Category: Crypto News, News

Dogecoin Price Rockets Past 14-Day Resistance

Key Notes

- Dogecoin rose 9% to lead the top 10 cryptos, driven by ETF optimism and heavy derivatives activity.

- Open interest surged 13.16% to $3.82B, signaling aggressive speculative positioning beyond spot market gains.

- Polymarket data shows ETF approval odds up 5%, further fueling bullish sentiment and trading volumes.

.

Dogecoin surged 9% on Saturday, August 9, rising above the $0.25 level for the first time in 14-days dating back to July 27. Dogecoin outpaced Ethereum to emerge as the best performer among the top 10 cryptocurrencies by market cap.

The Dogecoin price rally was fueled by a combination of ETF-related optimism and a sharp increase in speculative trading activity.

Dogecoin ETF Approval Odds as of August 9, 2025 | Source: Polymarket

Market sentiment improved following a 5% boost in confidence around the potential approval of a Dogecoin ETF, according to real-time data from prediction market Polymarket. This uptick raised approval odds to 67% at press time, adding momentum to a broader market rally already in motion, sending DOGE above its 14-day moving resistance level.

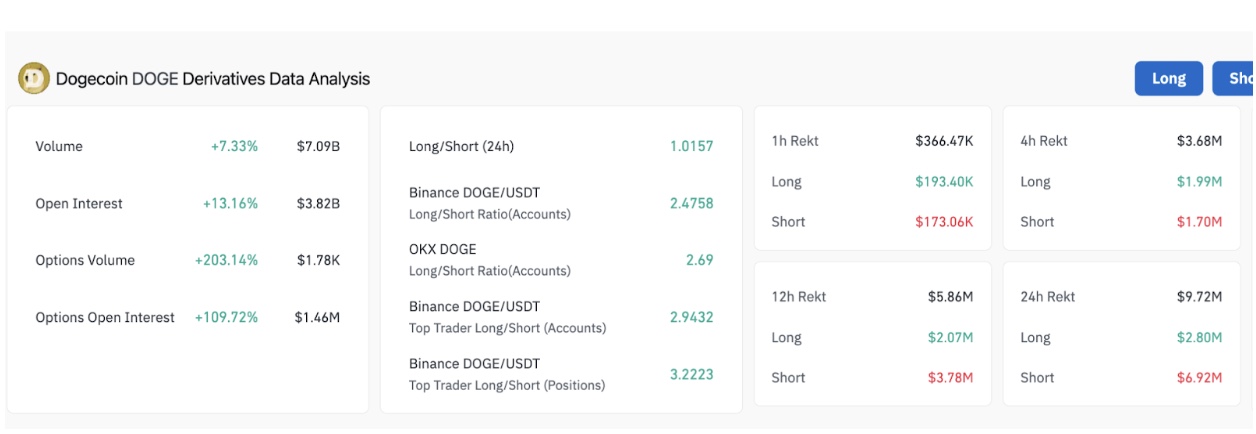

Dogecoin Derivative Market Analysis, August 9, 2025 | Coinglass

Dogecoin derivatives trading metrics over the last 24 hours reflected this uptick in bullish appetite. As in the Coinglass chart above, Open interest jumped 13.16% to $3.82 billion, surpassing the pace of spot price gains and signaling that leveraged traders are positioning for further upside.

The long/short ratio across major exchanges further confirmed the bullish bias. On Binance, the overall account-based long/short ratio stood at 2.47, while top traders held an even more aggressive bullish ratio of 3.22. The same sentiment was mirrored on OKX with a ratio of 2.69.

Liquidations over the past 24 hours totaled $9.72 million, skewed toward shorts with $6.92 million wiped out compared to $2.80 million for longs. This confirms that the short squeeze effect has likely propelled DOGE’s latest price breakout towards $0.25.

Dogecoin Price Forecast: Bulls Eye $0.268 Breakout Target

Technically, Dogecoin has broken decisively above the mid-Bollinger Band and 50-day moving average at $0.225, on pace to post four consecutive daily gains. As seen below, DOGE’s next major overhead resistance now lies at the $0.26 level, marked by the upper Bollinger Band, a level not seen since late July.

Dogecoin Derivative Market Analysis, August 9, 2025 | Coinglass

The daily RSI sits at 61.39, reflecting strong momentum while still shy of overbought conditions. Considering that top assets like Ethereum and Solana have already claimed new monthly time frame peaks, strategic short-term traders may consider Dogecoin price undervalued, despite its current overbought signals.

A daily close above $0.243 with sustained volume could see DOGE push toward $0.258 as an interim resistance, before retesting the $0.268 band top. A breakout above $0.268 would open the door for a rally toward $0.285, where prior selling pressure capped gains last month.

Failure to maintain $0.225 support could see a pullback to $0.211, the mid-range of the recent rally. A drop below $0.211 would expose the $0.182 lower Bollinger Band, effectively erasing the current monthly timeframe gains.

However, this scenario currently appears unlikely. Dogecoin derivatives positions heavily skewed long and Bitcoin’s 2% intraday rally to $117,900 on Saturday, after Harvard took a $116 million stake in Blackrock iBit BTC ETF, sparking fresh upside momentum.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: