Institutional recognition has pushed DOGE beyond its meme roots and into a new category of semi-regulated crypto assets. Technical indicators point to bullish breakout levels, suggesting momentum could carry DOGE higher in the near term.

At the same time, MAGACOIN FINANCE is emerging as the memecoin with the bigger upside story. With forecasts of 1600% ROI before DOGE even touches $0.50, MAGACOIN FINANCE is drawing comparisons to DOGE’s legendary early rally. Together, DOGE and MAGACOIN FINANCE are defining the memecoin market in 2025 — one with institutional credibility, the other with explosive growth potential.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

The XRP price prediction narrative just flipped from hopeful to urgent. With XRP trading near $3, regulators have cleared a fresh path for crypto ETFs, and a multi-asset fund that includes XRP has already won approval. That is real flow potential, and it is why every XRP price prediction this week leans bullish.

At the same time, an under-the-radar altcoin is breaking out of the pack. Remittix is priced around $0.10 and has investors whispering about double-digit returns in 2026, thanks to product progress and third-party security credentials that reduce guesswork for early buyers. Miss it now, regret it later.

The U.S. SEC just approved generic listing standards that let exchanges fast-track spot crypto ETFs, and a diversified ETF holding Bitcoin, Ether, XRP, Solana, and Cardano has received the green light. This turns the XRP price prediction from speculation into positioning because new products can list far faster than before.

XRP sits around $3 today, and desk models point to a run toward $3.06 to $3.67 on strong inflows, with scope for higher if resistance snaps.

Issuers are lining up single-asset XRP ETFs, and while several decisions were recently pushed to October and November, the pathway is now open, and the CEO of Ripple says approval this year is likely. That is why the average XRP price prediction for late 2025 is drifting higher.

Remittix is designed to transfer cryptocurrency into bank accounts across over 30 countries with real-time foreign exchange conversion. The project is valued at under $1, at approximately $0.10, making the upside math simple for early entries. Beyond talk, its wallet beta is already in the hands of community testers.

The team has completed third-party verification by CertiK and is ranked number one on that platform for pre-launch tokens. Additionally, liquidity access is improving with BitMart and LBANK listings secured after major funding milestones. Momentum is not future tense here; it is active. In numbers, Remittix has raised more than $26.2 million and counts over 25,000 holders.

The catalyst stack behind XRP is finally real, which is why every serious XRP price prediction now bakes in ETF-driven flows. But asymmetric upside often hides in plain sight. Remittix, at roughly $0.10, with verified security, active beta testing, and multiple listings already secured, offers the kind of scarcity window that closes without warning.

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Solana price is testing the $250 resistance once again, with participants watching closely to see if strong fundamentals can finally fuel a decisive breakout.

Solana price is once again pressing against the $250 ceiling, a level that has defined its recent trend with sharp rejections in the past. Despite this history, SOL continues to show resilience with strong fundamentals and steady network growth, leaving traders eager to see if this time, momentum can carry it higher, shaping the next major Solana price prediction.

Solana price is back at the $250 zone, a level that has consistently acted as a ceiling over the past year. Each of the last three approaches to this range ended in sharp rejections, making it a key supply area that traders are watching closely. The chart highlights how every test has been met with strong selling pressure, raising the question of whether history will repeat itself or if buyers finally have the strength to force a breakout.

Solana faces repeated rejections at the $250 mark. Source: Crypto Virtuos via X

From a technical perspective, $250 has become the make-or-break zone for SOL’s trend. If Solana price fails to clear it once again, a pullback towards the $220 to $230 support region looks likely. However, a decisive move above with strong volume could flip this heavy resistance into support, opening the door for continuation towards ATH levels.

Solana price is currently trading near $241, with the chart highlighting a rising channel that has guided price higher for months. While the structure has been constructive, indicators now suggest caution as SOL approaches the upper boundary of this channel. The indicators are showing signs of cooling near overbought levels, and the price is hovering close to the $250 resistance zone, which has historically triggered reversals.

Solana trades near $241 within a rising channel, but overbought signals and a flattening MACD hint at caution ahead. Source: CS2024 via X

Adding to this, the MACD is flattening after an extended run, hinting at a possible slowdown in momentum. A failure to break above the channel’s upper line could lead to a corrective move, with $220 to $225 standing out as immediate support. However, if volume picks up and buyers defend the trendline, the broader uptrend could sustain despite the pressure.

Solana is consolidating within a symmetrical triangle, with price compressing between the converging trendlines. At the moment, SOL is trading near $238, just below the midpoint of the structure. If the pattern resolves to the upside, the $270 level becomes the immediate target.

Solana consolidates inside a symmetrical triangle, with bulls eyeing a potential breakout towards $270 if $250 resistance finally gives way. Source: Crypto Elias via X

Analyst Crypto Elias points out that the triangle’s structure leans bullish, with the rising base showing steady accumulation. However, the key remains whether buyers can sustain momentum through the $250 resistance cluster that has capped rallies before. A clean breakout supported by volume would validate the bullish scenario, while failure here risks dragging Solana price back towards the $225 to $230 support range.

Solana’s fundamentals are quietly strengthening the bullish case. Cointelegraph shows that daily transactions have climbed 72% over the past year, and for three months straight the network hasn’t dipped below 40 million transactions a day. This level of sustained usage signals deep engagement across the ecosystem, giving SOL a foundation that many altcoins lack.

Solana’s daily transactions remain above 40 million, fueling hopes that strong fundamentals could finally help bulls break the $250 barrier. Source: Cointelegraph via X

Market watchers are now keenly looking at whether these fundamentals can provide the extra push needed to crack the $250 barrier. This level has acted as a ceiling multiple times, but with network activity showing no signs of slowing, bulls may finally have the support required to flip it into a base. If adoption-driven momentum holds, it could be the factor that turns repeated rejections into a confirmed breakout.

Solana’s repeated tests of the $250 zone highlight just how critical this level has become. While past rejections remind traders of the risks, the current mix of technical setups and improving fundamentals paints a more balanced picture. If buyers can finally push through with conviction, the move could shift market sentiment and set the stage for a stronger advance towards the $270 to $300 range.

At the same time, caution remains important. Failure to break above $250 cleanly could see Solana price slipping back towards the $220 to $230 support band, keeping it locked in its longer consolidation.

Dogecoin Price Prediction is in the news again with market players debating if the latest ETF filing could change the long-term future of the meme coin. The possibility of an SEC-approved spot product has been making the rounds regarding institutional appetite and how it can support tokens like DOGE.

Meanwhile, upstart projects such as Remittix (RTX) are gaining momentum on payment use cases within the real world beyond hype speculation, with a live Beta Wallet and leading industry CertiK verification.

Dogecoin is priced at around $0.2687 after seeing a meager 1.01% spike in the past 24 hours. Its market capitalization stands at $40.53 billion and trading volume has plummeted dramatically by nearly 46% to $2.13 billion. These statistics tell us about the trouble for meme coins in maintaining sustained liquidity, especially when speculative activity begins to dwindle.

Analysts at Dogecoin Price Prediction comment that success would frequently be dependent on community-driven demand and broader narratives such as ETF approvals. However, investors today are looking at alternatives in upcoming crypto projects that offer real-world practical solutions and less volatility.

Remittix (RTX), presently valued at $0.1080 per token, is becoming one of the cross-chain DeFi projects addressing real-world payment problems. Unlike meme coins, RTX provides instant bank transfers for cryptocurrency in 30+ countries. For this reason, its Beta Wallet is live and supports 40+ cryptocurrencies and 30+ fiat currencies, allowing for cheaper and faster international payments.

This focus on practical application sets Remittix apart as a crypto with real-world applications. The platform aims at freelancers, remitters and businesses in need of seamless cross-border payments. With low gas fee crypto payments and open FX conversion, RTX is being increasingly considered as one of the best DeFi altcoins for 2025.

Trust is further boosted because the Remittix team is fully verified by CertiK, the leader in blockchain audits with RTX officially ranked #1 for pre-launch tokens. This gives the project transparency and credibility missing from early-stage crypto investments.

The presale success has already freed up two future centralized exchange listings BitMart on the $20 million level and LBank after raising $22 million. These were announced to give Remittix a good future liquidity base once trading starts. Besides this, the ongoing $250,000 giveaway and referral program remain to keep the community engaged.

For followers of Dogecoin Price Prediction, the Grayscale ETF news is important, but it’s also a statement about the distinction between speculative tokens and utility-based projects. Remittix, with its operational infrastructure and rapid growth, is the type of early stage crypto investment others are calling the next big altcoin 2025. Learn more about the project on the official Remittix site.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

XRP price prediction is gaining intensity as investors weigh its potential around $3.00 to $3.50, while excitement builds for Stellar (XLM) due to recent ecosystem news. XLM just saw a surge to around $0.39 on high volume before pulling back, highlighting both opportunity and risk for those watching its breakout potential.

Meanwhile, Remittix (RTX) is being spotlighted as the crypto that could 50x this year. With its utility an incentives, Remittix may draw attention away from XRP’s established narrative and XLM’s momentum.

XRP is trading near $3.02, with resistance just above at about $3.15, where many chart watchers believe a breakout could propel gains toward $3.50 or more. However, strong whale selling and reduced ledger transaction activity suggest downside risk if XRP fails to maintain above support levels around $2.70 to $3.00.

XLM has experienced sharp price and volume moves recently. On September 16, 2025, XLM rallied from about $0.38 to $0.39 on surging volume exceeding 70 million before giving back some gains by afternoon.

Nonetheless, resistance is only just above $0.40, and a failure to break out could see a consolidation or a retreat to $0.36 to $0.38. XLM’s overall story is one of connecting TradFi and DeFi applications, with future upgrades to the protocol and buying interest serving to support.

Remittix shows signs that it might outperform XRP and XLM if current trends continue. Compared to XRP’s well-known resistance struggles and XLM’s volume-driven oscillations, Remittix is building both trust and utility from the ground up.

It is one of the few new PayFi altcoins with CertiK verification, meaning its team is now verified by the top blockchain security auditor. The wallet beta is live, and community members are already testing it, which gives early users real feedback and potentially lower risk than older tokens facing scaling or regulation headwinds.

Remittix offers a 15% USDT referral program that rewards new user acquisition more directly than what XRP or XLM currently do. Remittix has sold over 664 million tokens, is priced at $0.108 per token, and has raised over $25.9 million in funding. It is running a $250,000 giveaway to boost community engagement.

The team is verified by CertiK, and they secured exchange listings on BitMart and LBank through earlier funding milestones of $20 million and $22 million. A third CEX listing is in view. These metrics show that 50x is not just a hopeful promise.

Here are a few features that might help Remittix hit 50x:

XRP price prediction remains cautiously optimistic if resistance near $3.15 is overcome, with upside toward $3.50 or more, but the risk of downside exists if bearish signals persist. XLM appears promising, especially with institutional interest and ecosystem expansion, but it still needs to break above $0.40 decisively to avoid sideways trading.

Remittix, by comparison, could be the crypto that delivers 50x this year. For growth-seeking investors, Remittix may offer more upside if its roadmap stays on track and adoption accelerates.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Solana is trading at $238.45, with a market capitalization of $129.51 billion and a 24-hour trading volume of $3.55 billion. The token has been consolidating in recent sessions, but analysts say a technical breakout could define its next major move — with projections pointing as high as $310 in the medium term.

The Chicago Mercantile Exchange (CME), the world’s largest derivatives exchange, will introduce options on Solana (SOL) and XRP futures starting October 13. This expansion marks the first time CME has added altcoins beyond Bitcoin and Ethereum to its options lineup, highlighting the growing institutional demand for broader crypto exposure.

Since their debut earlier this year, Solana and XRP futures have seen notable momentum. More than 540,000 SOL futures contracts, worth $22.3 billion in notional value, have traded since March, with August posting record daily volumes of 9,000 contracts.

XRP futures have also drawn interest, recording $16.2 billion in trades and $942 million in open interest in August alone. CME’s global head of crypto products, Giovanni Vicioso, said the move reflects “significant growth and liquidity” in these markets.

Solana may also qualify for a spot ETF under the SEC’s new listing framework. The rules state that any altcoin with an established futures market on a regulated exchange for at least six months can apply. With Solana futures already trading on Coinbase and CME, SOL now sits in a position for potential ETF approval.

Analysts argue that spot ETF access could unlock fresh institutional demand, mirroring the impact seen when Bitcoin ETFs drew billions in inflows earlier this year.

Institutional exposure is also rising via Grayscale’s launch of the CoinDesk Crypto 5 ETF on NYSE Arca. The fund includes Bitcoin, Ethereum, XRP, Solana, and Cardano, offering investors a diversified basket of major digital assets.

This debut highlights growing appetite for regulated, multi-asset crypto products and could deepen liquidity in Solana over the coming quarters.

Technically, Solana is consolidating inside an ascending channel, with price compressing between the 50-hour EMA at $239 and the 200-hour EMA at $230. Buyers continue to defend higher lows, but sellers remain active near the $248–$253 resistance zone.

The Relative Strength Index sits at 45, signaling neutral momentum but leaning toward oversold territory. Candlestick formations show demand around $236, where repeated lower wicks signal strong buyer interest.

A breakout above $244 could open the way to $248, then $253, with further extension to the channel top near $259.

If momentum carries, analysts see SOL testing $300 in the medium term and potentially $310 if ETF approval accelerates inflows.

On the downside, a break below $231 would expose $226 and potentially $220, though broader institutional trends suggest dips may be short-lived.

For investors, this consolidation could be the foundation for Solana’s next major rally heading into 2026.

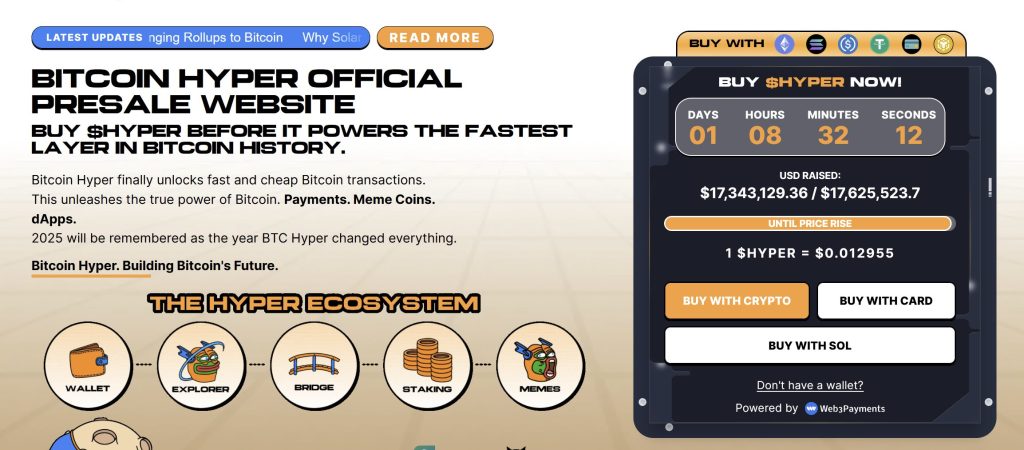

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.3 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012955—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Solana Price Prediction: Analysts Eye a Technical Breakout That Could Push SOL to $310 appeared first on Cryptonews.

The Dogecoin price prediction is heating up again as traders hunt the best crypto to buy now. DOGE has the crowd, SHIB has headlines and Remittix is the quiet mover that early buyers whisper about. Miss the early window and you may watch others ride the breakout. Remittix is already gaining traction across payments, security and listings if you want a 2026 edge, timing matters.

Dogecoin trades around $0.27 to $0.33 and the most cited Dogecoin price prediction ranges from $0.32 to as high as $2.80 in a bullish 2026. Momentum is tied to utility growth and potential ETF approvals. If approvals land, upside can accelerate.

If they stall, range trading may persist. For investors weighing the best crypto to buy now, the Dogecoin price prediction still offers a strong community and rising institutional attention.

SHIB sits near $0.000013. Recent burns reportedly surged by a large multiple, tightening supply and lifting sentiment. Even so, SHIB remains volatile and sensitive to risk cycles. The SHIB community is pushing development around ShibaSwap and ecosystem growth, but the path is uneven. For many traders comparing SHIB with the Dogecoin price prediction, patience and entry discipline are critical.

Remittix addresses a real-world problem that most memecoins overlook. Users can send crypto directly to bank accounts in more than 30 countries with transparent, real-time FX conversion. The wallet beta is already live with community testers. Security has been independently verified and the project currently sits at the very top of CertiK rankings for pre-launch tokens.

Listings are lined up with BitMart and LBank announced and confirmed, interest is building ahead of the next exchange. Funding momentum is strong, with more than $26,2 million raised and over 667 million RTX sold. The entry window will not stay open forever.

DOGE has brand power and an improving Dogecoin price prediction if the catalysts are met. SHIB has a passionate base and burns that can squeeze supply, yet remains choppy. Remittix brings real payment rails, verified security, active beta usage and multiple exchange listings on deck.

That combination creates a classic scarcity setup. If adoption keeps building, Remittix looks positioned to outpace SHIB into 2026 while the Dogecoin price prediction continues to depend on approvals. Do not be the trader who watches from the sidelines while the early entry passes by.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The heat wave from the Remittix token is spreading across the market this season as experts rate it ahead of the buzzing Cardano price prediction. According to the experts’ outlook, the Cardano price prediction suggests a surge to $2 by 2026 as the coin heads towards retesting $1 this month.

However, in the case of the Remittix token, experts believe it could outperform the ADA coin, as predictions show a potential high of $4 from its current price of $0.1080.

While the Remittix strong utility has been identified as a potential catalyst to fuel growth, experts are now pointing to other factors that could accelerate the surge. Here is a look at these factors and how the Cardano price prediction could hold up.

The ADA coin is showing all the signs of an incoming bull run as price returns near $1. Market analysis has seen experts tipping the Cardano coin for success this year, with progress taking it closer to an eventual ETF launch.

While the factors are gradually aligning for a breakout, Cardano price prediction suggests 2026 could be the big year. According to some expert opinion, the Cardano price prediction reflects the accumulation and institutional inflow that could follow the Cardano ETF approval.

Further, following the Cardano price prediction of $2 by 2026, experts say the accumulation could be ongoing already. Moreover, this accumulation could be fueling the coin’s return to $1 as investors eye an early clearance of the Cardano price prediction.

There has been a heightened interest in the Remittix token over the last few months, as the price is now $0.1080 and has raised over $26,2 million. The investors are now adding to their Remittix accumulation, prompting a projection of about 30x for this year. This includes the forward projection of the Remittix price as it nears an official listing, which could fuel an unprecedented surge.

However, as the beta wallet launch is already active and fueling a high inflow, experts believe a market launch could see it increase by up to 30x this year. Whereas analysts assess the potential for this surge, the following factors are showing a strong drive to fuel the surge:

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway