The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The GBP/USD weekly forecast reflects a persistent bearish bias, closing the week at 1.3140. The pound sterling faced pressure amid renewed UK economic concerns and a resilient greenback. The US dollar was boosted as Fed Chair Powell expressed uncertainty about a December rate cut, cautioning the markets.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

However, the policymakers remained divided about the Fed cut. The Cleveland Fed President Hammack expressed her lack of support for the recent Fed cut. Meanwhile, the Atlanta Fed’s Bostic noted the conflict between the dual mandates of price stability and employment.

On the UK side, the pound was subdued as the markets grappled with the UK’s fiscal situation. The Office for Budget Responsibility (OBR) lowered the productivity forecast by 0.3%, aiming for a potential £21 billion increase in the budget deficit by 2030.

Meanwhile, the Institute for Fiscal Studies (IFS) estimated a fiscal gap of £22 billion. Chancellor Rachel Reeves is pressured to increase taxes or borrow more in the November budget to curb this. The investor sentiment dampened slightly due to Reeve’s position. However, PM Keir Starmer backed her, easing the situation. Meanwhile, weak inflation data and rising expectations for further easing by the BoE further pressured the pound.

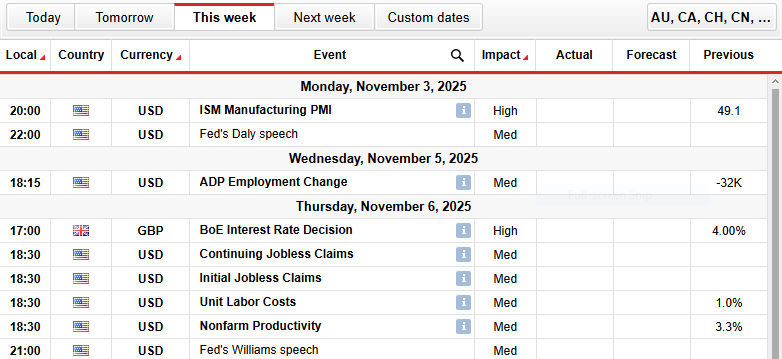

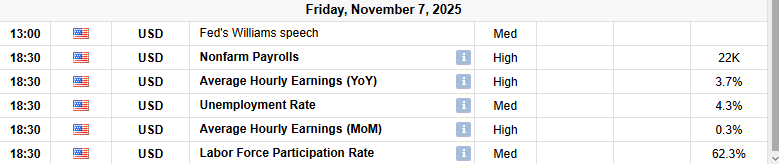

The major events in the coming week include:

Next week, traders anticipate the Fed’s Daly speech, the ISM manufacturing PMI, and ADP Employment. However, the nonfarm payrolls data remains the primary catalyst for the markets, as the markets missed the previous data amid the shutdown.

On the other hand, traders look ahead to BoE interest rate decisions for insights into potential rate cuts ahead. Markets are pricing in no change in the benchmark rates. Hence, the vote split will be the key to watch.

The GBP/USD stays under pressure, trading around 1.3140 after pulling back from 1.3370 earlier this week. The pair is well below the 20-day MA near 1.3338 and the 50-day MA around 1.3432, reflecting the downside pressure. Meanwhile, the 200-day MA around 1.3244 is a key support zone. The RSI at 40, above the oversold region, indicates that the downside pressure could stay intact unless a reversal signal emerges.

-Are you interested in learning about the forex indicators? Click here for details-

A decisive break above 1.3330 could alter the trend and open room for gains toward 1.3400 and 1.3460. Conversely, a sustained drop below 1.3100 could extend the downside towards 1.3050 and 1.2980.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The Euro to US Dollar (EUR/USD) exchange rate ended the week near 1.1607, after briefly dipping below 1.16 as the US dollar strengthened across G10 currencies.

EUR/USD has eased around 0.4% this week, slipping from highs near 1.165 earlier in the week despite slightly better-than-expected Eurozone GDP data.

Danske Bank described the euro’s pullback as part of a “tactically bearish but strategically bullish” outlook.

“The USD leg continues to drive price action,” the bank said, noting that Fed Chair Jerome Powell’s comments this week “clearly signalled discomfort with markets fully pricing a December rate cut.”

Danske expects the US dollar to remain firm in the near term, as only “materially softer US labour market and inflation data” could solidify expectations for a deeper easing cycle.

“Otherwise, 25bp could easily be priced out, initially adding further tailwinds to the broad USD,” the bank added.

However, it sees this dollar strength as temporary: “Renewed political pressure on the Fed to ease could re-emerge should Powell lean more hawkish — an important reason why we continue to view any near-term USD strength as tactical rather than structural.”

On the euro side, the bank noted that Q3 GDP rose 0.2% quarter-on-quarter, above expectations, and it expects growth to remain around that pace through Q4 as October PMIs “suggest underlying momentum has been sustained.”

Scotiabank described EUR/USD as “neutral” in the short term, noting that “the euro’s undertone is soft but steady support has emerged on dips to the mid-1.15s.”

It added that a break below 1.1525 could expose downside toward 1.1450, while resistance sits at 1.1575 and 1.1635.

Current EUR/USD rate: 1.1607

Danske Bank view: Tactically bearish, strategically bullish.

EUR/JPY gains ground after remaining flat in the previous session, trading around 178.50, near record highs, during the European hours on Thursday. The technical analysis of the daily chart suggests strengthening of a bullish bias as the currency cross has rebounded from the confluence support zone around the nine-day Exponential Moving Average (EMA) and lower boundary of the ascending channel pattern.

The short-term price momentum is stronger as the EUR/JPY cross remains above the nine-day EMA. The 14-day Relative Strength Index (RSI) has rebounded toward the 70 mark, strengthening the bullish bias. Further advances would lead the currency cross to reach overbought territory.

The EUR/JPY cross reached the all-time high at 178.71, reached on October 30. Further advances would support the currency cross to explore the region around the upper boundary of the ascending channel around 184.00.

On the downside, the EUR/JPY cross may again target the confluence support zone around the nine-day EMA of 177.27 and the ascending channel’s lower boundary around 177.00. A break below the channel would undermine the short-term bullish momentum, potentially putting downward pressure on the currency pair toward the 50-day EMA region near 174.75, followed by the seven-week low of 172.14, which was recorded on September 9.

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.13% | -0.05% | 0.66% | 0.03% | -0.04% | -0.14% | -0.12% | |

| EUR | 0.13% | 0.08% | 0.80% | 0.17% | 0.09% | -0.00% | 0.01% | |

| GBP | 0.05% | -0.08% | 0.73% | 0.08% | 0.02% | -0.09% | -0.07% | |

| JPY | -0.66% | -0.80% | -0.73% | -0.65% | -0.70% | -0.82% | -0.82% | |

| CAD | -0.03% | -0.17% | -0.08% | 0.65% | -0.06% | -0.17% | -0.16% | |

| AUD | 0.04% | -0.09% | -0.02% | 0.70% | 0.06% | -0.10% | -0.09% | |

| NZD | 0.14% | 0.00% | 0.09% | 0.82% | 0.17% | 0.10% | 0.04% | |

| CHF | 0.12% | -0.01% | 0.07% | 0.82% | 0.16% | 0.09% | -0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Follow our real-time updates to stay ahead of USD/JPY market developments.

Crucially, a rise toward 155 could raise expectations of the Ministry of Finance warning of an intervention, mirroring events in 2024. The potential for intervention will likely be the key downside risk for USD/JPY in the near-term, given that MoF warnings tend to follow sharp yen depreciation.

While Japanese economic data, BoJ forward guidance, and intervention threats will move the dial, traders should closely monitor US data, Fed chatter, and developments on Capitol Hill.

Traders may continue to face heightened USD/JPY volatility amid shifting sentiment toward the Fed and BoJ’s policy outlooks. Meanwhile, US Senate votes, economic data, and Fed commentary will also influence USD/JPY trends. Key events for the week ahead include:

Weaker-than-expected US labor market data, slower service sector activity, and falling consumer confidence may revive bets on a December Fed rate cut. A more dovish Fed policy stance could push USD/JPY toward 153. A break below 153 would enable the bears to target the 50-day EMA and the 149.358 support level.

Stronger-than-expected US labor market data, a higher ISM Services PMI reading, and a pickup in consumer confidence could temper expectations of a December Fed rate cut. A more hawkish Fed rate path may drive USD/JPY toward 155. A breakout from 155 could pave the way toward the 156.884 resistance level.

Beyond the data, traders should closely monitor FOMC members’ speeches for views on inflation, the economy, and the timing of further rate cuts.

On the daily chart, USD/JPY continued to trade above the 50- and 200-day Exponential Moving Averages (EMAs), reaffirming a bullish bias.

A break above the October 31, 2025, high of 154.415 could pave the way toward 155 and the February 2025 high of 155.880. A sustained move through 155.880 may open the door to retesting the 156.884 resistance level.

On the downside, a drop below 153 could bring the 50-day EMA and the 150 psychological support level into play. If breached, 149.358 would be the next key support level.

Silver price settled higher in its last intraday trading, after a series of consecutive gains, the price successfully breached bearish corrective trendline, leading it to surpass the resistance of its EMA50, to get rid of its negative pressure, on the other hand, this rise led the relative strength indicators to reach overbought levels, which may obstruct the continuation of these gains on the near-term basis, especially with the emergence of negative overlapping signals.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Full VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

The 20-day line, now at $4,086, was decisively breached last week, triggering a bearish retracement low at $3,886 — a critical support level. The breakdown was accompanied by additional bearish developments, including a drop below the top of a near-term rising trend channel and the prior low of $4,003. With key support now broken, the current upswing is testing that former support as resistance, but bulls have shown little conviction, barely extending beyond a tight three-day range sitting directly on support.

Rallies into the 10-day line at $4,070 and 20-day average at $4,086 form a formidable resistance zone. Expect resistance to turn price back down and fail the rally. The 10-day, now below the 20-day, takes on greater significance as dynamic resistance. A sustained advance above the 20-day would target the top rising channel line and a prior three-day resistance shelf from $4,144 to $4,161, where sellers could reassert control.

The pattern strongly suggests at least another leg down before the correction completes. If the 20-day cannot be reached, it signals persistent overhanging selling pressure likely resolving to the downside. The 20-day’s long-standing role as dynamic support since August’s advance makes the dynamics of the first pullback higher particularly significant — a test as resistance is expected before sellers regain full control and push lower.

The close below $3,972 is decisive — below it risks $3,886, above it tests $4,086. Resistance caps rallies, but failure to reach the 20-day flags deeper weakness. Watch $4,070-$4,086 closely — a break opens $4,144, while rejection targets lower support. The bearish crossover and weak rally favor sellers until proven otherwise.

For a look at all of today’s economic events, check out our economic calendar.

Why is the U.S. natural gas price rising today?

That was the question Rigzone asked Phil Flynn, a senior market analyst at the PRICE Futures Group, in an exclusive interview on Friday.

In response, Flynn told Rigzone that Thursday’s natural gas injection “was right in line” and added that “now we are getting forecasts indicating colder conditions for late October and early November”, which he outlined “have led to increased purchasing activity in major U.S. regions, including the Midwest and Northeast”.

“We saw initial weather models suggested a return of warmer temperatures, momentarily dampening the rally. Subsequent projections of below-normal temperatures have renewed bullish market sentiment,” Flynn added.

“This trend is consistent with global developments. Cold weather across Europe and Asia is reducing inventories, with European stocks declining by 11 percent since early October and supporting elevated benchmark prices such as Henry Hub,” he continued.

In its latest weekly natural gas storage report, which was released on Thursday and included data for the week ending October 24, the U.S. Energy Information Administration (EIA) noted that working gas in storage was 3,882 billion cubic feet as of October 24, according to its estimates.

“This represents a net increase of 74 billion cubic feet from the previous week,” the EIA said in that report.

“Stocks were 29 billion cubic feet higher than last year at this time and 171 billion cubic feet above the five-year average of 3,711 billion cubic feet. At 3,882 billion cubic feet, total working gas is within the five-year historical range,” it added.

When he was asked why the U.S. natural gas price is rising today in a separate exclusive interview on Friday, Art Hogan, Chief Market Strategist at B. Riley Wealth, pointed out that “U.S. natural gas futures successfully tested the important support level of $3.27 earlier this week and now has risen past $4.1 per MMBtu [million British thermal units], the highest in seven months”.

“Expectations of colder weather in the U.S. ahead of the winter supported demand for gas-intensive heating. Meanwhile, the average flow of gas to the eight big U.S. LNG export plants were at 16.5 billion cubic feet per day in October, well above the 15.7 billion cubic feet per day from the previous month to set up a fresh record ahead of the turn of the month,” he added.

Hogan went on to state that “high LNG flows were aligned with added demand from Europe as the gradual shun of Russian gas coincided with lower stocks in gas trading hubs, while the U.S. Presidential administration pressed for pledges of U.S. energy imports for Asian countries negotiating trade deals”.

In an EBW Analytics Group report sent to Rigzone by the EBW team on Friday, Eli Rubin, an energy analyst at the company, said the December natural gas contract “is nearing technical resistance at the 100-day moving average of $4.13 per MMBtu for the first time since June, with the market transitioning away from storage oversupply fears toward a robust structural winter narrative”.

“Fundamentally, though, the near to medium term remains very well supplied,” Rubin said in that report.

Rubin highlighted in this report that “daily LNG is skyrocketing, with early-cycle nominations smashing record highs by 0.6 billion cubic feet per day”.

“Strong Gulf Coast demand drove Henry Hub spot prices to $3.45 per MMBtu – the highest level since mid-July,” he added.

In the report, Rubin went on to state that “December contract strength, despite this week’s 25 billion cubic foot bearish weather shift and storage on track to surpass 3,950 billion cubic feet, signals upside momentum – and risks that early-winter optimism may exceed fundamentals”.

“While higher supply and technical resistance may slow upside … momentum appears quite strong into November,” he said.

To contact the author, email andreas.exarheas@rigzone.com

Used primarily as a bargaining tool to encourage Putin to return to the negotiating table regarding the Russia-Ukraine conflict, markets are seriously questioning the effectiveness of recent sanctions.

While predictably, the Kremlin made comments shortly after the announcement to suggest that the domestic Russian oil industry would be unaffected by new American sanctions, markets are now taking these comments more seriously.

This goes double for Vladimir Putin, who went on record to say he would not be “cowed” by other nations into making concessions about Ukraine, while simultaneously boasting about the success of new nuclear technology.

While it is understandable that Trump wants to target Russian fossil fuels, with the three largest companies by market cap in Russia, Lukoil, Rosneft, and Gazprom, all being energy corporations, it will take more supply-side risk to secure higher pricing for WTI, which is on pace for its worst yearly performance since 2020.

As expected, the level of risk premium priced into WTI markets has reduced significantly this week, not only due to the above, but also because of the market’s inherent nature: sudden news events often cause the markets to overreact.

Coffee beans in canvas sack by Bragin Alexey via Shutterstock

December arabica coffee (KCZ25) today is down -2.30 (-0.59%), and January ICE robusta coffee (RMF26) is down -7 (-0.15%).

Coffee prices are under pressure today but remain above Tuesday’s 2-week lows. Prices are sliding amid forecasts of rain this week in key coffee-growing areas of Brazil, which would partially alleviate the dry conditions from last week. Somar Meteorologia reported Monday that Brazil’s largest arabica coffee-growing area, Minas Gerais, received only 0.3 mm of rain during the week ended October 24, or 1% of the historical average.

Arabica coffee prices are also being undercut by speculation that the US may soon lift its 50% tariff on Brazilian coffee. On Monday, Brazil’s President Luiz Inacio Lula da Silva said he had a “surprisingly good” meeting with President Trump and said there could be a “definitive solution” on US-Brazil trade within days.

Shrinking ICE coffee inventories are supportive for prices. The 50% tariffs imposed on US imports from Brazil have led to a sharp drawdown in ICE coffee inventories. ICE-monitored arabica inventories fell to a 1.5-year low of 446,475 bags on Wednesday, and ICE robusta coffee inventories fell to a 3.25-month low of 6,111 lots. American buyers are voiding new contracts for Brazilian coffee purchases due to the 50% tariffs on US imports from Brazil, thereby tightening US supplies, as about a third of America’s unroasted coffee comes from Brazil.

Last Thursday, arabica coffee rallied to an 8.5-month nearest-futures high due to concern that excessive dry conditions in Brazil during the critical flowering period for coffee trees will threaten the 2026/27 coffee crop. According to the Bloomberg Brazil Weather Analysis, coffee-producing regions in Brazil have been experiencing an intense drought, with the state of Minas Gerais recording only about 70% of its average rainfall over the past month.

Coffee prices garnered support after the National Oceanic and Atmospheric Administration (NOAA) on September 16 increased the likelihood to 71% of a La Niña weather system in the southern hemisphere from October to December, which could bring excessive dry weather to Brazil and harm the 2026/27 coffee crop. Brazil is the world’s largest producer of arabica coffee.

Robusta coffee is under pressure from increased Vietnamese supplies. The Vietnam National Statistics Office reported on October 13 that Vietnam’s Jan-Sep 2025 coffee exports rose +10.9% y/y to 1.230 MMT. Also, Vietnam’s 2025/26 coffee production is projected to climb +6% y/y to 1.76 MMT, or 29.4 million bags, a 4-year high. In addition, the Vietnam Coffee and Cocoa Association (Vicofa) said last Friday that Vietnam’s coffee output in 2025/26 will be 10% higher than the previous crop year if weather conditions remain favorable. Vietnam is the world’s largest producer of robusta coffee.

Larger coffee exports are bearish for prices after the International Coffee Organization (ICO) reported on October 6 that global coffee exports for the current marketing year (Oct-Aug) rose +0.2% y/y to 127.92 million bags, indicating adequate exports and supplies.

Coffee prices found support after Conab, Brazil’s crop forecasting agency, cut its Brazil 2025 arabica coffee crop estimate on September 4 by -4.9% to 35.2 million bags from a May forecast of 37.0 million bags. Conab also reduced its total Brazil 2025 coffee production estimate by 0.9% to 55.2 million bags, from a May estimate of 55.7 million bags.

The USDA’s Foreign Agriculture Service (FAS) projected on June 25 that world coffee production in 2025/26 will increase by +2.5% y/y to a record 178.68 million bags, with a -1.7% decrease in arabica production to 97.022 million bags and a +7.9% increase in robusta production to 81.658 million bags. FAS forecasted that Brazil’s 2025/26 coffee production will increase by +0.5% y/y to 65 million bags and that Vietnam’s 2025/26 coffee output will rise by 6.9% y/y to a 4-year high of 31 million bags. FAS forecasts that 2025/26 ending stocks will climb by +4.9% to 22.819 million bags from 21.752 million bags in 2024/25.

On the date of publication,

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

The price of (EURUSD) settled lower with calm trading on its last intraday levels, due to the stability of the critical support at 1.1550, with the beginning of the positive signals on the relative strength indicators, after reaching oversold levels, attempting to offload some of the oversold conditions, amid the continuation of the negative pressure and the dynamic resistance that is represented by its trading below EMA50, under the dominance of the main bearish trend on the short-term basis and its trading alongside trendline.

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

Full VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)