The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

December 22, 2025 — Natural gas markets are starting the holiday-shortened week with a familiar winter tug-of-war: early-season cold boosted prices and withdrawals, but a shift toward milder forecasts is now cooling bullish momentum even as LNG export demand remains elevated.

In the U.S., front-month NYMEX natural gas futures slipped close to 2% in morning trade as forecasters leaned warmer into early January and Lower 48 production continued to surprise to the upside. Overseas, European gas prices edged lower in thin pre-holiday trading as steady supply from Norway and LNG flows helped offset expectations of stronger heating demand. Meanwhile, a wave of policy and geopolitics headlines—from Australia’s new gas reservation framework to fresh Russia-to-China pipeline and sanctioned LNG shipping developments—kept global traders focused on 2026–2027 contract risk and supply security.

U.S. natural gas futures fell by roughly 1.9% in the morning session, with the January contract around $3.901 per MMBtu at 09:40 a.m. ET, pressured by both higher production and forecasts that point to warmer-than-normal temperatures into early January—conditions that typically reduce heating demand. [1]

This pullback follows a sharp early-December run-up that briefly pushed Henry Hub pricing to multi-year highs. The American Gas Association’s latest market indicators describe a clear shift in sentiment: after an early cold snap, demand has eased and futures have been “retreating,” with weather remaining the dominant driver of daily volatility. [2]

Key U.S. price context (December swing):

The near-term narrative has shifted from “how cold did it get?” to “how warm will it be next?” Meteorologists cited in today’s market reporting expect the U.S. to remain mostly warmer than normal through early January, which would limit space-heating demand relative to seasonal norms. [5]

The AGA likewise points to holiday-period moderation, citing NOAA Climate Prediction Center outlooks that tilt above-normal across much of the country into the first week of the new year, with some regional exceptions. [6]

What matters for traders is not just temperature direction, but the speed and confidence of model changes. A single forecast shift can reprice the entire front of the curve, especially when liquidity thins around Christmas and New Year’s.

Even in winter, it’s hard for prices to sustain a rally when supply keeps setting new highs.

Financial firm LSEG data referenced in today’s reporting shows average Lower 48 output climbing to a record 109.9 Bcf/d so far in December, eclipsing November’s monthly record. [7]

The AGA similarly notes that after hitting an all-time daily high late last month, production dipped briefly and then rebounded; as of Dec. 22, output remained meaningfully higher than the same period last year (AGA cites +4.8% year over year). [8]

Why this matters for “natural gas price today” searches:

When supply is printing records, bullish weather needs to be consistently colder than normal—not just briefly cold—to keep prices elevated. Otherwise, the market tends to sell rallies and reward storage comfort.

Demand cooled week over week, but it’s not collapsing. The AGA reports total demand (including exports) for the week ending Dec. 22 fell 11.5% week over week while still running slightly above last year’s level for the comparable week. [9]

On the storage side, the latest widely cited U.S. weekly pull was sizable: the EIA reported a 167 Bcf withdrawal for the week ending Dec. 12, leaving working gas inventories at 3,579 Bcf. The AGA states stocks were about 0.9% above the five-year average at that point, though below year-ago levels. [10]

Bottom line: the early-winter drawdown was real, but strong production and still-comfortable inventories are limiting the urgency premium—especially when warmer forecasts appear.

If there’s a consistent floor under U.S. gas demand, it’s LNG.

Today’s reporting puts average feedgas flows to the eight large U.S. LNG export plants at 18.5 Bcf/d so far this month, up from a prior monthly record in November. [11]

AGA’s December 22 indicators add more color:

In other words: even if residential/commercial heating softens on warmth, export pull can keep the overall balance tighter than it looks from weather alone.

For readers looking beyond today’s tick-by-tick move, the EIA’s Short-Term Energy Outlook provides the clearest baseline forecast widely used in the market:

This is the macro framework traders are testing daily against real-time weather and production data.

European prices opened the week slightly softer, with trading described as narrow and holiday-thinned.

Reuters reporting cited Dutch February TTF down modestly to about €27.70/MWh in morning trade, while UK day-ahead prices also eased. Market participants pointed to steady Norwegian pipeline supply and LNG availability offsetting the colder-demand outlook. [18]

Storage remains the key European risk variable. Reuters also cited Gas Infrastructure Europe data putting EU storage around 67.24% full, and noted that lower inventory levels could encourage additional LNG procurement into January and February if winter demand strengthens. [19]

European takeaway: the region is not “out of gas,” but it is more sensitive to cold snaps and supply disruptions than it would be with storage closer to last year’s levels.

One of the biggest policy headlines of Dec. 22 comes from Australia, where the government unveiled a domestic gas reservation framework aimed at preventing future east-coast shortages and smoothing price spikes.

Reuters reports the plan would require LNG exporters on Australia’s east coast to allocate 15% to 25% of output for domestic use starting in 2027, with the mechanism designed around new contracts rather than existing long-term commitments. [20]

Australian media reporting frames the move as a “historic” shift for the east coast and suggests reserved volumes could reach hundreds of petajoules annually, with the policy intended to slightly oversupply the domestic market and put downward pressure on prices. [21]

Why this matters globally: Australia is a top-tier LNG exporter into Asia, and any policy that changes how incremental supply is marketed can ripple into longer-dated LNG pricing, portfolio contracting strategy, and buyer diversification plans.

Two Russia-linked gas developments reported on Dec. 22 underscore the market’s geopolitical undercurrent:

A Reuters report says Russian pipeline exports to China via Power of Siberia are expected to reach ~38.6–38.7 bcm in 2025, up from 31 bcm in 2024, and roughly at/above the pipeline’s planned annual capacity. The report also notes discussions on additional projects (including Power of Siberia 2), with pricing still a major hurdle. [22]

Reuters also reported that the LNG tanker Kunpeng loaded a cargo from Russia’s Portovaya LNG plant—despite Western sanctions—based on ship-tracking data. The vessel arrived Dec. 18 and departed with a cargo on Dec. 21, according to the report. [23]

For the market, these stories are less about today’s Henry Hub tick and more about future trade flows, enforcement risk, and how quickly supply can be rerouted when traditional buyers reduce purchases.

With Christmas approaching and liquidity thinning, the next moves could be driven by a small number of catalysts:

1. www.bairdmaritime.com, 2. www.aga.org, 3. www.aga.org, 4. www.aga.org, 5. www.bairdmaritime.com, 6. www.aga.org, 7. www.bairdmaritime.com, 8. www.aga.org, 9. www.aga.org, 10. www.aga.org, 11. www.bairdmaritime.com, 12. www.aga.org, 13. www.aga.org, 14. www.eia.gov, 15. www.eia.gov, 16. www.eia.gov, 17. www.eia.gov, 18. www.tradingview.com, 19. www.tradingview.com, 20. www.reuters.com, 21. www.theguardian.com, 22. www.reuters.com, 23. www.reuters.com, 24. www.bairdmaritime.com, 25. www.bairdmaritime.com, 26. www.bairdmaritime.com, 27. www.aga.org, 28. www.tradingview.com, 29. www.reuters.com, 30. www.reuters.com

Silver is extending one of the most dramatic bull runs in modern commodities history, with prices hovering near record territory on Monday, December 22, 2025. Around 1:38 p.m. ET, spot silver (XAG/USD) was trading roughly in the high-$68s per ounce, after pushing to fresh all-time highs earlier in the session. One widely followed retail spot quote showed $68.89/oz at 1:20 p.m. ET, up about 2.1% on the day. [1]

The bigger headline: silver has repeatedly printed new records in December and is now riding a powerful mix of rate-cut expectations, a softer U.S. dollar, safe-haven demand tied to geopolitical risk, and a still-tight physical market. Reuters reported spot silver touched a new all-time peak around $69.44/oz on Monday before easing back. [2]

Below is what’s moving the silver price today, how analysts are framing the rally, and what the latest forecasts and technical levels suggest for the days ahead.

Silver’s intraday action has been volatile but directionally bullish:

Silver’s 2025 move is also historically large. Reuters put silver’s year-to-date gain at roughly ~139%, dramatically outpacing gold on a percentage basis. [6]

The macro backdrop remains the core engine. Multiple reports describe investors positioning for looser U.S. monetary policy in 2026, a setup that tends to support non-yielding assets like precious metals.

Reuters said expectations of easier policy and a weaker dollar have been central to the late-year precious metals surge, with traders reacting to recent U.S. inflation and labor data that reinforced rate-cut bets. [7]

Business Insider similarly tied the record push in gold and silver to renewed market confidence that rates will trend lower into 2026, increasing the appeal of hard assets versus cash and bonds. [8]

Today’s rally isn’t only macro—it’s also risk hedging. Reuters highlighted rising safe-haven flows as U.S.-Venezuela tensions escalated following President Donald Trump’s announcement of a “blockade” targeting sanctioned oil tankers moving in and out of Venezuela. [9]

On top of that, FXStreet framed silver’s jump as part of a broader flight to safety amid renewed tension in the Middle East, noting Israel–Iran headlines as a catalyst during the Asian session. [10]

Silver is behaving like a hybrid: part safe haven, part industrial metal. Reuters has repeatedly emphasized the market’s focus on a persistent supply-demand deficit, while also pointing to investment flows. [11]

Business Insider added another layer: silver (along with copper) is being treated as an “AI and electrification” metal because of its role in data infrastructure and electrification, at a time when supply pressures remain a theme. [12]

A major reason silver’s move is commanding attention is that it’s arriving late in the year—when markets often get thin and profit-taking typically increases.

Reuters quoted analysts observing that investors have not treated the year-end period as a time to step away from the trade, with strong demand pushing prices to records anyway. [13]

That said, several analysts are also warning that silver’s volatility cuts both ways. Reuters has flagged the risk of steep corrections even in a structurally bullish market, simply because silver historically moves faster than gold in both directions. [14]

A key metric confirming silver’s outperformance is the gold–silver ratio (how many ounces of silver it takes to buy one ounce of gold).

Reuters reported the ratio has narrowed to roughly 64, down sharply from about 105 in April, reflecting how aggressively silver has caught up—and, recently, outpaced. [15]

FXStreet also pegged the ratio near 64.06 on Monday. [16]

In plain terms: silver isn’t just rising because gold is rising—silver is rising faster.

Forecasts for silver are widening—bulls point to structural deficits and macro tailwinds, while cautious houses warn that the pace of gains looks unsustainable in a straight line.

In Reuters’ Dec. 22 coverage, Macquarie strategists said drivers behind silver’s recent highs include the persistent deficit and stronger import demand in India during the festive period—and they expect silver to average $57 per ounce in 2026. [17]

That forecast matters because it implies meaningful downside from today’s near-$69–$70 neighborhood, even while acknowledging supportive fundamentals.

CBS News cited Capital Economics projecting gold could fall to $3,500 by the end of next year, arguing that a cooling in gold’s speculative boom would likely spill into silver as well. [18]

CBS also quoted Global X ETFs’ Trevor Yates describing the latest leg of the rally as being driven by a 2026 outlook featuring lower rates and a potentially softer dollar, adding that the firm remains constructive on both gold and silver (while acknowledging the path won’t be smooth). [19]

Bottom line on forecasts today: even among bullish narratives, there’s a growing emphasis on volatility and the risk that silver can overshoot before it mean-reverts.

Technical analysts are largely aligned that the trend remains bullish—but momentum indicators are stretched.

FXStreet’s technical forecast described silver as extending a well-established uptrend and printing fresh records around the $69.45 area during the Asian session. It also highlighted that last week’s breakout through $66.40–$66.50 was an important trigger level, while warning that overbought RSI readings argue for caution when chasing breakouts. [20]

A separate market write-up echoed that bullish bias, pointing to silver holding above its 100-hour moving average and showing strengthening momentum signals. [21]

What this means in practice:

The rally is not just a U.S. dollar story. In India, Times of India reported silver futures surged to a record ₹2,14,534 per kilogram on MCX as the global rally spilled over into domestic markets. [22]

This matters because India can be a major swing factor in physical demand—especially during periods of strong seasonal buying.

Silver is now trading in a zone where headlines can move price quickly, because positioning is heavy and liquidity can be thinner near year-end. The market’s next moves are likely to hinge on:

As of early afternoon on December 22, 2025, silver remains near record levels, supported by a powerful combination of macro tailwinds, geopolitical risk hedging, and tightness themes in the physical market. [27]

But today’s coverage also makes one point increasingly clear: the higher silver goes, the more the market is bracing for sharp swings—especially with technical signals stretched and forecasts for 2026 diverging widely. [28]

1. www.bullion.com, 2. www.reuters.com, 3. www.bullion.com, 4. www.reuters.com, 5. www.investing.com, 6. www.reuters.com, 7. www.reuters.com, 8. www.businessinsider.com, 9. www.reuters.com, 10. www.fxstreet.com, 11. www.reuters.com, 12. www.businessinsider.com, 13. www.reuters.com, 14. www.reuters.com, 15. www.reuters.com, 16. www.fxstreet.com, 17. www.reuters.com, 18. www.cbsnews.com, 19. www.cbsnews.com, 20. www.fxstreet.com, 21. uk.investing.com, 22. timesofindia.indiatimes.com, 23. www.reuters.com, 24. www.reuters.com, 25. www.reuters.com, 26. www.reuters.com, 27. www.reuters.com, 28. www.fxstreet.com

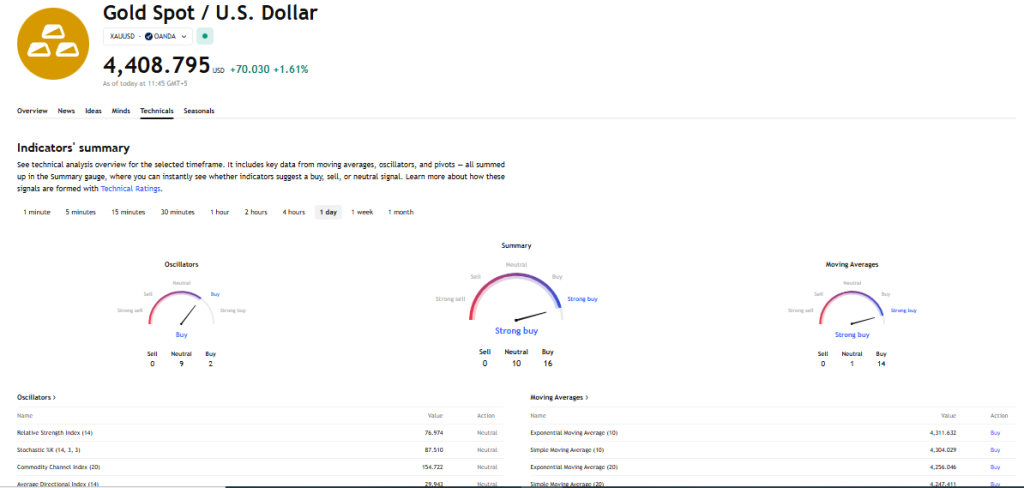

At 11:14 GMT, XAUUSD is trading $4408.58, up $69.81 or +1.61%.

Gold’s advance shows conviction rather than late-stage exhaustion. The metal is now up nearly 70% year-to-date, marking its strongest annual performance since 1979. Central bank accumulation, sustained portfolio hedging, and persistent geopolitical risk continue to absorb supply, keeping pauses brief and shallow.

The former resistance at $4381.44 has been decisively cleared. What capped price last week is now accepted above, reinforcing confidence that higher levels are being built on participation, not thin volume spikes.

A key signal today is gold’s resilience in the face of rising Treasury yields. The U.S. 10-year yield is ticking higher, yet gold shows no sensitivity. When gold rallies alongside firmer yields, it typically reflects urgency to secure exposure rather than rate-driven positioning, reinforcing the strength of current demand.

This behavior suggests positioning is being driven by capital preservation and risk hedging rather than tactical rate trades.

Expectations for lower U.S. interest rates remain a core tailwind. Federal Reserve Governor Stephen Miran reiterated that easing inflation supports rate cuts to offset labor market risks. Gold continues to benefit from lower real-rate expectations even as nominal yields firm.

Updated: December 22, 2025 — 10:23

Natural gas markets are starting the holiday-shortened week with a familiar tug-of-war: weather forecasts that lean warmer (near term) and sturdy supply are keeping prices contained, while LNG logistics, storage trends, and geopolitics continue to inject volatility into regional benchmarks.

Across the major hubs on Dec. 22, Europe’s TTF has edged lower in thin trade, Asia’s spot LNG is sitting near a 20‑month low, and the U.S. market is again revolving around the “big three” drivers—production, demand forecasts, and LNG feedgas flows. [1]

In early Monday trading, Dutch and British wholesale gas prices dipped as ample Norwegian supply and LNG availability counterbalanced expectations for colder weather later across parts of the continent. The Dutch front‑month TTF contract was reported lower around €27.95/MWh (about $9.61/mmBtu) in the morning, with markets quiet ahead of Christmas. [2]

A broader price reference also shows TTF around the high‑€27s on the day—consistent with the idea that Europe is entering late December with prices restrained, not tight, even as winter risk remains. [3]

In Asia, spot LNG continues to feel heavy. Industry pricing cited for February delivery into Northeast Asia put the JKM region around $9.50/mmBtu, down from $10/mmBtu the week prior—marking the lowest level since April 2024. Analysts attribute the softness to muted heating demand, ample Pacific supply, and pipeline gas availability (notably supporting China’s balance), keeping spot buying cautious and price-sensitive. [4]

A key detail for traders: multiple assessments highlighted Europe’s LNG pricing versus TTF and pointed to ongoing competition for cargoes as winter deepens—even though Asia is currently the “softer” side of the global LNG equation. [5]

In the U.S., market commentary today is dominated by near‑record production, milder weather expectations into early January, and strong feedgas demand from LNG export terminals. One widely circulated market summary (citing LSEG and storage data) describes U.S. Lower‑48 output around 109.6 bcfd and forecasts demand (including exports) falling from roughly 144.6 bcfd this week to about 127.5 bcfd over the next two weeks as warmth trims heating needs. [6]

At the same time, LNG remains a stabilizer: feedgas flows to major U.S. LNG terminals have been cited around 18.5 bcfd this month—above November’s record in that same commentary—helping cushion bearish weather shifts. [7]

The near-term setup remains broadly milder than normal, reducing the call on gas for space heating in the U.S. and easing immediate price pressure. [8]

In Europe, traders are balancing that same “now vs. later” weather dynamic: current fundamentals read bearish, but the market remains alert to risk factors that could flip sentiment quickly—especially if cold snaps arrive while storage is already lower than recent years. [9]

Europe’s storage is a centerpiece today: the latest figure cited puts EU gas storage at about 67.24% full—a level that’s not alarming on its own, but lower than recent years entering the heart of winter, raising the chance Europe must compete harder for LNG cargoes in January and February if temperatures turn colder. [10]

In the U.S., storage data referenced in today’s market write-up showed utilities withdrew 167 bcf for the week ended Dec. 12, leaving inventories around 3,579 bcf—described as slightly above the five‑year average (but below year‑ago levels). [11]

One of the most consequential natural gas policy headlines today is out of Australia: the government confirmed a plan that will require east‑coast LNG exporters to reserve a minimum share of gas for domestic use, with a proposed range of 15% to 25%, starting in 2027 (and applying to new contracts). [12]

The move is designed to reduce the risk of price spikes and help address a forecast supply gap on the east coast—an unusual dynamic for a country that is also one of the world’s largest LNG exporters. Reactions are mixed: manufacturers tend to welcome the prospect of more domestic supply, while exporters warn about investment signals and market intervention. [13]

Why it matters globally: Australia is a top-tier LNG supplier into Asia, so any rule that changes how much gas can be exported (even at the margin) is something LNG traders will model into forward balances—especially if winter demand or shipping constraints tighten. [14]

Reuters reporting today says Russia’s pipeline gas exports to China via Power of Siberia are expected up about 25% in 2025, reaching roughly 38.6–38.7 bcm, slightly above the pipeline’s planned annual capacity. [15]

But the same reporting underscores a central structural reality: greater flows to China do not fully replace the value (and scale) of the lost European market, and pricing remains a major hurdle for future Russian pipeline ambitions such as Power of Siberia 2. [16]

This matters for gas pricing because pipeline flows shape LNG demand indirectly: the more China can secure through pipeline gas at acceptable prices, the more selective it can be in spot LNG markets—one reason Asia’s spot buying has stayed cautious even as winter approaches. [17]

Another major headline today: a tanker named Kunpeng loaded LNG from Russia’s Portovaya LNG terminal, which is under Western sanctions, based on ship-tracking data cited by Reuters (Kpler and LSEG). The vessel reportedly arrived Dec. 18 and departed with cargo on Dec. 21—described as the first time this tanker has lifted LNG from a designated project. [18]

Market significance: even relatively small sanctioned volumes can matter at the margin in winter—especially in Europe, where LNG is now a core balancing mechanism. The broader issue is whether enforcement tightens, stays stable, or weakens in practice via transfers and “creative” routing. [19]

On the corporate side, the U.S. LNG growth story is facing a reality check. Reuters reports that Energy Transfer has suspended development of its Lake Charles LNG export project in Louisiana, citing cost pressures, market conditions, and a preference to focus on pipeline projects. The planned project capacity was reported around 16.45 million tonnes per annum. [20]

The company’s own announcement echoed that strategic pivot—suspending development to prioritize a backlog of pipeline investments, while remaining open to discussions with third parties. [21]

Why it matters today: LNG markets price long-term capacity expectations years ahead. Any meaningful delay, cancellation, or de‑risking of U.S. export growth can tighten future balances—especially if demand surprises higher (AI-driven power demand, industrial recovery, or faster coal-to-gas switching). [22]

Europe’s setup is straightforward but unstable: prices are currently subdued by supply, yet storage is lower than recent winters and the market is explicitly watching whether colder weather in early 2026 forces incremental LNG procurement. [23]

In the U.S., the next big directional catalyst remains weather model shifts. The current posture—warmer near-term, lower demand projections—keeps the market sensitive to any change that turns the outlook colder, because production is high but LNG demand has also been running strong. [24]

One notable forward view comes from Goldman Sachs (reported by Reuters): the bank forecasts European TTF averaging roughly €29/MWh in 2026 and €20/MWh in 2027, while expecting U.S. gas prices that “incentivize” production growth at around $4.60/mmBtu in 2026 and $3.80/mmBtu in 2027. [25]

That framing is important: the market is effectively searching for a level that keeps enough supply coming (especially from the U.S.) without crushing demand—an equilibrium that is increasingly shaped by LNG export capacity decisions, like the Lake Charles pause, and by policy choices, like Australia’s domestic reservation plan. [26]

As of Dec. 22, 2025 (10:23), the natural gas story is not a single narrative—it’s a set of interlocking ones:

1. www.tradingview.com, 2. www.tradingview.com, 3. tradingeconomics.com, 4. www.hellenicshippingnews.com, 5. www.hellenicshippingnews.com, 6. in.investing.com, 7. in.investing.com, 8. in.investing.com, 9. www.tradingview.com, 10. www.tradingview.com, 11. in.investing.com, 12. minister.dcceew.gov.au, 13. www.theguardian.com, 14. www.reuters.com, 15. www.reuters.com, 16. www.reuters.com, 17. www.reuters.com, 18. www.reuters.com, 19. www.reuters.com, 20. www.reuters.com, 21. www.businesswire.com, 22. www.reuters.com, 23. www.tradingview.com, 24. in.investing.com, 25. www.reuters.com, 26. www.reuters.com, 27. in.investing.com, 28. www.hellenicshippingnews.com, 29. www.tradingview.com, 30. www.reuters.com, 31. www.tradingview.com, 32. www.hellenicshippingnews.com, 33. in.investing.com, 34. minister.dcceew.gov.au

Silver (XAG/USD) prolongs its recent well-established uptrend and climbs to a fresh record high, around the $69.45 area, during the Asian session. Moreover, the broader technical setup seems tilted firmly in favor of bullish traders and suggests that the path of least resistance for the white metal remains to the upside.

Against the backdrop of repeated rebounds from the 100-hour Simple Moving Average (SMA) over the past two weeks or so, last week’s breakout through the $66.40-$66.50 horizontal resistance was seen as a key trigger for the XAG/USD bulls. A subsequent strength beyond the $67.20-$67.25 region last Friday validates the near-term positive outlook. The white metal currently trades around the $69.25 area, up 3% for the day.

Meanwhile, the Relative Strength Index (RSI) on hourly/daily charts sits above the 70 mark, signaling stretched conditions that could prompt a pause. The 100-hour SMA climbs to $65.57, with price holding well above it, keeping the near-term trend biased upward. Moreover, the Moving Average Convergence Divergence (MACD) stands at 0.19 in positive territory and continues to rise, suggesting strengthening bullish momentum.

Buyers would retain control while XAG/USD remains above the rising 100-period SMA, and a pullback toward $65.57 would meet dynamic support. The MACD staying positive supports the bullish tone, while an overbought RSI suggests consolidation could precede further gains. A decisive continuation above intraday highs could extend the advance, whereas failure to hold above the average would open room for a deeper retracement.

(The technical analysis of this story was written with the help of an AI tool)

(This story was corrected on December 22 at 07:36 GMT to say in the second bullet point that the overbought RSI, not overnight, on hourly/daily charts warrants caution before placing fresh bullish bets.)

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

There is an argument that there is an intervention zone near the 158 yen level, and that might be true, but typically speaking, that is a short-lived phenomenon. And I do think that the market is starting to call the bluff of the Bank of Japan.

Despite the fact that they raised rates, you still get paid at the end of every day to hold this pair. And the US dollar has been strengthening against most things. It’s not just the Japanese yen early in the session. The 155 yen level is a support level. The 158 yen level is a resistance area. We are hanging around in a 300-point range, but this candlestick on Friday is no joke.

And it does suggest that perhaps we have further upside to go. I think momentum in and of itself is an obvious thing, and I have no interest whatsoever in shorting this pair. If the market were to break down below the 155 yen level and perhaps the 50-day EMA, then we could fall to the 153 yen level, but the size of the candlestick tells me that the buyers are here to stay. This is a big move right in the face of the Bank of Japan.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

Robinhood Markets (HOOD) rose in its latest intraday trading, as the stock attempts to relieve part of its clear oversold condition on the RSI indicators, especially with the emergence of positive signals. However, negative pressure remains in place due to trading below its previous 50-day SMA, which reinforces the stability and dominance of the short-term descending corrective trend, particularly with price action moving alongside a supporting trendline.

High-risk warning: HOOD belongs to a group of stocks commonly known as “meme stocks,” which are characterized by heavy speculative activity. As a result, the stock’s price movement often deviates from technical expectations or fundamental analysis, and can at times be sudden and unpredictable.

Therefore we expect the stock to decline in its upcoming trading, especially as long as it remains below the resistance level at $125.60, targeting the pivotal support level at $102.10.

Today’s price forecast: Bearish

The EUR/USD continues to trade within a rebound zone despite recent selling pressure. The pair closed last week stable around the 1.1707 level after bulls failed to capitalize on a test of the 1.1800 psychological resistance. This followed market reactions to policy announcements from both the European Central Bank (ECB) and the Federal Reserve, alongside a batch of US economic releases that had been delayed by the longest government shutdown in US history.

According to reliable trading platforms, the EUR/USD will remain supported as long as bulls can push toward the 1.1800 resistance again. The RSI (Relative Strength Index) is currently reading around 59, supporting a bullish outlook while awaiting strong positive momentum to confirm the upward trend. Quiet and limited movement is expected as the annual holiday season approaches. Conversely, a bearish scenario on the daily chart would require a return to the 1.1500 support area. No major economic data is expected today from either the Eurozone or the US; therefore, the pair will move based on recent drivers amid low liquidity and reduced risk appetite ahead of the holidays.

According to recent Forex market data, the US Dollar retreated after US inflation was announced at 2.7% year-on-year for November, down from 3% in October. this decline contradicted analyst expectations, which had predicted an increase to 3.1%. This suggests the Federal Reserve will feel more comfortable cutting US interest rates again in the coming months.

Influenced by the data release, the US dollar index, which measures the dollar’s performance against other major currencies, fell to 98.20. The euro rose against the dollar to a high of 1.1750, while the British pound also reached a high of 1.3440.

According to the official announcement, the core inflation rate of the US Consumer Price Index (CPI) fell to 2.6% from 3.0% in October, a level that was expected to remain unchanged last month. Economists are treating lower-than-expected inflation with some skepticism, which may explain the dollar’s recovery from some of its earlier losses. Fawad Razaqzadeh, an analyst at City Index, commented that there was some skepticism surrounding this particular inflation report, given the impact of the government shutdown on data collection. He added, “Therefore, it might be best for markets not to overreact to one month’s data and to wait for the December report, which is due in January.” However, markets are accepting today’s figures as they are, buying stocks and selling “safe havens” as investors grow more confident that the Federal Reserve will cut interest rates further.

Meanhwile, the Federal Reserve remains committed to a sustainable 2.0% inflation target while protecting the labor market. If the Fed believes inflation is under control, it will lower rates to support businesses and households. Typically, Expectations of lower rates lead to a weaker US Dollar.

Traders advise monitoring the EUR/USD’s rise toward the 1.18 resistance to consider potential sell positions, provided risk management is strictly applied.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Gold is back in focus as price hold near record territory. On December 22, 2025, XAU/USD was trading close to $4,350, a level that would have sounded unrealistic just a few years ago. Yet today, it feels almost normal. Global investors are no longer asking if gold belongs in portfolios. They are asking how much exposure makes sense.

Several forces are shaping this moment. Interest rate expectations are shifting. Inflation fears have not fully faded. Central banks are still buying gold at a steady pace. At the same time, long-term forecasts are turning bolder. Some analysts now see a path toward $5,000 gold by 2026.

This price action is not driven by panic. It reflects deeper changes in how gold is viewed. Not just as a hedge. But as a strategic asset. The current consolidation near $4,350 shows caution, not weakness. Markets are pausing. Watching data. Waiting for the next trigger. And gold is quietly holding its ground.

As of December 22, 2025, gold hit a record high above $4,383 per ounce, and briefly pushed past $4,400, driven by hopes for more U.S. interest rate cuts and strong demand for safe assets like bullion.

Gold has climbed sharply this year. Prices are up about 67% in 2025, making this one of the strongest annual gains in decades.Even at levels near $4,350, buyers remain active. This shows the market is waiting for strong signals before moving higher. A weaker U.S. dollar and expectations that the Federal Reserve will cut rates next year are adding to the pressure.

Instead of falling back, gold keeps finding support at these high prices. Traders see this as a sign that demand is real, not just short-term speculation. More data will soon show whether this trend continues into 2026 or cools off after a huge rally.

Gold’s role in markets has changed dramatically over the past year. In early 2025, the rally began on safe-haven flows. Now, broad macro trends are backing price strength. This includes investor demand, central bank buying, and fears linked to global instability.

Unlike past cycles where gold only moved during crises, the current environment shows structural drivers pushing prices higher. Central banks have been big buyers of gold for years, and they continue to add reserves. This demand adds a firm base under prices.

Economic uncertainty, persistent inflation fears, and ongoing geopolitical risks have made gold a core part of many portfolios. This has turned gold from a trading asset into a strategic hedge for 2025 and beyond.

Several major financial institutions now see gold rising toward or above $5,000 per ounce by 2026. Reports show that banks like Bank of America and Société Générale have forecasts in this range.

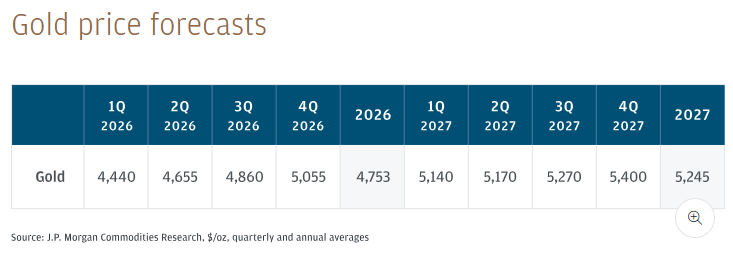

JP Morgan has forecast that gold could average over $5,000 per ounce by the fourth quarter of 2026, citing strong investor interest and central bank buying. Goldman Sachs projects a target near $4,900 by the end of 2026, backed by heavy official gold purchases.

These forecasts are not random guesses. They are based on models that assume continued demand, declining real yields, and broader geopolitical and economic risks remaining elevated. A path toward $5,000 is seen by some analysts as the natural next step if current trends persist.

Gold prices are highly sensitive to U.S. monetary policy expectations. When traders expect the Federal Reserve to cut interest rates, gold usually rises. This is because lower rates reduce the opportunity cost of holding non-yielding assets like gold.

In late 2025, markets priced in multiple rate-cut expectations for 2026. This has weakened the U.S. dollar and boosted gold. Even if rate cuts are gradual, a shift toward easier policy tends to support gold prices. The market is now watching incoming economic data closely for stronger clues on the Fed’s next moves.

Central banks around the world have been buying gold at a fast pace in recent years. This steady demand is not driven by short-term traders. It is structural. Countries diversify reserves to reduce reliance on the U.S. dollar, and gold becomes a key part of that strategy.

The pace of official gold purchases has stayed high through 2025, and projections suggest this trend will continue into 2026. Many banks now see this steady demand as a significant factor in pushing gold prices higher.

Three broad pressures are reinforcing gold’s appeal. First, inflation remains a concern globally, even as some inflation measures soften. Second, high public debt levels in major economies create uncertainty about future policy responses. Third, geopolitical risks continue to drive safe-haven buying.

When these pressures exist together, investors tend to seek assets that protect purchasing power and offer stability. Gold fits both roles. This mix of forces helps explain why prices are not falling back despite already high levels.

Technically, gold has been trading in a high range near $4,350. Analysts watch key support and resistance levels to judge whether the trend will extend or stall. Recent trading has shown gold holding above major support zones, signaling that buyers are active even after a big rally.

Short-term indicators show possible minor pullbacks, but the broader trend remains constructive unless critical levels break to the downside. Trading near these high levels is part of a normal consolidation after strong gains.

Simply calling gold “overvalued” at these levels misses the bigger picture. When adjusted for inflation and other factors, gold’s purchasing power remains strong. Historic comparisons show that current prices reflect long-term structural shifts rather than just short-term bubbles.

Even if price moves slow for a period, the fundamental drivers suggest that higher levels could still be justified over time.

Several risks could slow gold’s rise. A stronger-than-expected U.S. economy might delay rate cuts, boosting the dollar and pressuring gold. Geopolitical risks could ease, reducing safe-haven demand. Or central banks could slow their buying pace if prices rise too fast.

These risks do not make gold bearish. They simply show that the path to potential $5,000 levels is not guaranteed and depends on how key macro factors evolve.

Looking ahead, gold remains an important asset for diversification. Short-term moves may be volatile, but the broader trend shows strong support. Expert forecasts vary, but many see room for further gains. Central bank demand, monetary policy shifts, and ongoing uncertainty all feed into this outlook.

Even if gold does not hit exactly $5,000 in 2026, the trend toward higher ranges suggests it will remain a key part of global markets in the near future.

Many analysts see gold staying strong in 2026. Some forecasts put averages near $4,000-$4,900 per ounce by year‑end, backed by demand and macro trends.

Some major banks like Bank of America and HSBC say gold could hit or approach $5,000 in 2026 if rate cuts and safe‑haven flows persist.

Gold moves with factors like interest rates, U.S. dollar strength, central bank buying, and global risks, making it sensitive to macroeconomic shifts.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.

The GBPJPY pair took advantage of the repeated positive pressures to confirm the continuation of the bullish scenario, surpassing the target at 209.85 on Friday forming 261%Fibonacc extension level, to open the way for recording big extra gains by hitting 211.05 level.

Noticing that stochastic reaches the overbought level, which allows it to settle within the minor bullish channel levels, depending on forming extra support at 209.80 level, to expect forming new gains by its rally towards 211.60 reaching the resistance of the bullish channel at 212.25.

The expected trading range for today is between 210.00 and 211.60.

Trend forecast: Bullish