Category: Forex News, News

EUR/USD Forecast Today 01/07: Rally Continues (Chart)

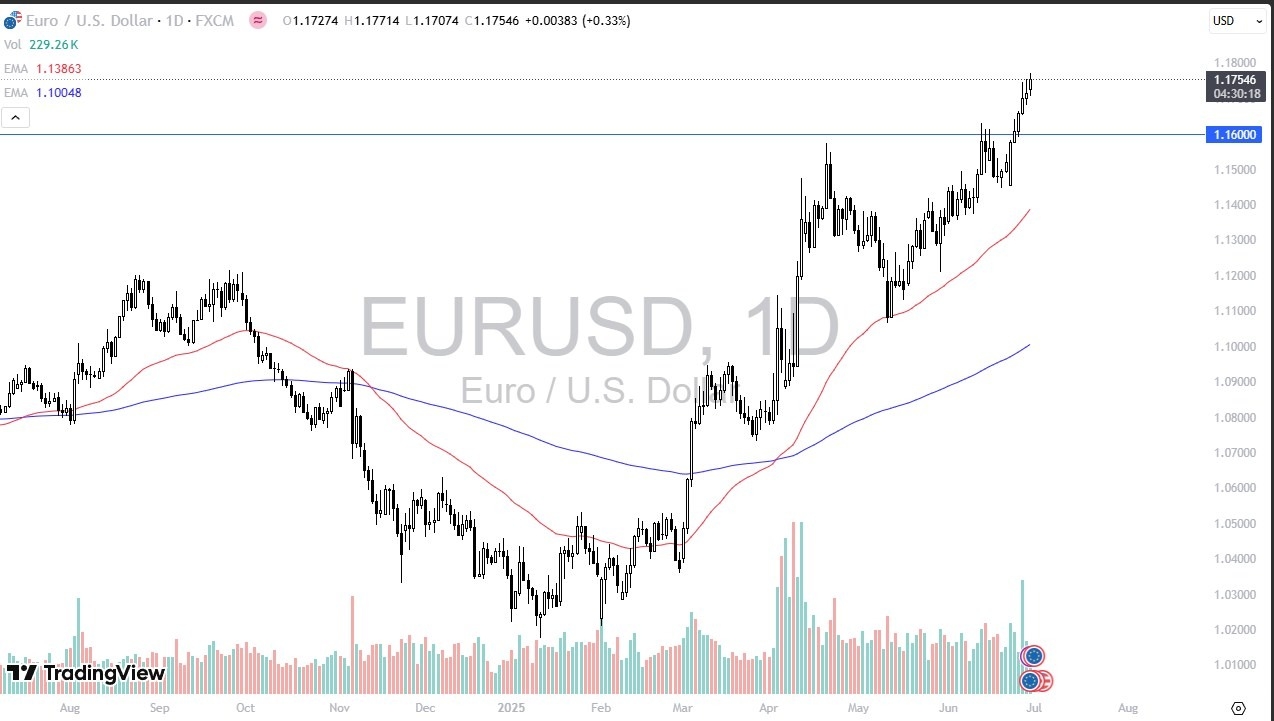

- The euro initially pulled back just a touch in the early hours of Monday, but it looks as if we are ready to continue going higher in what has been a slightly overextended run.

- At the end of the day, we are obviously very bullish of the market at the moment, despite the fact that I can give you a handful of reasons why the US dollar is oversold.

Perhaps we will turn around, but at this point in time you have to assume that there will be a bit of continuation overall, as the trend has clearly been positive for several months. If we do pull back from here, then we could look at a move to the 1.16 level, an area that previously had been a major resistance level. This could bring in a bit of “market memory” into the market, as traders would try to either cover short positions that has been wrong or perhaps try to join in on what had been a massive move higher.

Technical Analysis

The technical analysis for this market is obviously very bullish, but I also recognize that we have gotten a little ahead of ourselves. After all, the 50 Day EMA is all the way down at the 1.14 level but is rising to perhaps try to meet the rest of the market. On the other hand, if we continue to go higher, we will have to deal with the 1.18 level, which is a large, round, psychologically significant figure, and an area that would attract a certain amount of attention. Regardless, it does seem as if the euro is hell-bent on going much higher given enough time, so I think most traders will be looking at this through the prism of perhaps trying to find a little bit of value.

Over the longer term, a lot of this will come down to what the Federal Reserve does, and you should keep in mind that the Non-Foreign Payroll announcement comes out on Thursday this week instead of Friday, so it will compress some of the volatility as far as time is concerned. Whether or not that influences this pair remains to be seen, but now market participants have priced in a 95% probability that the Federal Reserve cut interest rates in September, driving this pair higher.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: