The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

Toronto, Canada, January 9th, 2026, Chainwire

DBTC DeFi today announced the launch of its fully automated decentralized finance platform, designed to generate daily yield without requiring trading, speculation, or ongoing user intervention. In a fast-moving market, where investors often struggle to respond to volatility in real time, DBTC DeFi introduces a system that aims to simplify yield generation by eliminating the need to time the market or actively manage positions.

Why DBTC DeFi Exists

DBTC DeFi was developed to provide a system aimed at generating consistent daily yield, without requiring users to make time-sensitive decisions. The protocol is designed to operate without the need for chart analysis, hardware management, or market timing.

How DBTC DeFi Works

The process is designed to function without technical setup or ongoing user decisions, aiming to provide consistent, automated output.

Key Features of DBTC DeFi

Structured Mechanism Over Market Speculation

DBTC DeFi operates through a structured execution model, rather than relying on speculative investment strategies. The system is designed to function independently of market conditions, with its yield mechanism not dependent on price forecasts or market timing by users.

Starting in Minutes

Sample Investment Structures:

About DBTC DeFi

DBTC DeFi is a leading decentralised finance platform that enables users to generate daily yield through fully automated, hands-off systems. By leveraging global green-energy infrastructure and secure technology, DBTC DeFi offers a reliable and eco-friendly investment solution.

Users can visit: https://dbtcdefi.com and Download the DBTC DeFi App now.

DBTC DeFi

info@dbtcdefi.com

By HOKANEWS Web3 Gaming Desk

The daily puzzle mechanics inside Hamster Kombat have become a defining feature of the play-to-earn gaming trend, and the Daily Cipher continues to be one of the most anticipated challenges for its growing community. On January 08, 2026, thousands of players once again logged into Telegram to decode a fresh Morse-code message in exchange for in-game rewards and HMSTR coins.

Blending classic code-breaking logic with modern Web3 gaming, the Daily Cipher has helped Hamster Kombat stand out in an increasingly crowded Telegram gaming landscape. The challenge is simple in concept, yet engaging enough to keep players returning every day.

The Hamster Kombat Daily Cipher is a recurring daily puzzle that tasks players with decoding a word or phrase written in Morse code. The cipher is made up of dots and dashes, and players must correctly interpret the signals to reveal the hidden message.

Once the correct word is submitted, players receive in-game rewards that can be used for upgrades, leveling, bonuses, and overall progression inside the Hamster Kombat ecosystem. These rewards are part of the game’s internal economy and contribute to long-term advancement rather than instant competition.

One of the key reasons for the feature’s popularity is accessibility. Hamster Kombat operates entirely through Telegram, meaning players do not need to install additional apps or manage external wallets. The official bot handles gameplay and in-game balances, allowing users to participate instantly.

Unlike simple tap-to-earn mechanics, the Daily Cipher adds a layer of active thinking. Players must recognize patterns, interpret Morse code, and submit answers correctly within the daily cycle. This approach encourages learning, problem-solving, and habit-building rather than passive clicking.

In the broader Web3 gaming space, features like the Daily Cipher highlight a shift toward interactive engagement models. By combining familiar logic puzzles with blockchain-inspired rewards, Hamster Kombat appeals to both casual players and those interested in experimenting with crypto-themed games.

For January 08, 2026, the official Daily Cipher word is:

TREND

The Morse code breakdown for today’s cipher is as follows:

Also, read this article: TON Station Daily Combo to unlock more exciting tasks, bonus rewards, and extra coins!

T: dash

R: dot dash dot

E: dot

N: dash dot

D: dash dot dot

Players must enter the decoded word exactly as required to receive their reward.

Solving the Daily Cipher is designed to be straightforward, even for players who are new to Morse code.

First, open Telegram and access the official Hamster Kombat bot.

Next, locate the Daily Cipher icon within the game interface.

Tap the icon to activate Cipher Mode. A visual confirmation screen appears, indicating that the challenge has started.

Use short taps to represent dots and long taps to represent dashes.

Maintain a brief pause between characters to ensure accurate input.

Once the full word is decoded, submit the answer.

If correct, the reward is added instantly to your in-game balance.

The entire process typically takes only a few minutes.

Beyond the Daily Cipher, Hamster Kombat offers several additional ways for players to grow their in-game coin balance.

Daily tasks and recurring events provide consistent rewards for regular participation and are often the primary source of steady progress.

The Toxin Challenge tournament offers competitive gameplay with potential daily payouts reaching up to one million coins, making it a popular option for active players.

Mini-games and elite missions provide alternative earning paths that combine entertainment with progression-based rewards.

By combining these activities with the Daily Cipher, players can optimize their daily earnings without excessive time investment.

Players should remain mindful of basic safety practices while participating in Telegram-based games.

All rewards are issued as in-game coins and do not guarantee real-world monetary value.

Only the official Hamster Kombat Telegram bot should be used to avoid impersonation or scam attempts.

Private keys, recovery phrases, and personal data should never be shared.

This article is for informational purposes only and does not constitute financial advice.

Understanding these limitations helps maintain realistic expectations and ensures a safe gaming experience.

The continued popularity of the Daily Cipher reflects Hamster Kombat’s broader strategy: encouraging daily interaction through lightweight, engaging challenges. By integrating classic puzzles like Morse code into a modern Telegram game, the project has created a unique identity within the Web3 gaming ecosystem.

As chat-based gaming continues to expand in 2026, features that promote thinking, consistency, and community interaction are likely to remain central to player retention.

The Hamster Kombat Daily Cipher for January 08, 2026 once again demonstrates how simple logic-based challenges can drive daily engagement in play-to-earn games. By solving the Morse code puzzle and participating consistently, players can earn HMSTR coins, progress steadily, and enjoy a more interactive gaming experience.

For those exploring Web3 gaming through Telegram, the Daily Cipher offers a balanced mix of challenge and accessibility—proving that earning rewards does not always require complex mechanics or high-risk participation.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer

@Erlin

Erlin is an experienced crypto writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides insights into the latest trends and innovations in the digital currency space.

Check out other news and articles on Google News

Cardano founder Charles Hoskinson says the network’s next growth phase depends on real DeFi usage rather than market hype. In a recent interview with Altcoin Daily, he said Cardano must post stronger on-chain numbers to compete with larger ecosystems. He pointed to user activity, capital flows, and stablecoin growth as the core signals that could define the network’s future direction.

Hoskinson said narrative cycles no longer provide enough momentum for Cardano. Instead, he said measurable DeFi performance must guide the ecosystem’s next stage. Those figures, he noted, should appear clearly on-chain.

He added that has reached its limits as a standalone layer-1 network. To move forward, he said the ecosystem must lean harder into decentralized finance activity. That shift, he argued, could reset growth expectations.

said Cardano’s monthly active users, total value locked, and stablecoin supply must grow sharply. He stated that these metrics need to increase between 10x and 100x from current levels. Such expansion, he said, would place Cardano closer to leading ecosystems.

He directly compared Cardano’s position with Ethereum and Solana. He said those networks already show stronger DeFi activity across key indicators. Cardano, he added, must now match those benchmarks.

Recent actions aim to close that gap. The Cardano Foundation committed eight-figure ADA funding to support stablecoin DeFi liquidity. The move seeks to increase usage and attract deeper capital pools.

Hoskinson said the ecosystem plans to onboard major stablecoins this year. He named USDC and USDT as targets for integration. He said their arrival could improve traction across DeFi applications.

Stablecoin growth, he noted, ties directly to higher transaction activity. That activity, in turn, affects user retention and capital efficiency. He said those links matter for sustained expansion. These liquidity efforts align with broader ecosystem goals. Hoskinson said stronger stablecoin flows could support lending, trading, and payments. Such use cases could lift Cardano’s core DeFi metrics.

Hoskinson described Midnight as part of Cardano’s growth plan rather than a separate bet. He said the privacy-focused sidechain represents a new generation of cryptocurrencies. Its design, he added, serves emerging market needs.

He said Midnight could capture a share in the privacy niche if development moves quickly. That progress, he argued, could draw users from , XRP, and other chains. Those users could then interact with Cardano-based DeFi.

Hoskinson said decentralized applications could benefit by integrating with Midnight. By adding privacy features, he said apps could attract new user segments. Could this hybrid approach deliver the next million users and reshape Cardano’s DeFi metrics?

Also Read:

Charles Hoskinson says Cardano’s next phase depends on measurable DeFi expansion rather than . He points to higher TVL MAU and stablecoin supply as core targets. Integration with Midnight could attract new users and liquidity. The takeaway is clear: on-chain results must now drive Cardano’s growth story.

Cardano founder Charles Hoskinson says the network’s next growth phase depends on real DeFi usage rather than market hype. In a recent interview with Altcoin Daily, he said Cardano must post stronger on-chain numbers to compete with larger ecosystems. He pointed to user activity, capital flows, and stablecoin growth as the core signals that could define the network’s future direction.

Hoskinson said narrative cycles no longer provide enough momentum for Cardano. Instead, he said measurable DeFi performance must guide the ecosystem’s next stage. Those figures, he noted, should appear clearly on-chain.

He added that has reached its limits as a standalone layer-1 network. To move forward, he said the ecosystem must lean harder into decentralized finance activity. That shift, he argued, could reset growth expectations.

Pi Network is steadily transforming the landscape of digital economies by bringing together millions of pioneers under a unified vision of utility, innovation, and community-driven development. With over 60 million users, Pi Network is no longer just a cryptocurrency platform—it is evolving into a Web3 ecosystem that fuses gaming, artificial intelligence, and decentralized finance, offering unprecedented utility for its participants.

The recent announcements highlight two major pillars of the Pi economy: Web3 gaming through CiDi Games and decentralized AI tasks via OpenMind. Both initiatives exemplify the network’s strategy of leveraging community power to generate real-world value, transcending traditional notions of digital currency and positioning PiCoin as a practical tool within a broader digital ecosystem.

Web3 gaming is a fast-growing sector within the blockchain space, offering decentralized ownership, tokenized rewards, and immersive experiences that empower users to participate actively in digital economies. CiDi Games, integrated with Pi Network, provides Pioneers the opportunity to become part of this emerging gaming universe. By participating in game economies, users can earn, spend, and utilize PiCoin, reinforcing the coin’s utility and creating a tangible bridge between digital assets and interactive entertainment.

Beyond gaming, Pi Network’s collaboration with OpenMind introduces a decentralized approach to artificial intelligence. Global AI tasks can be distributed across the network, harnessing the collective computational power and participation of Pi Pioneers. This not only accelerates AI development but also ensures that the benefits of innovation are shared broadly across the community. By combining PiCoin incentives with practical AI applications, Pi Network demonstrates a model where digital currency drives participation and value creation in real-world technological advancements.

The fusion of gaming and AI within the Pi ecosystem represents a new paradigm of utility for cryptocurrency. Rather than being a speculative asset dependent on market fluctuations, PiCoin is positioned as a tool for active engagement, productivity, and creative participation. Users are no longer passive holders; they become contributors, decision-makers, and beneficiaries of a decentralized economic model.

Community engagement is central to Pi Network’s approach. The platform’s 60M+ pioneers are the backbone of its ecosystem, providing the computational, social, and economic input required to sustain both gaming and AI applications. The network’s design ensures that participation is accessible to a broad audience while incentivizing meaningful contributions through rewards, governance participation, and opportunities for skill development.

The decentralized nature of these initiatives reinforces Pi Network’s commitment to Web3 principles. By distributing both computational tasks and governance across its community, the network avoids centralization risks while fostering a cooperative and participatory environment. This model contrasts with traditional centralized platforms, where value creation and decision-making are concentrated among a few stakeholders. Pi Network empowers its pioneers, aligning incentives with active participation and long-term ecosystem growth.

Technically, the integration of CiDi Games and OpenMind within the Pi Network ecosystem requires robust infrastructure. The network has continuously enhanced its blockchain capabilities, ensuring scalability, security, and efficient transaction processing. These improvements are critical as PiCoin moves beyond simple transactions to more complex applications involving gaming economies and distributed AI computation. The technical readiness of the platform is a key factor in enabling widespread adoption and maintaining user confidence.

From a market perspective, these developments position Pi Network as a project with tangible utility, addressing a challenge faced by many cryptocurrencies: demonstrating real-world relevance. By connecting PiCoin to gaming and AI applications, the network creates clear avenues for value generation and economic participation, moving beyond speculative investment to practical engagement. This strategy also enhances liquidity, network activity, and long-term sustainability, as users interact with the coin in meaningful ways.

The integration of Web3 gaming and AI also illustrates the potential for Pi Network to influence broader trends in digital economies. Gaming, AI, and decentralized finance are converging sectors within the blockchain ecosystem. Projects that can successfully combine these domains have the potential to redefine digital engagement, offering users multifaceted opportunities to earn, interact, and innovate within a unified platform. Pi Network’s initiatives exemplify this approach, demonstrating how community-driven ecosystems can create both economic and technological value.

For pioneers, active participation in these initiatives is both rewarding and impactful. Gamers within CiDi Games can earn PiCoin through play, while contributors to OpenMind tasks can leverage their computational resources for AI problem-solving. These mechanisms create feedback loops where participation strengthens the network, enhances utility, and incentivizes further engagement. By fostering such loops, Pi Network ensures that value is continuously created, distributed, and reinvested into the ecosystem.

The broader implications for Web3 adoption are significant. Projects that demonstrate practical utility, community involvement, and technical readiness are better positioned to achieve mainstream recognition and adoption. Pi Network’s focus on gaming and AI not only drives pioneer engagement but also provides a blueprint for other decentralized ecosystems seeking to integrate multiple domains of utility under a single token economy.

Education and onboarding remain essential as the network grows. Pioneers need clear guidance on participating in gaming economies, contributing to AI tasks, and leveraging PiCoin within the ecosystem. The Pi Core Team continues to provide resources, tutorials, and community support, ensuring that participation is accessible, engaging, and productive for all users. This focus on user empowerment is a defining characteristic of the Pi Network model.

Looking ahead, Pi Network’s emphasis on utility positions it for long-term growth and sustainability. By aligning its 60M+ pioneers with Web3 gaming and decentralized AI, the network is creating a self-sustaining economy where value flows organically through participation, collaboration, and innovation. This approach contrasts with many cryptocurrencies that rely solely on speculative demand, demonstrating that a well-structured, community-driven ecosystem can generate real-world impact.

In conclusion, Pi Network is redefining the role of digital currency by combining gaming, AI, and decentralized participation within a single ecosystem. Its 60M+ pioneers are not just users—they are contributors, decision-makers, and beneficiaries of a growing Web3 economy. Through CiDi Games and OpenMind, PiCoin gains practical utility, real-world relevance, and a foundation for long-term adoption. As the network continues to expand, Pi Network exemplifies how community, innovation, and decentralized power can converge to create a sustainable, engaging, and valuable digital economy for pioneers worldwide.

Writer @Victoria

Victoria Hale is a pioneering force in the Pi Network and a passionate blockchain enthusiast. With firsthand experience in shaping and understanding the Pi ecosystem, Victoria has a unique talent for breaking down complex developments in Pi Network into engaging and easy-to-understand stories. She highlights the latest innovations, growth strategies, and emerging opportunities within the Pi community, bringing readers closer to the heart of the evolving crypto revolution. From new features to user trend analysis, Victoria ensures every story is not only informative but also inspiring for Pi Network enthusiasts everywhere.

The articles on HOKANEWS are here to keep you updated on the latest buzz in crypto, tech, and beyond—but they’re not financial advice. We’re sharing info, trends, and insights, not telling you to buy, sell, or invest. Always do your own homework before making any money moves.

HOKANEWS isn’t responsible for any losses, gains, or chaos that might happen if you act on what you read here. Investment decisions should come from your own research—and, ideally, guidance from a qualified financial advisor. Remember: crypto and tech move fast, info changes in a blink, and while we aim for accuracy, we can’t promise it’s 100% complete or up-to-date.

The SUI price is trading sharply higher today, outperforming several major altcoins as on-chain activity and DeFi participation picked up over the past few hours. The move is being supported by rising transactions, stable liquidity, and expanding trading volumes, suggesting this is more than a short-lived speculative spike.

SUI is currently hovering near the $1.9–$2.0 zone, with over a 25% jump in the past 24 hours. The market cap increased above $7.44 billion, while the trading volume surged by over 85%, reaching over $1.65 billion. Sui always ranks among the coins that experience significant growth whenever the market recovers. The buying power of SUI is currently very strong and overwhelming, which has helped the price to surpass the previous peaks.

Now the question arises, will the SUI price continue to rise and mark new highs?

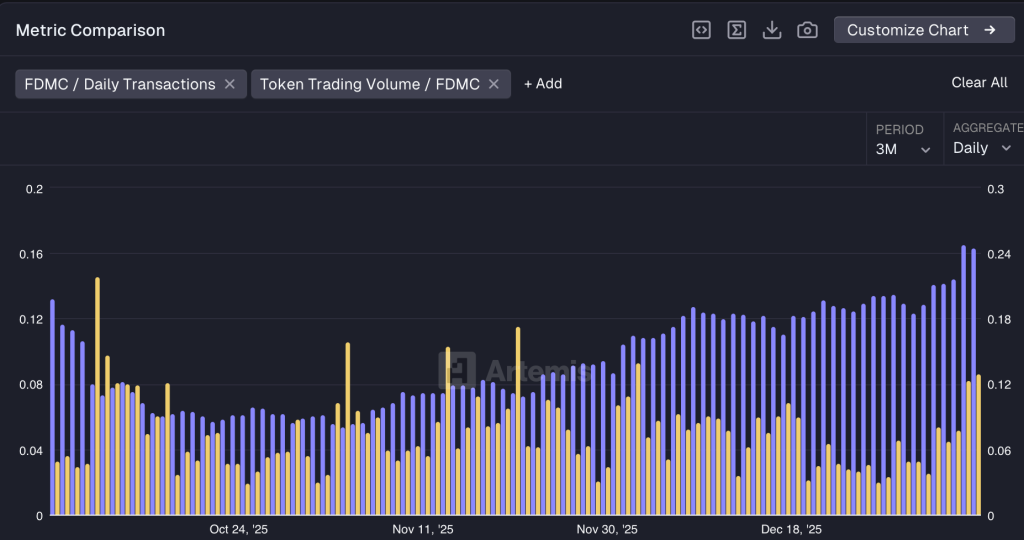

As SUI trades higher, on-chain data offers critical insight into whether the rally is driven by speculation or real network demand. This chart from Artemis displays a comparison of Sui’s daily transactions relative to its fully diluted market cap (FDMC) with token trading volume relative to FDMC over the past three months, highlighting how usage and market activity are evolving together.

The data shows a steady increase in transaction intensity, particularly since late November, suggesting that network activity is growing faster than SUI’s valuation. This points to expanding real usage across the ecosystem, including higher smart contract and application-level interactions.

Meanwhile, trading volume relative to FDMC remains volatile and largely range-bound, marked by brief spikes rather than sustained expansion. This divergence signals that recent price strength is not being fueled by excessive speculative trading.

Overall, the decoupling between rising usage and contained speculation supports the view that SUI’s current price trend is backed by organic adoption rather than short-term hype.

Blockchain data shows a visible pickup in transaction activity during the same period SUI’s price gained momentum. Despite the price surge, capital has not exited the Sui ecosystem. Total Value Locked has remained stable to slightly positive, indicating that investors are holding positions rather than selling into strength. Moreover, DEX activity on Sui has increased meaningfully, with the volumes rising in tandem with price.

This alignment between price and usage often reflects genuine demand, not just exchange-driven trades. Higher transaction counts point to increased smart contract interactions, more active wallets and stronger short-term ecosystem usage. This behavior also contrasts with typical short-term pumps, where liquidity drains quickly. In SUI’s case, capital commitment remains intact, reinforcing the bullish structure.

SUI has entered 2026 with a notable rebound after a prolonged downtrend, putting focus back on its daily structure. The chart highlights a recovery from a clearly defined base formed in December, with price now attempting to reclaim key levels. Importantly, this move comes as trend and volume indicators begin to show early signs of improvement, suggesting the bounce may have follow-through. With Supertrend and OBV in focus, traders are now assessing whether SUI can extend toward higher resistance zones.

The daily chart shows SUI rebounding from the $1.4–$1.6 demand zone after a prolonged decline from above $3. Price is now pushing toward the Supertrend level, making $2.10–$2.20 the first upside target. A decisive Supertrend flip could open the door toward $2.35–$2.50, with $3.0 acting as a major resistance if momentum strengthens. Meanwhile, OBV has flattened and started to curl higher, signaling reduced selling pressure. A breakdown below $1.45 would invalidate this recovery setup.

SUI’s recent rebound is showing early signs of structure rather than a random relief bounce. The combination of a defended demand zone, price pressing toward the Supertrend, and improving OBV suggests selling pressure is easing. As long as SUI holds above the $1.45–$1.50 base, upside attempts toward the $2.2 and $2.5 resistance zones remain valid. However, a sustained trend reversal will only be confirmed if the price can flip the Supertrend and maintain higher volume participation. Until then, the move should be viewed as a developing recovery rather than a confirmed uptrend.

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

BOCA RATON, FL, Jan. 05, 2026 (GLOBE NEWSWIRE) — DeFi Development Corp. (Nasdaq: DFDV) (the “Company”), the first public company with a treasury strategy built to accumulate and compound Solana (“SOL”), today announced the publication of a comprehensive analysis detailing Solana’s industry-leading performance across the most important onchain metrics in 2025. The full report is available here: https://defidevcorp.beehiiv.com/p/solana-2025

With 2025 now in the rear-view, the smart contract war has entered its second decade. For a second consecutive year, Solana not only outperformed every major smart contract platform but extended and compounded its lead across real demand and economic activity. The data shows Solana decisively ahead of Ethereum, BNB Chain, and all other competitors across usage, growth, and economic gravity.

Key highlights from the report include:

• Transactions & Throughput: Solana processed approximately 33.1 billion transactions in 2025, up 28% YoY, more than all other major blockchains combined. Solana also averaged over 1,100 transactions per second, a 34% increase from 2024.

• User Growth: Solana added approximately 1 billion new wallets in 2025, a ~50% year-over-year increase and more than every other major chain combined.

• Developer Ecosystem: Solana hosted approximately 10,753 active developers in 2025 (+41% YoY), surpassing Ethereum’s developer count.

• Onchain Economic Activity: Decentralized exchange (DEX) volume on Solana surged to $1.57 trillion, up 126% YoY, and eclipsed Ethereum’s ~ $946 billion total.

• Network Revenue: Solana generated approximately $1.41 billion in onchain fees, surpassing Ethereum even as fee levels remained dramatically lower.

• Fee Stability: Using DeFi Development Corp.’s Fee Stability Ratio (FSR), Solana scored roughly 743, signaling astronomically lower median transaction fees and median transaction fee volatility than peers.

• Tokenized Markets: In just six months following the launch of tokenized equities on Solana, the network processed approximately $2.9 billion in tokenized stock volume, more than any other chain.

The 2025 Solana Dominance Report is data-driven and transparent, drawing on publicly available metrics across transactions, wallet growth, throughput, developer activity, economic volume, revenue, fee reliability, and emerging markets such as tokenized securities.

To read the full analysis, visit: https://defidevcorp.beehiiv.com/p/solana-2025

About DeFi Development Corp.

DeFi Development Corp. (Nasdaq: DFDV) has adopted a treasury policy under which the principal holding in its treasury reserve is allocated to SOL. Through this strategy, the Company provides investors with direct economic exposure to SOL, while also actively participating in the growth of the Solana ecosystem. In addition to holding and staking SOL, DeFi Development Corp. operates its own validator infrastructure, generating staking rewards and fees from delegated stake. The Company is also engaged across decentralized finance (“DeFi”) opportunities and continues to explore innovative ways to support and benefit from Solana’s expanding application layer.

The Company is an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions, as well as value-add services, to multifamily and commercial property professionals, as the Company connects the increasingly complex ecosystem that stakeholders have to manage.

The Company currently serves more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders, including more than 10% of the banks in America, credit unions, real estate investment trusts (“REITs”), debt funds, Fannie Mae® and Freddie Mac® multifamily lenders, FHA multifamily lenders, commercial mortgage-backed securities (“CMBS”) lenders, Small Business Administration (“SBA”) lenders, and more. The Company’s data and software offerings are generally offered on a subscription basis as software as a service (“SaaS”).

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including concerning the warrant distribution; the anticipated record date and distribution date for the warrant; the anticipated gross proceeds from the exercise of warrants; the expected use of proceeds; the acceptance to trading of the warrants on the Nasdaq Capital Market; the prices of the warrants; and the existence of a market for those warrants. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” strategy,” “future,” “likely,” “may,”, “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control, including market risks, trends and uncertainties, and other risks and uncertainties more fully in the section captioned “Risk Factors” in the Company’s most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor Contact:

ir@defidevcorp.com

Media Contact:

press@defidevcorp.com

HONG KONG, HONG KONG, January 5th, 2026, Chainwire

TermMax, the leading fixed-rate protocol for decentralized finance, today announced the launch of the first fixed-rate borrowing market for tokenized stock collateral on BNB Chain, making Ondo Global Markets’ tokenized securities eligible collateral.

The launch comes amid unprecedented market volatility over the past two months, which has driven significant institutional demand for fixed-rate solutions in DeFi. While variable-rate protocols expose users to unpredictable borrowing costs and yield fluctuations, TermMax delivers the rate certainty institutional capital requires—mirroring the stock-borrowing experience familiar to traditional finance participants—while providing flexibility for early repayment or rollover extensions.

“Recent market turbulence has validated what we’ve long believed: institutions need rate certainty to deploy capital at scale in DeFi,” said Jerry Li, CEO at TermMax. “Our fixed-rate tokenization mechanism eliminates interest rate risk, enabling treasuries and institutional allocators to plan with confidence.”

Institutional Infrastructure Meets Fixed-Rate Innovation

TermMax’s protocol architecture addresses the core requirements of institutional DeFi participation. The platform’s zero-coupon bond model delivers predetermined yields for lenders and transparent borrowing costs, eliminating the rate volatility that has historically deterred institutional capital.

The growing Digital Asset Treasury (DAT) sector has demonstrated increasing demand for institutional-grade infrastructure. As corporate treasuries and asset managers allocate to digital assets, the need for sophisticated fixed-income products has become critical. TermMax’s curated vault system enables professional managers to deploy capital across multiple fixed-rate markets while maintaining rigorous risk parameters.

First-Mover Advantage in RWA Collateral

Following its roadmap, TermMax is expanding into RWA markets by integrating Ondo Global Markets tokens as eligible collateral. Ondo Global Markets, which has rapidly grown to become the largest tokenized securities platform with over $350 million in TVL, offers access to more than 100 tokenized U.S. stocks and ETFs.

This integration enables holders of tokenized equities to access fixed-rate liquidity against their positions—a capability previously unavailable in DeFi. By bridging traditional securities with fixed-rate borrowing, TermMax creates new capital efficiency opportunities for both crypto-native and traditional finance participants.

“The convergence of RWAs and fixed-rate DeFi represents the next evolution of on-chain finance,” added Jerry Li. “Being the first to offer Ondo Global Markets collateral for fixed-rate borrowing, TermMax is at the intersection of two of the fastest-growing sectors in digital assets.”

Addressing the Gap in RWA

The private credit sector’s expansion into blockchain infrastructure and the rapid tokenization of traditional securities have created substantial demand for fixed-rate products. TermMax provides fixed-rate stock token borrowing, allowing users to roll over for long-term borrowing or repay early at any time with minimal break-funding costs—the same flexibility as stock borrowing in traditional finance.

With physical delivery capabilities, TermMax can support options markets for stock token holders, enabling them to earn yield through covered call strategies. At the same time, users gain access to call and put options—extending financial engineering capabilities to stock token options markets-and this innovation has already been realized on BNB Chain for Binance Alpha token markets at TermMax.

Over-collateralization requirements and transparent on-chain tracking of all loan positions deliver risk management capabilities aligned with institutional standards.

About TermMax

TermMax is a fixed-rate tokenization protocol revolutionizing borrowing and lending in decentralized finance. By leveraging specialized tokens and smart contract logic, TermMax delivers predictable returns for lenders and transparent costs for borrowers. The protocol bridges traditional fixed-rate financing with DeFi, serving both institutional and retail users. For more information, users can visit https://ts.finance/termmax.

Contact

Growth Lead

Weiting Chen

Term Structure

weiting.chen@tkspring.com

Have you thought about playing the best NFT games and earning rewards while having fun? An NFT game gives you a chance to earn digital assets you actually own, trade, or sell, instead of just playing for points that disappear. These games are revolutionizing the way we think about gaming by combining entertainment with real-world value.

In this article, we are diving into how to choose the best NFT games, how to start playing them, and the key trends shaping the future of NFT gaming. Specifically, from earning opportunities to asset ownership and cross-game utility, we’ll cover everything you need to know to get started. Read on to find out.

| Game | Launch Year | Key Features | Platform | Blockchain |

| Axie Infinity | 2018 | Players collect, breed, and battle fantasy creatures called Axies. | PC, Android, iOS | Ronin (Ethereum Sidechain) |

| The Sandbox | 2018 | User‑generated voxel worlds, LAND/ESTATE ownership, NFT marketplace, Game Maker, social metaverse | PC, Mac | Ethereum / Polygon |

| Illuvium | 2024 | A virtual metaverse where players can build, own, and monetize gaming experiences. | AAA RPG, capture/battle Illuvials (NFT creatures), auto‑battler, open world, DAO governance, IlluviDEX | Immutable X (Ethereum Layer 2) |

| Alien Worlds | 2020 | Open-world RPG where players capture creatures called Illuvials. | Web, PC, Mobile (coming) | WAX, Ethereum, BNB Chain |

| Splinterlands | 2018 | Collectible card game with automated battles. | Web Browser, Mobile | Hive |

| Decentraland | 2020 | Decentralized 3D virtual reality platform with land ownership as NFTs. | Web Browser, PC, Mac | Ethereum |

| Nifty Island | 2024 | Social gaming platform with customizable islands and NFT interoperability. | Web | Ethereum (with plans for Solana & Base) |

| God Unchained | 2018 | Competitive card game, true asset ownership, esports focus | PC, Mac, Mobile (Beta) | Immutable X (Ethereum Layer 2) |

| Sorare | 2019 | Fantasy sports game with digital player cards | Web, Mobile | Ethereum |

| Shrapnel | 2024 | AAA first-person shooter with player-created assets. | PC | Avalanche |

NFT gaming in 2026 is more mature, more stable, and more focused on real player value than it was a few years ago. You are no longer choosing between fun and earning potential. The best NFT games now combine engaging gameplay with systems that reward time, skill, and smart decisions. Some titles focus on competition, others on strategy or collecting, but all of them give you a chance to earn assets you can actually own. Below, we start with a game that helped define the play to earn games space and still sets the standard for how players can make money playing games.

Axie Infinity remains one of the most recognized NFT video games because it blends strategy, ownership, and a working player economy. In the game, you build a team of creatures called Axies, each with unique abilities that affect how they perform in battles. These Axies are NFTs, which means you fully own them and can trade them with other players on the marketplace.

Gameplay revolves around turn based combat, daily tasks, and competitive matches against other players. Winning battles and staying active allows you to earn in game tokens that can be used inside the game or exchanged outside of it. Another major part of the experience is breeding. You can combine Axies to create new ones, then sell those Axies to other players who want specific traits or stronger teams. This makes trading nfts a central part of how players earn.

Axie Infinity runs on the Ronin blockchain, which was built to support fast transactions and low fees. This makes it easier for you to manage assets without losing value to high costs. In addition, the game also uses Axie Infinity Shards, known as AXS, which lets players take part in governance and long term decisions around the project.

If your goal is to profit from playing Axie Infinity, there are multiple earning paths. You can focus on competitive play, smart breeding, or marketplace activity. Success takes learning and patience, but for players who invest time into understanding the system, Axie Infinity continues to be one of the strongest earning focused NFT games available in 2026.

The Sandbox is a crypto gaming platform for players who enjoy creativity and ownership. Instead of focusing on combat or progression, this game centers on building, designing, and trading digital experiences. You explore a virtual world made up of land parcels, known as LAND, which are NFTs owned by players. Each piece of land can be developed into exciting games, social spaces, or interactive experiences that other players can visit.

Gameplay in The Sandbox revolves around creation and participation. You can design characters, objects, and environments using the game’s tools, then turn those creations into NFTs. These assets can be sold or traded in the marketplace, giving you a clear path to earning through creativity rather than competition. Many players focus on designing popular experiences or rare items that attract demand from other users.

Understanding how to buy nft assets is key to getting started. Typically, you need a crypto wallet and the platform’s native token to buy items from the marketplace. Once purchased, these NFTs belong to you and can be held, traded, or used to build experiences inside the game. Ownership is recorded on the blockchain, which helps keep transactions transparent and secure.

The Sandbox uses its own token to handle in game activity, rewards, and governance. This allows players to take part in decisions that shape the platform’s future. Strong partnerships with brands, artists, and creators have helped keep the ecosystem active and relevant.

When you think about combining stunning visuals with the chance to generate profit through gameplay, Illuvium stands out as a top contender. This open-world role-playing game (RPG) immerses you in a beautifully designed alien planet where you can explore, battle, and collect creatures known as Illuvials. Each Illuvial is a unique NFT, giving you full ownership and the ability to trade them on some of the best NFT marketplaces.

Illuvium’s gameplay is a mix of exploration and strategy. You’ll venture across diverse landscapes, capturing Illuvials and assembling a powerful team to compete in battles. They’re NFTs that you can sell or trade, offering a real opportunity to earn. The game operates on the Ethereum blockchain, ensuring secure transactions and ownership of your digital assets.

To get started, you’ll need a crypto wallet and some Ethereum to participate in the game’s economy. Illuvium also features its own token, ILV, which can be used for staking, governance, and rewards. The game’s marketplace is a hub for trading Illuvials, weapons, and other in-game items, making it one of the best NFT marketplaces for players looking to profit from their gaming efforts.

Illuvium’s combination of high-quality graphics, engaging gameplay, and financial opportunities has made it a favorite among gamers and crypto enthusiasts alike. Whether you’re exploring the alien world or trading NFTs, Illuvium offers a unique blend of entertainment and earning potential, making it a must-try for anyone interested in the future of gaming.

Alien Worlds is a blockchain based game that places you inside a virtual metaverse built around exploration and resource collection. The game is set across multiple planets, each with its own economy, rules, and community. As a player, you choose a planet to align with and take part in activities that help you earn rewards while shaping how that planet develops.

Gameplay in Alien Worlds is simple to understand, which makes it accessible to new players. You mine for resources using tools that exist as NFTs. Each tool has different strengths, and choosing the right one affects how often and how much you earn. The resources you collect are tokens that can be used within the game or traded outside of it. This structure allows you to earn value through consistent participation rather than complex mechanics.

What makes Alien Worlds stand out is how it blends governance with gameplay. Planets are controlled by decentralized organizations, which means players can vote on decisions that affect rewards, rules, and future game development. This creates a sense of shared ownership inside the virtual metaverse and gives players a voice beyond just playing the game.

NFTs in Alien Worlds include tools, land, and other assets that can be traded with other players. For example, land owners earn rewards when players mine on their land, which opens another path for earning through ownership instead of active play. This adds depth to the economy and rewards long-term planning.

Splinterlands is a captivating card-based strategy game that has gained immense popularity among fans of free NFT games. This blockchain-powered game allows you to collect, trade, and battle with digital cards, each of which is a unique NFT. The game’s focus on strategy and skill makes it an engaging experience for players of all levels.

In Splinterlands, you will build a deck of cards featuring various characters, abilities, and stats. These cards are not just in-game assets. They are NFTs that you fully own and can trade or sell on the game’s marketplace. The battles are fast-paced and require careful planning, as each match is influenced by the unique abilities of your cards and the rules of the game.

One of the standout features of Splinterlands is its accessibility. It is one of the few free NFT games that allows you to start playing without a significant upfront investment. While you can purchase additional cards to enhance your deck, the game offers plenty of opportunities to earn rewards through gameplay. Completing daily quests, winning battles, and participating in tournaments can earn you valuable in-game assets and cryptocurrency.

Splinterlands operates on the Hive blockchain, ensuring fast and secure transactions. The game’s marketplace is a hub for trading cards, where you can buy, sell, or rent cards to other players. This creates a dynamic economy that adds depth to the gameplay and provides opportunities to earn.If you are looking for a free NFT game that combines strategy, ownership, and earning potential, Splinterlands is a fantastic choice. Its engaging mechanics and player-driven economy make it a standout title in the world of blockchain gaming.

Decentraland is a virtual world that redefines the concept of free NFT games by offering a platform where you can create, explore, and trade within a decentralized metaverse. Built on the Ethereum blockchain, Decentraland allows you to own virtual land, design unique experiences, and monetize your creativity through NFTs.

In Decentraland, you can purchase virtual plots of land, known as LAND, which are represented as NFTs. These plots can be developed into anything you imagine, from interactive games to virtual art galleries or even digital storefronts. The platform’s user-friendly tools make it easy to bring your ideas to life, whether you are a seasoned developer or a beginner exploring the world of NFTs.

What sets Decentraland apart is its thriving marketplace, where you can trade LAND, wearables, and other digital assets. These NFTs are fully owned by you, giving you the freedom to sell or trade them as you see fit. The platform uses its native cryptocurrency, MANA, for transactions, which you can acquire through exchanges or earn by participating in the ecosystem. Decentraland also offers a social aspect, allowing you to interact with other players, attend virtual events, and explore user-generated content. It is a community-driven metaverse where creativity and ownership take center stage.

Nifty Island is a social focused NFT game that blends creativity, exploration, and ownership in a way that feels accessible to both gamers and creators. The game centers on player owned islands, which act as personal spaces you can build, customize, and share with others. These islands are NFTs, meaning you fully own them and control how they are used inside the platform.

Gameplay in Nifty Island revolves around interaction and creation rather than combat. You can design your island using assets, games, and interactive elements, then invite other players to visit. Many players earn by hosting experiences, showcasing digital art, or building mini games that attract traffic. The more engaging your island is, the more opportunities you have to earn through rewards and marketplace activity.

Nifty Island also connects closely with the broader NFT ecosystem. You can display NFTs you already own from other collections, turning your island into a personal gallery or social hub. This makes the game appealing if you are active in NFT communities and want a space that reflects your identity. Assets created or used on the platform can be traded, giving players flexibility in how they approach earning.

From an earning perspective, Nifty Island appeals to players who want options beyond grinding or competition. You can earn through island ownership, event participation, and creative contributions. This makes it attractive to players who enjoy social interaction and long term building rather than fast paced gameplay.

Gods Unchained is a competitive card game that has carved its place among the most popular NFT video games. Designed for players who enjoy strategy and skill-based gameplay, this blockchain-powered game allows you to collect, trade, and battle with digital cards, each of which is a unique NFT. The game’s focus on ownership and fair play has made it a favorite among gamers and crypto enthusiasts alike.

In Gods Unchained, you build a deck of cards featuring gods, spells, and creatures, each with unique abilities. Every card is an NFT that you fully own, giving you the freedom to trade or sell them on the game’s marketplace. Winning battles and completing challenges can earn you additional cards and rewards, adding depth and excitement to the gameplay.

The game operates on the Ethereum blockchain, ensuring secure transactions and true ownership of your digital assets. Gods Unchained also uses Immutable X, a layer-2 scaling solution, to provide gas-free transactions, making it easier for you if you are getting started with Gods Unchained. This seamless integration of blockchain technology enhances the gaming experience. What sets Gods Unchained apart is its emphasis on fair play. Matches are skill-based, ensuring that your success depends on strategy rather than the size of your wallet. This approach has attracted a dedicated community of players who value both the competitive aspect and the opportunity to own and trade NFTs.

Sorare is a sports focused NFT game built around real world football, baseball, and basketball. Instead of controlling characters in a virtual world, you collect digital player cards that are tied to real athletes and their actual performance. Each card is an NFT with different levels of rarity, which affects how competitive and valuable it can be.

Gameplay is based on fantasy style tournaments. You create teams using your cards and earn points based on how those athletes perform in real matches. Strong performance leads to rewards, which can include new cards or digital prizes with real value. This structure rewards knowledge, research, and smart decision making rather than fast reflexes.

Trading plays a major role in Sorare. You can buy, sell, or trade cards on the marketplace, and many players focus on spotting undervalued players early. Because the cards are limited and tied to licensed teams and leagues, demand stays consistent. This makes Sorare appealing to sports fans who enjoy strategy and long term planning.

Sorare is easy to understand and does not rely on complex mechanics. When you enjoy sports analytics and collecting, it offers a clear and skill driven way to earn through NFT ownership without needing to grind gameplay for hours.

Shrapnel is a tactical first person shooter built around blockchain technology and player owned items. The game puts you in fast paced combat scenarios where gear, weapons, and cosmetic items are NFTs you can buy, sell, or trade. Instead of simply earning points or achievements, you earn assets that have real world demand because other players want them.

Gameplay in Shrapnel focuses on skill and strategy. You complete matches, earn rewards based on performance, and unlock rare items that can be listed on NFT marketplaces. Because these assets are blockchain based, you truly own what you earn. This approach gives you a clear path for earning through competitive play and trading NFTs rather than only through in game progression.

Buying and selling NFTs in Shrapnel is straightforward once you connect a digital wallet. The marketplace lets you see what items are listed, compare prices, and choose when to trade. This makes it easier for you to turn your in game success into tangible value outside the game world.

Shrapnel also emphasizes community and competition. Events, tournaments, and seasonal content keep the gameplay fresh and give players more chances to earn valuable rewards. After seeing what some of the top NFT games look like, it’s time to think about what fits you best. Your goals, budget, and playing style should guide your choice more than hype or trends.

NFT games are digital games that let you own in game items instead of just using them. In NFT video games, things like characters, skins, weapons, or land exist as non fungible tokens, also called NFTs. These NFTs exist on a blockchain, which is a shared digital record that shows who owns what. Because of this, the items you earn are yours, not the game company’s. You can keep them, trade them, or sell them if other players want them.

When you play NFT games, you interact with both gameplay and an economy. You complete tasks, win matches, explore worlds, or build assets, and the game rewards you with NFTs or crypto tokens. These rewards have value because they can be used in game or traded outside the game. This is why many NFT video games are known as top play-to-earn games. Your time and effort can lead to real rewards, not just progress on a screen.

Behind the scenes, NFT games use smart contracts, which are automatic programs that run on the blockchain. Smart contracts control how items are created, how rewards are given, and how ownership is tracked. When you earn an NFT, the blockchain records it under your digital wallet. This makes ownership clear and hard to fake. Games that manage this well often become the most profitable NFT games to earn money because players trust the system, and the market stays active.

Most NFT games follow similar working mechanics, even though the gameplay styles differ.

With the growing popularity of NFT games, choosing the right one can feel like navigating a maze. Your choice not only determines your entertainment but also your potential to earn. To make the most of your time and resources, it is essential to evaluate a few critical factors before diving in.

The first thing to consider is the quality of the gameplay. A game should be engaging and enjoyable, offering more than just financial incentives. Look for games with immersive storylines, strategic depth, or unique mechanics that keep you coming back. A well-designed game ensures a loyal player base, which is crucial for the long-term value of its NFTs.

For those aiming to profit from NFT assets, the earning potential of a game is a key factor. Investigate the play-to-earn model, how rewards are distributed, and what activities generate income. Some games offer rewards for completing tasks, while others provide passive income through asset ownership like virtual land. Understanding the game’s tokenomics is vital to assess its sustainability.

A strong and active community often reflects the health of an NFT game. Check the game’s social media presence, forums, and Discord channels. A vibrant community not only enhances the gaming experience but also indicates the project’s credibility and potential for growth. Developers who actively engage with players are a big plus.

The blockchain on which the game operates plays a significant role in its performance. Games built on reliable blockchains like Ethereum, Solana, or Polygon offer better security and scalability. Additionally, ensure the game supports popular crypto wallets and has low transaction fees, as these factors directly impact your experience and earnings.

An active marketplace is essential for trading and liquidating your NFTs. Before committing, explore the game’s marketplace to check transaction volumes and liquidity. A bustling marketplace ensures you can easily buy, sell, or trade assets, turning your in-game achievements into real-world financial gains.

Getting started with NFT games is straightforward. Here are the key steps to help you start playing NFT games with clarity.

The first step is setting up a digital crypto wallet, which acts as your identity and bank account in the gaming ecosystem. It stores your cryptocurrencies and NFTs. Popular wallets include MetaMask for Ethereum-based games or Phantom for Solana. Always secure your recovery phrase offline to protect your assets.

Select a game that matches your interests. Whether you enjoy strategy, role-playing, or trading card games, there’s something for everyone. Research games with active communities and sustainable economies. You might wonder who blockchain games are designed for ; the answer is everyone, from casual players to hardcore strategists.

Before investing, take time to understand the game’s rules, tokenomics, and reward systems. Many games offer tutorials or free-to-play modes, which are great for learning the basics without financial risk.

Most NFT games require an initial investment, such as purchasing characters, land, or starter packs. You’ll need to buy the game’s native token or a major cryptocurrency like Ethereum, transfer it to your wallet, and use it to acquire assets from the game’s marketplace.

Once you have your assets, connect your wallet to the game’s official website. This step usually involves clicking a Connect Wallet button and approving a request in your wallet app. After connecting, you can start playing, completing quests, or earning rewards.

Join the game’s community on platforms like Discord or Twitter. Engaging with other players provides valuable tips, strategies, and updates. Active participation can also lead to exclusive events or drops that enhance your gaming experience.

NFT games continue to evolve as players demand better value, clearer ownership, and experiences that last beyond a single title. In 2026, the focus has shifted from short term hype to systems that reward commitment and creativity. Understanding these trends helps you spot games with real potential and avoid projects that lack direction. The most important changes center on how players earn, what they own, and how assets move across games.

Play to earn, often shortened to P2E, is one of the strongest forces shaping NFT gaming today. In P2E games, your time and skill translate into rewards you can actually use or trade. Instead of grinding for points that reset every season, you earn tokens or NFTs that hold value outside the game. This model attracts players who want their effort to matter. Game developers are also refining P2E systems to avoid inflation and burnout by rewarding smart play, competition, and long term participation rather than endless repetition.

Asset ownership is a core reason players choose NFT games over traditional ones. When you earn or buy an item, you own it fully. That ownership lives on the blockchain, not on a company server. You can trade items, sell them, or hold them for future use. This shift gives you control and flexibility. It also encourages healthier game economies, since players care more about assets they truly own.

Cross game utility is becoming more important as the space matures. Some NFT games now design assets that work across multiple experiences. A character, item, or token earned in one game may unlock features or value in another. This approach protects your investment of time and money by extending the life of your assets. As more developers collaborate, cross game utility helps create connected ecosystems instead of isolated games.

The world of NFT games in 2026 offers a diverse range of opportunities for gamers, blending entertainment with the potential for real-world rewards. From strategy-based card games to immersive metaverse experiences, these games cater to various interests and skill levels. Choosing the right game involves evaluating factors like gameplay quality, earning potential, and community engagement. As blockchain technology continues to evolve, NFT games are set to become even more innovative and accessible. Gamers who embrace this trend can enjoy not only engaging gameplay but also the chance to own and trade unique digital assets, making the experience both fun and rewarding.

NFT games can be profitable, but success depends on several factors, including the game’s economic model, your level of engagement, and market conditions. Many players earn through reward systems, where completing tasks or winning battles rewards them with tokens or NFTs. These assets can often be sold or traded for real money. However, profitability is not guaranteed, as the value of NFTs and tokens can fluctuate based on demand, game popularity, and broader cryptocurrency market trends.

The No. 1 NFT game is subjective and depends on what players value most, such as gameplay, earning potential, or community size. Axie Infinity is often regarded as a leading NFT game due to its robust play-to-earn model and active player base. Other popular contenders include The Sandbox, which focuses on virtual land ownership and creativity, and Gods Unchained, a strategy card game with competitive elements. The top game for you will depend on your interests and goals within the NFT gaming space.

Yes, it is possible to lose money playing NFT games. Many games require an initial investment in NFTs or tokens, and the value of these assets can decrease due to market volatility, changes in the game’s economy, or reduced player interest. Additionally, transaction fees for buying, selling, or trading NFTs can add up, further impacting your financial outcomes. It’s important to research the game thoroughly and only invest what you can afford to lose.

Yes, there are free NFT games that allow players to start without any upfront investment. These games often provide free starter characters, cards, or resources to help new players get started. Examples include Gods Unchained, which offers free card packs, and Splinterlands, where players can earn rewards without purchasing assets initially. While free NFT games can be a great way to explore blockchain gaming, earning potential may be limited compared to games that require an investment.

NFT games generate income through various revenue streams, including in-game purchases, transaction fees, and marketplace activity. Developers earn when players buy NFTs, such as characters, skins, or virtual land, directly from the game. Additionally, many games charge a percentage fee on transactions made in their marketplaces. Some games also generate revenue through tokenomics, where players use the game’s native cryptocurrency for purchases or staking. These mechanisms create a sustainable ecosystem that benefits both developers and players.

Market analysts point out that the continued progress of the US Senate Crypto Bill is seen by some investors as an important signal that the crypto industry is moving towards a more standardized and institutionalized operating phase. Against this backdrop, the market is not only focusing on XRP’s price potential but also beginning to re-examine long-term return logic, passive income models, and the value of DeFi infrastructure.

In this round of discussions, M DeFi’s Passive Income model has gradually attracted market attention and is regarded as a structured return path that is different from short-term speculation.

About Us | M DeFi

M DeFi is a DeFi platform focused on decentralized finance infrastructure (DeFi) and innovative yield models.

Through a transparent yield settlement mechanism, cloud-based crypto mining technology, and a green energy crypto mining system, the platform provides users with a way to **participate in a cryptocurrency passive income network without needing to master complex technologies**.

The platform consistently emphasizes:

Transparent Yield Model

Risk-Aware Participation

Compliance and Prudence

Sustainable Development

With Crypto Passive Income and DeFi Yield becoming an industry trend, M DeFi’s passive income model is gradually attracting the attention of global investors.

Key Strengths of M DeFi

✔ Stable DeFi Yield Model: Based on robust computing infrastructure and system models, rather than short-term price speculation.

✔ Daily Yield Settlement: Yields are credited to accounts daily, with traceable and verifiable records.

✔ Green cryptocurrency cloud computing: Prioritizing the use of clean energy to enhance sustainability.

✔ Extremely Low Barrier to Entry: No mining rigs required, no maintenance needed, and no electricity costs.

✔ Global DeFi Ecosystem: Continuously expanding its node and partner network to enhance system resilience.

Start Crypto Passive Income Easily

Users only need to complete:

1️⃣ New users receive a $17 bonus upon registration.

2️⃣ Select a revenue plan

3️⃣ The system will automatically run the revenue model.

All technical calculations, computing power scheduling, and revenue distribution processes are completed by the system, and users can view their assets and revenue status in a transparent environment.

Featured Plans

Investment Amount: $100 | Term: 2 days | Daily Yield: $4 | Total Return: $100 + $8

Investment Amount: $500 | Term: 6 days | Daily Yield: $6 | Total Return: $500 + $36

Investment Amount: $1500 | Term: 10 days | Daily Yield: $20.85 | Total Return: $1500 + $208.5

Investment Amount: $5200 | Term: 22 days | Daily Yield: $80.6 | Total Return: $5200 + $1773.2

Investment Amount: $11000 | Term: 27 days | Daily Yield: $192.5 | Total Return: $11000 + $5197.5

The above are sample product information; please refer to the platform’s official announcements for details.

Contact Us

For further information about:

M DeFi Platform

DeFi Yield Solutions

Crypto Passive Income Participation

You can contact us through the following official channels:

👉 Website: https://mdefim.com/

👉 Email: info@mdefim.com

(Click here to download the M DeFi app)

Conclusion | As Regulation Returns to Rationality, Long-Term Return Models Become the New Focus

With the ongoing progress of the US Senate Crypto Bill, market discussions have revived the expectation of XRP reaching $3; simultaneously, the logic of crypto investment is shifting from price trading to passive return models.

Against this backdrop, M DeFi’s passive income model has become one of the important reference points for investors re-evaluating their asset allocation structures.

In the future, transparency, sustainable returns, and compliance pathways may become key to the development of the cryptocurrency industry.

info@mdefim.com

M DeFi is a DeFi platform focused on decentralized finance infrastructure (DeFi) and innovative yield models.

This release was published on openPR.