Category: Crypto News, News

How stability in crypto market could spark XRP price rally to $3

- XRP price gradually extends gains as the cryptocurrency market holds steady.

- XRP holds above critical support at $2.22, strengthened by the 100-day EMA.

- A breakout from the descending channel could spark significant bullish momentum, potentially driving a rally past $3.

- The surge in long-position liquidations while Open Interest remains unchanged signals declining interest and a potential pullback.

Ripple (XRP) price consolidates gains at the time of writing on Tuesday, following three consecutive daily green candles. Trading at $2.26, XRP is down over 1% on the day, mirroring the stability in the broader crypto market. Recently approved futures XRP Exchange-Traded Funds (ETFs) suggest a stronger bullish outcome is in the offing.

Bitcoin (BTC) remains above $94,000, with its uptrend driven by surging net inflows into spot BTC ETFs, easing trade tensions between the United States (US) and China, as well as short squeezes.

Select altcoins, including Virtuals Protocol, Floki, and Hyperliquid (HYPE), are extending their lead, suggesting that investors are shifting their attention to lesser-known coins that achieve higher profit margins.

XRP price nurtures potential breakout to $3

XRP’s price generally drops within the confines of a descending channel. However, since the cross-border money remittance token rebounded from its yearly low at $1.61 on April 7, the potential for a rally beyond $3.00 significantly increased.

Despite the rejection of $2.36, a level tested on Monday, XRP maintains its position above the 50, 100, and 200-day Exponential Moving Averages (EMAs), confirming bullish momentum. The EMAs are sloping upward, further reinforcing a strong bullish trend.

The 50-day and 100-day EMAs provide immediate support at $2.20 and $2.22, respectively. A reversal to these levels is possible, and XRP could collect more liquidity as traders buy the dip.

The Relative Strength Index (RSI) indicator’s neutral position at 58.11 could hold the scales in the bulls’ favor, especially if it stays above the midline of 50. This could increase the potential for a breakout above the descending channel.

Beyond the seller congestion at $2.40, supply zones at $2.80 and $3.00 are worth remembering as they could slow the potential XRP rally. Higher volume on upward moves will be crucial in pushing XRP toward $3.00.

XRP/USDT daily chart

Factors that could keep XRP price elevated

Several developments could support XRP’s bullish outlook in the near term, including ongoing talks between Ripple and the Securities and Exchange Commission (SEC) regarding a potential settlement. Earlier this month, Ripple and the SEC were granted a temporary stay of the appeals process, allowing for settlement negotiations and enabling the SEC’s commissioners to vote on the matter.

The recently approved futures XRP ETFs could help bolster the token’s bullish outlook over the coming months. Moreover, Ripple’s intentional push to the stablecoin market and tokenization services boosts sentiment.

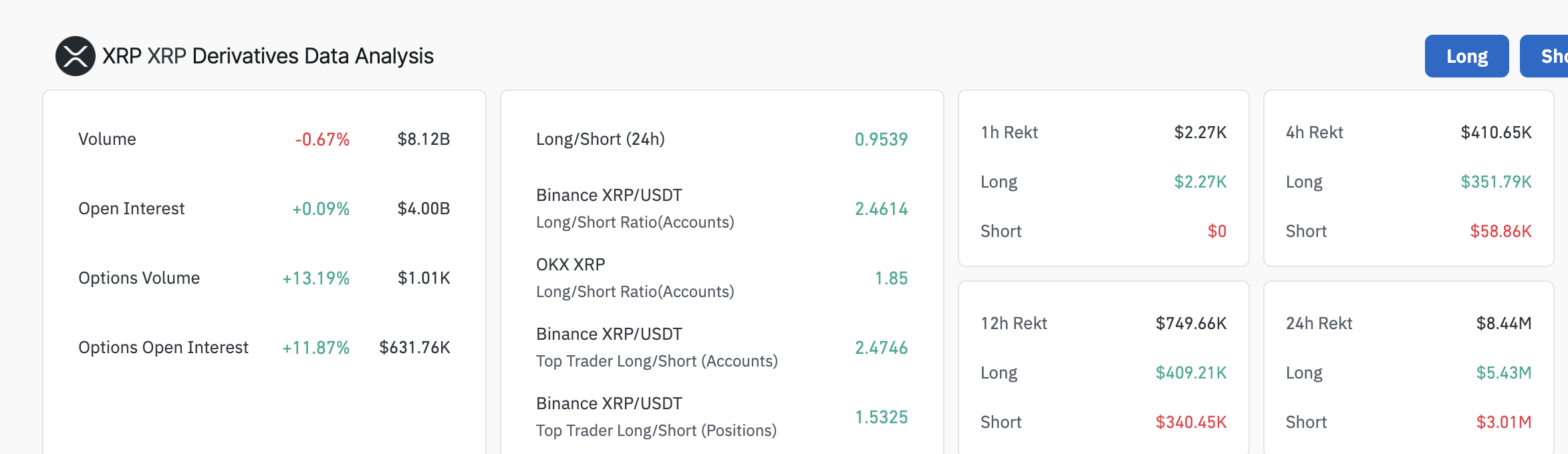

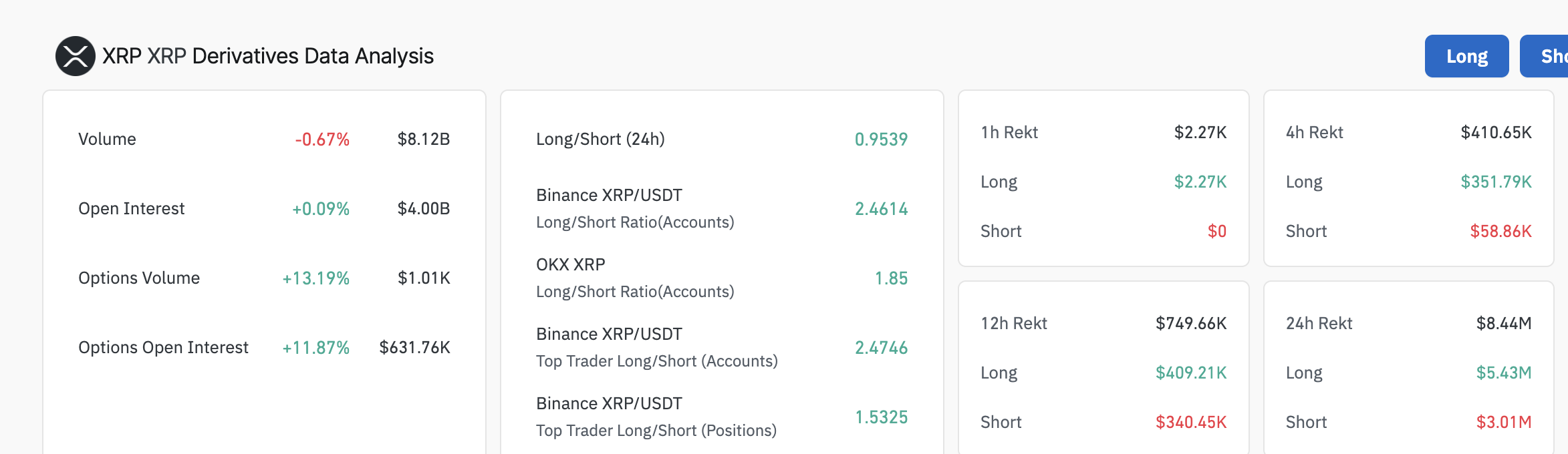

The derivatives data from Coinglass highlights a slight increase in Open Interest (OI) of 0.09% to $4 billion, indicating that new positions are being opened, which reflects growing trader interest.

The long/short ratio of 0.9559 leans towards shorts rather than longs, indicating that confidence among traders is waning. Over $350,000 was liquidated in long positions compared to approximately $59,000 in short positions in the past four hours, suggesting that bulls are being shaken out, which may potentially weaken the bullish outlook.

XRP derivatives’ Open Interest | Source: Coinglass

Beyond the support provided by the 50-day and the 100-day EMAs, XRP could extend the down leg to retest the 200-day EMA at $1.98. A deeper correction to $1.80 is possible if the broader crypto market sentiment turns bearish.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

, allowing for settlement negotiations and enabling

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: