The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

Gold is testing bearish commitments at the $4,250 psychological level on Thursday, pausing a two-day uptrend as markets weigh a less hawkish than feared US Federal Reserve (Fed) policy announcements.

Gold extended its overnight advance into early Asian trading on Thursday before witnessing a profit-taking pullback as sellers jumped in once again at the $4,250 level.

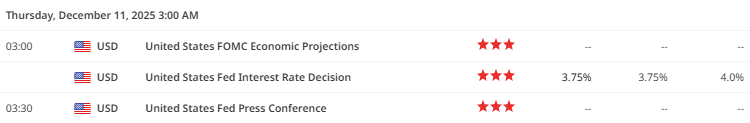

Non-yielding assets such as Gold built on its recent bullish momentum after the Fed delivered on the expected 25 basis points (bps) interest rate cut to 3.5%-3.75% on Wednesday.

Despite the widely anticipated rate cut, the US Dollar was slammed across the board alongside the US Treasury bond yields as Fed Chairman Jerome Powell at his post-meeting press conference stuck to a cautious tone, disappointing those who had been positioned for a more hawkish one.

Markets continued to price in two more rate cuts next year, against the Fed’s median expectation for a single quarter-percentage-point cut next year, powering Gold at the expense of the Greenback.

Traders picked up on the Fed’s concerns over a slowing labor market, lending further support to the bright metal.

Now, with the critical Fed event risk out of the way, the focus turns toward the US employment data, with the Jobless Claims eagerly wait for fresh insights on the state of the labor market ahead of next week’s delayed Nonfarm Payrolls releases.

In the daily chart, XAU/USD trades at $4,225.19. The 21-, 50-, 100- and 200-day Simple Moving Averages (SMAs) climb in bullish alignment, with the shorter ones above the longer ones. Price holds above all these references, reinforcing buyers’ control. The Relative Strength Index (14) prints at 61.83, positive and shy of overbought. Measured from the $4,381.17 high to the $3,885.84 low, the 61.8% retracement at $4,191.95 has been reclaimed, while the 78.6% retracement at $4,275.16 caps the topside.

On dips, the 21-day SMA at $4,157.88 offers initial support, with the 50-day at $4,105.76 cushioning deeper pullbacks. Momentum stays firm while the RSI holds above 50; a loss of the 21-day average could slow the rally and send price toward the 50-day SMA.

(The technical analysis of this story was written with the help of an AI tool)

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The GBP/USD price is trading lower near 1.3365 on Thursday ahead of the London session, pressured by a modest rebound in the US dollar following Wednesday’s Federal Reserve meeting. Despite the pullback, the downside remains limited as the Fed ultimately delivered a dovish tone, encouraging investors to sell the greenback into any strength.

If you are interested in automated forex trading, check our detailed guide-

The Fed cuts the rate by 25 bps for the third straight meeting. However, the voting split, with two members favoring a pause and Trump-appointed Stephen Miran requesting a more substantial move, reflects the growing division within the committee.

In Powell’s press conference, he emphasized that policymakers need time to assess the impact of the easing on the economy. Meanwhile, the Fed projected only one cut in 2026, but traders are speculating on two more cuts, especially after Powell flagged the downside risk to the labor market. The shift in tone triggered a broad dollar sell-off, with the Dollar Index falling to the lowest level since October 21, while the GBP/USD marked a fresh top at 1.3391 before falling.

US yields also slid after the Fed announced fresh Treasury bill purchases, starting from December 12, initiating $40 billion program to stabilize liquidity. The earlier-than-expected balance sheet expansion plan weighed on the yields, adding more pressure on the dollar.

However, the GBP outlook remains complex amid the Bank of England’s easing expectations. Markets now price in an 88% probability of a BoE rate cut next week, following a series of softer UK data that signals easing inflationary pressure. The divergence, with the Fed being flexible and the BoE moving sooner than expected, is limiting the GBP/USD from extending its rally despite dollar weakness.

The broad market sentiment remains cautious as the GBP/USD is left to balance between the dovish Fed and the vulnerability in the pound linked to the BoE. Traders now await the US initial Jobless Claims data due in Thursday’s New York Session for intraday direction.

The GBP/USD 4-hour chart shows the price drifting slowly towards the 20-period MA at around 1.3350. The RSI is off the overbought zone but remains stable, indicating a temporary choppiness before an upside continuation.

–Are you interested to learn more about forex options trading? Check our detailed guide-

However, breaching the 20-period MA could push the price further down towards the 50-period MA at 1.3330, ahead of the demand zone around 1.3275. On the upside, today’s top at 1.3391 remains a key resistance ahead of 1.3420.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The 20-day average at $4.68—decisively broken on Tuesday—was tested and rejected as resistance Wednesday with the session high of $4.70, delivering textbook bearish behavior where prior dynamic support transforms into overhead supply. Yesterday’s daily close below that average locked in the breakdown, immediately shifting focus to the 50-day average as the next prominent dynamic support line on the downside path.

Compounding the bearish case, the lower boundary line of the ascending wedge pattern was violated as well, providing additional technical confirmation for the corrective thrust. Although a brief bounce could materialize before natural gas presses lower, the overall trajectory suggests it will eventually unfold that way after the hard sell-off that followed last week’s $5.50 high.

That $5.50 peak looks to have completed the short-term trend for now, with the decisive selling immediately after and the failure of a key trend indicator like the 20-day average tipping the scales heavily toward bears. Any potential bounce in the near term may encounter resistance at higher price levels, including not just the 20-day average but also the 10-day line at $4.87. Monday’s low found support right around that average, only for Tuesday’s high to meet it as resistance, again illustrating how prior dynamic support is now showing as resistance and providing even further evidence for the bears.

Further bearish alignment appears on the weekly chart, where a one-week reversal has already triggered this week and there is a good chance the close will confirm the breakdown below last week’s low of $4.76. The weekly trend has held strong since the October higher swing low at $2.89, marking seven straight weeks up. This represents the first decisive breakdown of a prior week’s low since then, a development that underscores the shift in sentiment.

The relationship to a couple of rising trend channels provides further indications that the price of natural gas got severely overextended and was due for this bearish correction. Bullish momentum had accelerated sharply following a reclaim of the 200-day average, culminating in natural gas breaking out of a trend channel where the top channel line connects directly to the early-October swing high at $3.59. Then, on the new high day last week, there was a sharp breakout above the top channel line (200%) of the second channel—but that has proven to be a false breakout, as the swift reversal now validates.

Natural gas continues to exhibit clear bearish control with the 20-day breakdown, wedge violation, and emerging weekly reversal all pointing to further downside toward the 50-day average. While a bounce testing the 10-day or 20-day as resistance fits the pattern, the overextended advance demands correction until excess unwinds—defense at the 50-day would signal possible stabilization, but momentum stays firmly with sellers for now.

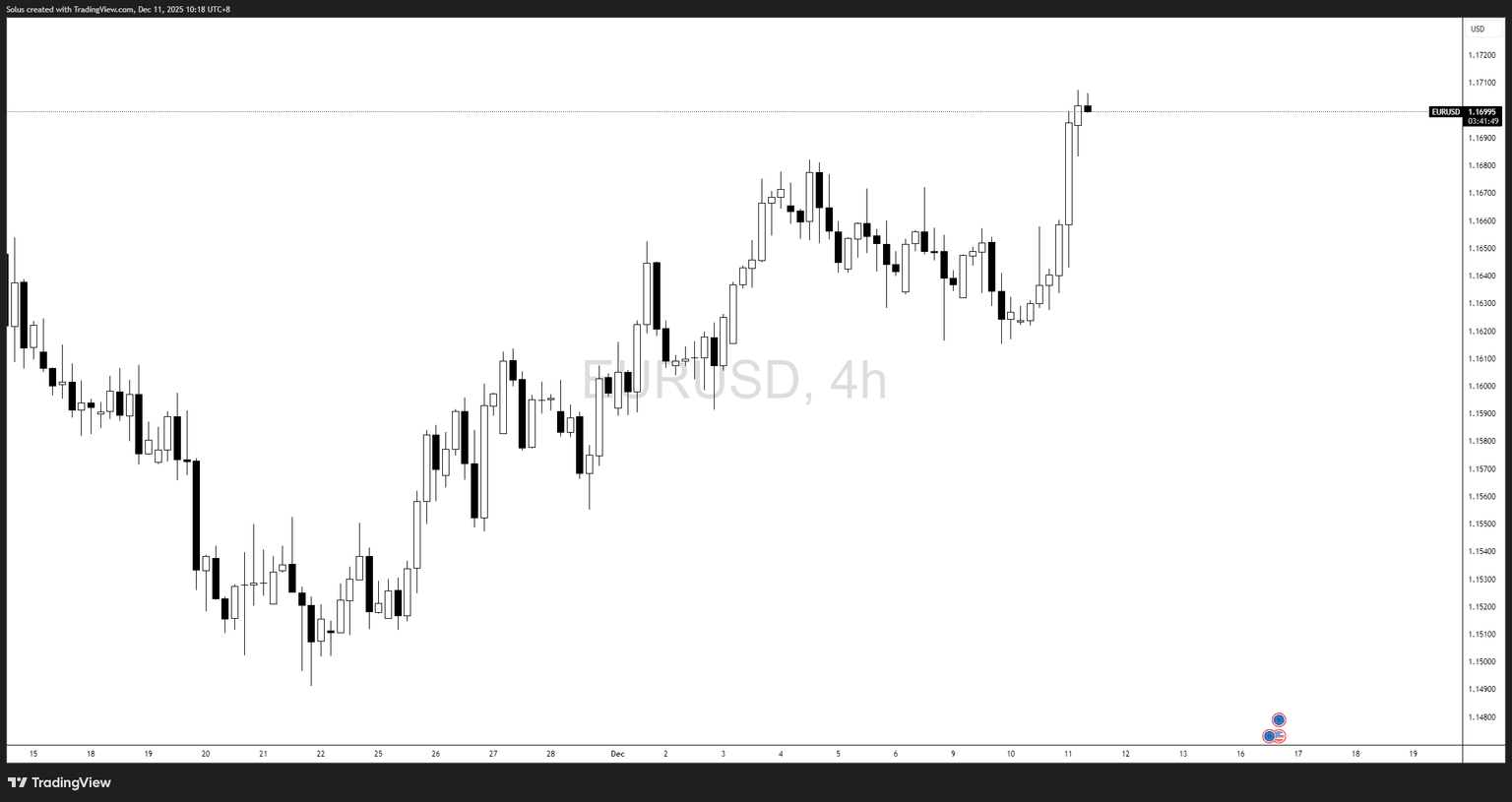

EUR/USD traded sharply higher following the Federal Reserve’s December rate cut, a move that financial markets had largely priced in—but the reaction shows that the tone of Powell’s press conference carried even more weight.

Instead of signaling a one-and-done scenario, the Fed emphasized:

This pushed markets into a deeper dovish repricing, sending Treasury yields lower and undermining USD strength. EUR/USD immediately capitalized, breaking above previous swing highs and tapping levels not seen in weeks.

Even though the ECB is not aggressively hawkish, the euro benefits from:

The result: EUR/USD has shifted into a clearer bullish trend structure, supported by both fundamentals and technicals.

Impact: Bearish USD → bullish EUR/USD

Impact: Reinforces downside pressure on the USD

Powell acknowledged slowing demand and hinted that the balance of risks is shifting. He avoided sounding restrictive—this alone added fuel to EUR/USD buyers.

Impact: Encourages further EUR/USD upside unless future data reverses sentiment

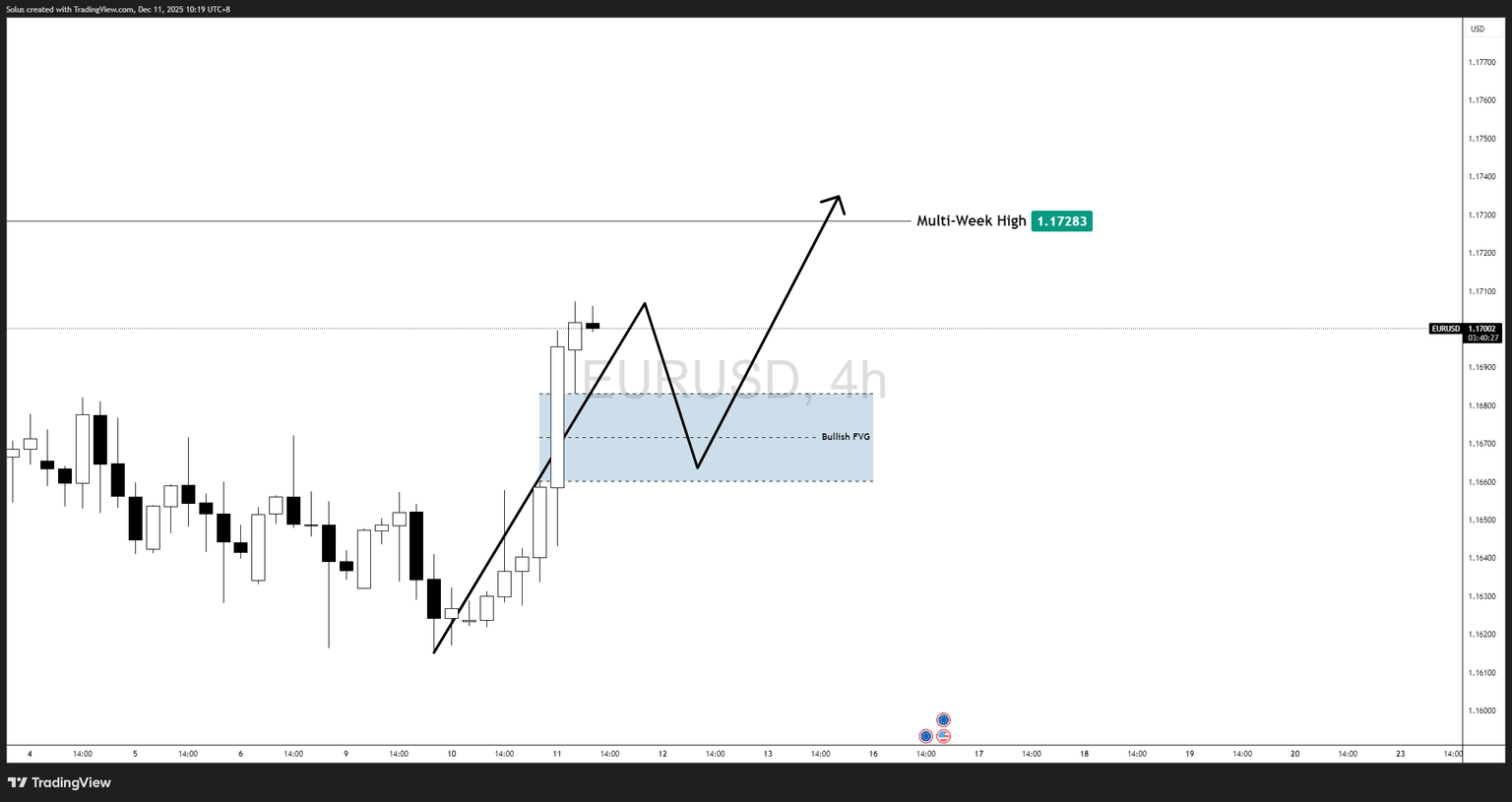

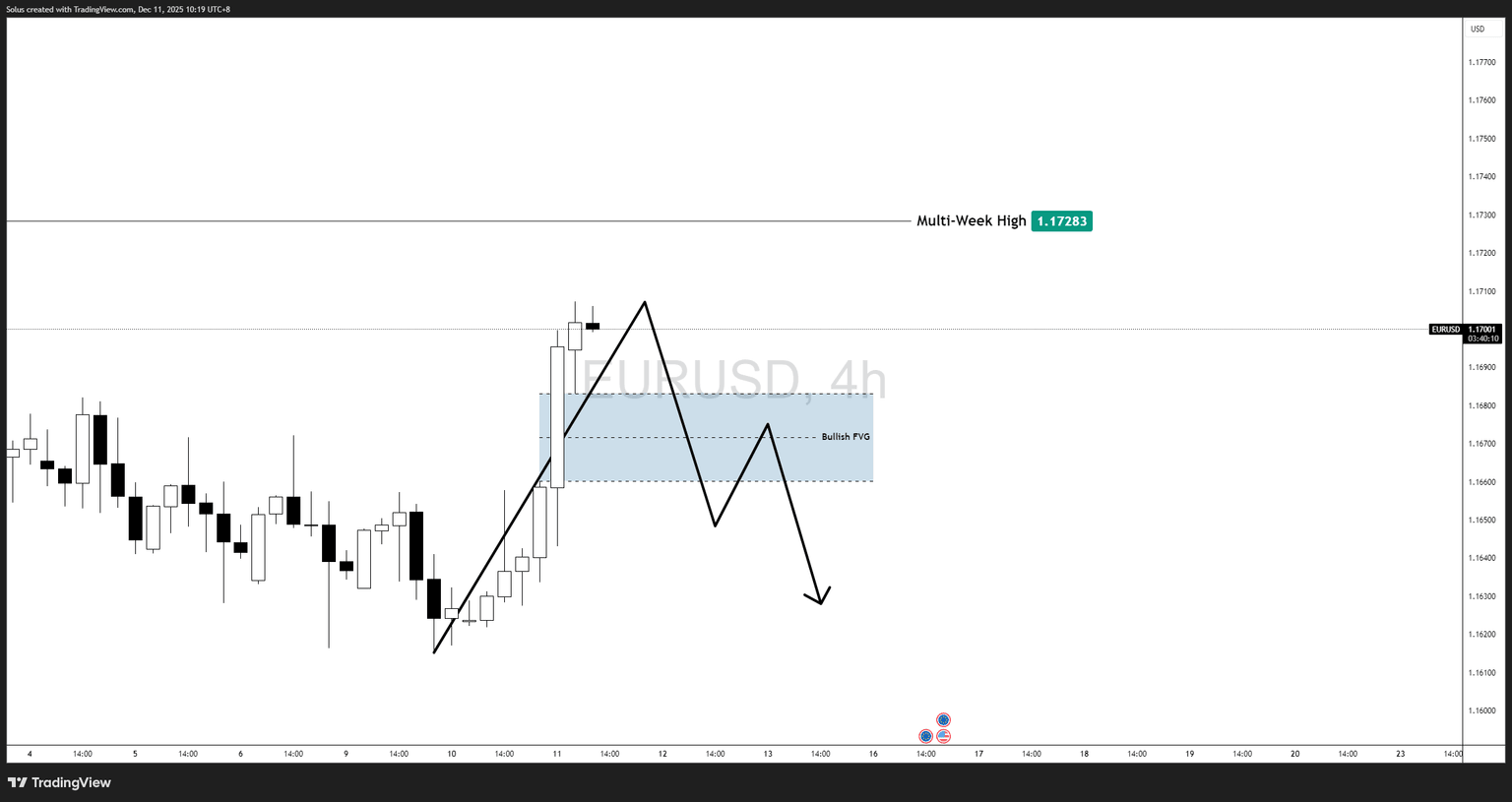

Your 4H charts show a newly formed bullish Fair Value Gap (FVG) following the impulsive rally post-FOMC. Price is currently sitting above the multi-week high around 1.1728, but short-term exhaustion is visible.

The rally has extended aggressively, suggesting that a corrective move into the 4H FVG is possible before continuation. The broader daily structure remains bullish, with clean displacement and a shift toward higher highs.

A bullish continuation remains the higher-probability path if:

Upside targets:

A dovish Fed + structural breakout supports this idea.

A corrective decline may unfold if:

Downside levels:

This would not break the overall bullish narrative but would reset the trend.

The December Fed rate cut has already reshaped USD expectations. With the door open for further easing and the U.S. economy cooling, EUR/USD now has fundamental backing for medium-term upside—provided the Eurozone doesn’t weaken sharply in upcoming data.

Technically, the market wants a pullback. Fundamentally, the dollar wants to soften.

Put together, EUR/USD favors buy-the-dip conditions into the 4H FVG unless macro data flips the narrative.

Platinum price ended the last bullish rally after facing the barrier at $1695.00, to settle below it to form mixed trading by its fluctuating near $1665.00.

The price keeps providing mixed trading, but stochastic attempt to provide bullish momentum to breach the previously- mentioned barrier, reinforcing the chances of recording extra gains that might begin at $1715.00 and $1745.00, while the risk of changing the trend is represented by breaking the support at $1605.00, which forces it to suffer big losses by reaching $1575.00 initially.

The expected trading range for today is between $1645.00 and $1745.00

Trend forecast: Bullish

– Written by

David Woodsmith

STORY LINK Pound to Dollar Rate JUMPS as FED to Pause After Today’s Rate Cut

The Pound to Dollar exchange rate (GBP/USD) rallied to 1.33828 on Wednesday after the Fed cut rates by 25bps but signalled a higher bar for further easing, according to Wells Fargo. “The FOMC reduced the fed funds target range and signaled that additional easing will face a higher bar at its next meeting.”

Despite hawkish dissents, Wells Fargo notes the Fed still maintains an easing bias into 2025, with its policy-rate outlook unchanged. “The Committee maintains an easing bias, with the median 2025 rate unchanged at 3.375%.”

The bank expects the Fed to slow, not end, the easing cycle. “We continue to look for two more 25bps cuts next year.”

Wells Fargo adds that new reserve-management purchases are technical only. “RMPs will have no bearing on our view of the stance of monetary policy.”

PRE-FED:

GBP/USD found some support below 1.3300 and is trading around 1.3320 with a firm dollar limiting scope for any fresh advance.

The Federal Reserve policy decision is likely to be crucial for near-term direction with choppy trading and potential short-term dollar gains if the Fed is cautious over the scope for 2026 rate cuts.

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

Although noting the potential for dollar gains after the Fed decision, ING added; “but the release of what should be soft jobs data next week and seasonal December weakness suggest that today’s dollar rally might not last.

According to UoB; “today, there is scope for GBP to test 1.3265 before a recovery can be expected. Based on the current momentum, a clear break below this level is unlikely. On the upside, resistance levels are at 1.3330 and 1.3355.

IG Group commented; “The early September low at $1.33 is now being fought over, but a close above here helps to reinforce the bullish view.”

There are very strong expectations that the Fed will cut rates later on Wednesday by a further 25 basis points to 3.75% with the main focus on the policy outlook.

ING commented; “The big focus will be the Summary of Economic Projections (SEP), the number of dissenters against the 25bp cut, and then Chair Powell’s press conference.”

BNY Americas macro strategist John Velis commented; “The post-meeting press conference could be – as always – a wild card.”

There is the risk of relatively hawkish comments from Chair Powell and some dissents against the December decision to cut rates.

MUFG commented; “Given the divisions over the outlook it will be difficult for Powell to send a strong message of pause but no doubt by reaching a consensus the message will certainly be that the Fed have been pro-active and can now assess incoming data.”

Some members will also be reluctant to forecast further significant cuts for next year.

BNY’s Velis added; During recent FOMC pressers, Chair Powell’s tone has often departed from the actual policy action taken or the statement accompanying that action. We could easily see a rate cut, a dovish set of dots, and a somewhat hawkish qualitative assessment at Wednesday’s press conference.”

ING commented; “While all the above sounds dollar positive, it is also widely expected. And perhaps it is still a surprise that the rates market still has so much easing priced in. Presumably, this is the Kevin Hassett effect, where his arrival at the Fed in February can throw a dovish cloak over the FOMC outlook.”

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts

– Written by

Frank Davies

STORY LINK Pound to Dollar Price Forecast: GBP Steady with “Dots to Dictate Reaction”

The Pound to Dollar exchange rate (GBP/USD) traded steadily above $1.33 on Wednesday as markets positioned themselves ahead of the Federal Reserve’s final interest rate decision of the year.

At the time of writing, GBP/USD was trading near $1.3310, almost unchanged from the start of the session.

The US Dollar (USD) was muted through Wednesday’s European trade as investors assessed the likely outcome of the Federal Reserve’s evening policy announcement.

Expectations around a December rate cut have swung sharply in recent weeks, but market consensus has now solidified around a 25-basis-point reduction.

With the move largely priced in, attention has shifted to what may come next. Forward guidance from the Fed still holds the potential to move the Dollar, especially if Chair Jerome Powell strikes a firmer tone, as he did following October’s meeting.

According to Scotiabank, “After USD gains earlier this week and markets perhaps expecting a (mildly) “hawkish cut” today, traders are poorly positioned for messaging that leans somewhat dovish.

“After a 25bps cut today, swaps do not have another rate cut fully priced in until mid-2026.

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

“Beyond the rate decision, forecasts and the dots will dictate the market’s reaction.

“No changes are expected in the median dot for the next few years.

“The consensus does expect a mild nudge lower for the long-term median (i.e., terminal rate) dot to 3%, however, which would align a little closer to current market thinking.”

Traders will also parse the updated Summary of Economic Projections (SEP). Should policymakers maintain guidance for just one rate cut in 2026, compared with market expectations for at least two, the US Dollar could receive renewed support.

The Pound (GBP) treaded water on Wednesday, with the absence of UK economic data leaving Sterling without a clear catalyst.

Price action was largely guided by broader market sentiment, with traders hesitant to establish strong positions ahead of the Fed’s announcement.

This caution kept the Pound rangebound, contributing to the subdued tone across GBP/USD markets.

Beyond the Fed decision, focus will shift to the UK’s upcoming GDP release for October.

Economists expect the data to show the economy returning to growth for the first time since June, although only by around 0.1%. Such a muted rebound may provide limited support for Sterling and could instead reinforce concerns over the UK’s lacklustre economic trajectory.

Weak growth prospects would likely strengthen expectations of a Bank of England (BoE) interest rate cut next week, potentially limiting GBP upside.

On the US front, the Dollar may encounter headwinds on Thursday if initial jobless claims point to a larger-than-expected rise in early December, adding weight to the argument for a more accommodative Fed.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts

If gold remains above the 20-day average, now at $4,154, the bull trend structure remains in place and suggests an upside continuation. Last week’s high of $4,264 is the key resistance level to break to show that the buyers are getting more aggressive and it signals a continuation of the rally that began from the October swing low. Although the 20-day average broke during the pullback, the 50-day average was not reached, reflecting relatively strong demand. Similarly, since low the 50-day line has done a good job of tracking potential dynamic support without price having touched it.

In the event that gold gets bearish with a drop below the 20-day average, the 50-day average, now at $4,097, is the next key dynamic support area. Since it has not been tested as support since the August breakout, support is anticipated to be seen around the average if it is approached. Concurrently, if gold breaks below it, that would be a bearish sign and put the near-term uptrend at risk of a deeper correction.

Gold broke out of two rising trend channels in October before failing to sustain the breakout with a drop back into the channels. However, the recent correction has been contained largely near the top of the channels. That is a sign of strength. At the same time, if selling from the failed breakout reasserts itself with a drop below the 50-day average, the rising centerline of the shorter channel becomes a potential target. Currently, the line has converged with a 50% retracement level at $3,825.

On the upside, a sustained breakout above $4,264 swing high targets the completion of an initial measured move target at $4,356. The trend high at $4,381 is the next upside target from there, followed by a 127.2% measured move projection at $4,454.

Gold’s measured recovery and successful 10-day reclaim keep the larger bull trend dominant as long as the 20-day average holds. Clearance of $4,264 unlocks $4,356–$4,381 minimum; any weakness finds initial defense at the 50-day line, with the channel top and centerline confluence as the ultimate backstop before deeper risk emerges.

For a look at all of today’s economic events, check out our economic calendar.

Gold price kept seesawing around the $4,200 mark throughout the first half of Wednesday, unable to attract investors. The FX board has been quiet due to the absence of a clear directional catalyst, exacerbated by the United States (US) government shutdown and the resulting uncertainty, which affected even the Federal Reserve (Fed)’s odds for a December interest rate cut.

However, the release of soft employment-related figures revived speculation that the central bank will deliver. And the day has come, the Fed is expected to announce a 25 basis points (bps) interest rate cut following its two-day meeting in the upcoming American afternoon.

Beyond the rate cut, policymakers are also expected to share their views on economic progress and monetary policy through the Summary of Economic Projections (SEP). Finally, Chairman Jerome Powell will hold a press conference, in which he will explain the officials’ reasoning beyond the decision. Market participants will be looking for clues on the interest rate path for 2026 and 2027.

Ahead of the announcement, the US Dollar (USD) trades with a soft tone while stocks maintain a positive bias. Should the Fed cut rates as expected and hint at more than one rate cut in the foreseeable future, such trends are likely to continue.

In the 4-hour chart, XAU/USD trades at $4,201.02, slightly below its daily opening. The 20-period Simple Moving Average (SMA) has flattened just above the current level and edges marginally lower. At the same time, the 100- and 200-period SMAs continue to rise well below the current level, preserving a medium-term bullish bias. Support aligns with the 100-period SMA at $4,161.04, while the 200-period SMA at $4,100.74 underpins the broader trend. In the meantime, the Momentum indicator remains below 0 and edges higher, while the Relative Strength Index (RSI) sits at 49 (neutral) and turns up, indicating sellers are losing steam.

XAU/USD daily chart shows that the 20-day SMA climbs above the 100- and 200-day SMAs, and all three slope higher, highlighting sustained bullish pressure. Price holds above its key averages, with the 20-day SMA at $4,153.07 offering nearby dynamic support. Finally, the Momentum indicator remains above its midline but eases, pointing to modest deceleration in buying interest, while the RSI indicator stands at 59, consistent with a positive tone.

(The technical analysis of this story was written with the help of an AI tool)

– Written by

David Woodsmith

STORY LINK Fed LIVE: Test for Pound Sterling Bulls, GBP/USD Dependent on Dip Buyers?

The Pound to Dollar (GBP/USD) exchange rate has found some support below 1.3300 and is trading around 1.3320 with a firm dollar limiting scope for any fresh advance.

The Federal Reserve policy decision is likely to be crucial for near-term direction with choppy trading and potential short-term dollar gains if the Fed is cautious over the scope for 2026 rate cuts.

Although noting the potential for dollar gains after the Fed decision, ING added; “but the release of what should be soft jobs data next week and seasonal December weakness suggest that today’s dollar rally might not last.

According to UoB; “today, there is scope for GBP to test 1.3265 before a recovery can be expected. Based on the current momentum, a clear break below this level is unlikely. On the upside, resistance levels are at 1.3330 and 1.3355.

IG Group commented; “The early September low at $1.33 is now being fought over, but a close above here helps to reinforce the bullish view.”

There are very strong expectations that the Fed will cut rates later on Wednesday by a further 25 basis points to 3.75% with the main focus on the policy outlook.

ING commented; “The big focus will be the Summary of Economic Projections (SEP), the number of dissenters against the 25bp cut, and then Chair Powell’s press conference.”

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

BNY Americas macro strategist John Velis commented; “The post-meeting press conference could be – as always – a wild card.”

There is the risk of relatively hawkish comments from Chair Powell and some dissents against the December decision to cut rates.

MUFG commented; “Given the divisions over the outlook it will be difficult for Powell to send a strong message of pause but no doubt by reaching a consensus the message will certainly be that the Fed have been pro-active and can now assess incoming data.”

Some members will also be reluctant to forecast further significant cuts for next year.

BNY’s Velis added; During recent FOMC pressers, Chair Powell’s tone has often departed from the actual policy action taken or the statement accompanying that action. We could easily see a rate cut, a dovish set of dots, and a somewhat hawkish qualitative assessment at Wednesday’s press conference.”

ING commented; “While all the above sounds dollar positive, it is also widely expected. And perhaps it is still a surprise that the rates market still has so much easing priced in. Presumably, this is the Kevin Hassett effect, where his arrival at the Fed in February can throw a dovish cloak over the FOMC outlook.”

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts