Category: Crypto News, News

Dogecoin Falls to $0.19 Today: Are Whales and Holders Pulling Out?

Jakarta, Pintu News – The House of Doge ‘s much-anticipated announcement – a merger plan that could see Dogecoin’s corporate unit listed on NASDAQ as early as 2026 – has rekindled optimism among the DOGE community.

Enthusiasm for this news pushed the Dogecoin price up nearly 45% through October 13, recovering sharply from its low point during the “Black Friday crash.”

However, this recovery was also used as a moment to exit the market. Some large holding groups started selling some of their holdings, suggesting that the price surge was fueled more by hype than fundamental conviction.

As of October 15, the price has been flat, so traders are now focusing more on the 4-hour chart to look for early signs of Dogecoin’s next move. So, how is the current Dogecoin price moving?

Dogecoin Price Drops 3.55% in 24 Hours

On October 16, 2025, Dogecoin’s price fell by 3.55% over the past 24 hours, trading at $0.1973 — approximately IDR 3,285. During that 24-hour span, DOGE fluctuated between IDR 3,451 and IDR 3,236.

At the time of writing, Dogecoin’s market capitalization is around IDR 493.55 trillion, with a 24-hour trading volume of roughly IDR 44.27 trillion.

Read also: Ethereum Holds Steady at $4,000 Today — Is a Breakout Coming for ETH?

Whales and Long-Term Holders Exit During and After Price Rise

In the wake of the hype surrounding the House of Doge, on-chain data shows that big wallets and long-term investors alike reduced their holdings significantly.

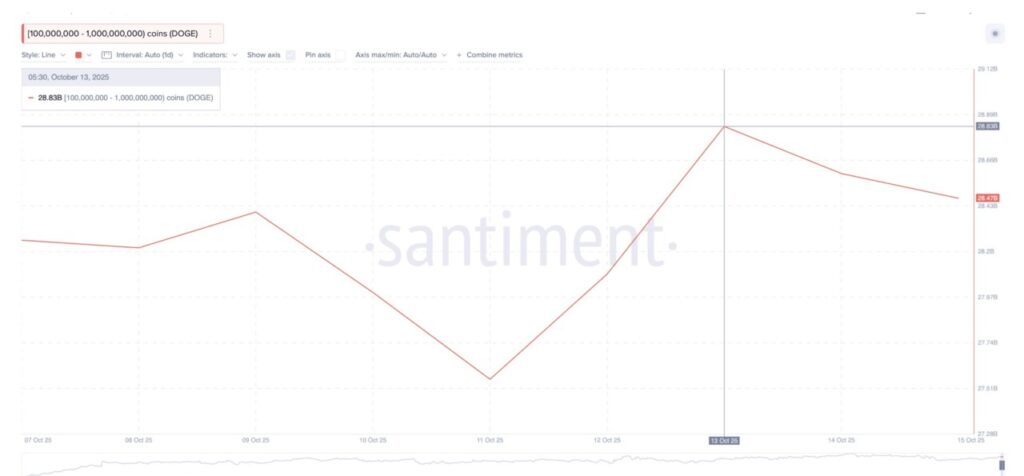

Whale wallets – those holding between 100 million and 1 billion DOGE – saw their balances drop from 28.83 billion DOGE on October 13 (the day of the merger announcement) to 28.47 billion DOGE two days later.

This means that around 360 million DOGEs have been sold, which equates to around $74 million based on the current Dogecoin price.

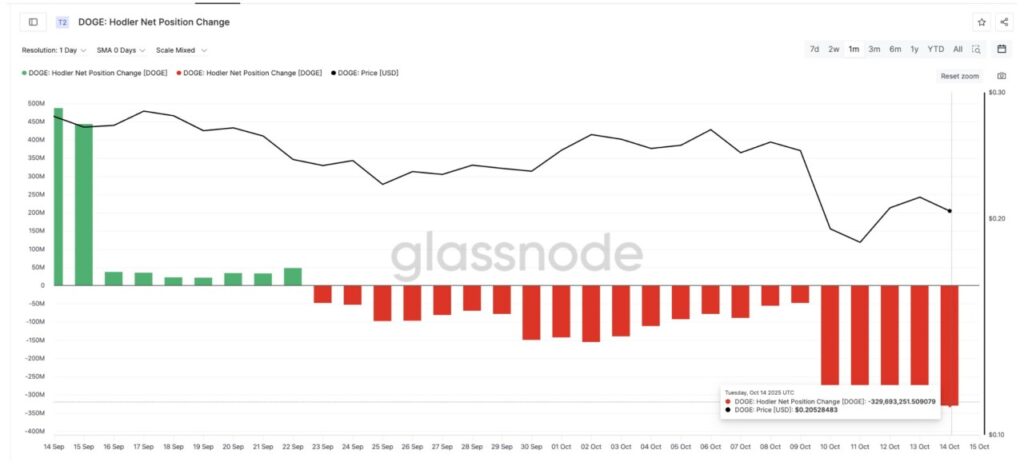

Meanwhile, the Holder Net Position Change indicator – which tracks whether long-term investors are buying or selling – remained in the negative zone and even worsened. Between October 9 and 14, net sell-offs increased from -48 million DOGE to -329 million DOGE, indicating that even loyal holders are starting to exit.

Although negative sentiment due to the crash played a part, conditions did not improve much even though the “Black Friday” tension began to subside.

A small positive note: compared to October 12, when the figure was around -366 million DOGE, the current value of -329 million DOGE shows slight signs of buying starting to return after the merger news.

Read also: Bitcoin Drops to $110,000 Today — Could It Fall to $50,000? Peter Brandt Thinks So

In total, nearly 640 million DOGE, worth about $130 million, exited the wallets of whales and long-term holders during and after the 45% price spike. This pattern indicates that many investors took advantage of the temporary upward momentum to reduce exposure or secure smaller losses.

Dogecoin Price Faces Crucial Test Near $0.20 Level

In the 4-hour chart (which is used to detect trend shifts earlier), the Dogecoin price is still moving in a descending triangle pattern – a technical pattern that generally indicates potential weakness if buyers fail to defend key levels.

The upper resistance zone is around $0.206, and a daily close above this level could signal short-term strength.

However, not all signals are bullish in this chart. The Relative Strength Index (RSI) indicator – which is used to measure momentum as well as overbought or oversold conditions – shows a hidden bearish divergence.

The price forms a lower high while the RSI prints a higher high, indicating weakening purchasing power. This kind of divergence usually signals a correction in the short term.

On the other hand, the $0.194 level is a crucial support line and an important base of this descending triangle pattern. If the price breaks this level decisively downwards, then there is a potential for a deeper correction. The next target could be towards the $0.181 level and even up to $0.149, which are the next support bases of the triangle pattern.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: