Category: Crypto News, News

Ethereum Price Prediction, Today December 26 – InsideBitcoins

Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price prediction reveals that ETH remains one of the most influential assets in the crypto market, serving as the foundation for decentralized finance, NFTs, and smart contract innovation.

Ethereum Prediction Data:

- Ethereum price now – $2,975.92

- Ethereum market cap – $358.84 billion

- Ethereum circulating supply – 120.69 million

- Ethereum total supply – 120.69 million

- Ethereum Coinmarketcap ranking – #2

Being an early adopter of transformative crypto projects has often proven to be one of the biggest advantages for long-term investors, and Ethereum is a textbook example of this principle in action. From its all-time low recorded in October 2015, ETH has surged by an extraordinary +706,595.55%, highlighting how early exposure to strong fundamentals and real utility can deliver outsized returns over time. Even today, despite short-term price fluctuations between roughly $2,891 and $2,991 in the past 24 hours and trading nearly 40% below its all-time high of $4,953.73, Ethereum continues to demonstrate why early conviction matters. As the backbone of smart contracts, DeFi, NFTs, and countless blockchain innovations, ETH shows that identifying high-potential projects early, before mainstream adoption, can be far more impactful than trying to time perfect entries later in the cycle.

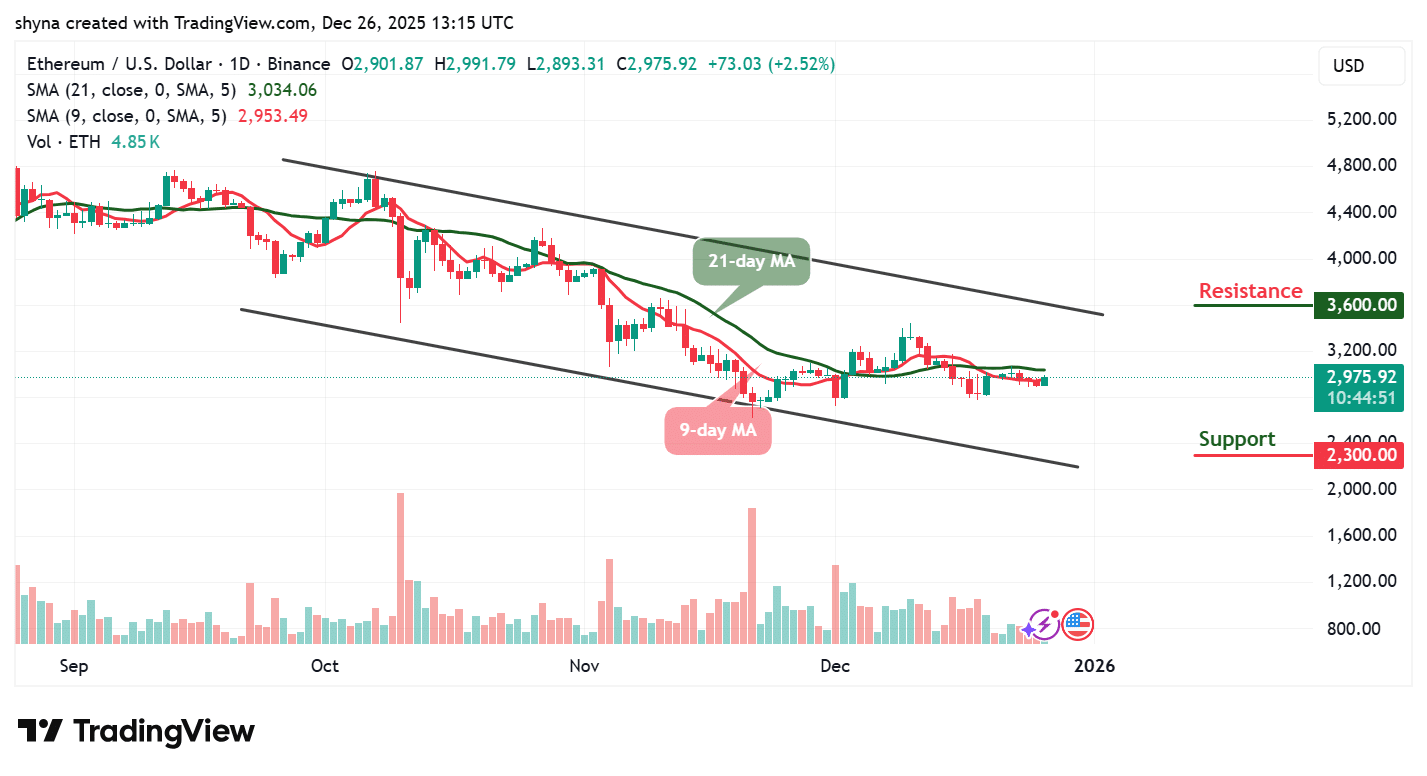

ETH/USD Market

Key Levels:

Resistance levels: $3,600, $3,800, $4,000

Support levels: $2,300, $2,100, $1,900

At the time of analysis, ETH/USD is trading around $2,976, following a mild rebound from the lower boundary of its descending channel on the daily chart. This recovery suggests that buyers are beginning to show interest near key demand levels, although the broader trend still reflects consolidation after a prolonged corrective phase. Price action remains compressed between dynamic trendlines, indicating that a decisive breakout or breakdown may be approaching.

Ethereum Price Prediction: ETH Tests Moving Average Resistance

From a technical standpoint, Ethereum is hovering just below the 21-day moving average while the 9-day moving average is attempting to flatten, signaling slowing bearish momentum. The inability to reclaim and hold above these short-term moving averages keeps ETH vulnerable to renewed selling pressure. However, a sustained close above the 21-day MA would strengthen bullish conviction and could open the door for a push toward the descending channel’s upper boundary.

Be Ready For This ETH Move

Looking upward, the first major hurdle for bulls sits at $3,600, which aligns with prior resistance and the upper structure of the channel. A clean breakout above this level could trigger accelerated upside toward $3,800 and potentially $4,000, where stronger supply is expected. Such a move would likely require a noticeable expansion in volume to confirm that buyers have regained control of the trend. On the downside, failure to maintain current levels may expose Ethereum to renewed weakness. A decisive drop below the lower channel support could send ETH/USD toward the $2,300 support zone, with additional downside risk extending to $2,100 and $1,900 if bearish momentum intensifies. For now, Ethereum (ETH) sits at a critical inflection point, where holding above structural support keeps recovery hopes alive, while rejection from moving averages may prolong consolidation or trigger another leg lower.

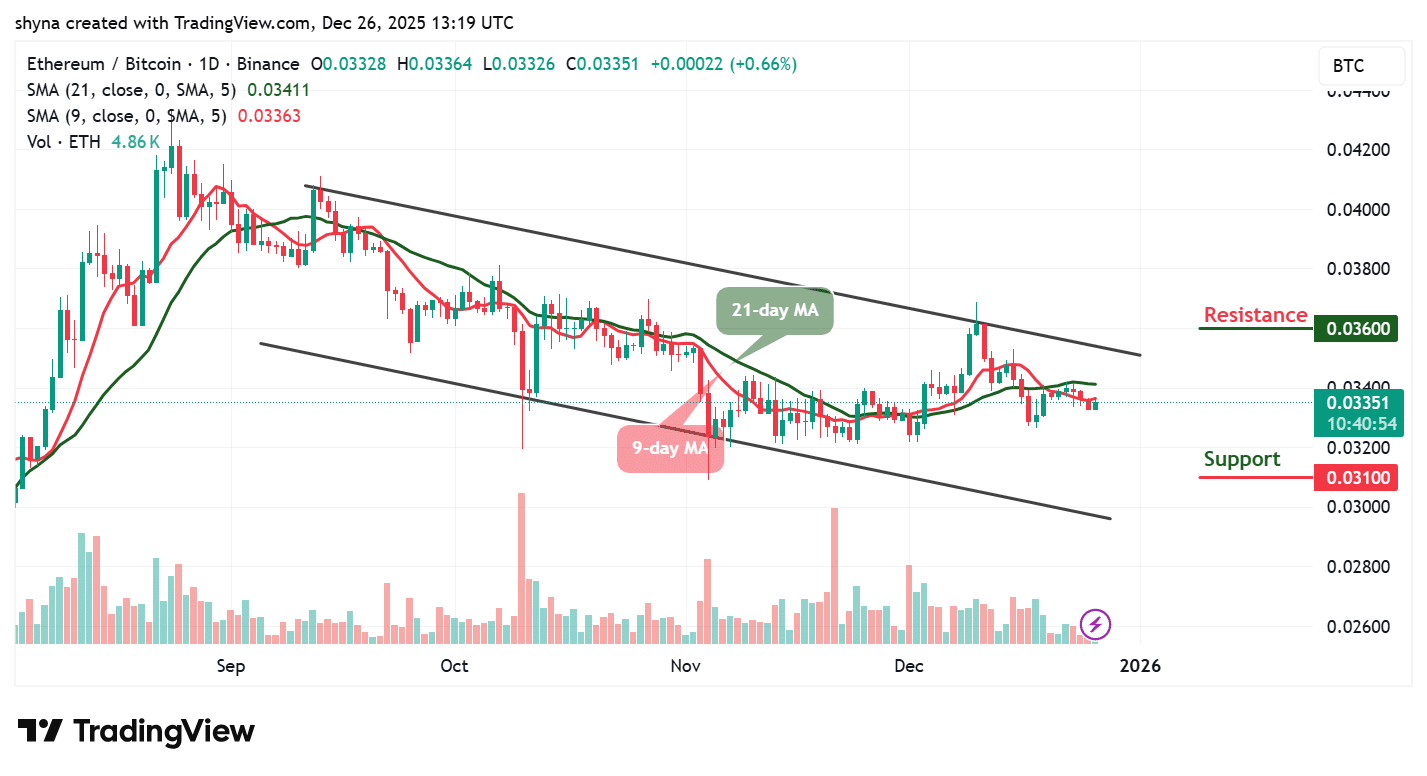

ETH/BTC Consolidates Within Descending Channel

On the daily chart, ETH/BTC is currently trading around 0.0335 BTC (≈ 3,351 SAT), consolidating within a well-defined descending channel that has guided price action since the September peak. The pair recently rebounded from the lower boundary of this channel near 0.0310 BTC (≈ 3,100 SAT), signaling that buyers are actively defending this support zone. However, price remains capped below the 21-day moving average, while the 9-day moving average continues to act as short-term resistance, suggesting that bullish momentum is still tentative and the broader structure remains corrective rather than impulsive.

Technically, the next directional move will depend on how ETH/BTC reacts around the mid-channel and moving average cluster. A sustained daily close above the 21-day MA would improve the bullish outlook and could allow price to grind higher toward the key resistance at 0.0360 BTC (≈ 3,600 SAT), where sellers previously stepped in aggressively. A breakout above this level would signal relative strength for Ethereum against Bitcoin and potentially mark the beginning of a trend shift. Conversely, failure to hold above 3,300 SAT may invite renewed downside pressure, exposing ETH/BTC to another test of the 3,100 SAT support, with a breakdown likely extending losses toward the lower channel boundary.

Moreover, @0xPepesso, who has over 156k followers on X (formerly Twitter), shared a bullish outlook on $ETH, noting that the price appears to be on the verge of a breakout after tightening within a falling channel around a major demand zone. According to the analysis, selling pressure is clearly weakening, suggesting that momentum may be shifting in favor of the bulls, with a potential move opening up toward the $5,000 level, adding a confident reminder that the signal shouldn’t be ignored.

$ETH IS MOMENTS AWAY FROM A BREAKOUT

Price is compressed inside a falling channel at a key demand zone

Selling pressure is fading

Next target: $5,000

Don’t say, I didn’t warn you! pic.twitter.com/j2ohb2JQ1p

— Pepesso (@0xPepesso) December 26, 2025

Nevertheless, Ethereum’s current price action reflects a market under pressure but quietly building energy for a decisive move. The crypto analyst above, @0xPepesso, highlights fading selling pressure and a potential breakout from a compressed structure at a key demand zone, which closely aligns with the broader chart analysis showing a rebound from channel support and tightening price action. While the technical outlook remains cautious, with price still constrained by moving average resistance and a descending channel, the flattening short-term averages suggest bearish momentum is weakening. Overall, both perspectives point to Ethereum approaching a critical inflection point, where sustained buying interest could trigger an upside breakout, while rejection at key technical barriers may prolong consolidation before the next major move.

Related News

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: