Category: Crypto News, News

Dogecoin accumulation zone reentry signals potential 600% bullish reversal

Dogecoin (DOGE) is drawing attention as technical indicators suggest a potential bullish reversal, with analysts highlighting key price levels and patterns that could shape its near-term trajectory. The cryptocurrency has re-entered a historically significant accumulation zone between $0.15 and $0.22, a range that has historically acted as a catalyst for sharp upward moves. This area, located at the lower boundary of a long-term logarithmic channel, has supported Dogecoin’s price since 2015 and has previously triggered rallies ranging from 900% to 13,000%. The most notable example occurred in 2021, when DOGE surged from this zone to a peak of $0.7335 [1].

Recent price action suggests a similar dynamic may be unfolding. On-chain data indicates that Dogecoin has formed four higher lows within the channel, reinforcing buyer activity in this historically undervalued region. Analysts note that sustained trading above the accumulation band could drive the price toward the mid-channel resistance level of approximately $0.73, a critical threshold that served as a breakout point during the 2021 rally [1]. If this target is breached, the upper boundary of the historical channel—currently estimated between $2.30 and $3.00—could become the next focus, aligning with trends seen in 2017 and 2021 [1].

Short-term momentum has also shown signs of strengthening. A recent hourly chart analysis by trader TATrader_Alan revealed a breakout above a descending trendline, marked by a series of lower highs before a new higher high (HH) was printed. This development has opened the door for further upward movement, with analysts targeting $0.24 to $0.255 as immediate intraday goals [1]. The HH came after multiple failed attempts to exceed the downward-trending resistance, signaling a potential shift in market sentiment.

Technical patterns further reinforce the bullish case. A double bottom formation, validated by a break above the $0.25 neckline, has positioned Dogecoin for a potential push toward $0.42, a level associated with prior bullish cycles [3]. On-chain metrics, including increased wallet activity and transaction volumes, underscore growing investor interest, particularly in the $0.10–$0.15 support and $0.15–$0.20 resistance zones [3]. Meanwhile, a W-shaped pattern on the weekly chart has added to the case for a sustained upward trend, historically linked to strong breakouts [6].

Analysts have also highlighted macro-level factors. Whale accumulations exceeding 100 million DOGE in single transactions and a bullish crossover on the H4 chart—viewed as a key entry signal—suggest institutional confidence in Dogecoin’s long-term potential [3]. Some forecasts project gains of over 600% if current trends persist, driven by a combination of whale activity, volume surges, and pattern confirmations [1]. However, these projections remain conditional on broader market conditions and sustained momentum above critical technical levels.

Despite the optimistic signals, risks persist. A July 17 report noted sideways trading dynamics, with Dogecoin lingering near $0.2382 and lacking clear directional cues [5]. Traders are advised to monitor volume spikes and price action for confirmation of a breakout, as false signals could lead to sharp reversals. Additionally, the cryptocurrency’s correlation with Bitcoin means that broader market trends could influence its trajectory. A sustained BTC rally might amplify gains across meme coins, while a downturn could trigger volatility.

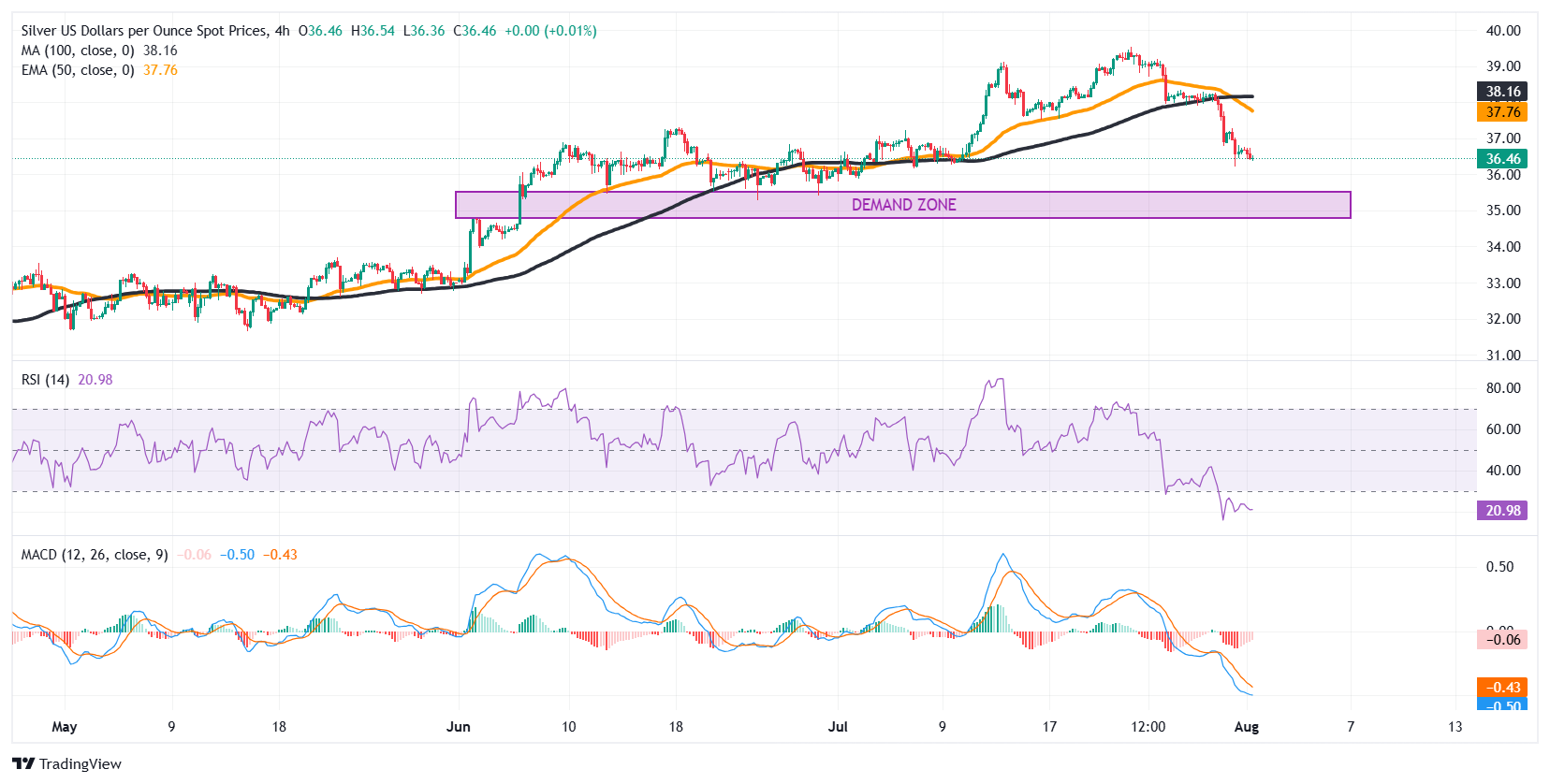

Dogecoin’s recent performance has seen a 2.5% gain in the last 24 hours, with the price trading at $0.2368 as of the latest data. Its market capitalization stands at $35.58 billion, though daily trading volumes have fallen to $2.27 billion [1]. Analysts caution that while the technical setup appears favorable, the asset’s inherent volatility and dependence on retail sentiment mean that caution is warranted. Strategies such as long entries above the 50-period moving average on the H4 chart and stop-loss placements below recent swing lows are recommended for risk management [3].

Long-term forecasts, such as a 2030 target of $0.00010, hinge on broader adoption and macroeconomic conditions but remain speculative. For now, the focus remains on near-term catalysts, with traders advised to balance technical analysis with fundamental developments. The convergence of trendline breakouts, pattern formations, and volume surges creates a compelling case for cautious optimism, though vigilance against unexpected macroeconomic shifts is essential [3].

Source: [1] [Dogecoin Looking At Bullish Price Action, Watch Out For These Signs](https://coinmarketcap.com/community/articles/688703cb092f266c0faa5fd2/) [2] [Where Dogecoin Could Be by 2025, 2026, and 2030](https://finance.yahoo.com/news/doge-price-prediction-where-dogecoin-093029168.html) [3] [Dogecoin (DOGE) H4 Chart Signals Bullish Crossover](https://blockchain.news/flashnews/dogecoin-doge-h4-chart-signals-bullish-crossover-key-trading-opportunity) [4] [Dogecoin Aims for $0.42 Breakout as Double Bottom Fuels Rally](https://bravenewcoin.com/insights/dogecoin-doge-price-prediction-dogecoin-aims-for-0-42-breakout-as-double-bottom-fuels-rally) [5] [DOGE Price Prediction Gets Stuck as Sideways Trading Takes Over](https://thetradable.com/crypto/-doge-price-prediction-gets-stuck-as-sideways-trading-takes-over-2) [6] [Dogecoin Price Prediction: DOGE Prints Majorly Bullish Weekly W Formation](https://coincentral.com/dogecoin-price-prediction-doge-prints-majorly-bullish-weekly-w-formation-1-the-new-baseline/) [7] [Dogecoin Price Prediction: Can DOGE Rebound Toward $0.26 After Key Bounce?](https://www.fxleaders.com/news/2025/07/26/dogecoin-price-prediction-can-doge-rebound-toward-0-26-after-key-bounce/)

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: