Category: Forex News, News

Looks to build on strength above 200-day SMA post-BoJ, ahead of US PCE data

- USD/JPY reverses an intraday dip led by upbeat data from Japan and the BoJ’s hawkish pause.

- The uncertainty over the timing of the next BoJ interest rate hike continues to undermine the JPY.

- Reduced bets for a September rate cut by the Fed act as a tailwind for the USD and spot prices.

The USD/JPY pair attracted fresh buyers following an intraday slide to the 148.60-148.55 region and touched its highest level since early April during the first half of the European session on Thursday. The Japanese Yen (JPY) struggles to capitalize on its gains, led by the upbeat domestic macro data and the Bank of Japan’s (BoJ) hawkish pause. This, along with the underlying US Dollar (USD) bullish sentiment, turns out to be a key factors acting as a tailwind for the currency pair.

A preliminary government report showed that Industrial Production in Japan unexpectedly rose 1.7% from the previous month in June, signaling resilience among manufacturers despite headwinds from US trade tariffs. A separate report revealed that Retail Sales in Japan grew for the 39th consecutive month, by 2.0% year-on-year in June, compared to the previous month’s downwardly revised reading of 1.9% and better than market expectations. The latter suggested that private consumption in Japan remained strong, which, along with the US-Japan trade deal, keeps hopes alive for the BoJ rate hike later this year.

In fact, BoJ Governor Kazuo Ueda, speaking to reporters during the post-meeting press conference, said that Japan’s economy is recovering moderately and that the US-Japan trade deal reduces uncertainty over the economic outlook. Earlier, the central bank, as was expected, decided to maintain the status quo at the end of the July meeting. In the accompanying policy statement, the BoJ reiterated that it will continue to raise the policy rate if the economy and prices move in line with the forecast. Adding to this, an upward revision of the BoJ’s inflation forecast revived bets for a further monetary policy tightening by the year-end.

The initial market reaction, however, turns out to be limited amid the growing acceptance that signs of cooling inflation in Japan and political uncertainty would complicate the BoJ’s policy normalization path. The ruling Liberal Democratic Party’s loss in the July 20 polls fueled concerns about Japan’s fiscal health amid calls from the opposition to boost spending and cut taxes. This suggests that prospects for BoJ rate hikes could be delayed for a bit longer. Meanwhile, the Federal Reserve (Fed) Chair Jerome Powell tempered hopes for an immediate rate cut, which favours the USD bulls and supports the USD/JPY pair.

In fact, Powell said it was too soon to say whether the Fed would cut rates at its next meeting and that the current modestly restrictive monetary policy has not been holding back the economy. Earlier on Wednesday, the US central bank left interest rates unchanged in a split decision that saw two governors dissenting for the first time since 1993. The market focus now shifts to the release of the US Personal Consumption Expenditure (PCE) Price Index later during the North American session. The crucial inflation data will influence the USD and produce short-term trading opportunities around the USD/JPY pair.

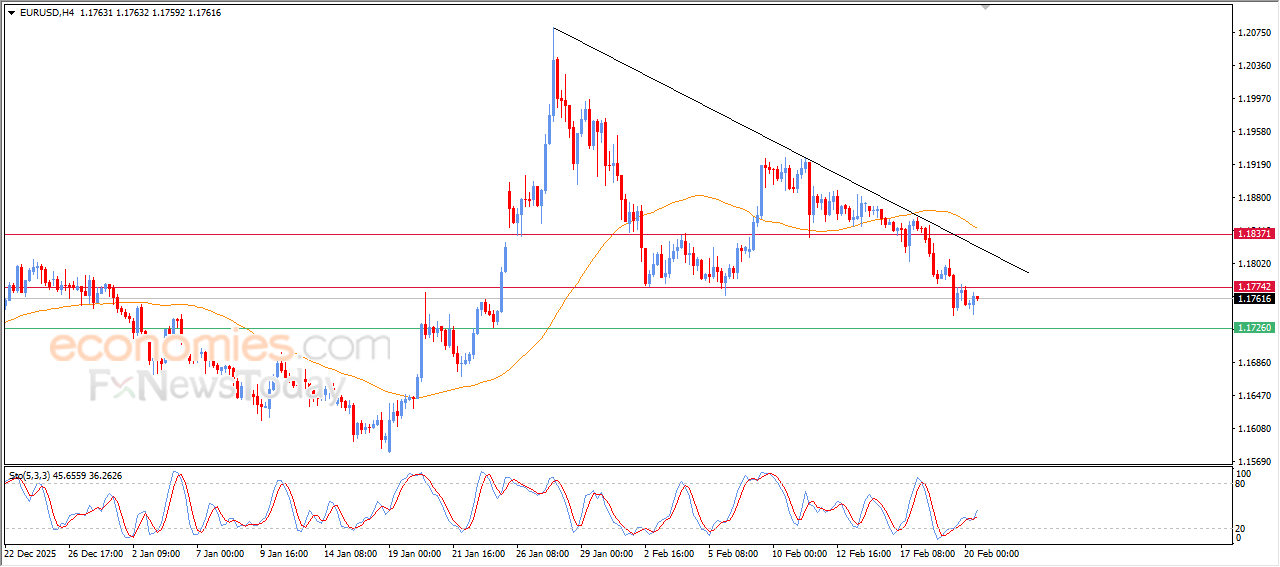

USD/JPY daily chart

Technical Outlook

The USD/JPY pair is now looking to build on the momentum beyond the 200-day Simple Moving Average (SMA) and could aim to reclaim the 150.00 psychological mark amid positive oscillators on the daily chart. The momentum could extend further towards the next relevant hurdle near the 150.40 area before spot prices eventually climb to the 151.00 round figure.

On the flip side, the 149.00 mark now seems to protect the immediate downside. Any further corrective slide might continue to attract dip-buyers and find decent support near the 148.55 region. A convincing break below the latter, however, could drag the USD/JPY pair to the 148.00 mark and the overnight swing low, around the 147.80 area. Some follow-through selling would expose the 147.00 mark and the 100-day SMA, currently pegged near the 146.70 region. The latter coincides with last week’s swing low, which, if broken, might shift the near-term bias in favor of bearish traders.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: