Category: Forex News, News

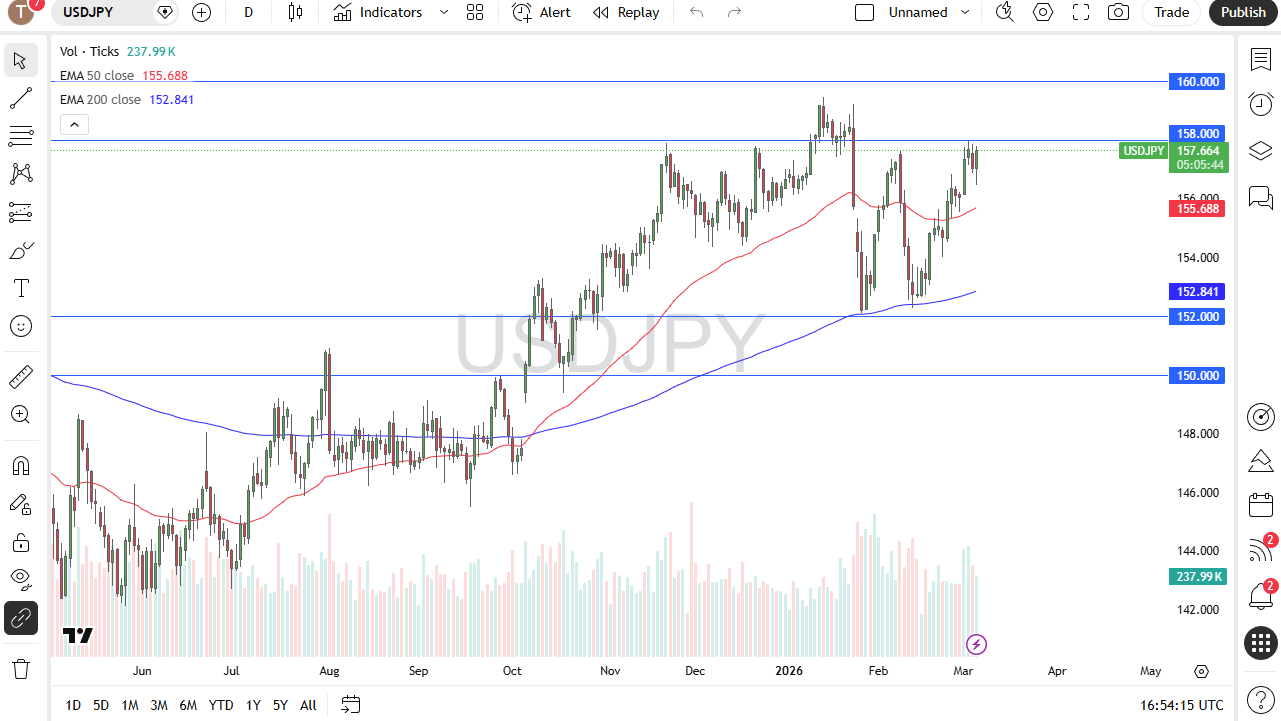

Defends 200-EMA/50% Fibo. confluence ahead of US CPI

The USD/JPY pair gains strong positive traction on Friday and, for now, seems to have snapped a four-day losing streak to over a two-week low, around the 152.30-152.25 region, touched the previous day. The US Dollar (USD) is looking to build on the post-NFP recovery amid reduced bets that the Federal Reserve (Fed) will cut rates soon, acting as a tailwind for the currency pair. Apart from this, some repositioning trade ahead of the latest US consumer inflation figures, due later during the North American session, turns out to be another factor acting as a tailwind for spot prices.

Both the headline Consumer Price Index (CPI) and the core gauge are seen rising 0.3% MoM in January and 2.5% from a year earlier. Any significant divergence from the expected readings will influence market expectations about the Fed’s policy path and drive the USD demand, which should provide a fresh impetus to the USD/JPY pair. In the meantime, the upbeat US Nonfarm Payrolls (NFP) report released on Wednesday forced investors to trim their bets for a March rate reduction. However, traders are still pricing in a greater chance of two more Fed rate cuts this year.

Furthermore, concerns about the central bank’s independence might hold back the USD bulls from placing aggressive bets. The Japanese Yen (JPY), on the other hand, could draw support from expectations that Prime Minister Sanae Takaichi could be more fiscally responsible. Investors also remain hopeful that Takaichi’s policies will boost the economy. This might prompt the Bank of Japan (BoJ) to stick to its rate-hike path, which marks a significant divergence in comparison to dovish Fed bets and might also contribute to keeping a lid on any meaningful appreciation for the USD/JPY pair.

Meanwhile, traders remain on high alert amid the possibility of a coordinated Japan-US intervention to stem the JPY weakness. This might further hold back traders from placing aggressive bullish bets around the USD/JPY pair, suggesting that the intraday move up is more likely to get sold into. Nevertheless, spot prices remain on track to register heavy weekly losses. Moreover, the aforementioned fundamental backdrop seems tilted firmly in favor of bearish traders and backs the case for an extension of the steep decline witnessed since the beginning of this week.

USD/JPY daily chart

Technical Analysis:

The USD/JPY pair once again shows some resilience below the 200-day Exponential Moving Average (SMA) and bounces off the 50% Fibonacci retracement level of the April 2025 to January 2026 strong move up. The rising 200-day EMA at 152.47 keeps the broader uptrend intact.

Meanwhile, the Moving Average Convergence Divergence (MACD) line sits below zero and has weakened, signaling bearish momentum within a corrective phase. RSI at 41 (neutral) reflects subdued impulse. The 38.2% retracement at 152.09 offers immediate support, and holding above it would preserve the bullish bias.

A close back above the 23.6% retracement at 154.91 would ease pressure and refocus topside. The 200-day EMA continues to underpin the structure, and a daily close below it would risk extending the pullback. MACD turning higher toward the zero line would hint at fading bearish momentum, while RSI pushing through 50 would reinforce an improving tone.

(The technical analysis of this story was written with the help of an AI tool.)

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: