Category: Crypto News, News

Ethereum Price Prediction Sounds Alarm on Bear Channel

That’s it. I’m done. I’m done with crypto. Lamest bull market of my life. didn’t even make it to 150k. Tom Lee’s Ethereum price prediction was wrong, and ETH made a new ATH for all of two seconds. There was no alt season.

And the only coins that did anything notable were flagrant casino 1000x tokens. Future of finance my ass.

Meanwhile, Ether cracked below the $3,100 level for the first time since early November, slipping to $3,066 on Sunday during a broader crypto pullback.

The drop came alongside a surge in ETF redemptions and growing concerns that Ethereum is becoming the “risk-on” trade of the sector. So what’s going on with Ethereum? Is it dying?

DISCOVER: 20+ Next Crypto to Explode in 2025

Investment manager Timothy Peterson highlighted a worrying trend that isn’t visible in headline ETF flows.

“Spot ether ETFs posted net outflows in four of the past five weeks, totaling roughly 7 percent of cost-basis capital,” Peterson said.

Cost-basis withdrawals track how much of the original capital committed to an ETF is leaving and it isn’t look good for Ethereum. Rising redemptions here show conviction weakening among long-term holders, not just traders repositioning.

It leaves our Ethereum price prediction showing that the price will not be near the ATH again for the rest of 2025. Not good.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

A sweep across key analytics platforms adds more context to the ETH price:

-

CoinGecko: Ether down 11 percent in 24 hours

-

DeFi Llama: ETH TVL fell 2.1 percent this week, reversing prior gains

-

FRED (Rates): Long-term yields remain elevated, restraining risk assets

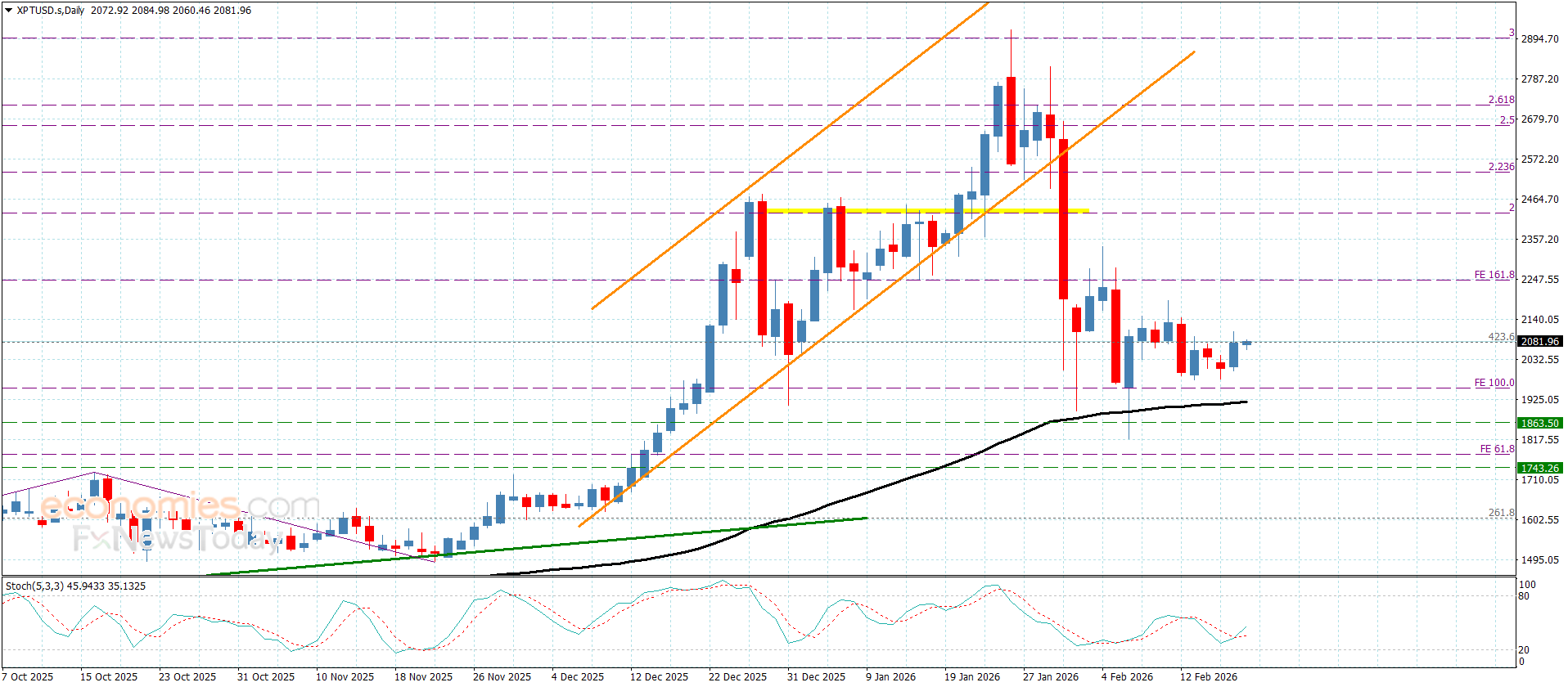

Despite the volatility, ETH still trades comfortably above its 200-day moving average near $2,550, a level that has historically defined cycle support zones.

Ethereum’s 4-hour chart shows price locked inside a narrowing falling wedge, which is a corrective pattern that often precedes upside breaks. ETH has repeatedly been rejected at the upper trendline and the stacked supply zones near $3,550 and $3,800.

A decisive reclaim of $3,350 will flip the short-term trend and open a path back toward $3,550. Failure keeps the wedge intact and elevates the risk of a $3,000 retest or even a quick liquidity sweep below it before any true reversal.

Ether slipping under $3,100 says more than a bad trading day. ETF outflows, shaky macro signals, and stubborn resistance have all piled onto the chart at the same time.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: