Category: Crypto News, News

Dogecoin Price Prediction: DOGE Survives as Market Enters Critical Consolidation Phase

Jakarta, Pintu News – Dogecoin (DOGE) is currently trading at technically sensitive levels, as short-term momentum starts to slow down after the previous sharp rally. The latest price action on Kraken’s 4-hour DOGE/USD chart shows that buyers still dominate the overall market structure.

However, consolidation below the resistance area indicates that the market is evaluating the direction of the move, rather than going straight for a breakout. This pause came after an impulsive move from the $0.115 to $0.155 range, which signaled strong participation from the buyers’ side.

As a result, traders are now focusing on whether the support level can hold during this cooling phase.

DOGE Price Structure Shows Strength, but Momentum Begins to Weaken

Dogecoin’s short-term trend is still bullish, although the upward momentum is starting to ease. DOGE continues to form higher lows, indicating that the recovery structure is maintained.

Read also: Shiba Inu Still Under Pressure Due to Surge in Liquidations: Can SHIB Price Rise?

Moreover, the medium-term trend appears to be stabilizing after the formation of a higher low around the $0.116 level. This recovery has shifted market sentiment away from aggressive selling pressure. However, the price is now stuck below the $0.148 supply zone, creating a narrow trading area.

Importantly, DOGE is still trading above the key area of the Fibonacci level and EMA cluster combined, which reinforces the bullish bias. The $0.141 to $0.142 zone is the first important point for the bulls to defend.

This level is a combination of the 0.618 Fibonacci retracement and the previous breakout area. If the price fails to hold here, then there is a risk of a deeper correction. On the other hand, the $0.138 to $0.137 range has a dense cluster of EMAs, adding to the significance of the area as a demand zone.

Resistance is still clear and layered. DOGE faces immediate selling pressure around $0.148, which is the area where the price has recently been stuck. In addition, the psychological level of $0.150 could attract new momentum if broken successfully. A confirmed breakout above $0.155 would signal the continuation of the uptrend and open up the potential towards $0.160.

On the downside, a controlled correction to around $0.134 is still considered reasonable and does not damage the long-term structure. However, if there is a net breakdown below $0.125, then the bullish scenario will fall. Therefore, traders are now watching these zones closely to determine the direction of the next move.

Derivatives and Spot Flow Data Point to a Market Reset

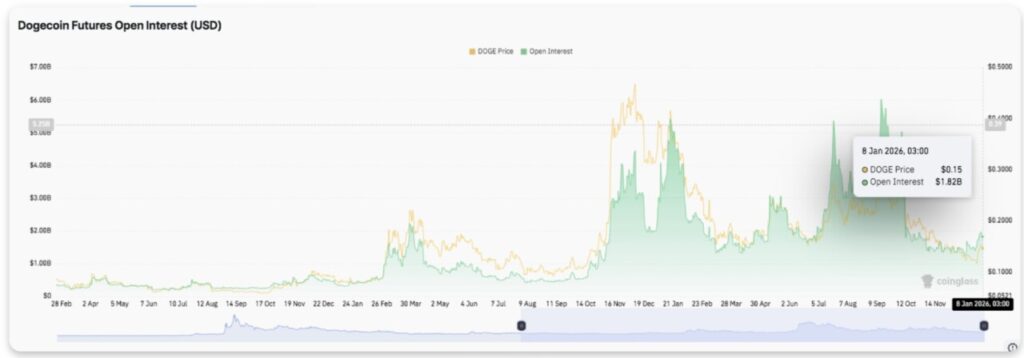

Derivatives data provides important context to the structure of price charts. Open interest in the Dogecoin futures market shows a cyclical pattern – expanding during rallies and contracting after the price peaks.

The peak in open interest that occurred near the previous high suggests aggressive use of leverage to chase the price. However, the latest data shows that open interest has now stabilized at around $1.8 billion as the DOGE price hovers around $0.15. This stability indicates reduced speculative pressure.

Read also: PEPE Price Jumps 50% in a Week: Is an 80% Rise Awaiting?

Spot flow data supports this view. In recent sessions, net outflows from exchanges have continued to dominate, meaning DOGE is being pulled off trading platforms.

This suggests that selling pressure is likely to be limited. The latest outflow of around $11.7 million occurred while the price stayed above the $0.14 level. Overall, this behavior reflects cautious accumulation, rather than aggressive speculation.

Dogecoin Price Technical Outlook

Dogecoin’s price structure remains positive as key technical levels are still evident ahead of the short-term trading sessions.

Currently, the price is still in a consolidation phase after a strong impulsive rise, which reflects compression rather than exhaustion.

Rising Levels (Resistance):

Immediate resistance is in the range of $0.1478-$0.1485, an area where sellers have consistently held back the upside.

If price manages to break and hold this zone, the upside potential could continue to $0.1500, then to the swing high at $0.1557. A confirmed breakout above $0.155 would most likely accelerate the momentum towards the $0.160 area.

Downside Levels (Support):

Initial support is in the $0.1410-$0.1420 range, which is reinforced by the 0.618 Fibonacci retracement and the previous breakout structure. Below that, the EMA cluster in the range of $0.1383-$0.1375 becomes an important demand zone.

If the price correction continues, the $0.1340 area could be the next target, while $0.1255 becomes the last level that determines the validity of the bullish scenario.

Upper Limit Resistance:

The high of $0.1557 is an important point that the bulls need to break in order to continue the uptrend and open up the upside potential to higher levels.

From a Structure Perspective:

DOGE price appears to be moving in a compression pattern (volatility tightening) within a narrowing range, after rallying from $0.115 to $0.155. The pattern of higher lows is still intact, while short-term lower highs are also forming indicating a consolidation phase below the resistance.

Therefore, volatility expansion becomes increasingly likely as the price approaches the apex of this pattern.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: