Category: Crypto News, News

Institutional Solana Holdings Rise Amid Price Volatility and Market Uncertainty

Corporate treasury firms are increasingly allocating capital to Solana (SOL), signaling renewed confidence in the blockchain platform despite recent market turbulence. Firms such as Upexi and DeFi Development are among the leading investors, with Upexi holding 1.9 million SOL and DeFi Development holding 1.1 million SOL. While Upexi has incurred a $0.9 million loss due to price declines, DeFi Development has maintained a relatively stable performance. This growing institutional exposure suggests a broader acknowledgment of Solana’s utility in treasury strategies, particularly among early adopters [1].

The increasing rate of corporate Solana acquisition is supported by data from CoinGecko, which shows a sharp uptrend in institutional holdings. Upexi’s aggressive strategy has made it the top holder, but this approach has also exposed the firm to significant short-term volatility. Meanwhile, DeFi Development’s more measured approach has allowed it to retain value amid market fluctuations. The trend reflects a broader shift in the corporate treasury market toward digital assets, with Solana emerging as a key contender in the space [2].

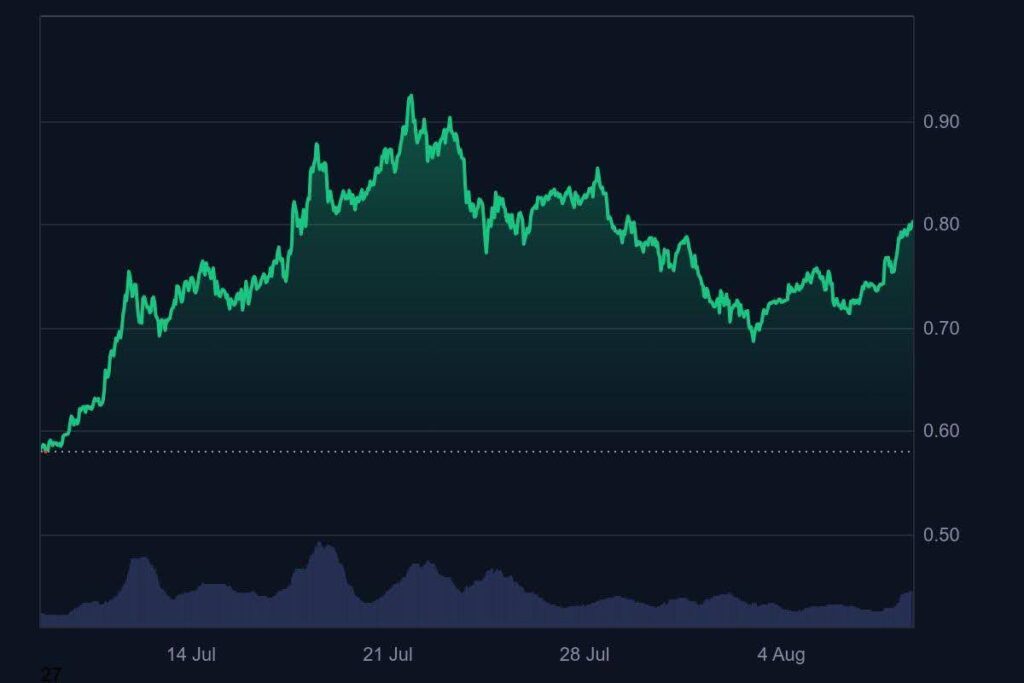

Despite the growing interest, Solana’s price volatility remains a challenge. As of late July 2025, SOL was trading at around $170.69, with a 4.83% increase observed in the past 24 hours. However, the broader trend remains uncertain, with some analysts forecasting a potential 10% price correction before any meaningful recovery could take hold. This uncertainty has created a cautious environment for investors, even as buying pressure intensifies at lower price levels [3].

Retail and institutional traders alike have been closely watching whale activity, which has played a pivotal role in shaping short-term market dynamics. Observations suggest that large investors are accumulating Solana at discounted levels, which has fueled speculation that the price could test the $200 level again in the near future. While bullish forecasts have emerged, with some analysts projecting a price target of $500, more conservative views remain focused on short-term price stability [4].

The growing interest in Solana treasuries is not limited to native tokens. The broader Solana ecosystem has seen a resurgence, particularly with the performance of tokens like Pump.fun’s PUMP, which has drawn attention to the platform’s innovation potential. This diversification of investment opportunities has reinforced the belief that Solana is more than just a fast, low-cost blockchain—it is a growing infrastructure for decentralized finance and digital innovation [5].

The current state of Solana treasuries indicates that early investors and institutional players are positioned to benefit if the market stabilizes. However, the path to recovery is likely to be uneven, with further volatility expected in the short term. As corporate treasuries continue to allocate capital to Solana, the actions of these major holders will play a critical role in determining the asset’s trajectory in the months ahead.

Source: [1] https://beincrypto.com/solana-treasury-trend-coingecko-report/ [2] https://coincentral.com/solana-price-prediction-sol-recovery-possible-but-traders-may-have-to-focus-on-trending-altcoins-for-short-term/

[3] https://www.thecoinrepublic.com/2025/08/06/whales-buying-solana-dip-why-sol-price-to-200-is-possible/ [4] https://coincentral.com/sol-price-prediction-500-target-in-sight-while-solana-slayer-unilabs-finance-aims-for-100x-in-2025/ [5] https://finance.yahoo.com/news/pump-pump-pumping-again-solana-200053615.htmlWritten by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: